North America Circulating Tumor Cells (CTC) Liquid Biopsy Market, By Technology (CTC Detection Methods, CTC Enrichment Methods, Ex Vivo Positive Selection, Molecular (RNA)-Based Technologies, Functional In vitro Cell Invasion Assay, Xenotransplantation Models, Microchips, Single Spiral Microchannel, Negative Selection & Immunocytochemical Technologies), Application (Cancer Stem Cell Research, Multiple Chromosome Abnormalities & Others), End User (Research & Academic Institutes, Reference Laboratories & Hospitals & Physician Laboratories),Country (U.S., Canada, Mexico) - Industry Trends and Forecast -2029

Market Analysis and Insights: North America Circulating Tumor Cells (CTC) Liquid Biopsy Market

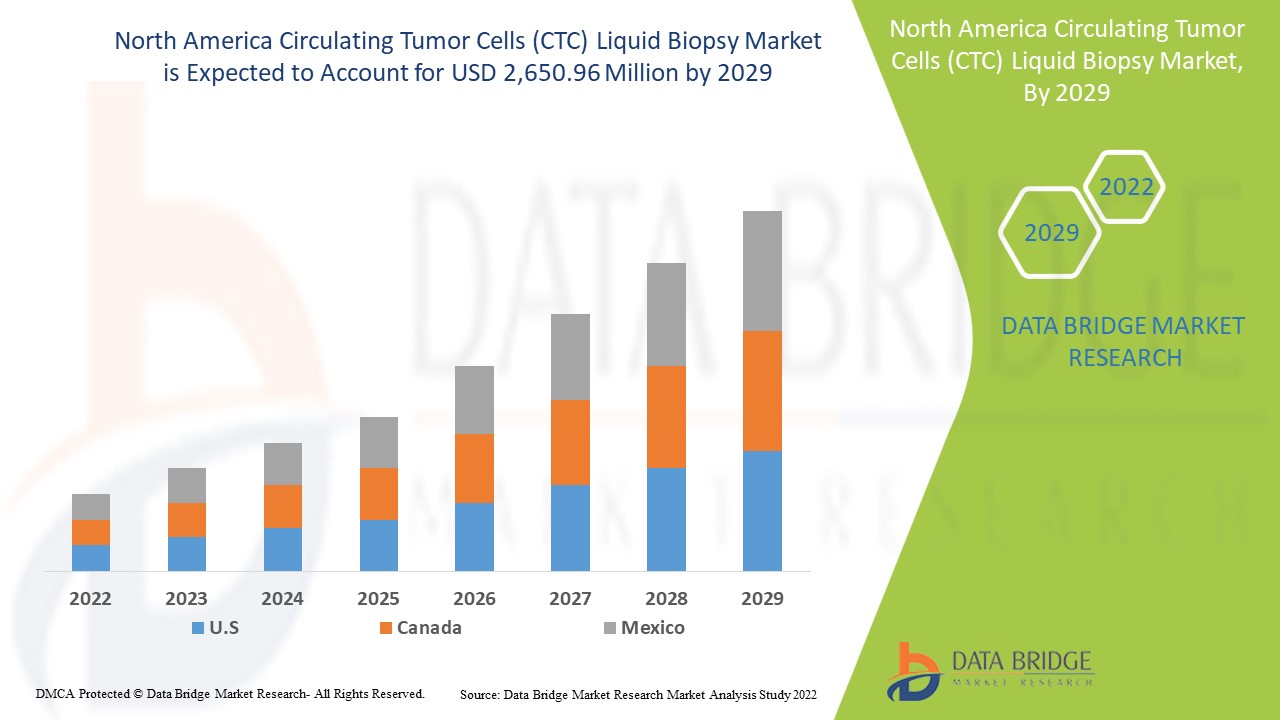

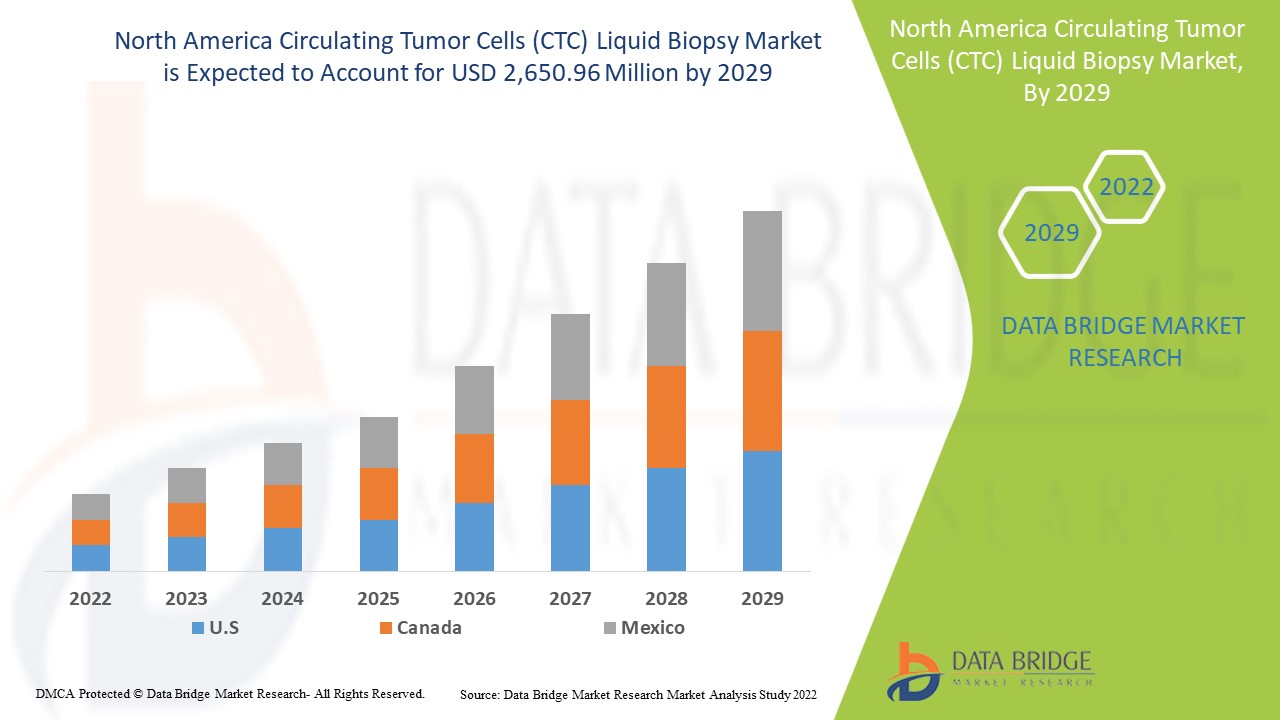

North America circulating tumor cells (CTC) liquid biopsy market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 25.9% in the forecast period of 2022 to 2029 and is expected to reach USD 2,650.96 million by 2029 from USD 442.64 million in 2021. The high prevalence of chronic diseases and increasing R&D activities for its effective application is likely to be the major drivers which propel the demand of the market in the forecast period.

The liquid biopsy is a non-invasive blood test which detects circulating tumor cells and tumor DNA fragments which are released into the blood from primary tumors and metastatic sites. It is a simple and precise alternative to surgical biopsy procedure, which allows surgeon to detect cancer at a very early stage.

The circulating tumor cells are a rare sub-set of cells which function as a seed of metastases. It is found in blood of patients who have developed solid tumors. The testing of circulating tumor cells allows the detection and quantification of tumor cells in the blood of cancer patients. The various types