Global Bulletproof Glass Market

Market Size in USD Billion

CAGR :

%

USD

5.02 Billion

USD

11.25 Billion

2024

2032

USD

5.02 Billion

USD

11.25 Billion

2024

2032

| 2025 –2032 | |

| USD 5.02 Billion | |

| USD 11.25 Billion | |

|

|

|

|

Bullet Proof Glass Market Size

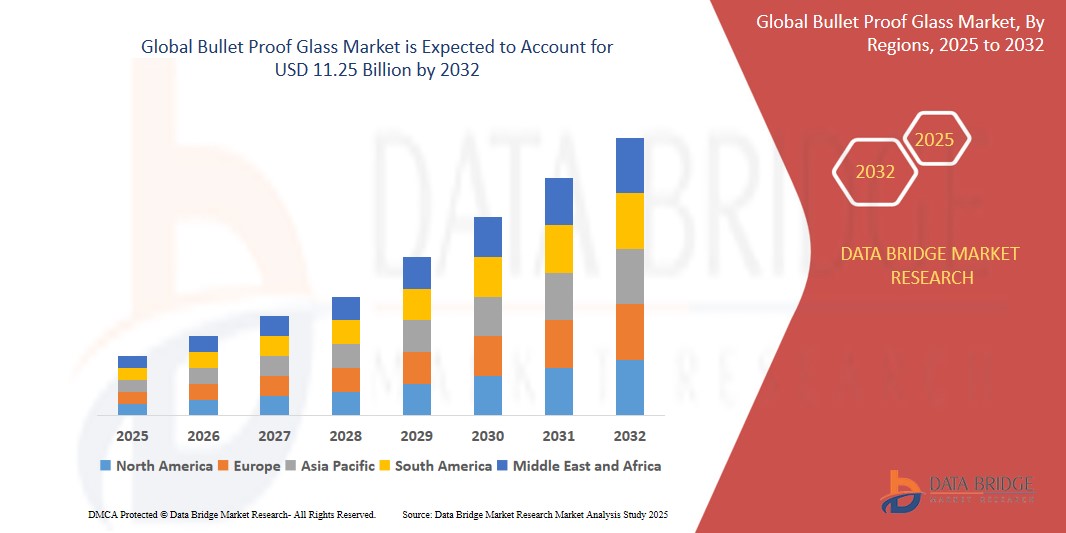

- The global bullet proof glass market size was valued at USD 5.02 billion in 2024 and is expected to reach USD 11.25 billion by 2032, at a CAGR of 10.62% during the forecast period

- This growth is driven by factors such as rising security threats, military spending, VIP protection needs, automotive growth, material advancements, urbanization, and demand in emerging markets

Bullet Proof Glass Market Analysis

- Bulletproof glass is a specialized type of glass designed to withstand high-impact forces and provide protection against ballistic threats. It is commonly used in applications such as armored vehicles, ATM booths, government buildings, and high-security locations to safeguard individuals and assets

- The bulletproof glass market is experiencing significant growth, driven by rising security concerns, increasing military and defense investments, growing demand for armored vehicles, advancements in material technologies, and the expanding need for personal and property protection in urban and emerging markets

- North America is expected to dominate the bullet proof glass market with a share of 35.8%, due to its strong defense sector, increasing security concerns, and high demand for advanced protection solutions in both commercial and residential spaces

- Asia-Pacific is expected to be the fastest growing region in the bullet proof glass market during the forecast period due to rising security concerns, rapid urbanization, and a growing demand for armored vehicles

- Acrylic segment is expected to dominate the market with a market share of 47.7% due to its high optical clarity, lightweight nature, cost-effectiveness, and ease of fabrication. Acrylic is easier to cut and shape compared to glass-clad alternatives, making it ideal for applications such as ATM enclosures, display cases, and certain vehicle windows where moderate ballistic protection is required. Its lower cost compared to polycarbonate or laminated glass also drives demand across commercial and civilian sectors

Report Scope and Bullet Proof Glass Market Segmentation

|

Attributes |

Bullet Proof Glass Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bullet Proof Glass Market Trends

“Increasing Military and Defense Spending”

