Global Mineral Wool Market

Market Size in USD Billion

CAGR :

%

USD

14.80 Billion

USD

24.73 Billion

2024

2032

USD

14.80 Billion

USD

24.73 Billion

2024

2032

| 2025 –2032 | |

| USD 14.80 Billion | |

| USD 24.73 Billion | |

|

|

|

|

What is the Global Mineral Wool Market Size and Growth Rate?

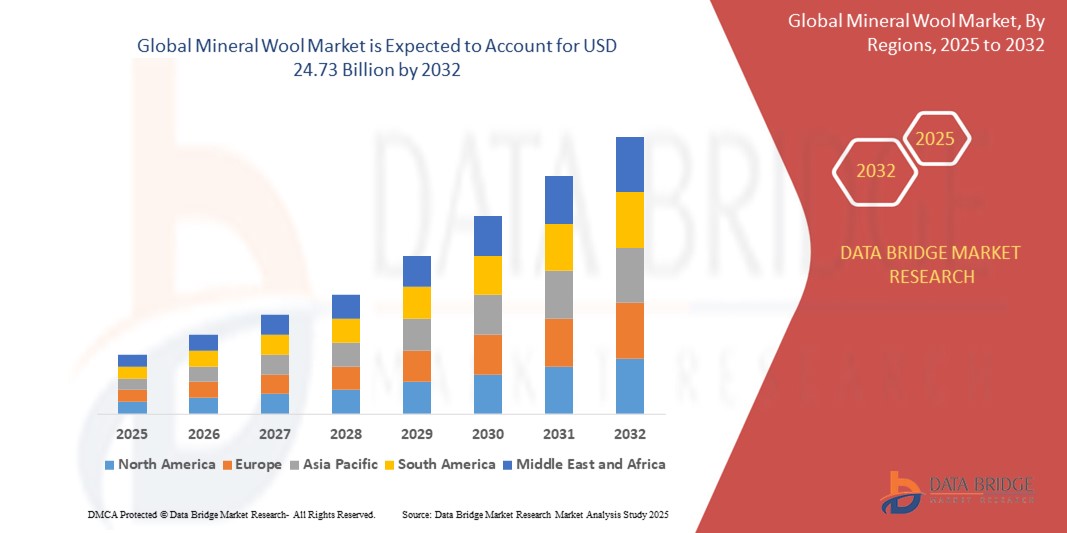

- The global mineral wool market size was valued at USD 14.80 billion in 2024 and is expected to reach USD 24.73 billion by 2032, at a CAGR of 6.63% during the forecast period

- The mineral wool market plays a pivotal role in the global construction and insulation sectors, driven by its versatile applications and superior performance characteristics. Mineral wool, derived from natural minerals such as basalt, diabase, and slag, is highly valued for its exceptional thermal insulation properties, ability to dampen sound, and fire resistance capabilities

- These attributes make it a preferred choice across various industries, particularly in building and construction, where energy efficiency and safety are paramount concerns. Technological advancements in manufacturing processes have enhanced the efficiency and performance of mineral wool products, driving innovation and expanding their applications beyond traditional insulation

What are the Major Takeaways of Mineral Wool Market?

- The rising awareness of energy conservation and sustainability is driving significant demand for mineral wool as a preferred insulation material in both residential and commercial buildings. Consumers and businesses asuch as are increasingly prioritizing energy-efficient construction practices to reduce operational costs and environmental impact

- Mineral wool's excellent thermal insulation properties help buildings maintain comfortable indoor temperatures while minimizing the need for heating and cooling, thereby enhancing energy efficiency. This trend is particularly strong in regions with stringent building codes and regulations focused on reducing carbon footprints, driving the adoption of mineral wool across new construction and retrofit projects

- Asia-Pacific dominated the mineral wool market with the largest revenue share of 44.2% in 2024, driven by rapid urbanization, booming construction activity, and increasing demand for energy-efficient insulation materials across the region

- North America mineral wool market is expected to register the fastest CAGR of 11.4% from 2025 to 2032, driven by the region’s growing emphasis on energy efficiency, sustainable construction, and stringent fire safety regulations

- The Stone Wool segment dominated the mineral wool market with the largest market revenue share of 52.4% in 2024, owing to its superior fire resistance, thermal insulation, and acoustic performance

Report Scope and Mineral Wool Market Segmentation

|

Attributes |

Mineral Wool Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Mineral Wool Market?

“Sustainability and Fire-Resistant Solutions Driving Market Transformation”

- A significant and fast-evolving trend in the global mineral wool market is the increasing focus on eco-friendly insulation materials and enhanced fire safety, driven by stricter building regulations and global sustainability initiatives

- Leading manufacturers are developing recyclable, low-emission, and bio-based Mineral Wool insulation, catering to the construction sector's growing demand for green materials

- The rising adoption of mineral wool with improved fire-resistance ratings is transforming building safety standards, especially in high-rise constructions, commercial complexes, and industrial facilities

- Innovations such as hydrophobic mineral wool panels are gaining traction due to their moisture resistance and enhanced thermal performance in extreme environments

- Major players including ROCKWOOL, Owens Corning, and Knauf Insulation are investing in next-generation Mineral Wool solutions that combine energy efficiency, fire resistance, and sustainability, aligning with global climate action goals

- The increasing emphasis on green buildings, energy conservation, and occupant safety is fundamentally reshaping the mineral wool industry and accelerating the adoption of high-performance insulation solutions worldwide

What are the Key Drivers of Mineral Wool Market?

