Global Laboratory Informatics Market

Market Size in USD Billion

CAGR :

%

USD

4.68 Billion

USD

11.02 Billion

2024

2032

USD

4.68 Billion

USD

11.02 Billion

2024

2032

| 2025 –2032 | |

| USD 4.68 Billion | |

| USD 11.02 Billion | |

|

|

|

|

Laboratory Informatics Market Size

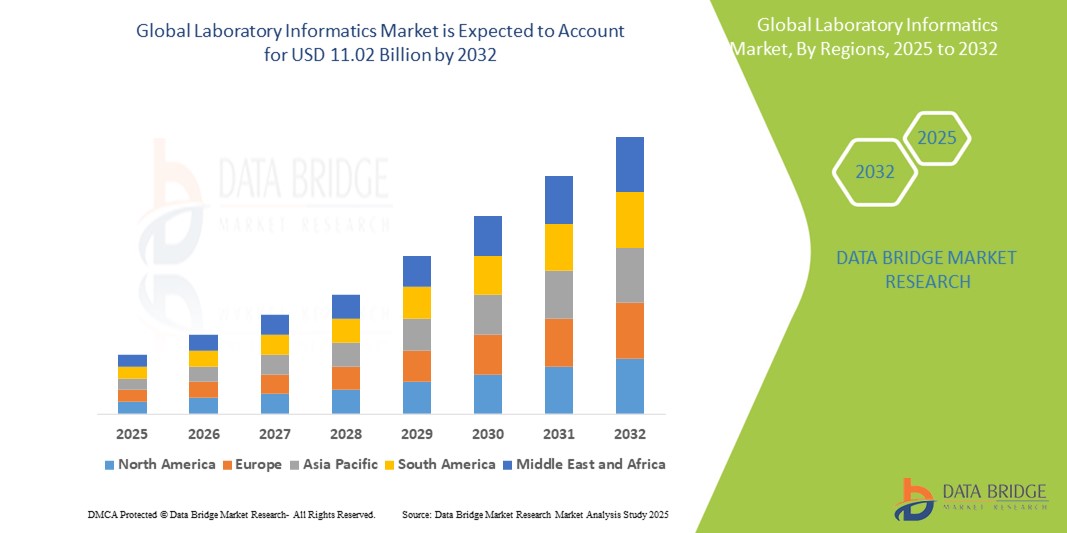

- The global laboratory informatics market size was valued at USD 4.68 billion in 2024 and is expected to reach USD 11.02 billion by 2032, at a CAGR of 11.30% during the forecast period

- The market growth is largely fueled by the growing demand for laboratory automation and efficiency, particularly within pharmaceutical and biotechnology research and development

- Furthermore, rising regulatory requirements for data integrity and compliance, along with the increasing adoption of cloud-based solutions for flexible data management and collaboration, are establishing laboratory informatics as a critical tool for modern laboratories. These converging factors are accelerating the uptake of laboratory informatics solutions, thereby significantly boosting the industry's growth

Laboratory Informatics Market Analysis

- Laboratory informatics solutions, encompassing software such as Laboratory Information Management Systems (LIMS), Electronic Lab Notebooks (ELN), and Chromatography Data Systems (CDS), are increasingly vital for modern laboratories in managing complex data, automating workflows, and ensuring regulatory compliance across industries

- The escalating demand for laboratory informatics is primarily fueled by the increasing need for laboratory automation to enhance efficiency, the growing volume of data generated in research and diagnostic settings, and the stringent regulatory requirements for data integrity and quality

- North America dominates the laboratory informatics market with the largest revenue share of 42.60% in 2024, characterized by the region's advanced healthcare and pharmaceutical industries, substantial investments in research and development, and the early adoption of digital solutions in laboratories. The U.S. is a major contributor to this dominance, driven by technological advancements and the presence of key market players

- Asia-Pacific is expected to be the fastest growing region in the laboratory informatics market during the forecast period due to increasing urbanization, rising disposable incomes, growing investments in healthcare and pharmaceutical R&D