- One prominent trend in the global bullet proof glass market is the increasing military and defense spending

- This trend is driven by the growing geopolitical tensions, the need for enhanced national security, and the expansion of defense infrastructure globally

- For instance, governments worldwide are investing in the development and procurement of armored vehicles, protective buildings, and other security-focused infrastructures

- The rising demand for armored military vehicles, government buildings, and security vehicles is contributing to the growth of the bulletproof glass market

- As military spending continues to rise, the demand for advanced, durable, and reliable bulletproof glass solutions is expected to drive market expansion and technological innovation

Bullet Proof Glass Market Dynamics

Driver

“Expanding Technological Advancements”

- Expanding Technological Advancements is a key driver of growth in the bulletproof glass market, as innovations in materials and manufacturing processes enhance the performance and versatility of protective glazing solutions

- This need is particularly prominent in sectors such as automotive, defense, and high-security buildings, where advances in materials such as glass-clad polycarbonate and hybrid laminates are improving the strength, durability, and ballistic resistance of bulletproof glass

- As the demand for lighter, stronger, and more versatile protective solutions rises, manufacturers are focusing on developing advanced technologies that offer improved ballistic performance while maintaining optical clarity and reducing weight

- Innovations such as electrochromic glass, which allows windows to switch between transparent and opaque states for enhanced privacy, are also gaining traction

- The push for enhanced security, reduced material weight, and better functionality in various applications is further driving technological advancements in the bulletproof glass market

- For instance, PPG Industries has been advancing hybrid laminated glass solutions that combine ballistic resistance with superior optical clarity

- XPEL has introduced automotive window films with bulletproof qualities, providing additional protection to vehicles

- As technological innovations continue to shape the industry, they are expected to significantly impact product development and long-term growth in the bulletproof glass market

Opportunity

“Rising Demand for Armored Vehicles”

- Rising Demand for Armored Vehicles presents a significant opportunity for the bulletproof glass market, as the need for enhanced protection in military, government, and civilian sectors continues to grow

- Automotive manufacturers and defense contractors are increasingly seeking advanced ballistic solutions to incorporate into armored vehicles, ensuring safety without compromising vehicle performance or aesthetics

- This opportunity aligns with the rising security concerns in regions with geopolitical instability, as well as the growing demand for private armored vehicles among high-net-worth individuals and executives

- For instance, Companies such as Armormax and Inkas Armored Vehicle Manufacturing are leveraging advanced bulletproof glass materials in their armored vehicle offerings, ensuring robust protection while maintaining vehicle efficiency

- BMW and Mercedes-Benz are integrating bulletproof glass into their luxury armored vehicle models, responding to the growing demand from VIP clients for both security and style

- As the demand for armored vehicles continues to rise, the bulletproof glass market is poised to benefit from this trend, driving growth and innovation in materials and technology

Restraint/Challenge

“Growing Installation Complexity”

- Growing Installation Complexity presents a significant challenge for the bulletproof glass market, as the installation of advanced protective glazing systems requires highly specialized techniques and expertise

- The need for precise fitting, integration with existing architectural designs, and ensuring structural integrity during installation drives up both labor and material costs, making it more difficult for manufacturers to offer cost-effective solutions

- This challenge is especially prominent in sectors such as automotive and commercial buildings, where custom installation processes and the requirement for specific configurations add to the complexity

- For instance, Companies such as Armormax and Inkas Armored Vehicle Manufacturing must invest heavily in skilled labor and customized solutions to meet the specific security needs of armored vehicles, which raises the overall cost

- Without advancements in more efficient installation processes or modular systems, the complexity and cost of installation may slow market growth, particularly in cost-sensitive sectors or emerging markets

Bullet Proof Glass Market Scope

The market is segmented on the basis of type, security level, car type, application, and end-user.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Security Level |

|

|

By Car Type |

|

|

By Application |

|

|

By End-User |

|

In 2025, the acrylic is projected to dominate the market with a largest share in type segment

The acrylic segment is expected to dominate the bullet proof glass market with the largest share of 47.7% in 2025 due to its high optical clarity, lightweight nature, cost-effectiveness, and ease of fabrication. Acrylic is easier to cut and shape compared to glass-clad alternatives, making it ideal for applications such as ATM enclosures, display cases, and certain vehicle windows where moderate ballistic protection is required. Its lower cost compared to polycarbonate or laminated glass also drives demand across commercial and civilian sectors.

