Global Hospital Laboratory Information Management Systems Market

Market Size in USD Billion

CAGR :

%

USD

1.92 Billion

USD

8.60 Billion

2024

2032

USD

1.92 Billion

USD

8.60 Billion

2024

2032

| 2025 –2032 | |

| USD 1.92 Billion | |

| USD 8.60 Billion | |

|

|

|

|

Hospital Laboratory Information Management Systems Market Size

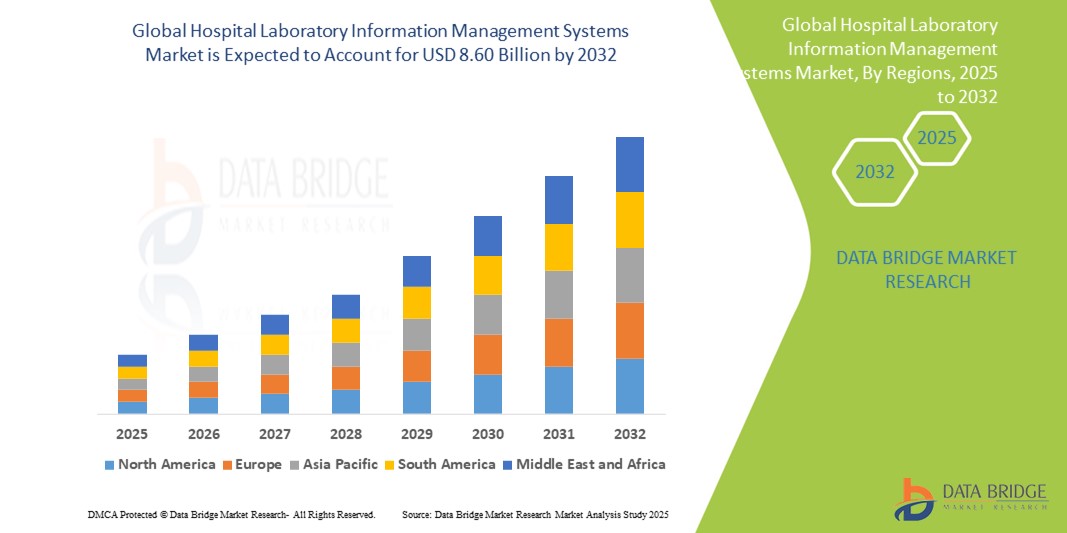

- The global hospital laboratory information management systems market size was valued at USD 1.92 billion in 2024 and is expected to reach USD 8.60 billion by 2032, at a CAGR of 20.55% during the forecast period

- The market growth is largely fueled by the increasing need for enhanced efficiency and automation within hospital laboratories, leading to streamlined workflows and reduced manual errors in both diagnostic and research settings

- Furthermore, the growing emphasis on data security, regulatory compliance (such as HIPAA), and the seamless integration of laboratory data with Electronic Health Records (EHRs) is establishing hospital laboratory information management systems as a crucial component of modern healthcare infrastructure. These converging factors are accelerating the adoption of sophisticated LIS solutions, thereby substantially driving the industry's growth

Hospital Laboratory Information Management Systems Market Analysis

- Hospital Laboratory Information Management Systems (LIS), offering comprehensive digital management of laboratory data and workflows, are increasingly vital components of modern healthcare and research facilities in both clinical and commercial settings due to their enhanced efficiency, data accuracy, and seamless integration with other healthcare IT systems

- The escalating demand for hospital laboratory information management systems is primarily fueled by the growing need for automation in laboratories, stringent regulatory requirements for data management, and a rising preference for integrated and efficient laboratory operations

- North America dominates the hospital laboratory information management systems market with the largest revenue share of 41.4% in 2025, characterized by early adoption of healthcare IT solutions, high healthcare expenditure, and a strong presence of key industry players, with the U.S. experiencing substantial growth in LIS implementations across hospitals and diagnostic centers

- Asia-Pacific is expected to be the fastest-growing region in the hospital laboratory information management systems market during the forecast period, with an anticipated CAGR of 13.15% due to increasing healthcare investments, rising awareness of the benefits of laboratory automation, and a growing number of hospitals and clinical laboratories

- The software segment is expected to dominate the hospital laboratory information management systems market with a market share of 63.7% in 2025, due to the core functionalities it provides for data management and workflow automation

Report Scope and Hospital Laboratory Information Management Systems Market Segmentation

|

Attributes |

Hospital Laboratory Information Management Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hospital Laboratory Information Management Systems Market Trends

“Enhanced Convenience Through AI and Voice Integration (in the context of Hospital LIS)”

- A significant and accelerating trend in the global hospital laboratory information management systems market is the increasing integration with artificial intelligence (AI) and, to a lesser extent, voice-controlled interfaces for specific functionalities. This fusion of technologies is significantly enhancing user convenience and control over laboratory workflows and data access

- For instance, certain advanced LIS solutions are exploring or implementing voice commands for tasks such asinitiating instrument analysis or retrieving specific sample information under secure and controlled conditions. Similarly, AI is being integrated to offer more intuitive user interfaces and streamlined data entry processes

- AI integration in hospital laboratory information management systems enables features such as learning user interaction patterns to potentially suggest more efficient workflows and providing more intelligent alerts based on instrument status or critical sample information. For instance, AI algorithms could analyze user behavior to predict frequently accessed data points, optimizing interface layouts for faster access. Furthermore, voice control capabilities could offer lab technicians hands-free operation in sterile environments for specific data retrieval tasks.

