Global Meat Testing Market

Market Size in USD Billion

CAGR :

%

USD

9.21 Billion

USD

19.03 Billion

2024

2032

USD

9.21 Billion

USD

19.03 Billion

2024

2032

| 2025 –2032 | |

| USD 9.21 Billion | |

| USD 19.03 Billion | |

|

|

|

|

Meat Testing Market Size

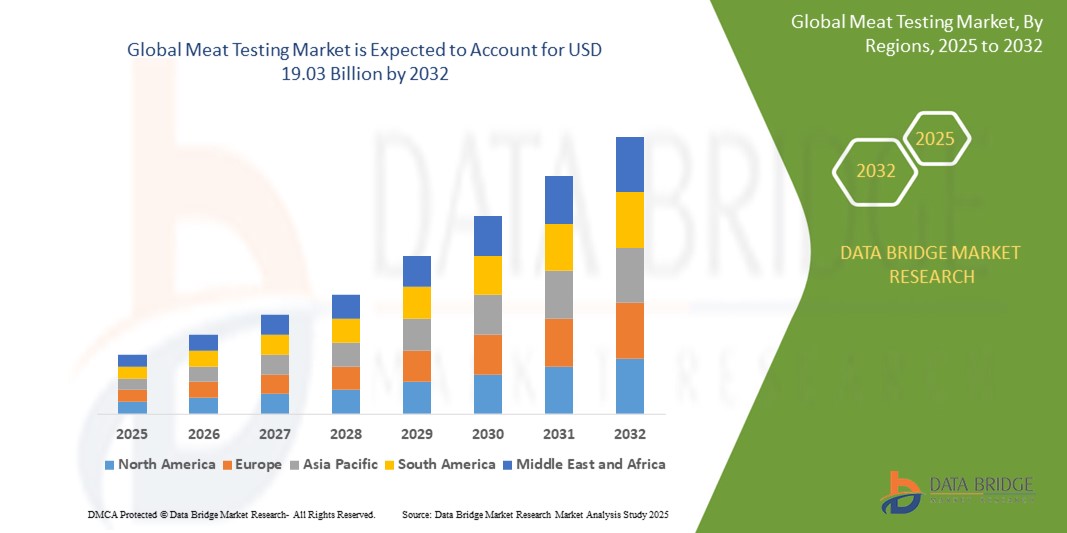

- The Global Meat Testing Market size was valued at USD 9.21 billion in 2024 and is expected to reach USD 19.03 billion by 2032, at a CAGR of 8.4% during the forecast period

- The market growth is largely fueled by the growing demand for religious food certifications along with increasing number of product recalls

- Furthermore, growing number of international trades of meat products, rising consumption of meat as well as seafood, increasing prevalence of stringent regulations across various countries to ensure meat safety, increase in the number of outbreaks due to contaminated meat, thereby significantly boosting the industry's growth

Meat Testing Market Analysis

- Meat testing is a term given to the meat inspection testing process for any external allergen or chemical that may make it unsafe for human consumption. This approach is used for the identification and grading of meat, which helps to establish if the origin of the source of meat is tainted at any point of the supply chain or if the meat has been contaminated

- Increasing expansions in service portfolio for meat and seafood testing, surging levels of investment in research and development activities, development of rapid testing technologies along with adoption of multi-containment detection systems which will further contribute by generating massive opportunities that will lead to the growth of the meat testing market

- North America dominates the meat testing market with the largest revenue share of 43.51% in 2025, characterized by advanced food safety infrastructure and strong emphasis on pathogen detection and quality assurance further reinforce its leadership.

- Asia-Pacific is expected to be the fastest growing region in the meat testing market during the forecast period due to growing meat consumption, rising concerns over food safety, and increasing government initiatives to regulate food testing standards

- Meat segment is expected to dominate the meat testing market with a market share of 38.5% in 2025, driven by the increasing consumption of red meat globally and the need for rigorous testing to ensure safety

Report Scope and Meat Testing Market Segmentation

|

Attributes |

Meat Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Meat Testing Market Trends

“Integration of AI and Advanced Technologies in Meat Testing”

- A significant trend in the Global Meat Testing Market is the integration of artificial intelligence (AI) and advanced technologies to enhance testing accuracy and efficiency. AI algorithms are being employed to detect contaminants and ensure meat quality, improving food safety standards.

- For instance, AI-driven systems can analyze meat samples for pathogens and adulterants more rapidly than traditional methods, enabling quicker response times in the supply chain. This technological advancement is crucial for maintaining consumer trust and complying with stringent regulations.

- The use of machine learning models allows for predictive analysis of potential contamination risks, facilitating proactive measures in meat processing and distribution. This predictive capability is transforming quality control processes in the meat industry.