- Laboratory information management systems (LIMS) segment dominates the laboratory informatics market with a market share of 50.45% in 2024, driven by its established reputation for security and ease of retrofit into existing door setups

Report Scope and Laboratory Informatics Market Segmentation

|

Attributes |

Laboratory Informatics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Laboratory Informatics Market Trends

“Enhanced Efficiency and Insights Through AI and Cloud Integration”

- A significant and accelerating trend in the global laboratory informatics market is the deepening integration with artificial intelligence (AI), machine learning (ML), and cloud computing platforms. This fusion of technologies is significantly enhancing data management, workflow automation, and the extraction of valuable insights from complex laboratory data

- For instance, leading LIMS providers such as LabVantage, LabWare, and Thermo Fisher Scientific are integrating advanced analytics and AI capabilities into their platforms, allowing for predictive modeling, automated analysis, and anomaly detection. Cloud-based LIMS solutions, such as those offered by Scispot and CloudLIMS, are gaining traction due to their scalability, accessibility, and cost-efficiency

- AI and ML integration in laboratory informatics enables features such as automated data entry via OCR, predictive analytics for experiment outcomes and equipment maintenance, and improved quality control through real-time monitoring and anomaly detection. For instance, AI algorithms can analyze historical data to predict potential test failures or optimize resource allocation based on testing volume fluctuations. Furthermore, cloud computing facilitates remote access to data, seamless collaboration across geographically dispersed teams, and robust data storage, addressing the increasing volume of data generated in modern labs

- The seamless integration of laboratory informatics systems with AI and cloud platforms facilitates centralized control over various aspects of laboratory operations, creating a unified and automated environment. Through a single interface, users can manage samples, analyze data, and ensure compliance, reducing manual errors and improving turnaround times

- This trend towards more intelligent, intuitive, and interconnected laboratory systems is fundamentally reshaping user expectations for laboratory efficiency and data utilization. Consequently, companies are developing AI-enabled informatics solutions with features such as natural language processing for interacting with data and advanced analytics for deeper scientific discoveries

- The demand for laboratory informatics solutions that offer seamless AI and cloud integration is growing rapidly across life sciences, pharmaceuticals, biotechnology, and other sectors, as laboratories increasingly prioritize efficiency, data integrity, and advanced analytical capabilities

Laboratory Informatics Market Dynamics

Driver

“Growing Need Due to Rising Data Volume, Automation, and Regulatory Compliance”

- The increasing volume and complexity of data generated in modern laboratories, coupled with the escalating need for automation and stringent regulatory requirements across industries, are significant drivers for the heightened demand for laboratory informatics solutions

- For instance, major players such as Thermo Fisher Scientific, LabWare, and LabVantage are continuously enhancing their LIMS, ELN, and CDS platforms to handle vast datasets, automate workflows, and ensure compliance with regulations such as FDA's 21 CFR Part 11 and ISO standards. Such continuous advancements and strategic developments by key companies are expected to propel the laboratory informatics industry growth in the forecast period

- As laboratories strive to improve efficiency, reduce manual errors, and accelerate research and development cycles, laboratory informatics offers advanced capabilities for data management, instrument integration, and real-time monitoring. This provides a compelling upgrade over traditional, paper-based laboratory processes

- Furthermore, the growing adoption of laboratory automation, including robotics and high-throughput screening, necessitates robust informatics solutions to effectively manage the resulting surge in data and streamline the entire experimental workflow

- The critical need for data integrity, audit trails, and efficient reporting to meet regulatory obligations in industries such as pharmaceuticals, biotechnology, and clinical diagnostics are key factors propelling the adoption of laboratory informatics solutions. The increasing shift towards cloud-based deployments further enhances accessibility and scalability, contributing to market growth

Restraint/Challenge

“Concerns Regarding Data Security, Integration Complexities, and High Implementation Costs”

- Concerns surrounding the cybersecurity vulnerabilities of interconnected laboratory devices and informatics systems, including LIMS, ELN, and CDS, pose a significant challenge to broader market penetration. As these systems handle sensitive research data, intellectual property, and often patient information, they are susceptible to hacking attempts, data breaches, and ransomware attacks, raising anxieties among potential users about the integrity and confidentiality of their critical data

