Global Meat Substitutes Market

Market Size in USD Billion

CAGR :

%

USD

5.57 Billion

USD

9.47 Billion

202

2032

USD

5.57 Billion

USD

9.47 Billion

202

2032

| 203 –2032 | |

| USD 5.57 Billion | |

| USD 9.47 Billion | |

|

|

|

|

Meat Substitutes Market Size

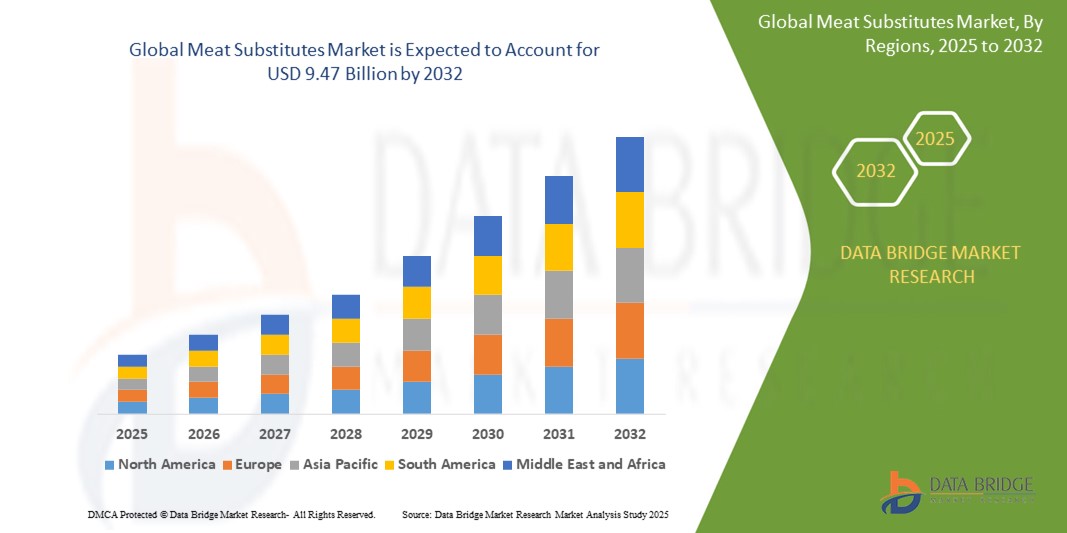

- The global meat substitutes market size was valued at USD 5.57 billion in 2024 and is expected to reach USD 9.47 billion by 2032, at a CAGR of 6.85 % during the forecast period

- This growth is driven by factors such as the rising shift toward plant-based diets, increasing health and environmental concerns related to traditional meat consumption, and a growing consumer base seeking sustainable and ethical food alternatives globally

Meat Substitutes Market Analysis

- Meat substitutes are plant-based or cultured alternatives to animal meat, widely used across sectors such as foodservice, retail, and ready-to-eat meals, offering sustainable, protein-rich solutions for health-conscious and environmentally aware consumers

- The demand for meat substitutes is significantly driven by rising consumer awareness about health, ethical concerns over animal welfare, and the environmental impact of livestock farming, along with continuous innovations in plant-based and fermented protein technologies

- Asia-Pacific is expected to dominate the global meat substitutes market, accounting for approximately 42.3% of the market share in 2024. This dominance is attributed to the growing vegetarian population, rapid urbanization, and increasing demand for high-protein and sustainable food options in countries such as China, India, and Indonesia

- North America is projected to hold a significant share of the meat substitutes market due to increasing consumer interest in flexitarian diets, strong investments in food-tech startups, and the expanding presence of plant-based products in mainstream retail and foodservice chains

- The soy-based protein segment is projected to dominate the global meat substitutes market, holding approximately 35% of the total market share. This dominance is due to soy's high protein content, cost-effectiveness, and its established use in meat analogs, making it a key ingredient in plant-based product development

Report Scope and Meat Substitutes Market Segmentation

|

Attributes |

Meat Substitutes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Meat Substitutes Market Trends

“Innovation in Plant-Based Protein and Product Development”

- One prominent trend in the meat substitutes market is the increasing innovation in plant-based proteins and product formulations to cater to diverse consumer preferences for taste, texture, and nutritional value

- Companies are focusing on enhancing the flavor profiles and improving the textures of plant-based meats to closely mimic traditional meat products, addressing the needs of flexitarians and meat-eaters looking to reduce their meat consumption without compromising on the sensory experience

- These innovations include the development of new plant-based protein sources such as peas, lentils, mung beans, and mycoprotein, which offer different textures and nutritional benefits

- For instance, In April 2024, Nestlé launched a new line of plant-based burgers made from pea protein, which aims to replicate the taste and juiciness of traditional beef burgers, catering to a growing demand for more sustainable and healthier alternatives to red meat

- The focus on clean-label, non-GMO ingredients and the adoption of technologies like extrusion and fermentation is reshaping the industry, enabling manufacturers to offer meat substitutes that are both healthier and more environmentally friendly. This is further supported by advancements in protein extraction and cell-based technologies