- The seamless integration of hospital laboratory information management systems with other hospital information systems and analytical platforms facilitates centralized control over various aspects of the laboratory and broader healthcare environment. Through a single interface, users can manage sample tracking, test results, and instrument data alongside patient records and diagnostic insights, creating a unified and automated laboratory experience

- This trend towards more intelligent, intuitive, and interconnected laboratory information systems is fundamentally reshaping user expectations for lab efficiency and data management. Consequently, companies are developing AI-enabled hospital laboratory information management systems with features such as automated data validation based on historical patterns and voice command compatibility for specific, secure laboratory operations

- The demand for hospital laboratory information management systems that offer seamless AI and voice control integration (where applicable and secure) is growing rapidly across both clinical and research sectors, as laboratories increasingly prioritize convenience, efficiency, and comprehensive smart lab functionality

Hospital Laboratory Information Management Systems Market Dynamics

Driver

“Growing Need Due to Rising Demand for Efficiency and Data Integration”

- The increasing pressure on healthcare facilities for enhanced efficiency, reduced errors, and seamless data integration, coupled with the growing adoption of Electronic Health Records (EHRs) and the need for regulatory compliance, is a significant driver for the heightened demand for hospital laboratory information management systems

- For instance, in May 2024, several major hospital networks announced initiatives to upgrade their laboratory infrastructure with advanced LIS solutions to improve turnaround times and data accuracy. Such strategic investments by healthcare providers are expected to drive the hospital laboratory information management systems industry growth in the forecast period

- As healthcare organizations become more focused on optimizing laboratory workflows and ensuring data integrity for better patient care and operational efficiency, hospital laboratory information management systems offer advanced features such as automated sample tracking, instrument integration, and comprehensive audit trails, providing a compelling upgrade over manual or outdated systems

- Furthermore, the growing popularity of integrated healthcare IT ecosystems and the desire for interconnected data management are making hospital laboratory information management systems an integral component of these systems, offering seamless integration with EHRs, billing systems, and other hospital platforms

- The convenience of automated workflows, real-time data access for clinicians, and the ability to manage complex laboratory operations through user-friendly software applications are key factors propelling the adoption of hospital laboratory information management systems in both hospital and reference laboratory sectors. The trend towards cloud-based LIS solutions and the increasing availability of modular and scalable options further contribute to market growth

Restraint/Challenge

“Concerns Regarding Data Security and High Implementation Costs”

- Concerns surrounding the data security and privacy of sensitive patient information managed by connected systems, including hospital laboratory information management systems, pose a significant challenge to broader market penetration. As hospital laboratory information management systems rely on network connectivity and software, they are susceptible to cybersecurity threats and data breaches, raising anxieties among healthcare providers about the security of their patient data and compliance with regulations such asHIPAA

- For instance, high-profile reports of cyberattacks on healthcare institutions have made some hospitals hesitant to adopt comprehensive LIS solutions without robust security measures

- Addressing these data security concerns through strong encryption, stringent access controls, regular security updates, and compliance certifications is crucial for building trust among healthcare organizations

- While various pricing models are emerging, the perceived premium for sophisticated LIS technology can still impede widespread adoption, especially for organizations that are primarily focused on immediate cost savings

- Overcoming these challenges through enhanced cybersecurity measures tailored to healthcare, clear demonstration of the return on investment through improved efficiency and reduced errors, and the development of more cost-effective and scalable hospital laboratory information management systems options will be vital for sustained market growth

Hospital Laboratory Information Management Systems Market Scope

The market is segmented on the basis of type, component, deployment model, and industry.

