Global Carbon Polymorph Group Minerals Market

Market Size in USD Million

CAGR :

%

USD

179.02 Million

USD

246.89 Million

2024

2032

USD

179.02 Million

USD

246.89 Million

2024

2032

| 2025 –2032 | |

| USD 179.02 Million | |

| USD 246.89 Million | |

|

|

|

|

Carbon Polymorph Group Minerals Market Size

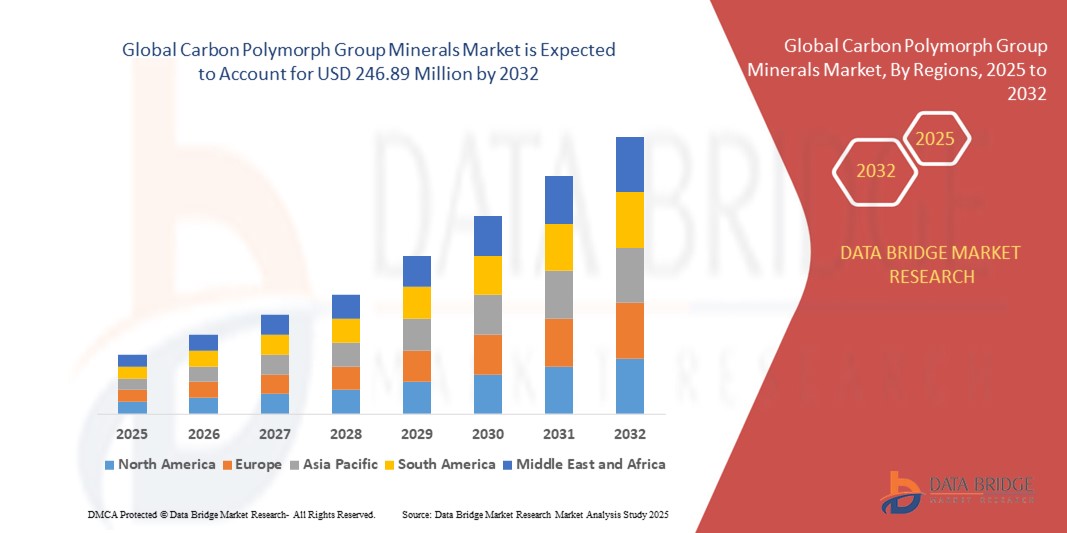

- The global carbon polymorph group minerals market size was valued at USD 179.02 million in 2024 and is expected to reach USD 246.89 million by 2032, at a CAGR of 4.10% during the forecast period

- The market growth is largely fuelled by the rising industrial demand for synthetic and natural carbon polymorphs such as diamond and graphite, supported by advancements in material science, electronics, and high-performance manufacturing

- Increasing investments in sustainable mining practices and innovations in synthetic production technologies are further expanding accessibility and reducing environmental impact, thereby boosting long-term market potential

Carbon Polymorph Group Minerals Market Analysis

- The increasing adoption of graphite in electric vehicle (EV) batteries, lubricants, and refractories is a key factor propelling market expansion. With global efforts to transition toward cleaner energy, graphite remains a crucial component in lithium-ion battery production. In addition, graphite’s excellent thermal and electrical conductivity continues to drive its demand across metallurgical and electronic applications

- The diamond segment—both natural and synthetic—is gaining momentum due to growing utilization in industrial cutting, drilling, and polishing tools. Technological innovations in chemical vapor deposition (CVD) processes have made synthetic diamonds more accessible and cost-effective for use in optical, thermal, and quantum computing applications

- North America dominated the carbon polymorph group minerals market with the largest revenue share of 39.4% in 2024, driven by a strong industrial base, rising demand for advanced materials in electronics and energy storage, and the presence of key graphite and synthetic diamond manufacturers

- Asia-Pacific region is expected to witness the highest growth rate in the global carbon polymorph group minerals market, driven by expanding electronics and automotive industries, abundant natural graphite reserves, and strong government initiatives promoting domestic mineral processing and exports

- The graphite segment accounted for the largest market revenue share in 2024, driven by its extensive usage across energy storage, lubricants, and refractories. Graphite is critical in lithium-ion battery anodes, making it highly valuable in electric vehicle and electronics manufacturing. Its excellent thermal conductivity and stability also make it indispensable in industrial furnaces and foundry operations

Report Scope and Carbon Polymorph Group Minerals Market Segmentation

|

Attributes |

Carbon Polymorph Group Minerals Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Expansion of Graphene Applications in Flexible Electronics • Rising Demand for Synthetic Diamonds in Quantum Computing |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Carbon Polymorph Group Minerals Market Trends

Rising Adoption of Synthetic Carbon Polymorphs in Industrial Applications

- The growing use of synthetic carbon polymorphs, particularly synthetic diamonds and graphene, is transforming the industrial landscape by offering consistent quality, controlled purity, and lower extraction costs. These materials are increasingly used in electronics, thermal management, cutting tools, and semiconductors, where performance and reliability are critical