of biological phenotypes of circulating tumor cells (CTCs) exits includes stem cell-like or mixed, mesenchymal or epithelial. These phenotypes are present in blood in a very small quantity. Due to which, their detection needs a phase of isolation-enrichment. After that, a second phase of detection.

The growing demand of circulating tumor cells (CTC) liquid biopsy because of their efficacy, high prevalence of cancer are the major drivers propelling the demand for circulating tumor cells (CTC) liquid biopsy market in the forecast period. However, the unclear regulatory and reimbursement scenario, shortage of skilled personnel is restraining the circulating tumor cells (CTC) liquid biopsy market growth in the forecast period.

North America circulating tumor cells (CTC) liquid biopsy market report provides details of market share, new developments, and impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief. Our team will help you create a revenue impact solution to achieve your desired goal.

North America Circulating Tumor Cells (CTC) Liquid Biopsy Market Scope and Market Size

North America circulating tumor cells (CTC) liquid biopsy market is categorized into three notable segments which are based on technology, application and end user. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of technology, circulating tumor cells (CTC) liquid biopsy market is segmented into CTC detection methods, CTC enrichment methods, ex vivo positive selection, molecular (RNA)-based technologies, functional in vitro cell invasion assay, xenotransplantation methods, microchips, single spiral microchannel, negative selection and immunocytochemical technologies In 2021, CTC detection methods segment is expected to dominate the market because of increasing use of this technology in the academics and research centers for the tests of liquid biopsy.