- The growing demand for energy-efficient and fire-resistant insulation in residential, commercial, and industrial buildings is a primary driver of the mineral wool market, fueled by regulatory mandates and environmental awareness

- For instance, in March 2024, ROCKWOOL launched its next-generation mineral wool products featuring enhanced recyclability and superior fire resistance to support sustainable construction practices

- The global push toward carbon-neutral buildings and strict energy codes is driving the use of mineral wool insulation, which offers excellent thermal performance and significantly reduces energy consumption

- Rising urbanization, infrastructure development, and the demand for resilient, disaster-proof structures are accelerating market growth, especially in fire-prone regions

- In addition, increasing investments in industrial insulation for power plants, petrochemical facilities, and HVAC systems are boosting demand for mineral wool due to its thermal, acoustic, and fire-retardant properties

- The combination of environmental regulations, energy efficiency targets, and safety requirements is propelling rapid growth and innovation within the mineral wool industry

Which Factor is challenging the Growth of the Mineral Wool Market?

- The relatively high production costs and energy-intensive manufacturing processes of mineral wool products pose a challenge to broader market penetration, particularly in price-sensitive regions

- For instance, manufacturers often face increased costs associated with raw materials such as basalt and slag, along with the need for advanced production technologies to meet quality standards

- In addition, health concerns related to airborne fibers during installation can create hesitancy among end-users, although advancements in product safety and certifications are addressing these challenges

- Complex handling and installation procedures, especially for large-scale industrial applications, may increase labor costs and discourage adoption among smaller contractors

- Furthermore, competition from alternative insulation materials such as polyurethane foam or cellulose insulation, which may offer lower upfront costs, can limit mineral wool market share

- To overcome these barriers, industry players are focusing on cost optimization, product innovation, and sustainable production practices, ensuring Mineral Wool remains a preferred solution for safe and energy-efficient insulation globally

How is the Mineral Wool Market Segmented?

The market is segmented on the basis of type, product, and end user.

- By Type

On the basis of type, the mineral wool market is segmented into Glass Wool, Stone Wool, and Slag Wool. The Stone Wool segment dominated the mineral wool market with the largest market revenue share of 52.4% in 2024, owing to its superior fire resistance, thermal insulation, and acoustic performance. Stone Wool is extensively used in building insulation, industrial applications, and HVAC systems due to its durability, sustainability, and ability to withstand high temperatures. Its non-combustible nature makes it a preferred solution for enhancing building safety and energy efficiency.

The Slag Wool segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its increasing use in industrial insulation and power plant applications. Slag Wool, made from recycled blast furnace slag, offers excellent thermal and sound insulation properties, contributing to its growing demand in both commercial and industrial settings focused on sustainability and energy savings.

- By Product

On the basis of product, the mineral wool market is segmented into Board, Blanket, Loose Wool, and Others. The Blanket segment held the largest market revenue share of 41.7% in 2024, attributed to its ease of installation, flexibility, and widespread use in walls, roofs, and HVAC systems for thermal and acoustic insulation. Blankets are highly preferred in both residential and commercial construction due to their ability to cover large surface areas efficiently and provide effective thermal management.

The Loose Wool segment is projected to register the fastest CAGR from 2025 to 2032, supported by its increasing adoption in irregular or hard-to-reach spaces. Loose Wool is ideal for insulating complex structures, filling cavities, and improving energy efficiency in new builds and renovation projects, particularly in the residential sector.

- By End User

On the basis of end user, the mineral wool market is segmented into Automotive and Transportation, Building and Construction, Industrial, Consumer Appliances, and Others. The Building and Construction segment dominated the market with the largest revenue share of 57.6% in 2024, driven by strict energy efficiency regulations, fire safety requirements, and the global push for sustainable construction materials. The demand for mineral wool in insulation applications such as walls, roofs, facades, and floors is rapidly growing to enhance building performance and occupant comfort.

The Automotive and Transportation segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the rising demand for lightweight, fire-resistant, and sound-insulating materials in vehicles. As electric vehicles (EVs) and advanced mobility solutions become mainstream, Mineral Wool's ability to provide thermal management and acoustic comfort is propelling its adoption across the transportation industry.

Which Region Holds the Largest Share of the Mineral Wool Market?