- The shift toward synthetic production is also driven by environmental concerns and regulatory pressures associated with natural mining. Laboratory-grown diamonds and engineered graphite variants enable ethical sourcing and sustainable manufacturing, making them attractive for companies focusing on green production practices

- As technological barriers lower, the affordability and scalability of synthetic production methods such as chemical vapor deposition (CVD) and high-pressure high-temperature (HPHT) processes are improving. This encourages broader usage across mid-size manufacturers and boosts innovation across the supply chain

- For instance, in 2023, several U.S.-based semiconductor manufacturers incorporated synthetic diamond substrates into chip fabrication processes to improve heat dissipation and enhance device performance. This move highlighted the growing role of synthetic carbon polymorphs in advanced electronics

- While synthetic adoption is expanding, ongoing research, innovation, and cost optimization remain crucial. Manufacturers must ensure consistency in output quality and invest in application-specific formulations to fully harness the potential of carbon polymorphs in emerging industrial fields

Carbon Polymorph Group Minerals Market Dynamics

Driver

Growing Demand for Graphite and Diamond in Energy Storage and Industrial Tooling

• The increasing demand for lithium-ion batteries across electric vehicles, consumer electronics, and energy storage systems is significantly driving the consumption of graphite, which serves as a critical anode material. This growth is expected to continue as clean energy adoption expands globally

• In parallel, industrial-grade diamonds—both natural and synthetic—are witnessing growing demand in cutting, drilling, grinding, and polishing applications due to their unmatched hardness and durability. Sectors such as mining, aerospace, and construction heavily rely on diamond-tipped tools for precision and efficiency

• Moreover, advancements in nanotechnology and material science are enabling the integration of carbon polymorphs into high-performance coatings, conductive inks, and composite materials. These developments are expanding the scope of applications and accelerating the commercialization of next-generation carbon-based solutions

• For instance, in 2022, battery manufacturers in South Korea and Germany significantly increased their imports of purified natural graphite to meet the soaring demand for EV battery production, reinforcing graphite's strategic importance in energy storage technologies

• While the demand outlook remains positive, maintaining high-quality raw material supply and securing long-term procurement partnerships will be key to ensuring uninterrupted growth across both established and emerging end-use industries

Restraint/Challenge

Environmental and Ethical Concerns in Natural Extraction Processes

• The mining and extraction of natural carbon polymorphs, particularly diamonds and graphite, pose significant environmental challenges including land degradation, water contamination, and high carbon emissions. These issues have led to stricter regulatory scrutiny and limited expansion of conventional mining operations

• In certain regions, diamond mining has also raised ethical concerns linked to labor rights, community displacement, and conflict financing. These concerns have negatively impacted consumer perception and led to the rising popularity of certified ethical or lab-grown alternatives

• Limited availability of high-grade graphite and diamond reserves in specific geographies also creates regional dependencies and price volatility. Supply disruptions due to political instability, environmental restrictions, or labor disputes can affect downstream industries that rely heavily on consistent raw material input

• For instance, in 2023, environmental protests halted operations at a major graphite mining site in Mozambique, disrupting supply chains for several European battery manufacturers and delaying production schedules

• To mitigate these challenges, market participants must invest in responsible sourcing, expand recycling initiatives, and develop sustainable alternatives through synthetic production technologies. Transparency, certification programs, and traceability will play a crucial role in maintaining stakeholder trust and regulatory compliance

Carbon Polymorph Group Minerals Market Scope

The market is segmented on the basis of type, product type, and end user.

- By Type

On the basis of type, the carbon polymorph group minerals market is segmented into graphite and diamond. The graphite segment accounted for the largest market revenue share in 2024, driven by its extensive usage across energy storage, lubricants, and refractories. Graphite is critical in lithium-ion battery anodes, making it highly valuable in electric vehicle and electronics manufacturing. Its excellent thermal conductivity and stability also make it indispensable in industrial furnaces and foundry operations.

The diamond segment is expected to witness the fastest growth rate from 2025 to 2032, supported by rising demand for synthetic diamonds in precision tooling and semiconductor applications. Industrial-grade diamonds are increasingly used in high-performance machining, polishing, and thermal management, while the market also benefits from growing research investments in nanodiamond and quantum technologies.

- By Product Type

On the basis of product type, the market is segmented into pharmaceutical grade, industrial grade, and bio grade. The industrial grade segment dominated the market in 2024, owing to its widespread usage in cutting, grinding, and thermal insulation solutions. Industrial grade graphite and diamond products continue to be core materials in manufacturing and construction environments where durability and performance are critical.

The pharmaceutical grade segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing applications of carbon-based materials in drug delivery systems, medical diagnostics, and biomedical coatings. The rise in clinical trials and pharmaceutical research is further enhancing the demand for ultra-pure, biocompatible forms of graphite and diamond.