- On the basis of application, circulating tumor cells (CTC) liquid biopsy market is segmented into cancer stem cell research, multiple chromosome abnormalities and others. In 2021, cancer stem cell research segment is expected to dominate the market because of increasing demand of early diagnosis and treatment of cancer.

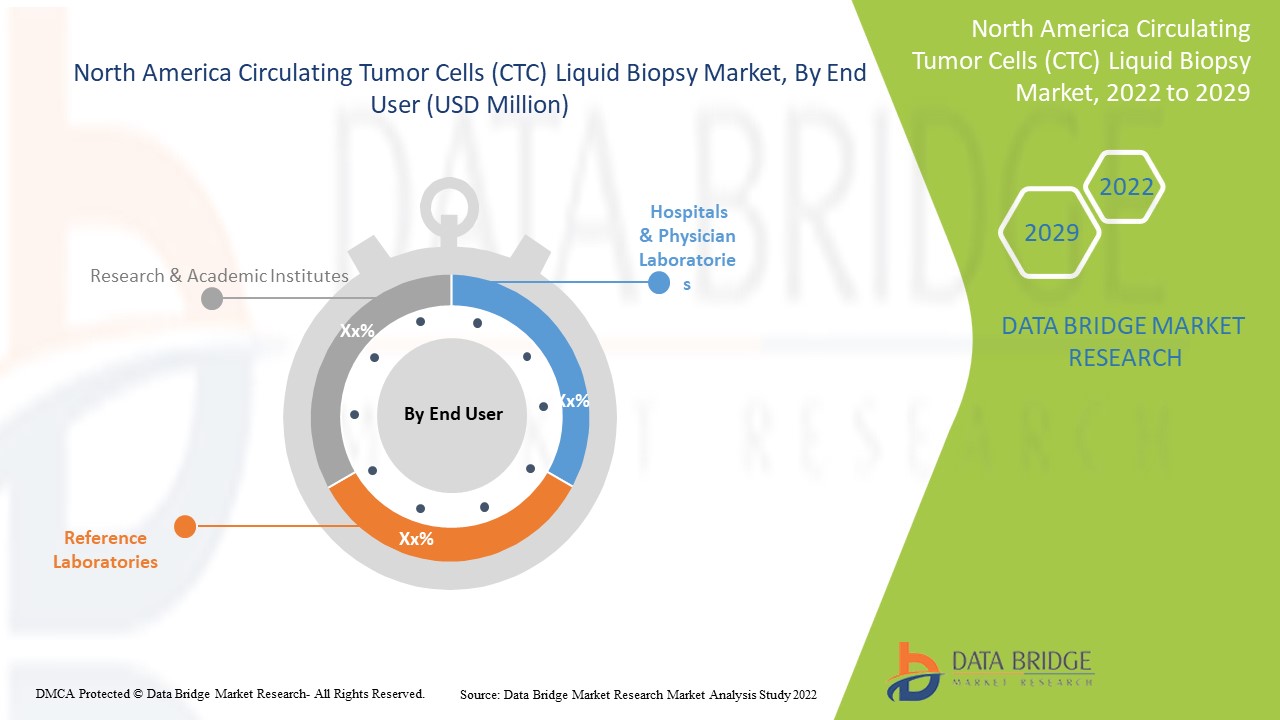

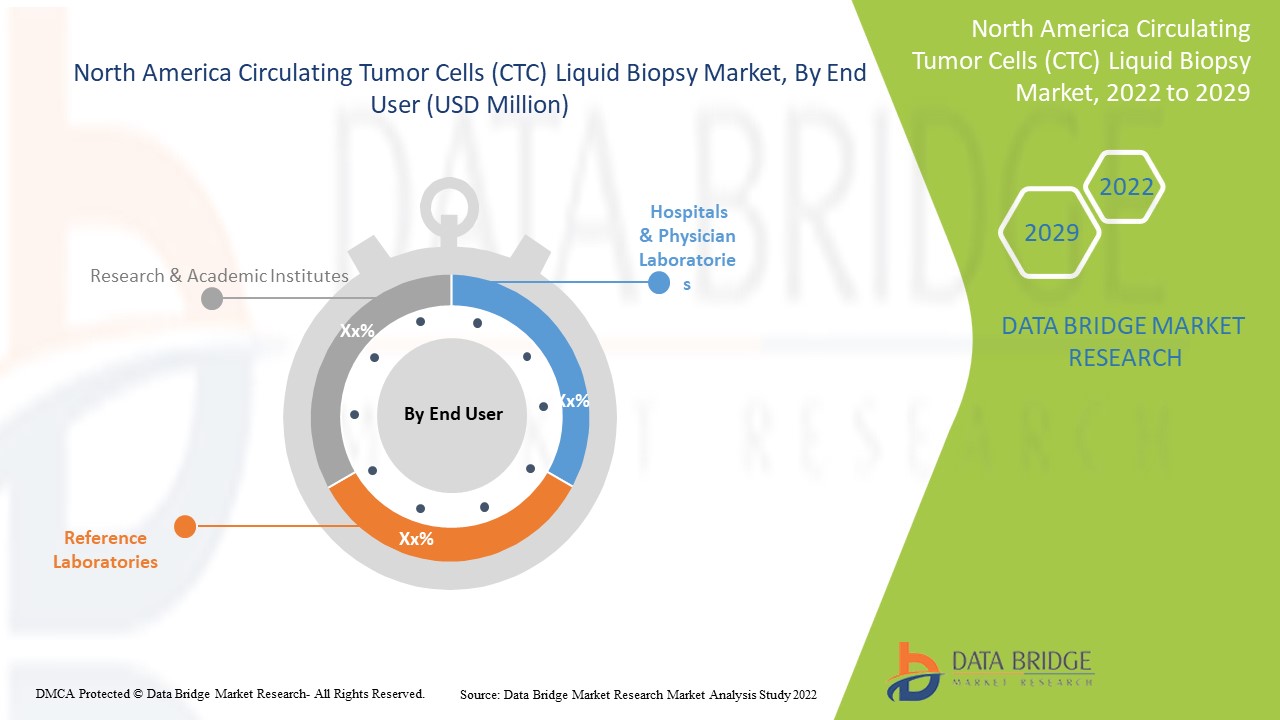

- On the basis of end user, circulating tumor cells (CTC) liquid biopsy market is segmented into research and academic institutes, reference laboratories and hospitals and physician laboratories. In 2021, academic and research institutes segment is expected to dominate the market because of research and academic institutes perform an essential role to accelerate research and development in the various therapeutic area related to liquid biopsies.

North America Circulating Tumor Cells (CTC) Liquid Biopsy Market Country Level Analysis

North America circulating tumor cells (CTC) liquid biopsy market is analysed and market size information is provided by country, technology, application and end user.

The countries covered in the North America circulating tumor cells (CTC) liquid biopsy market report are U.S., Canada and Mexico.

The U.S. is dominating the circulating tumor cells (CTC) liquid biopsy in the North American region due to rise in number of cancer patients and presence of major players in the market.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of sales channels are considered while providing forecast analysis of the country data.

The Presence of Advanced Technology and Strategic Initiatives Taken by Players are Creating New Opportunities in The North America Circulating Tumor Cells (CTC) Liquid Biopsy Market