- These advancements are transforming the plant-based food sector, increasing market penetration in both developed and emerging economies, and supporting the growing global shift toward sustainable and plant-based diets

Meat Substitutes Market Dynamics

Driver

“Growing Demand for Sustainable and Health-Conscious Food Alternatives”

- The rising consumer demand for sustainable, plant-based, and health-conscious food options is significantly driving the growth of the meat substitutes market. As awareness about the environmental impact of animal agriculture increases, more consumers are turning to plant-based alternatives for their dietary needs

- As economies grow, particularly in developed regions and emerging markets, the need for healthier, protein-rich food options that also align with ethical and environmental values is fueling the expansion of the meat substitutes market

- Consumers are seeking meat substitutes that provide the nutritional benefits of traditional meat while being lower in fat, cholesterol, and environmental footprint

For instance,

- In January 2024, Impossible Foods expanded its presence in Europe by introducing its plant-based beef alternatives in major supermarket chains, catering to the growing demand for sustainable and healthier food options across the region

- In addition, the rise of flexitarian diets, which combine plant-based meals with occasional meat consumption, is further contributing to the market’s growth. Meat substitutes are increasingly seen as a viable and delicious alternative by consumers who want to reduce their meat intake for health and sustainability reasons

- As a result, the demand for plant-based proteins and alternative meats is witnessing significant growth globally, especially in markets like North America, Europe, and Asia-Pacific, where consumers are more conscious of their dietary choices and the environmental impact of their food

Opportunity

“Advancements in Plant-Based Product Innovation and Consumer Customization”

- The integration of advanced technologies in plant-based product development presents a significant opportunity for meat substitutes companies to enhance product offerings, improve nutritional profiles, and cater to a diverse range of consumer preferences

- Technologies such as precision fermentation, extrusion, and advanced protein processing enable manufacturers to create products with more authentic tastes, textures, and nutritional benefits, offering significant improvements over traditional plant-based options

- These innovations also present opportunities for customization, allowing companies to create plant-based meats tailored to specific dietary needs such as gluten-free, low-sodium, or allergen-free options, further expanding the market reach

For instance,

- In February 2024, Eat Just launched a new plant-based chicken product that uses advanced fermentation technology to mimic the texture and flavor of traditional chicken, catering to consumers seeking a more authentic plant-based meat experience

- The ability to incorporate sustainable ingredients and clean-label practices, alongside consumer demand for transparency in food sourcing, is creating a unique opportunity for meat substitutes brands to build strong consumer loyalty

Restraint/Challenge

“High Production Costs and Pricing Pressures”

- The high production costs associated with plant-based meat substitutes pose a significant challenge to market growth, particularly for smaller companies and those operating in emerging markets where price sensitivity is high

- Plant-based meat products, especially those made from innovative protein sources or using advanced production technologies like fermentation, often require substantial capital expenditure for research, development, and scaling. This can result in higher retail prices, which may limit their accessibility to certain consumer segments

- Ongoing operational costs, including sourcing raw materials, research and development, and marketing to raise awareness, can also be a financial burden for companies competing in a highly price-competitive market

For instance,

- In March 2024, a report by Bloomberg Intelligence highlighted that smaller companies in Southeast Asia struggle to offer affordable plant-based meat products due to high production costs and a lack of economies of scale, which hinders widespread adoption of meat substitutes in the region

- The financial burden of producing high-quality, affordable plant-based meats can make it challenging for companies to compete with traditional meat products, which benefit from established supply chains and lower production costs

- These pricing pressures and production costs may deter some companies from expanding their operations or investing in new product lines, ultimately limiting the broader market adoption of plant-based meat substitutes in price-sensitive regions

Meat Substitutes Market Scope

The market is segmented on the basis of source, category, product type, type, distribution channel, storage outlook, and form.

|

Segmentation |

Sub-Segmentation |

|

By Source |

|

|

By Category |

|

|

By Product Type |

|

|

By Type |

|

|

By Distribution Channel |

|

|

By Storage Outlook |

|

|

By Form |

|

In 2025, the soy-based protein segment is projected to dominate the industrial boilers market with the largest share in the fuel source segment.

The soy-based protein segment is projected to dominate the global meat substitutes market, holding approximately 35% of the total market share. This dominance is attributed to soy protein’s high nutritional value, affordability, and versatility in food processing, making it a preferred ingredient in plant-based meat formulations. Soy-based products offer a texture and flavor profile that closely mimic traditional meat, increasing their appeal among consumers seeking familiar meat alternatives. In addition, the long-standing consumer acceptance of soy in Asian and Western cuisines, along with strong supply chain infrastructure, further supports its widespread adoption across the food and beverage industry.

The tofu and tofu ingredients is expected to account for the largest share during the forecast period in type segments

The Tofu and Tofu Ingredients segment is expected to dominate the meat substitutes market with the largest market share of approximately 40% in 2025. This dominance is attributed to tofu’s long-standing popularity as a plant-based protein source, particularly in Asia, where it is widely consumed. Tofu is favored for its versatility, high protein content, and ability to mimic the texture and taste of meat in a variety of dishes. The growing global demand for vegan and vegetarian diets, along with tofu's increasing availability in international markets, is driving its widespread adoption.

