Global Liquid Biopsy Market, By Product (Instruments, Consumables and Accessories, and Services and Software), Biomarker Type (Circulating Tumor Cells (CTCS), Circulating Cell-Free DNA (CFDNA), Cell-free RNA, Extracellular Vesicles, Exosomes, and Others), Sample Type (Blood Sample Based, Urine Sample Based, Saliva and Other Tissue Fluid Sample-Based, Fecal Based Sampling, and Others), Analytical Type (Molecular, Proteomics, and Histology/Imaging), Application Type (Cancer Applications and Non-Cancer Applications), Clinical Application (Routine Screening, Patient Work-Up, Therapy Selection, Treatment Monitoring, Recurrence Monitoring, and Others), Technology (Multi-Gene Parallel Analysis, and Single-Gene Analysis), End User (Hospitals, Reference Laboratories, Diagnostic Centers, Research Centers and Academic Institutes, and Others), Distribution Channel (Direct Tender, Third Party Distributor, and Others) – Industry Trends and Forecast to 2031.

Liquid Biopsy Market Analysis and Size

In the liquid biopsy market, monitoring minimal residual disease (MRD) represents a significant application. This involves utilizing liquid biopsy techniques to detect and analyze residual cancer cells or DNA in the bloodstream post-treatment. This non-invasive approach offers a valuable tool for assessing treatment efficacy and predicting the likelihood of cancer recurrence. The continuous development of liquid biopsy technologies and their integration into clinical practice further drives the growth and adoption of liquid biopsy solutions for MRD monitoring within the market.

In November 2023, Illumina Inc. announced TruSight Oncology 500 ctDNA v2, an advanced iteration of its liquid biopsy assay designed for comprehensive genomic profiling in oncology. This upgraded version promises enhanced sensitivity and specificity in detecting cancer-associated mutations from circulating tumor DNA.

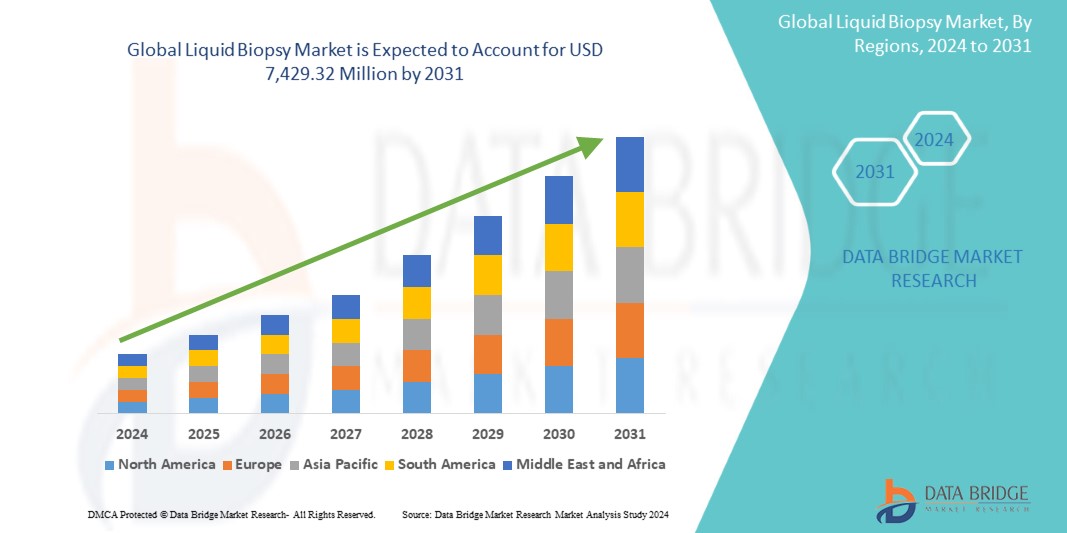

Global liquid biopsy market size was valued at USD 2.31 billion in 2023 and is projected to reach USD 8 billion by 2031, with a CAGR of 16.8% during the forecast period of 2024 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024-2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016-2021)

