Europe Liquid Biopsy Market, By Product (Instruments, Consumables & Accessories, Services & Software), Biomaker Type (Circulating Tumor Cells (CTCS), Circulating Cell-Free DNA (CFDNA), Cell-free RNA, Extracellular Vesicles, Exosomes, and Others), Sample Type (Blood Sample-Based, Urine Sample-Based, Saliva & Other Tissue Fluid Sample-Based, and Others), Analytical Type (Molecular, Proteomics, and Histology/Imaging), Application Type (Cancer Applications and Non-Cancer Applications), Clinical Application (Routine Screening, Patient Work-Up, Therapy Selection, Treatment Monitoring, Recurrence Monitoring, and Others), Technology (Multi-Gene Parallel Analysis, and Single-Gene Analysis), End User (Hospitals, Reference Laboratories, Diagnostic Centers, Research Centers & Academic Institutes, and Others), Distribution Channel (Direct Tender, Third Party Distributor, and Others) - Industry Trends and Forecast to 2030.

Europe Liquid Biopsy Market Analysis and Insights

The increasing awareness of advanced diagnostic technology Europe has enhanced the demand for the market. The rising healthcare expenditure for better health services also contributes to the market's growth. The major market players focus on various service launches and approvals during this crucial period. In addition, the increase in improved advancement of processes and techniques also contributes to the rising demand for liquid biopsy.

The Europe liquid biopsy market is expected to grow in the forecast year due to the rise in market players and the availability of advanced services. Along with this, manufacturers are engaged in the developmental activity for launching novel services in the market. The increasing development in the field of advanced healthcare techniques is further boosting market growth.

However, difficulties such as the lack of standardized protocols and the lack of skilled professionals might hamper the growth of the Europe liquid biopsy market in the forecast period.

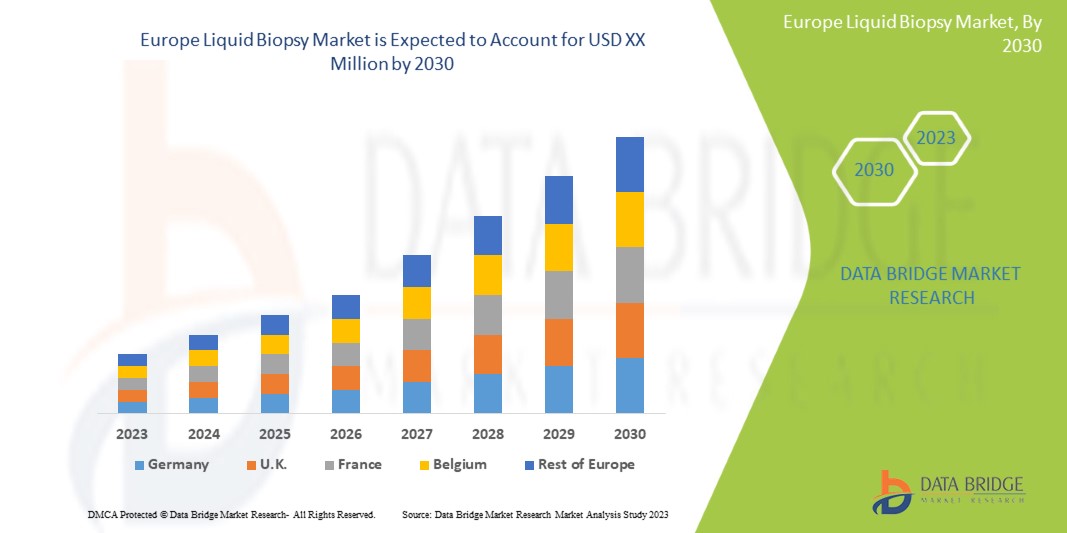

Data Bridge Market Research analyzes that the Europe liquid biopsy market will grow at a CAGR of 15.1% during the forecast period of 2023 to 2030.