Meat Substitutes Market Regional Analysis

“Asia-Pacific is Projected to Register the Highest CAGR in the Meat Substitutes Market”

- Asia-Pacific is expected to account for a significant share of the global meat substitutes market, estimated at approximately 42.3% in 2025.

- The region has a long-standing tradition of plant-based diets, with tofu, tempeh, and other soy-based products playing a central role in daily meals, making it a natural hub for the adoption of meat substitutes

- Countries like China, Japan, and India have seen increasing interest in plant-based alternatives due to rising health consciousness, concerns over food security, and environmental sustainability

- The growing middle class in these countries, combined with increasing urbanization and a shift toward Western dietary habits, is driving demand for meat substitutes

- In addition, regional players and multinational companies are investing heavily in the development and distribution of plant-based products, further strengthening the market's expansion in the Asia-Pacific region

“North America is Projected to Register the Highest CAGR in the Meat Substitutes Market”

- North America is expected to witness the highest growth rate in the meat substitutes market, driven by increasing consumer demand for plant-based alternatives, a rising focus on sustainability, and growing concerns over health and animal welfare

- The U.S. is emerging as a key market due to its strong preference for plant-based diets, the presence of major plant-based food companies such as Beyond Meat, Impossible Foods, and Nestlé, and a growing consumer base interested in healthy and ethical food choices

- The increasing availability of meat substitutes in mainstream supermarkets and fast-food chains, along with innovations in plant-based products that closely mimic meat textures and flavors, is propelling the market's rapid growth

- Canada, with its rising health-conscious population and significant interest in environmental sustainability, is also contributing to the rapid adoption of plant-based products. Increased investments by both local and global players, along with government support for sustainable agriculture, further strengthen the market in North America

Meat Substitutes Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Ashland (U.S.)

- Dow (U.S.)

- Chevron Phillips Chemical Company (U.S.)

- BASF SE (Germany)

- Exxon Mobil Corporation (U.S.)

- Solvay (Belgium)

- NALCO India (India)

- Air Products and Chemicals, Inc. (U.S.)

- 3M (U.S.)

- FMC Corporation (U.S.)

- Akzo Nobel N.V. (Netherlands)

- SNF Group (France)

- NASCO (U.S.)

- Clariant (Switzerland)

- Huntsman International LLC (U.S.)

- Orica Limited (Australia)

- ArrMaz (U.S.)

- Kemira (Finland)

Latest Developments in Global Meat Substitutes Market

- In May 2024, Tofurky made waves at the National Restaurant Association Show by introducing its Next Generation Plant-Based Deli Slices, designed specifically for foodservice clients. These savory, protein-rich cold cuts—available in Turk’y and Ham varieties—offer upgraded taste, texture, and visual appeal, emulating whole muscle cuts of traditional meats. The slices underwent rigorous consumer testing, with 59-81% of respondents preferring them over legacy versions. This launch aligns with the growing demand for plant-based menu options, providing chefs and restaurant operators with versatile, delicious alternatives

- In March 2024, The Kraft Heinz Not Company LLC introduced NotHotDogs and NotSausages, marking the Oscar Mayer brand’s expansion into the plant-based market. Developed in collaboration with TheNotCompany, Inc., these meat alternatives aim to deliver savory, smoky flavors that appeal to a wide demographic. Available in Bratwurst and Italian sausage varieties, they address consumer demand for better taste and texture in plant-based options. The launch reflects Kraft Heinz’s commitment to innovation in plant-based foods, ensuring flavor and quality remain uncompromised

- In February 2024, Beyond Meat unveiled its Beyond IV platform, marking the fourth generation of its Beyond Burger and Beyond Beef products. This latest innovation focuses on enhanced taste, texture, and nutritional benefits, aiming to appeal to a broader audience of plant-based enthusiasts. The new formulations feature avocado oil, reducing saturated fat by 60%, while maintaining a juicy, meaty experience. Set for a spring launch in U.S. stores, these products reinforce Beyond Meat’s commitment to continuous innovation in meat alternatives

- In December 2023, Quorn, a leading brand in the U.K. meat-free market, reintroduced its vegetarian Quorn Fillet Pieces, celebrated for their quality and flavor. These versatile fillets are ideal for a range of dishes, from stir-fries to creamy pasta sauces, offering a high-protein, low-fat alternative to chicken. Quorn’s commitment to nutrition and taste reinforces its position in the expanding plant-based market, catering to health-conscious consumers seeking sustainable meat alternatives

- In August 2023, Beyond Meat, Inc. expanded its burger lineup with the introduction of the Beyond Stack Burger, a thin, stackable plant-based patty designed to deliver an extraordinary taste experience. This smash-style burger offers a juicy, beef-like texture, catering to evolving consumer preferences for plant-based options. With 35% less saturated fat than traditional beef patties and zero cholesterol, it aligns with health-conscious and sustainable eating trends. The Beyond Stack Burger is easy to cook from frozen in just six minutes, making it a convenient and flavorful alternative

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Meat Substitutes Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Meat Substitutes Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Meat Substitutes Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.