- By Type

On the basis of type, the hospital laboratory information management systems market is segmented into broad based LIMS and industry-specific LIMS. The broad based LIMS segment dominates the largest market revenue share of 61.6% in 2025, driven by its versatility and adaptability to various laboratory settings and workflows. Laboratories often prioritize Broad Based LIMS for their ability to handle diverse data types and processes, and their compatibility with existing IT infrastructure

The industry-specific LIMS segment is anticipated to witness the fastest growth rate, of 31.4% from 2025 to 2032, fueled by increasing demand for tailored solutions that address the unique requirements of specific industries such as pharmaceuticals, genomics, and clinical diagnostics. These industries often require specialized functionalities and compliance features, driving the adoption of customized LIMS solutions

- By Component

On the basis of component, the hospital laboratory information management systems market is segmented into software and services. The software segment held the largest market revenue share in 2025 of 63.7%, driven by the essential role it plays in providing the core functionalities of LIMS, including data acquisition, sample tracking, and workflow management. LIMS software is a fundamental requirement for any laboratory seeking to automate its operations and improve efficiency

The services segment is expected to witness a significant CAGR of 33.5% of the market share in 2025 and growing, driven by the increasing complexity of LIMS implementations and the growing need for expert support in areas such as system integration, validation, and training. As laboratories adopt more sophisticated LIMS solutions, the demand for professional services to ensure successful deployment and ongoing maintenance is rising.

- By Deployment Model

On the basis of deployment model, the hospital laboratory information management systems market is segmented into on-premise LIMS, remote hosted LIMS, and cloud LIMS. The on-premise LIMS segment held the largest market revenue share in 2025, driven by the preference of many organizations, particularly larger institutions, to maintain direct control over their data and IT infrastructure. On-premise LIMS deployments offer a higher degree of customization and security, which is crucial for some organizations.

The cloud LIMS segment is expected to witness the fastest CAGR from 2025 onwards, driven by its scalability, cost-effectiveness, and accessibility. Cloud-based LIMS solutions eliminate the need for significant upfront investments in hardware and IT infrastructure, making them an attractive option for smaller laboratories and those seeking to reduce their IT burden.

- By Industry

On the basis of industry, the hospital laboratory information management systems market is segmented into life sciences, petrochemical refineries and oil and gas, food and beverage and agriculture, chemical, environmental testing laboratories, and other industries. The life sciences segment accounted for the largest market revenue share in 2025, driven by the extensive use of LIMS in pharmaceutical and biotechnology research, clinical trials, and drug discovery. The stringent regulatory requirements and the need for precise data management in the life sciences industry drive the adoption of LIMS

The petrochemical refineries and oil and gas segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing focus on quality control, regulatory compliance, and process optimization in these industries. LIMS helps these industries manage complex sample workflows, ensure product quality, and meet environmental regulations.

Hospital Laboratory Information Management Systems Market Regional Analysis

- North America dominates the hospital laboratory information management systems market with the largest revenue share, of 41.4% in 2024, driven by a growing demand for laboratory automation and efficiency, as well as increased awareness of the benefits of digital laboratory management

- Healthcare and research institutions in the region highly value the enhanced data management, regulatory compliance, and seamless integration offered by hospital laboratory information management systems with other healthcare IT systems such as EHRs and analytical tools

- This widespread adoption is further supported by high healthcare expenditure, a technologically advanced healthcare infrastructure, and the growing preference for streamlined workflows and data-driven insights, establishing hospital laboratory information management systems as a favored solution for hospitals, diagnostic centers, and research facilities

U.S. Hospital Laboratory Information Management Systems Market Insight

The U.S. hospital laboratory information management systems market captured the largest revenue share within North America, with 44.7% of the North American market in 2024. This dominance is driven by the swift uptake of connected laboratory instruments and the expanding trend of digital laboratory management. Healthcare and research institutions are increasingly prioritizing the enhancement of laboratory efficiency and data quality through intelligent, integrated LIS solutions. The growing preference for streamlined workflows, combined with robust demand for data analytics and regulatory compliance features, further propels the hospital laboratory information management systems industry.

Europe Hospital Laboratory Information Management Systems Market Insight

The European hospital laboratory information management systems market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent data management regulations and the escalating need for enhanced efficiency and data security in laboratories. The increase in research activities, coupled with the demand for connected laboratory systems, is fostering the adoption of Hospital Laboratory Information Management Systems. European healthcare providers and research facilities are also drawn to the data integrity and audit trail capabilities these systems offer.

U.K. Hospital Laboratory Information Management Systems Market Insight

The U.K. hospital laboratory information management systems market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the escalating trend of laboratory automation and a desire for heightened data management and compliance. In addition, concerns regarding data accuracy and traceability are encouraging both hospital and research laboratories to choose advanced LIS solutions. The UK’s embrace of digital healthcare initiatives, alongside its robust pharmaceutical and biotech sectors, is expected to continue to stimulate market growth.

Germany Hospital Laboratory Information Management Systems Market Insight

The German hospital laboratory information management systems market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of digital data management and the demand for technologically advanced, efficient laboratory solutions. Germany’s well-developed healthcare infrastructure, combined with its emphasis on innovation and quality, promotes the adoption of hospital laboratory information management systems, particularly in hospital and research settings. The integration of hospital laboratory information management systems with laboratory instruments and analytical software is also becoming increasingly prevalent, with a strong preference for secure, compliant, and user-friendly solutions aligning with local healthcare standards.