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015- 2020)

|

|

Quantitative Units

|

Revenue in Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Product (Instruments, Consumables & Accessories, Services & Software), Biomaker Type (Circulating Tumor Cells (CTCS), Circulating Cell-Free DNA (CFDNA), Cell-free RNA, Extracellular Vesicles, Exosomes, and Others), Sample Type (Blood Sample-Based, Urine Sample-Based, Saliva & Other Tissue Fluid Sample-Based, and Others), Analytical Type (Molecular, Proteomics, and Histology/Imaging), Application Type (Cancer Applications and Non-Cancer Applications), Clinical Application (Routine Screening, Patient Work-Up, Therapy Selection, Treatment Monitoring, Recurrence Monitoring, and Others), Technology (Multi-Gene Parallel Analysis, and Single-Gene Analysis), End User (Hospitals, Reference Laboratories, Diagnostic Centers, Research Centers & Academic Institutes, and Others), Distribution Channel (Direct Tender, Third Party Distributor, and Others)

|

|

Countries Covered

|

Germany, U.K., France, Italy, Spain, Netherlands, Russia, Switzerland, Turkey, Belgium, and Rest of Europe

|

|

Market Players Covered

|

F. Hoffmann-La Roche Ltd, Guardant Health, Thermo Fisher Scientific Inc., QIAGEN, Labcorp, Johnson & Johnson Services, Inc., Illumina Inc, mdxhealth, NeoGenomics Laboratories, Bio-Rad Laboratories, Inc., Natera, Inc., CARDIFF ONCOLOGY, INC., Menarini Silicon Biosystems, Sysmex Inostics Inc., and ANGLE plc among others

|

Market Definition

A liquid biopsy is a medical test that involves the analysis of various biomolecules, such as DNA, RNA, proteins, and other substances in a patient's blood or other bodily fluids, to diagnose and monitor various medical conditions, including cancer. Unlike traditional biopsies that involve the removal of tissue samples from the body, a liquid biopsy is non-invasive and can provide important diagnostic information without the need for surgery or other invasive procedures. Liquid biopsies are still in the early stages of development but hold promise for improving the detection and management of cancer and other diseases.

Europe Liquid Biopsy Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below

Drivers

- Growing demand for non-invasive liquid biopsy technique

Liquid biopsies consist of isolating tumor-derived entities such as circulating tumor cells, circulating tumor DNA, and tumor extracellular vesicles among others, present in the body fluids of patients with cancer, followed by an analysis of genomic and proteomic data contained within them. Methods for isolation and analysis of liquid biopsies have rapidly evolved over the past few years, as described in the review, thus providing greater details about tumor characteristics such as mutations, tumor staging, tumor progression, heterogeneity, and gene and clonal evolution, among others. Liquid biopsies from cancer patients have opened up newer avenues in detection and continuous monitoring, treatment based on precision medicine, and screening of markers for therapeutic resistance. Non-invasive cancer diagnostics offer a safer and more patient-friendly approach, resulting in a growing demand for these methods.

- Advancements in precision medicine due to liquid biopsy

Precision medical oncology in the clinical management of cancer may be achieved through the diagnostic platform called "liquid biopsy" (LB). The LB was recognized as a powerful real-time approach for the molecular monitoring of this dynamic cancer disease. This method utilizes the detection of Biomakers in blood for prognostic and predictive purposes by non-invasive means, which in the near future will represent a change in the paradigm of molecular biology understanding and the heterogeneity of tumors. Advancements in precision medicine, fueled by the use of liquid biopsy techniques, have contributed significantly to the growing demand for non-invasive cancer diagnostics. Liquid biopsy techniques, such as the analysis of circulating tumor DNA (ctDNA), Circulating Tumor Cells (CTCs), or exosomes in blood or other body fluids, provide valuable information about the genetic makeup of tumors, enabling precision medicine approaches in cancer care.