The defense & VIP vehicles is expected to account for the largest share during the forecast period in application segment

In 2025, the defense & VIP vehicles segment is expected to dominate the market with the largest market share of 33.5% due to rising need for enhanced security in military operations, political environments, and among high-profile individuals. Growing geopolitical tensions, increasing defense budgets, and the escalating threat of targeted attacks have driven demand for armored transport. In addition, the expansion of armored luxury vehicle offerings for VIPs and executives has contributed to this segment’s strong growth.

Bullet Proof Glass Market Regional Analysis

“North America Holds the Largest Share in the Bullet proof glass Market”

- North America dominates the bullet proof glass market with a share of 35.8%, driven by its strong defense sector, increasing security concerns, and high demand for advanced protection solutions in both commercial and residential spaces

- U.S. holds a significant share due to its robust defense industry, rising security threats, and the growing need for protective glass in sectors such as automotive, military, and critical infrastructure

- The region’s market dominance is further supported by substantial defense spending, high demand for armored vehicles, and technological innovations in bulletproof glass materials. Companies such as Armormax, PPG Industries, and Guardian Glass are key players developing advanced solutions to meet security needs in both government and civilian sectors

- With the continued focus on enhancing national security and reducing crime rates, North America is expected to retain its leadership in the bulletproof glass market through 2032, with the U.S. contributing the majority of market share

“Asia-Pacific is Projected to Register the Highest CAGR in the Bullet proof glass Market”

- Asia-Pacific is expected to witness the highest growth rate in the bullet proof glass market, driven by rising security concerns, rapid urbanization, and a growing demand for armored vehicles

- China holds a significant share due to its expanding defense budget, increasing demand for armored vehicles, and rising security risks. The country's strong automotive sector and growing luxury vehicle market further fuel the demand for bulletproof glass in vehicles

- The region’s growth is also supported by the increasing adoption of advanced security solutions in both residential and commercial sectors, driven by urbanization and a heightened focus on infrastructure protection

- As demand for high-end vehicles and defense applications rises, along with the region’s expanding focus on national security, Asia-Pacific is expected to become the fastest-growing region in the bulletproof glass market through 2032, with China being a key contributor to this growth

Bullet Proof Glass Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Saint-Gobain Glass (France)

- PPG Industries, Inc. (U.S.)

- AGC Inc. (Japan)

- TAIWAN GLASS IND. CORP.(Taiwan)

- Nippon Sheet Glass Co., Ltd. (Japan)

- Armortex (U.S.)

- Apogee Enterprises, Inc. (U.S.)

- Binswanger Glass (U.S.)

- Schott AG (Germany)

- Centigon (U.S.)

- armass glass (Turkey)

- Stec Armour Glass (Malaysia)

- Total Security Solution (U.S.)

- Smartglass International (Ireland)

Latest Developments in Global Bullet Proof Glass Market

- In January 2023, Asahi India Glass Limited collaborated with Enormous Brands to create brand films for its AIS Windows range, signaling a strategic effort to bolster its position in the doors and windows market. This move aligns with the broader trends in the bulletproof glass market, as companies seek innovative marketing strategies to differentiate their products and appeal to consumers' safety concerns

- In January 2023, Guardian Glass acquired Vortex Glass, a Miami-based fabrication business, to strengthen its presence in the tempered glass segment, which is crucial for applications such as office partitions, shower doors, and glass railings. This acquisition reflects the growing demand for diversified offerings within the bulletproof glass market, as companies aim to cater to diverse architectural needs while ensuring robust security features

- In February 2022, MIT chemical engineers developed a groundbreaking material through a novel polymerization process. This material, more potent than steel yet as light as plastic, boasts an elastic modulus four to six times greater than traditional bulletproof glass, potentially revolutionizing industries requiring lightweight, high-strength materials

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Bulletproof Glass Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Bulletproof Glass Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Bulletproof Glass Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.