|

|

Quantitative Units

|

Revenue in USD Billion, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Product (Instruments, Consumables and Accessories, and Services and Software), Biomarker Type (Circulating Tumor Cells (CTCs), Circulating Cell-Free DNA (CFDNA), Cell-free RNA, Extracellular Vesicles, Exosomes, and Others), Sample Type (Blood Sample Based, Urine Sample Based, Saliva and Other Tissue Fluid Sample-Based, Fecal Based Sampling, and Others), Analytical Type (Molecular, Proteomics, and Histology/Imaging), Application Type (Cancer Applications and Non-Cancer Applications), Clinical Application (Routine Screening, Patient Work-Up, Therapy Selection, Treatment Monitoring, Recurrence Monitoring, and Others), Technology (Multi-Gene Parallel Analysis, and Single-Gene Analysis), End User (Hospitals, Reference Laboratories, Diagnostic Centers, Research Centers and Academic Institutes, and Others), Distribution Channel (Direct Tender, Third Party Distributor, and Others)

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

|

|

Market Players Covered

|

Thermo Fisher Scientific Inc. (U.S.), Illumina, Inc. (U.S.), BIOCEPT, INC. (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Exact Sciences Corporation (U.S.), Menarini Silicon Biosystems (Italy), Epic Sciences (U.S.), NeoGenomics Laboratories (U.S.), mdxhealth (Belgium), F. Hoffmann-La Roche Ltd (Switzerland), QIAGEN (Netherlands), Oncocyte Corporation (U.S.), Johnson & Johnson Services, Inc. (U.S.), PathAI, Inc. (U.S.), Guardant Health (U.S.), Laboratory Corporation of America Holdings (U.S.), ANGLE plc (U.K.), Natera, Inc. (U.S.), Sysmex Inostics Inc. (U.S.)

|

|

Market Opportunities

|

|

Market Definition

Liquid biopsy is a medical technique transforming diagnostics by analyzing biomolecules such as DNA, RNA, and proteins in bodily fluids such as blood. Unsuch as invasive traditional biopsies, it is non-invasive, offering vital diagnostic insights into conditions such as cancer without surgery. Although still evolving, liquid biopsies show immense promise in enhancing cancer detection and management, marking a significant leap in medical innovation.

Liquid Biopsy Market Dynamics

Drivers

- Rise in Integration of AI Enhances Accuracy of Cellular Data Extracted from Liquid Biopsy Samples

Artificial Intelligence (AI) is transforming liquid biopsy technology by enhancing its accuracy, efficiency, and predictive capabilities. Through advanced algorithms and machine learning, AI can analyze vast amounts of genetic, proteomic, and cellular data extracted from liquid biopsy samples. This enables early detection of diseases such as cancer, offering personalized treatment insights and monitoring disease progression. AI-driven liquid biopsy platforms streamline diagnostics, making them more accessible and cost-effective, thus driving market growth. With its ability to uncover actionable insights from complex biological data, AI is catalyzing the expansion of liquid biopsy applications in healthcare, leading to improved patient outcomes and driving the market forward.

In November 2020, NeoGenomics, Inc. launched a mobile phlebotomy service for liquid biopsy tests, leveraging AI-enhanced diagnostics such as InvisionFirst and NeoLAB. This initiative aligns with the growing trend of AI-driven liquid biopsy technologies, extending accessibility to patients through convenient sample collection at their locations. Partnering with phlebotomy companies for widespread coverage, NeoGenomics optimizes the efficiency of its AI-powered liquid biopsy solutions, driving market adoption and improving patient access to advanced diagnostics.