Opportunity

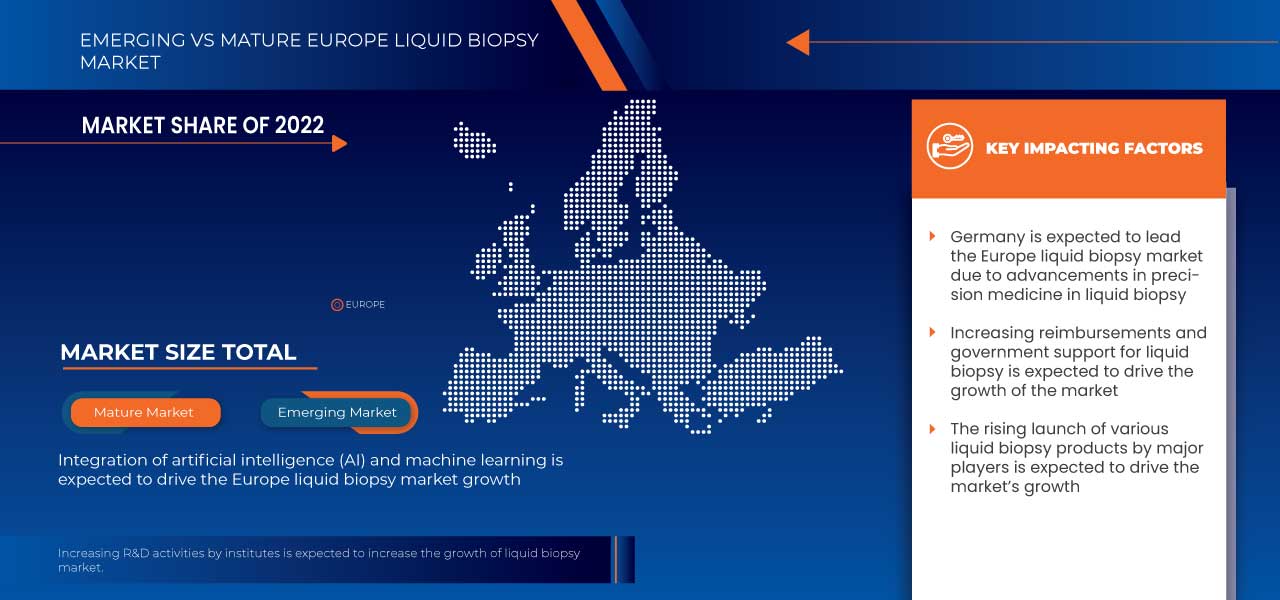

- Integration of Artificial Intelligence (AI) and machine learning

Liquid biopsy-based approaches offer many new opportunities to measure molecular Biomakers for diagnosing, prognosis, and monitoring disease. Artificial Intelligence (AI), such as machine learning, and its ability to identify signatures of specific disease states in multiplexed data will be key to taking advantage of the new molecular information that microchip-based diagnostics can extract.

Thus, the integration of AI and machine learning is expected to act as an opportunity for the growth of the market.

- Increasing reimbursements and government support for liquid biopsy

The adoption of liquid biopsy has been significantly influenced by government backing. Governments throughout the world have put legislation in place to encourage the adoption of liquid biopsy because they understand how it may enhance patient care, lower healthcare costs, and advance precision medicine. Incorporating liquid biopsy into national cancer screening programs or treatment recommendations is only one example of how this might be done. Other examples include financing for research and development of liquid biopsy technologies and backing clinical trials and studies to produce evidence on their therapeutic efficacy. Such government assistance has aided in boosting liquid biopsy test knowledge, adoption, and reimbursement coverage.

Thus, increasing reimbursements and government support for liquid biopsy is expected to act as an opportunity for the market's growth.

Restraint/Challenge

- High cost of liquid biopsy tests

The liquid biopsy is severely constrained by the high cost. While liquid biopsy tests show promise for non-invasive illness detection and monitoring, including cancer, there are cost-related obstacles that may prevent their widespread use.

The necessity for specialized tools and technologies is one of the biggest economic obstacles. Costly tools, including digital PCR machines, NGS platforms, and automated sample processing systems, are frequently needed for liquid biopsy studies. Smaller healthcare facilities with tighter budgets may find it difficult to afford the initial investment and ongoing maintenance costs connected with these technologies, which limits their capacity to provide liquid biopsy tests to patients.

Thus, the high cost of liquid biopsy tests is expected to restrain the market's growth.