North America circulating tumor cells (CTC) liquid biopsy market also provides you with detailed market analysis for every country's growth in a particular industry with products sales, the impact of advancement in the market, and changes in regulatory scenarios with their support for the dental instruments market. The data is available for the historic period 2011 to 2020.

Competitive Landscape and North America Circulating Tumor Cells (CTC) Liquid Biopsy Market Share Analysis

North America circulating tumor cells (CTC) liquid biopsy market competitive landscape provide details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width, and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the company's focus related to circulating tumor cells (CTC) liquid biopsy market.

The major companies providing circulating tumor cells (CTC) liquid biopsy are Eurofins Genomics ( a subsidiary of Eurofins Scientific), MDx Health, Guardant Health, IMMUCOR, Thermo Fisher Scientific, Inc., Menarini Silicon Biosystems, QIAGEN, Exact Sciences Corporation, Myriad Genetics, Inc., LungLife AI, Inc., Bio-Rad Laboratories, Inc., Illumina, Inc. , Natera Inc., ExoDx ( a subsidiary of Bio-Techne Corporation), Biocept, Inc., F. Hoffman-La Roche Ltd. ,FOUNDATION MEDICINE, INC., Lucence Health, Inc., Inivata Ltd, Biolidics Limited, Vortex Biosciences among others.

For instance,

- In November 2020, Lucence Health, Inc. announced the launch of first early detection study which evaluates the use of its liquid biopsy technology. This will help the company to advance the launch of novel products.

Collaboration, joint ventures, and other strategies by the market player is enhancing the company market in the circulating tumor cells (CTC) liquid biopsy market, which also provides the benefit for the organization to improve their offering for circulating tumor cells (CTC) liquid biopsy market.

SKU-