- Rising Healthcare Expenditure Promotes the Adoption of Liquid Biopsy Technologies

With greater investment in healthcare infrastructure and resources, there's heightened emphasis on advanced diagnostic tools such as liquid biopsies. These technologies offer non-invasive and efficient methods for cancer detection, monitoring, and personalized treatment planning. As healthcare systems strive to improve patient outcomes with the benefits of liquid biopsies in terms of early detection, treatment efficacy assessment, and minimal invasiveness make them an attractive option. Consequently, the rising healthcare expenditure acts as a catalyst for the widespread adoption and growth of the liquid biopsy market.

Opportunities

- Growing Demand for Non-Invasive Liquid Biopsy Techniques due to its Impact on Cancer Diagnosis

Over the last decade, traditional invasive methods have given way to non-invasive techniques such as liquid biopsy. This approach involves isolating tumor-derived components, such as circulating tumor cells and DNA, from bodily fluids for genomic and proteomic analysis. Consequently, the market is witnessing substantial growth as healthcare providers increasingly rely on these advanced, less intrusive methods for more accurate cancer detection and personalized treatment strategies.

- Growing Advancements in Precision Medicine due to Liquid Biopsy

Advancements in this field enable non-invasive detection and monitoring of diseases through analysis of circulating biomarkers such as circulating tumor DNA (ctDNA), circulating tumor cells (CTCs), and exosomes. This approach facilitates early diagnosis, treatment selection, and monitoring of treatment response, enhancing patient outcomes. With its ability to provide real-time insights into disease progression and therapeutic efficacy, liquid biopsy holds immense potential for personalized medicine, driving growth in the liquid biopsy market as it becomes an indispensable tool in oncology and beyond.

Restraints/Challenges

- High Cost of Liquid Biopsy Tests Limits its Adoption among the Patients

Liquid biopsy tests often involve advanced technologies and specialized equipment, contributing to their expensive nature. Additionally, factors such as laboratory processing fees and the need for skilled personnel further elevate the overall cost. As a result, patients may encounter financial barriers, particularly in regions with limited access to healthcare resources or inadequate insurance coverage. The affordability gap hinders widespread adoption of liquid biopsy tests, despite their potential benefits in terms of early cancer detection and personalized treatment.

- Shortage of Skilled Professionals Limits the Scalability of Liquid Biopsy Techniques

Liquid biopsy, a non-invasive method for detecting biomarkers in bodily fluids such as blood, requires specialized training and expertise for accurate analysis and interpretation of results. The scarcity of qualified professionals capable of conducting these intricate tests limits the widespread adoption and scalability of liquid biopsy techniques, thereby constraining market growth. This bottleneck impedes the efficient utilization of liquid biopsy as a diagnostic tool in oncology and other fields, hindering its potential impact on healthcare outcomes.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In January 2022, QIAGEN's Biotech Grants program winners were announced, displaying the company's dedication to fostering partnerships with biotech and pharma firms. Supporting these businesses, QIAGEN aims to bolster their success in the market, contributing to its revenue growth strategy

- In January 2022, Exact Sciences Corporation expanded its cancer diagnostics portfolio by acquiring Prevention Genetics, a genetic testing laboratory. This strategic move enables Exact Sciences to venture into hereditary cancer testing, complementing its existing offerings and enhancing its position in the diagnostics market

- In July 2021, Biocept Inc. secured a South Korean patent for its Primer-Switch technology, a significant milestone for the molecular diagnostic services provider. This technology, based on real-time PCR and associated methods, enables the detection of mutations in circulating tumor DNA, aiding in the identification of rare cancer biomarkers and strengthening Biocept's position in the field of cancer diagnostics

Liquid Biopsy Market Scope

The market is segmented on the basis of product, biomarker type, sample type, analytical type, application type, clinical application, technology, end user, and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

Product

- Instruments

- Consumables and Accessories

- Services and Software

Biomarker Type

- Circulating Tumor Cells (CTCc)

- Circulating Cell-Free DNA (CFDNA)