- Lack of skilled professionals performing liquid biopsy

The demand for liquid biopsy tests is increasing due to their potential clinical utility in cancer detection, monitoring, and personalized treatment decision-making. However, there may be limited resources, including personnel, equipment, and funding, to support the implementation of liquid biopsy programs in healthcare institutions. This can result in a shortage of skilled professionals who can perform liquid biopsy tests, especially in regions or healthcare settings with limited resources.

Thus, the lack of skilled professionals performing liquid biopsies is expected to challenge the market growth.

Recent Development

- In January 2022, Exact Sciences Corporation announced the acquisition of Prevention Genetics, a genetic testing laboratory, to complement its advanced cancer diagnostics portfolio and support its entrance into hereditary cancer testing (HCT).

Europe Liquid Biopsy Market Scope

The Europe liquid biopsy market is categorized into nine notable segments which are product, Biomaker type, sample type, analytical type, application type, clinical application, technology, end user, and distribution channel. The growth amongst these segments will help you analyze market growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Instruments

- Consumables & Accessories

- Services & Software

On the basis of product, the market is segmented into instruments, consumables & accessories, services & software.

Biomaker Type

- Circulating Tumor Cells (CTCS)

- Circulating Cell-Free DNA (CFDNA)

- Cell-Free RNA

- Exosomes

- Extracellular vesicles

- Others

On the basis of biomaker type, the market is segmented into circulating tumor cells (CTCS), circulating cell-free DNA (CFDNA), cell-free RNA, extracellular vesicles, exosomes, and others.

Sample Type

- Blood Sample-Based

- Urine Sample-Based

- Saliva & Other Tissue Fluids Sample-Based

- Others

On the basis of sample type, the market is segmented into blood sample-based, urine sample-based, saliva & other tissue fluid sample-based, and others.

Analytical Type

- Molecular

- Proteomic

- Histology/Imaging

On the basis of analytical type, the market is segmented into molecular, proteomics, and histology/imaging.

Application Type

- Cancer Applications

- Non-Cancer Applications

On the basis of application type, the market is segmented into cancer applications and non-cancer applications.

Clinical Application

- Routine Screening

- Therapy Selection

- Treatment Monitoring

- Recurrence Monitoring

- Patient Work-Up

- Others

On the basis of clinical application, the market is segmented into routine screening, patient work-up, therapy selection, treatment monitoring, recurrence monitoring, and others.

Technology

- Multi-Gene-Parallel Analysis

- Single Gene Analysis

On the basis of technology, the market is segmented into multi-gene parallel analysis and single-gene analysis.

End User

- Hospitals

- Reference Laboratories

- Diagnostics Centers

- Research Centres and Academic Institutes

- Others

On the basis of end user, the market is segmented into hospitals, reference laboratories, diagnostic centers, research centers & academic institutes, and others.

Distribution Channels

- Direct Tender

- Third Party Distributor

- Others

On the basis of distribution channel, the market is segmented into direct tender, third party distributor, and others.

Europe Liquid Biopsy Market Regional Analysis/Insights

The Europe liquid biopsy market is analyzed, and market size insights and trends are provided based on product, biomaker type, sample type, analytical type, application type, clinical application, technology, end user, and distribution channel.

The countries covered in this market report are Germany, U.K., France, Italy, Spain, Netherlands, Russia, Switzerland, Turkey, Belgium, and Rest of Europe.

In 2023, Germany is expected to dominate the Europe region due to the increasing cancer prevalence and awareness, the demand in this region is projected to be driven by a rise in cancer cases.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as downstream and upstream value chain analysis, technical trends, Porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands and the impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe Liquid Biopsy Market Share Analysis

The Europe liquid biopsy market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, company strengths and weaknesses, product launch, clinical trials pipelines, brand analysis, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the Europe liquid biopsy market.

Some of the major players in the Europe liquid biopsy market are F. Hoffmann-La Roche Ltd, Guardant Health, Thermo Fisher Scientific Inc., QIAGEN, Labcorp, Johnson & Johnson Services, Inc., Illumina Inc, mdxhealth, NeoGenomics Laboratories, Bio-Rad Laboratories, Inc., Natera, Inc., CARDIFF ONCOLOGY, INC., Menarini Silicon Biosystems, Sysmex Inostics Inc., and ANGLE plc among others.

SKU-