- Additionally, the adoption of blockchain technology is emerging in meat testing to ensure traceability and transparency across the supply chain, providing consumers with verifiable information about meat origin and handling.

- These technological integrations are reshaping the meat testing landscape, driving demand for innovative solutions that offer enhanced accuracy, speed, and reliability in ensuring meat safety and quality.

Meat Testing Market Dynamics

Driver

“Stringent Food Safety Regulations and Rising Consumer Awareness”

- The implementation of stringent food safety regulations worldwide is a primary driver for the meat testing market. Regulatory bodies mandate rigorous testing protocols to prevent foodborne illnesses and ensure public health.

- Rising consumer awareness regarding food safety and quality is increasing demand for tested and certified meat products. Consumers are more informed and concerned about the origins and handling of their food, influencing purchasing decisions.

- The globalization of the meat trade necessitates standardized testing to comply with various international regulations, ensuring that exported and imported meat products meet safety standards across different markets.

Restraint/Challenge

“High Costs and Technical Limitations in Developing Regions”

- The high costs associated with advanced meat testing technologies can be a barrier, especially for small and medium-sized enterprises and in developing regions where resources are limited.

- Technical limitations, such as lack of infrastructure and skilled personnel, hinder the adoption of sophisticated testing methods in certain areas, affecting the consistency and reliability of meat safety assessments.

- Addressing these challenges requires investment in affordable testing solutions, training programs, and infrastructure development to ensure widespread implementation of effective meat testing practices globally.

Meat Testing Market Scope

The market is segmented on the basis of type, test type, form, and technology.

- By Type

On the basis of type, the Meat Testing Market is segmented into meat and seafood. The meat segment dominates the largest market revenue share of 38.5% in 2025, driven by the increasing consumption of red meat globally and the need for rigorous testing to ensure safety, detect pathogens, and comply with international trade standards. The demand for meat testing is also bolstered by strict government regulations and consumer awareness regarding contamination and adulteration.

The seafood segment is anticipated to witness the fastest growth rate of 23.4% from 2025 to 2032, fueled by rising seafood consumption, particularly in Asia-Pacific, and the growing concern over mercury, histamine, and microbial contamination. The perishable nature of seafood also necessitates more frequent testing to ensure freshness and quality throughout the supply chain.

- By Test Type

On the basis of test type, the meat testing market is segmented into microbiological tests, chemical tests, and nutritional tests. The microbiological tests held the largest market revenue share in 2025 of, driven by the high risk of contamination from pathogens like Salmonella, Listeria, and E. coli in meat and seafood products. These tests are critical for detecting spoilage organisms and ensuring public safety, especially for fresh and minimally processed products.

The nutritional tests segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the growing demand for detailed nutritional labeling, health-conscious consumers, and the food industry’s need for transparency in fat, protein, and micronutrient content. Nutritional testing supports regulatory compliance and consumer trust in meat-based products.

- By Form

On the basis of unlocking mechanism, the meat testing market is segmented into fresh meat, frozen meat, processed meat, cured meat, smoked meat, canned meat, cooked meat, and poultry. The processed meat held the largest market revenue share in 2025, driven by its widespread consumption and higher risk of contamination due to complex production processes. Routine testing for preservatives, additives, and pathogens is essential to ensure safety and shelf-life.

The frozen meat segment is expected to witness the fastest CAGR from 2025 to 2032, favored for its extended shelf-life and international trade convenience. Ensuring the microbial safety and chemical stability of frozen meat during storage and transportation drives testing demand in this category.

- By Technology

On the basis of technology, the meat testing market is segmented into traditional testing, rapid testing. The traditional testing segment accounted for the largest market revenue share in 2024, driven by the its established reliability, standardized protocols, and wide acceptance in regulatory frameworks. These tests are widely used in quality control labs and are considered highly accurate, especially for chemical and microbiological analyses.

The rapid testing segment is expected to witness the fastest CAGR from 2025 to 2032, driven by advancements in diagnostic technologies that offer quicker turnaround times and on-site testing capabilities. Industries benefit from real-time results that reduce product recall risks and improve supply chain responsiveness, making rapid testing increasingly popular.

Meat Testing Market Regional Analysis

- North America dominates the Meat Testing Market with the largest revenue share of 43.51% in 2024, driven by strict regulatory oversight from bodies such as the USDA and FDA and growing consumer demand for transparency in meat safety and labeling.

- The region's advanced food safety infrastructure and strong emphasis on pathogen detection and quality assurance further reinforce its leadership.

- Food processors and retailers in North America are investing heavily in robust testing systems to comply with evolving safety regulations and to build consumer trust. Technological innovation, including rapid testing solutions and traceability systems, is also supporting the widespread adoption of meat testing throughout the food supply chain.