- By End User

On the basis of end user, the market is segmented into pharmaceuticals, coatings, surfactants, and others. The coatings segment held the largest market share in 2024, fueled by the use of graphite and nanodiamond-based additives in anti-corrosive, thermal, and wear-resistant formulations. These coatings find extensive applications in automotive, aerospace, and heavy machinery industries.

The pharmaceuticals segment is expected to witness the fastest growth rate from 2025 to 2032, owing to the increasing use of carbon polymorph materials in bioimaging, targeted therapy, and drug formulation. Their biocompatibility and nanoscale functionalities make them highly suited for next-generation healthcare solutions.

Carbon Polymorph Group Minerals Market Regional Analysis

• North America dominated the carbon polymorph group minerals market with the largest revenue share of 39.4% in 2024, driven by a strong industrial base, rising demand for advanced materials in electronics and energy storage, and the presence of key graphite and synthetic diamond manufacturers

• The region’s growth is further supported by increased research and development initiatives and the growing adoption of carbon-based materials in high-performance applications such as electric vehicle batteries, lubricants, and semiconductors

U.S. Carbon Polymorph Group Minerals Market Insight

The U.S. carbon polymorph group minerals market captured the largest revenue share in North America in 2024, attributed to robust demand across aerospace, defense, and electronics sectors. The expansion of electric vehicle manufacturing and the need for high-purity graphite in lithium-ion battery production are major contributors to market growth. In addition, government funding in clean energy and critical material supply chain resilience is supporting domestic production and technological innovation in carbon polymorph minerals.

Europe Carbon Polymorph Group Minerals Market Insight

The Europe carbon polymorph group minerals market is expected to witness the fastest growth rate from 2025 to 2032, backed by strong demand for sustainable and high-performance materials in industrial and medical applications. Countries such as Germany, France, and the United Kingdom are investing in synthetic diamond production and graphite applications, particularly in electronics, renewable energy, and advanced coatings. Stringent environmental regulations are also encouraging innovations in low-emission and biodegradable alternatives.

Germany Carbon Polymorph Group Minerals Market Insight

Germany is expected to lead the European market due to its advanced manufacturing ecosystem and strong focus on precision engineering. The country’s industrial sector utilizes graphite in numerous applications including lubricants, molds, and conductive materials. In addition, Germany’s growing investments in energy storage technologies and the use of synthetic diamonds in optical and cutting tools are key factors driving market expansion.

U.K. Carbon Polymorph Group Minerals Market Insight

The U.K. is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand for pharmaceutical-grade graphite in drug delivery systems and the increasing adoption of diamond films in medical and research devices. The UK's emphasis on technological innovation and sustainable material sourcing is also boosting its position in the European market.

Asia-Pacific Carbon Polymorph Group Minerals Market Insight

The Asia-Pacific region i is expected to witness the fastest growth rate from 2025 to 2032, supported by rapid industrialization, growing demand in electronics and automotive sectors, and abundant raw material availability. Countries such as China, India, and Japan are key contributors, driven by the expansion of battery production and increasing usage of graphite and diamond derivatives in manufacturing, metallurgy, and nanotechnology.

China Carbon Polymorph Group Minerals Market Insight

China held the largest revenue share in the Asia-Pacific market in 2024, owing to its dominance in graphite mining and processing, along with extensive application of carbon materials in battery manufacturing, metallurgy, and high-temperature furnaces. China's strategic initiatives to secure raw materials for electric vehicles and electronics production are further fueling demand for carbon polymorph group minerals.

Japan Carbon Polymorph Group Minerals Market Insight

Japan’s carbon polymorph group minerals market is expected to witness the fastest growth rate from 2025 to 2032, supported by technological innovation and high standards in electronics and precision tools. The country’s focus on high-purity synthetic diamonds for semiconductors and the use of graphite in advanced batteries and nuclear reactors underline its role as a key market. In addition, Japan’s aging infrastructure and demand for durable, energy-efficient materials are expected to strengthen long-term market growth.

Carbon Polymorph Group Minerals Market Share

The Carbon Polymorph Group Minerals industry is primarily led by well-established companies, including:

- Advanced Diamond Technologies, Inc. (U.S.)

- Metalgrass LTD (Germany)

- Sumitomo Electric Industries, Ltd. (Japan)

- Triton Minerals Limited (Australia)

- Resonac Holdings Corporation (Japan)

- GrafTech International (U.S.)

- Nippon Graphite Fiber Co., Ltd. (Japan)

- Tokai Carbon Co., Ltd. (Japan)

- Focus Graphite (Canada)

- Burgundy Diamond Mines Limited Company (Australia)

- Lucara Diamond (Canada)

- Rio Tinto (U.K.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Carbon Polymorph Group Minerals Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Carbon Polymorph Group Minerals Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Carbon Polymorph Group Minerals Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.