- For instance, high-profile reports of cybersecurity incidents in healthcare and research sectors have made some laboratories hesitant to fully embrace digital transformation, including the adoption of comprehensive informatics solutions. The increasing reliance on cloud-based systems, while offering flexibility, also introduces new security considerations

- Addressing these cybersecurity concerns through robust encryption, multi-factor authentication, granular access controls, and regular vulnerability assessments is crucial for building trust. Companies such as LabVantage and LabWare emphasize their advanced security features and compliance with regulations such as FDA 21 CFR Part 11 and GDPR in their marketing to reassure potential buyers

- In addition, the relatively high initial cost of implementing comprehensive laboratory informatics systems, including software licensing, hardware upgrades, customization, data migration, and extensive training, can be a significant barrier to adoption for smaller laboratories or those with limited budgets. While cloud-based solutions can reduce upfront infrastructure costs, recurring subscription fees can still be substantial

- Furthermore, the complexity of integrating diverse laboratory instruments, legacy systems, and different software platforms can lead to significant implementation challenges, time delays, and additional costs. A lack of standardized communication protocols among various vendors further exacerbates these integration hurdles

- Overcoming these challenges through enhanced cybersecurity measures, clear communication on data protection, the development of more affordable and scalable solutions, and streamlined integration frameworks will be vital for sustained market growth

Laboratory Informatics Market Scope

The market is segmented on the basis of product, delivery mode, component, and end use.

- By Product

On the basis of product, the global laboratory informatics market is segmented into laboratory information management systems (LIMS), electronic lab notebooks (ELN), Scientific data management systems (SDMS), laboratory execution systems (LES), electronic data capture (EDC) and clinical data management systems (CDMS), Chromatography Data Systems (CDS), and Enterprise Content Management (ECM). The laboratory information management systems (LIMS) segment dominates the largest market revenue share of 50.45% in 2024, driven by its comprehensive capabilities in managing the entire sample lifecycle, automating workflows, generating reports, and ensuring regulatory compliance. Laboratories increasingly prioritize LIMS for its ability to integrate and organize vast amounts of data efficiently. The market also sees strong demand for LIMS due to its critical role in enhancing operational efficiency and data integrity across various scientific disciplines

The electronic lab notebooks (ELN) segment is anticipated to witness the fastest growth rate from 2025 onwards, fueled by the accelerating digitalization of research and development activities and the benefits of seamless data capture, organization, and collaboration. ELNs offer researchers a digital alternative to paper notebooks, providing easy accessibility, robust data integrity, and real-time sharing capabilities, making them highly suitable for modern, interconnected research environments

- By Delivery Mode

On the basis of delivery mode, the global laboratory informatics market is segmented into on-premise, web-hosted, and cloud-based. The cloud-based segment held the largest market revenue share, driven by its inherent scalability, enhanced accessibility, and significantly reduced upfront infrastructure costs. Cloud-based solutions enable remote data storage, real-time tracking, and easier collaboration across geographically dispersed teams, making them a preferred choice for contract research organizations (CROs) and smaller laboratories

The web-hosted segment is expected to witness substantial growth, fueled by the increasing need for flexible, scalable, and accessible laboratory informatics solutions that can be accessed via web browsers. This mode offers a balance between on-premise control and cloud-based convenience, appealing to organizations seeking a managed solution without full cloud migration

- By Component

On the basis of component, the global laboratory informatics market is segmented into software and services. The services segment held the larger market revenue share driven by the increasing complexity of laboratory informatics systems and the consequent higher demand for specialized support. Services such as implementation, training, customization, and ongoing maintenance are crucial for successful deployment and optimal functioning of these systems. The trend of outsourcing LIMS operations by an increasing number of users also significantly contributes to this segment's growth

The software segment is expected to witness lucrative growth due to the continuous launch of technologically advanced software, often via SaaS (Software as a Service) delivery models, designed for efficient information management in laboratories. Innovations in AI and machine learning integration within software platforms are further driving demand, offering enhanced automation and analytical capabilities