U.S. Meat Testing Market Insight

The U.S. Meat Testing Market captured the largest revenue share of 79.23% within North America in 2025, fueled by the rigorous food safety legislation, the high prevalence of meat consumption, and frequent foodborne illness outbreaks. The U.S. market is characterized by early adoption of advanced testing technologies, such as PCR and ELISA, and a strong demand for microbial and chemical testing in both fresh and processed meat categories. Moreover, consumer awareness campaigns and proactive industry initiatives further encourage ongoing market growth.

Europe Meat Testing Market Insight

The European meat testing market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent food safety regulations under EFSA guidelines and increasing demand for organic and traceable meat products. The region has a well-established quality control system and is witnessing a rise in cross-border trade, necessitating advanced testing for compliance with EU standards. The adoption of automated and high-throughput testing systems is also advancing rapidly across meat processors in the region.

U.K. Meat Testing Market Insight

The U.K. Meat Testing Market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by growing consumer concern over food origin, labelling accuracy, and contamination risks. The post-Brexit regulatory shift is prompting both importers and domestic producers to enhance their testing protocols. Additionally, sustainability efforts and the rise of plant-meat blends are creating new quality control challenges, further supporting testing adoption across the U.K.’s meat supply chain.

Germany Meat Testing Market Insight

The German meat testing market is expected to expand at a considerable CAGR during the forecast period, fueled by heightened awareness of meat authenticity and public concern regarding chemical residues and antibiotic use in livestock. Germany’s robust meat processing industry and strong export activity drive demand for comprehensive microbiological and chemical testing. Technological innovation, traceability integration, and a preference for rapid and reliable testing methodologies are accelerating market penetration.

Asia-Pacific Meat Testing Market Insight

The Asia-Pacific meat testing market is poised to grow at the fastest CAGR of over 23.41% in 2025, driven by growing meat consumption, rising concerns over food safety, and increasing government initiatives to regulate food testing standards. Rapid urbanization, expanding retail chains, and evolving dietary preferences in countries like China, India, and Japan are driving demand for testing services. Investments in food safety infrastructure and the emergence of domestic testing labs are improving market accessibility across the region.

Japan Meat Testing Market Insight

The Japan meat testing market is gaining momentum due to the country's focus on food quality, safety assurance, and technological precision. High per capita meat consumption and consumer demand for traceability and clean-label products are encouraging extensive testing in retail and processing sectors. Additionally, Japan’s emphasis on automation and lab efficiency supports the use of molecular testing technologies to meet regulatory and commercial requirements.

China Meat Testing Market Insight

The China Meat Testing Market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to the government’s push for food safety reforms following past contamination scandals. The expanding meat processing industry and the rise of e-commerce food platforms necessitate stringent testing for both microbial and chemical hazards. Domestic and international producers are adopting standardized testing methods to meet regulatory compliance and ensure safe supply to China’s growing urban population.

Meat Testing Market Share

The meat testing industry is primarily led by well-established companies, including:

- SGS SA (Switzerland)

- Eurofins Scientific (Luxembourg)

- Intertek Group plc (U.K.)

- ALS Limited (Australia)

- Mérieux NutriSciences (France)

- TÜV SÜD (Germany)

- Bureau Veritas (France)

- AsureQuality (New Zealand)

- Microbac Laboratories, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- FoodChain ID Group Inc. (U.S.)

- Romer Labs Division Holding GmbH (Austria)

- LGC Limited (U.K.)

- Symbio Laboratories (Australia)

- Certified Laboratories (U.S.)

- QIMA (Hong Kong)

- AB Sciex Pte. Ltd. (Singapore)

- NEOGEN Corporation (U.S.)

- Bio-Check (UK) Ltd. (U.K.)

- SYNLAB (Germany)

Latest Developments in Global Meat Testing Market

- In July 2021, Intertek Group plc acquired JLA Brasil Laboratório de Análises de Alimentos S.A., a prominent Brazilian provider of testing services for food, agriculture, and the environment. This strategic move aims to strengthen Intertek’s food safety testing capabilities for its customers in Brazil.

- In May 2021, Eurofins Scientific expanded its presence in the UK by acquiring Eurofins Scientific Alliance Technical Laboratories (ATL) Ltd., with the objective of enhancing its testing services across food, water, and animal feed sectors.

- In May 2020, Bureau Veritas partnered with Leela Palaces in India to introduce the “Surakhsha” initiative, focused on upholding top-tier food safety and hygiene standards. This collaboration also integrates technology to support hygiene practices, thereby boosting Bureau Veritas’ food safety testing offerings.

- In January 2020, ALS acquired Aquimisa Group, an independent food testing company based in Spain. The acquisition is intended to broaden ALS’s European footprint and aligns with its strategy to capitalize on global food and pharmaceutical sector opportunities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Meat Testing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Meat Testing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Meat Testing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.