- Asia-Pacific dominated the mineral wool market with the largest revenue share of 44.2% in 2024, driven by rapid urbanization, booming construction activity, and increasing demand for energy-efficient insulation materials across the region. Countries such as China, India, Japan, and South Korea are witnessing high consumption of Mineral Wool due to the growing need for thermal and acoustic insulation in residential, commercial, and industrial sectors

- Rising investments in infrastructure development, stricter building energy codes, and heightened awareness of sustainable construction practices are fueling the market's growth across Asia-Pacific

- The presence of cost-competitive manufacturers, favorable government initiatives for energy efficiency, and expanding industrial and automotive production further solidify the region's dominant position in the global mineral wool market

China Mineral Wool Market Insight

The China mineral wool market accounted for the largest revenue share within Asia-Pacific in 2024, supported by the country's massive construction sector, expanding urban development projects, and strong emphasis on energy conservation. China's stringent fire safety regulations and growing preference for eco-friendly insulation solutions are driving mineral wool adoption across commercial and residential buildings. Moreover, China's position as a global manufacturing hub and the presence of key domestic players contribute significantly to market growth.

Japan Mineral Wool Market Insight

The Japan mineral wool market is experiencing steady growth, fueled by the nation's advanced construction standards, focus on earthquake-resistant structures, and emphasis on energy-efficient insulation. The country's aging building stock and increasing demand for renovation projects are boosting mineral wool usage in residential and commercial applications. Japan's push for sustainable materials and its leadership in technological innovation are supporting continued market expansion.

India Mineral Wool Market Insight

The India mineral wool market is projected to grow at a notable CAGR during the forecast period, driven by rapid urbanization, increasing infrastructure investments, and the push for energy-efficient, fire-safe buildings. Government policies promoting affordable housing and smart cities, along with growing industrial development, are accelerating demand for mineral wool products in both new construction and retrofit projects. Rising awareness of environmental benefits further supports market growth.

Which Region is the Fastest Growing Region in the Mineral Wool Market?

North America mineral wool market is expected to register the fastest CAGR of 11.4% from 2025 to 2032, driven by the region’s growing emphasis on energy efficiency, sustainable construction, and stringent fire safety regulations. The U.S. and Canada are witnessing increasing demand for thermal and acoustic insulation in residential, commercial, and industrial sectors to meet evolving building codes and sustainability targets. Rising retrofitting activities, the trend toward green buildings, and strong investments in infrastructure modernization are key drivers propelling market growth across North America. Technological advancements, along with a growing preference for recyclable, eco-friendly insulation materials, are further enhancing mineral wool adoption in the region.

U.S. Mineral Wool Market Insight

The U.S. mineral wool market captured the largest revenue share within North America in 2024, fueled by increasing demand for high-performance insulation in energy-efficient buildings, commercial spaces, and industrial facilities. The nation’s efforts to reduce carbon emissions, combined with government incentives for sustainable construction, are accelerating the adoption of mineral wool. The growing need for soundproofing in urban areas and rising awareness of fire safety further support market expansion in the U.S.

Canada Mineral Wool Market Insight

The Canada mineral wool market is expected to grow steadily, driven by the country’s commitment to achieving net-zero emissions and improving building energy efficiency. The demand for mineral wool is rising in both residential and commercial construction, supported by strict building codes, environmental regulations, and the push for high-performance, sustainable insulation materials.

Which are the Top Companies in Mineral Wool Market?

The mineral wool industry is primarily led by well-established companies, including:

- Johns Manville (U.S.)

- Knauf Insulation (U.S.)

- Owens Corning (U.S.)

- Paroc Group (Finland)

- ROCKWOOL A/S (Denmark)

- Saint-Gobain (France)

- URSA (Spain)

- İzocam A.Ş. (Turkey)

- USG Corporation (U.S.)

- PGF (Australia)

- Thermafiber, Inc. (U.S.)

- Lloyd Insulations (India) Limited (India)

- Gyptech Systems Private Limited (India)

- Polybond (India)

- Minwool Rock Fibres Limited (India)

- PUNJSTAR INDUSTRIES PVT. LTD. (India)

- Shree Ram Equitech Pvt. Ltd. (India)

- DHANBAD ROCKWOOL INSULATION PRIVATE LIMITED (India)

- METECNO (Italy)

What are the Recent Developments in Global Mineral Wool Market?

- In August 2023, Owens Corning enhanced its presence in the European residential sector by acquiring a leading European manufacturer of mineral wool, reinforcing the company's commitment to expanding its insulation product portfolio across the region

- In June 2022, Rockwool A/S, also known as the ROCKWOOL Group, inaugurated its first experiential center in India, located in Hedehusene, Greater Copenhagen, Denmark. The center offers immersive product demonstrations and reflects the company's dedication to strengthening customer engagement with real-life experiences

- In January 2022, Knauf Insulation announced the acquisition of a glass mineral wool production facility in Central Romania, a strategic initiative to meet the increasing demand for mineral wool in Eastern Europe and CIS markets while expanding its production capabilities

- In May 2021, SPI completed the acquisition of Bigham Insulation Supply, GLT, NewStar, Rocky Mountain Construction Wholesale, and Thermaxx Jackets, a move that significantly expanded SPI's product offerings and market footprint in the insulation and construction sectors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Mineral Wool Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Mineral Wool Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Mineral Wool Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.