Asia-Pacific Hospital Laboratory Information Management Systems Market Insight

Asia-Pacific hospital laboratory information management systems market is poised to grow at the fastest CAGR of 13.15%, driven by increasing healthcare investments, rising adoption of advanced technologies, and a growing number of hospitals and research laboratories in countries such as China, Japan, and India. The region's growing inclination towards digital healthcare and laboratory automation, supported by government initiatives promoting healthcare IT adoption, is driving the adoption of Hospital Laboratory Information Management Systems. Furthermore, as APAC emerges as a hub for pharmaceutical research and clinical diagnostics, the demand for efficient and compliant LIS solutions is expanding to a wider healthcare base.

Japan Hospital Laboratory Information Management Systems Market Insight

The Japan hospital laboratory information management systems market is gaining momentum due to the country’s high-tech culture, rapid digitalization in healthcare, and demand for efficiency. The Japanese market places a significant emphasis on data accuracy and reliability, and the adoption of hospital laboratory information management systems is driven by the increasing number of automated laboratories and research facilities. The integration of hospital laboratory information management systems with other healthcare information systems and laboratory instruments is fueling growth.

India Hospital Laboratory Information Management Systems Market Insight

India is expected to witness a significant compound annual growth rate (CAGR) in the hospital laboratory information management Systems market due to increasing investments in healthcare infrastructure, a growing number of hospitals and diagnostic laboratories, and rising awareness of the benefits of laboratory automation and data management.

Hospital Laboratory Information Management Systems Market Share

The hospital laboratory information management systems industry is primarily led by well-established companies, including:

- Clinisys, Inc. (U.K.)

- Thermo Fisher Scientific Inc. (U.S.)

- Abbott (India)

- Illumina, Inc. (U.S.)

- LabVantage Solutions Inc. (U.S.)

- LabLynx (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Labworks (U.S.)

- Dassault Systèmes (France)

- Siemens (Germany)

- Confience (U.S.)

- Eusoft Srl (Italy)

- Sapio Sciences (U.S.)

- Autoscribe Informatics (U.K.)

- LabWare (U.S.)

- CrelioHealth Inc. (U.S.)

Latest Developments in Global Hospital Laboratory Information Management Systems Market

- In April 2023, Cerner Corporation (now part of Oracle Health) initiated strategic partnerships with several international hospital networks aimed at enhancing laboratory workflows and data management through its advanced Hospital Laboratory Information Management Systems. This initiative underscores the company's dedication to delivering comprehensive and integrated LIS solutions tailored to the diverse operational needs of the global healthcare market. By leveraging its global expertise and extensive suite of software and services, Oracle Health is not only addressing regional healthcare challenges but also reinforcing its position in the rapidly evolving global Hospital Laboratory Information Management Systems market

- In March 2023, Thermo Fisher Scientific Inc., introduced advanced cloud-based LIMS solutions specifically engineered for improving data accessibility and collaboration across geographically dispersed hospital laboratories and research facilities worldwide. This innovative approach is designed to enhance data security and streamline research protocols, offering a reliable and effective solution for global laboratory management. This advancement highlights Thermo Fisher Scientific's commitment to developing cutting-edge digital technologies that safeguard critical laboratory data and improve operational efficiency for institutions and their communities globally

- In March 2023, Siemens Healthineers successfully collaborated with a major hospital system in Europe, aimed at enhancing diagnostic accuracy and turnaround times through its advanced Hospital Laboratory Information Management Systems and integrated automation solutions. This initiative harnesses state-of-the-art technologies to create a more efficient and data-driven laboratory environment, underscoring Siemens Healthineers' dedication to utilizing its expertise in innovative healthcare IT systems. The project highlights the increasing significance of integrated LIS and automation in addressing complex diagnostic challenges, contributing to the development of healthier, more effectively treated communities globally

- In February 2023, LabWare, announced strategic partnerships with several national public health organizations to enhance disease surveillance and reporting capabilities through its flexible and scalable LIMS platform. This collaboration is designed to improve public health outcomes and streamline data sharing for healthcare professionals, facilitating more efficient and secure management of health information. The initiative underscores LabWare's commitment to driving innovation and improving operational effectiveness within the global public health sector

- In January 2023, Epic Systems Corporation, unveiled new features and enhanced interoperability within its Beaker laboratory module at a major healthcare IT conference in 2023. These innovative functionalities, equipped with advanced analytics and seamless integration with other healthcare systems, enable hospitals globally to achieve improved diagnostic accuracy and streamlined workflows. The Epic announcement highlights the company’s commitment to integrating robust laboratory information management capabilities within a comprehensive EHR platform, offering healthcare providers enhanced efficiency and control while ensuring robust diagnostic support across global healthcare markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.