- By End Use

On the basis of end use, the global laboratory informatics market is segmented into life sciences, CROs, chemical industry, food and beverage and agriculture industries, environmental testing laboratories, petrochemical refineries and oil and gas industry, and other industries. The Life Sciences segment accounted for the largest market revenue share, driven by the extensive research and development activities in drug discovery, biotechnology, and personalized medicine, coupled with stringent regulatory compliance requirements for data management and quality control within these fields. The critical need for accurate and traceable data in pharmaceutical and biotech R&D fuels the adoption of informatics solutions

The CROs (Contract Research Organizations) segment is expected to witness the fastest growth rate from 2025 onwards, fueled by the increasing trend of outsourcing laboratory services by pharmaceutical and biotechnology companies. CROs benefit significantly from laboratory informatics solutions that provide efficient project management, robust data handling, and seamless collaboration with clients, enabling them to handle large volumes of diverse studies and meet strict deadlines

Laboratory Informatics Market Regional Analysis

- North America dominates the laboratory informatics market with the largest revenue share of 42.60% in 2024, driven by the region's advanced healthcare and pharmaceutical industries, substantial investments in research and development, and the early adoption of digital solutions in laboratories

- Organizations in the region highly value the enhanced efficiency, data integrity, and robust regulatory compliance offered by laboratory informatics solutions, particularly in the context of stringent requirements from agencies such as the FDA

- This widespread adoption is further supported by high per-capita healthcare expenditure, a technologically advanced infrastructure, and a growing emphasis on digital transformation in laboratories, establishing informatics as a critical tool for managing complex data and automating workflows in both research and clinical settings

U.S. Laboratory Informatics Market Insight

The U.S. laboratory informatics market captured a substantial revenue share of 34.1% in 2024, the largest share within North America, fueled by the increasing demand for high accuracy and efficiency in laboratory results, the expanding applications of laboratory informatics solutions, and the rising number of diagnostic procedures. The evolving pathology landscape in the U.S., characterized by rising workloads, cost pressures, and rapid technological advancements, underscores the necessity for innovative laboratory systems. The integration of AI, ML, and cloud services in medical instruments further propels the market.

Europe Laboratory Informatics Market Insight

The Europe laboratory informatics market is projected to expand at a substantial CAGR from 2025 to 2032, primarily driven by stringent regulatory guidelines for data management and the escalating need for enhanced efficiency in healthcare and research facilities. The European Commission's Digital Single Market Strategy, which encourages the development of digital networks and services, is fostering the adoption of laboratory informatics. European laboratories are also drawn to the benefits of cloud-based solutions for scalability and real-time access. The region is experiencing significant growth across life sciences, chemical, and environmental testing applications, with informatics solutions being incorporated to meet increasing demand for data-driven decision-making

U.K. Laboratory Informatics Market Insight

The U.K. laboratory informatics market is anticipated to grow at a noteworthy CAGR from 2025 to 2032, driven by the increasing need for efficient data management in healthcare, rising per capita income, and a growing prevalence of chronic disorders. The UK's focus on streamlining patient data and leveraging comprehensive data through initiatives such as the National Health Services (NHS) is expected to bring more efficiency to the system, thereby stimulating market growth. The strong adoption of electronic systems and the need for efficient healthcare data are key drivers.

Germany Laboratory Informatics Market Insight

The Germany laboratory informatics market is expected to expand at a considerable CAGR during the forecast period and is projected to lead the regional market in terms of revenue in Europe by 2030. This growth is fueled by increasing awareness of digital transformation in healthcare and research, coupled with a strong focus on technological innovation. Germany’s well-developed infrastructure and robust healthcare system promote the adoption of laboratory informatics, particularly in pharmaceutical, biotechnology, and clinical laboratories. The emphasis on data security and privacy aligns with local market expectations, further driving adoption

Asia-Pacific Laboratory Informatics Market Insight

The Asia-Pacific laboratory informatics market is poised to grow at the fastest CAGR during the forecast period, driven by increasing urbanization, rising disposable incomes, and rapid technological advancements in countries such as China, Japan, and India. The region's growing inclination towards digitalization in healthcare and research, supported by government initiatives promoting technological adoption, is driving the uptake of laboratory informatics. Furthermore, as APAC emerges as an outsourcing hub for laboratory services and pharmaceutical manufacturing, the demand for efficient data management and automation is expanding to a wider laboratory base.