- Cell-Free RNA

- Extracellular Vesicles

- Exosomes

- Others

Sample Type

- Blood Sample-Based

- Urine Sample-Based

- Saliva and Other Tissue Fluids Sample-Based

- Fecal Sample Based

- Others

Analytical Type

- Molecular

- Proteomic

- Histology/Imaging

Application Type

- Cancer Applications

- Non-Cancer Applications

Clinical Application

- Routine Screening

- Patient Work-Up

- Therapy Selection

- Treatment Monitoring

- Recurrence Monitoring

- Others

Technology

- Multi-Gene-Parallel Analysis

- Single Gene Analysis

End User

- Hospitals

- Reference Laboratories

- Diagnostics Centers

- Research Centres And Academic Institutes

- Others

Distribution Channel

- Direct Tender

- Third Party Distributor

- Others

Liquid Biopsy Market Regional Analysis/Insights

The market is categorized into nine notable segments based on product, biomarker type, sample type, analytical type, application type, clinical application, technology, end user, and distribution channel.

The countries covered in this market report U.S., Canada, Mexico, Germany, U.K., France, Russia, Italy, Spain, Turkey, Poland, Belgium, Netherlands, Switzerland, Denmark, Sweden, Norway, Finland, rest of Europe, China, Japan, India, Australia, South Korea, New Zealand, Singapore, Thailand, Philippines, Malaysia, Indonesia, Vietnam, Taiwan, rest of Asia-Pacific, Brazil, Argentina, rest of South America, Saudi Arabia, U.A.E., South Africa, Egypt, Qatar, Kuwait, Oman, Bahrain, and rest of Middle East And Africa.

In North America, U.S. is expected to dominate the market due to the country's high prevalence of chronic conditions and a sizable geriatric population creates significant demand for nurse calling systems to support patient care. Additionally, the rise in healthcare expenditure in the U.S. underscores a growing investment in healthcare infrastructure and technology, including nurse calling systems. These factors collectively position the U.S. as a leader in driving market growth and innovation within the region, reflecting its commitment to improving patient outcomes and healthcare delivery.

In Europe, Germany dominates the market due to the strong presence of key players such as F. Hoffmann-La Roche Ltd, QIAGEN, and Sysmex Inostics Inc. This dominance is attributed to Germany's robust research and development infrastructure, highly skilled workforce, and supportive government policies fostering innovation. The country's strategic geographical location within Europe also facilitates collaboration and access to markets across the continent. Consequently, Germany serves as a hub for cutting-edge research, technological advancements, and market leadership in the biotech and life sciences industries throughout Europe.

In Asia-Pacific, China dominates the market due to its ability to meet increasing demand, particularly from emerging markets. Leveraging its manufacturing capabilities and competitive pricing, Chinese companies have captured significant market share within the region. Furthermore, China's strategic focus on expanding its presence in emerging markets has contributed to its leadership position. This trend underscores China's emergence as a key player in the global liquid biopsy market, driven by both its production capabilities and growing demand from dynamic markets across Asia-Pacific.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed base and New Technology Penetration

The market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the market. The data is available for historic period 2016-2021.

Competitive Landscape and Liquid Biopsy Market Analysis

The market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in RandD, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product approvals, product width and breadth, application dominance, and product type lifeline curve. The above data points provided are only related to the company’s focus on the market.

Some of the major players operating in the market are:

- Thermo Fisher Scientific Inc. (U.S.)

- Illumina, Inc. (U.S.)

- BIOCEPT, INC. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Exact Sciences Corporation (U.S.)

- Menarini Silicon Biosystems (Italy)

- Epic Sciences (U.S.)

- NeoGenomics Laboratories (U.S.)

- mdxhealth (Belgium)

- F. Hoffmann-La Roche Ltd (Switzerland)

- QIAGEN (Netherlands)

- Oncocyte Corporation (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- PathAI, Inc. (U.S.)

- Guardant Health (U.S.)

- Laboratory Corporation of America Holdings (U.S.)

- ANGLE plc (U.K.)

- Natera, Inc. (U.S.)

- Sysmex Inostics Inc. (U.S.)

- STRECK (U.S.)

- Predicine (U.S.)

SKU-