Japan Laboratory Informatics Market Insight

The Japan laboratory informatics market is gaining momentum with a projected CAGR in 2025 to 2032, due to the country’s high-tech culture, strong emphasis on research and development, and increasing demand for efficiency and compliance. The Japanese market places a significant emphasis on data accuracy and integrity, and the adoption of laboratory informatics is driven by the increasing integration of digital solutions across industries. The push for automation and the use of advanced technologies, including AI and cloud computing, are fueling growth

India Laboratory Informatics Market Insight

The India laboratory informatics market accounted for a significant market revenue share in Asia Pacific in 2024. This is attributed to the country's expanding middle class, rapid urbanization, and high rates of technological adoption in the healthcare and life sciences sectors. India is witnessing an increase in the setup of biotech companies and diagnostic labs, which are increasingly opting for laboratory informatics solutions to manage and store patient and test data effectively. The push towards digital health initiatives and the availability of increasingly affordable informatics options are key factors propelling the market in India.

Laboratory Informatics Market Share

The laboratory informatics industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc (U.S.)

- LabWare (U.S.)

- LabVantage Solutions Inc. (U.S.)

- Agilent Technologies Inc. (U.S.)

- Revvity (U.S.)

- Waters Corporation (U.S.)

- Dassault Systèmes (France)

- Abbott (U.S.)

- Promega Corporation (U.S.)

- Schrödinger, Inc. (U.S.)

- Sapio Sciences (U.S.)

- Autoscribe Informatics (U.K.)

- Quality Systems International (QSI) (U.S.)

- RURO, Inc. (U.S.)

- Novatek International (Canada)

- CSols Inc. (U.S.)

- Cerner Corporation (U.S.)

- McKesson Corporation (U.S.)

- Scientific Equipment Repair (U.S.)

Latest Developments in Global Laboratory Informatics Market

- In May 2025, Waters Corporation acquired Halo Labs, an innovator of specialized imaging technologies for detecting and identifying interfering materials in therapeutic products. This acquisition integrates Halo Labs' Aura platform, which performs full-spectrum particle analysis, complementing Waters' existing light scattering detection solutions. This move enhances Waters' offerings in large molecule development and quality assurance/quality control (QA/QC), particularly for emerging biopharma therapies such as CAR T-cell therapies

- In April 2025, Revvity Signals Software, a division of Revvity, Inc., launched its Signals One platform. This unified software platform, evolved from the company's existing research portfolio, is designed to streamline data management across the entire drug discovery lifecycle. It addresses the growing complexity of drug modalities research by integrating advanced research capabilities and fostering collaboration in multidisciplinary workflows

- In March 2025, LabWare, a global leader in LIMS, unveiled new additions to its SaaS portfolio, including LabWare ASSURE, LabWare QAQC, and LabWare GROW. These offerings aim to redefine how laboratories integrate LIMS, providing instant access to scalable, ready-to-use enterprise configurations. This expansion focuses on reducing deployment risk and accelerating time-to-go-live, making high-quality informatics solutions accessible to both startups and global enterprises with OpEx-based pricing

- In February 2025, Agilent Technologies and ABB Robotics announced a cooperation agreement to deliver advanced laboratory automation solutions. This collaboration combines Agilent's cutting-edge analytical technologies and laboratory software with ABB's state-of-the-art robotics

- In February 2024, LabVantage Solutions announced significant growth in its Professional Services Organization, expanding globally to reduce implementation timelines for customers. Concurrently, LabVantage introduced a "Digitally Native Ecosystem" aimed at boosting speed and success in R&D laboratories, emphasizing how the strategic integration of AI and automation is reshaping lab operations for faster, more accurate diagnostic insights

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.