Global Laboratory Filtration Market

Market Size in USD Billion

CAGR :

%

USD

4.62 Billion

USD

9.00 Billion

2024

2032

USD

4.62 Billion

USD

9.00 Billion

2024

2032

| 2025 –2032 | |

| USD 4.62 Billion | |

| USD 9.00 Billion | |

|

|

|

|

Laboratory Filtration Market Size

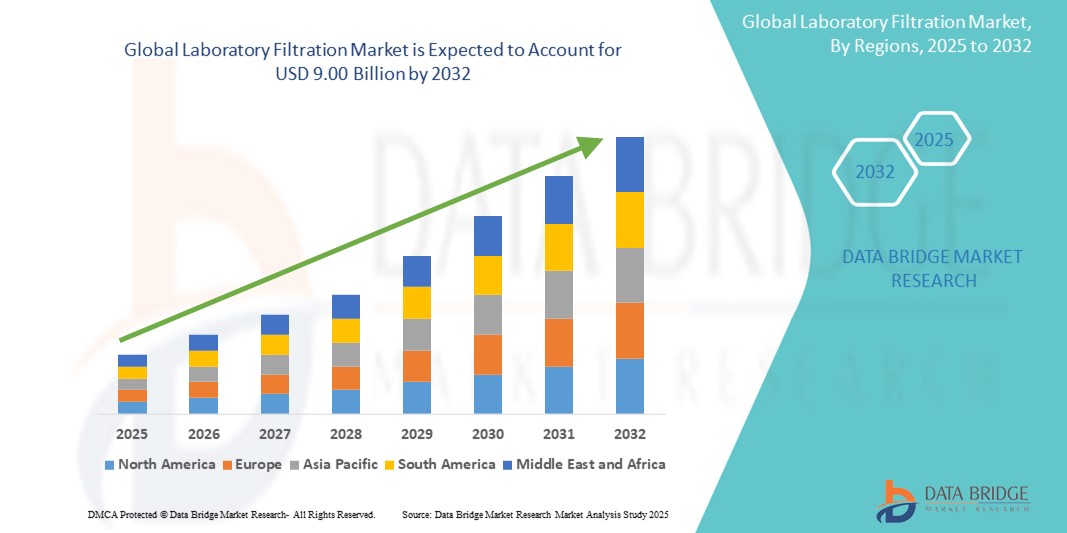

- The global laboratory filtration market size was valued at USD 4.62 billion in 2024 and is expected to reach USD 9.00 billion by 2032, at a CAGR of 8.7% during the forecast period

- This growth is driven by factors such as the rising demand of diagnostic testing, technological advancements in laboratory equipments and increasing focus on precision medicine

Laboratory Filtration Market Analysis

- Laboratory filtration systems are critical tools used in various scientific and industrial applications, providing efficient separation and purification of samples. They are essential for processes such as cell culture, protein purification, and microbiological analysis

- The demand for laboratory filtration products is significantly driven by the increasing focus on drug development, biotechnology research, and quality control in the pharmaceutical and food industries

- North America is expected to dominate the laboratory filtration market, with 45.6% market share, driven by a well-established biotechnology and pharmaceutical industry, advanced healthcare infrastructure, and significant R&D investments in drug development and diagnostics

- Asia-Pacific is expected to dominate the laboratory filtration market, with 30.9% market share, driven by rapid industrialization, increasing healthcare spending, and the expanding biotechnology and pharmaceutical sectors

- Filtration Media segment is expected to dominate the market with a market share of 53.5% due to its extensive use in various laboratory applications. Filtration media, including membrane filters, filter papers, and syringe filters, play a critical role in removing particles, pollutants, and impurities from fluids, ensuring the desired level of purity

Report Scope and Laboratory Filtration Market Segmentation

|

Attributes |

Laboratory Filtration Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Laboratory Filtration Market Trends

“Advancements in Filtration Technologies for Laboratory Applications”

- One prominent trend in the laboratory filtration market is the continuous innovation in filtration technologies, aimed at improving efficiency, precision, and reliability in laboratory processes

- These advancements include the development of high-performance membrane filters, single-use filtration systems, and automated filtration devices, which are increasingly being adopted in research labs, pharmaceutical production, and quality control processes

- For instance, next-generation membrane filters are being designed with enhanced porosity, chemical resistance, and low protein-binding properties, making them ideal for critical applications such as sterile filtration, cell culture, and bioprocessing

- These technological innovations are transforming laboratory workflows, reducing contamination risks, improving sample recovery, and driving the demand for advanced filtration systems in various scientific and industrial applications

Laboratory Filtration Market Dynamics

Driver

“Increasing Demand for High-Purity Filtration in Laboratories”

- The demand for laboratory filtration products is significantly driven by the need for high-purity filtration in research, clinical diagnostics, pharmaceutical manufacturing, and bioprocessing

- As the complexity of scientific research grows, laboratories require filtration systems that can effectively remove contaminants, particles, and microorganisms, ensuring accurate and reliable experimental results

- In addition, the rise in biologics, cell-based therapies, and precision medicine has further increased the need for high-efficiency filtration systems that maintain the integrity of sensitive samples

For instance,

- In March 2024, according to a report published by the American Society for Microbiology, the rapid growth of cell and gene therapies is driving the demand for advanced filtration technologies, as these therapies often require highly controlled environments and contaminant-free processing. The need for precision and consistency in these applications is significantly boosting the adoption of innovative laboratory filtration products

- As a result, the laboratory filtration market is witnessing significant growth, driven by the increasing focus on quality control, process efficiency, and stringent regulatory standards

Opportunity

“Technological Advancements in Filtration Systems”

- Continuous technological advancements in filtration systems are creating substantial growth opportunities in the laboratory filtration market. Innovations such as single-use filters, membrane technologies, and automated filtration devices are improving filtration efficiency and reducing the risk of contamination

- These advanced systems are particularly beneficial in high-throughput laboratories, biopharmaceutical manufacturing, and analytical testing, where speed, precision, and reliability are critical

For instance,

- In February 2025, according to a report by the International Society for Pharmaceutical Engineering (ISPE), the adoption of single-use filtration systems in biopharmaceutical production has increased significantly due to their cost-effectiveness, reduced risk of cross-contamination, and simplified process validation. These systems are now widely used in downstream bioprocessing, vaccine production, and cell culture applications

- The integration of smart sensors, automation, and digital monitoring technologies into laboratory filtration systems is also enhancing process control, reducing downtime, and improving overall operational efficiency

Restraint/Challenge

“High Operational Costs and Complex Regulatory Requirements”

- The high operational costs and stringent regulatory requirements associated with laboratory filtration systems present significant challenges for market growth

- Filtration systems often require substantial investments in infrastructure, regular maintenance, and periodic validation to ensure compliance with industry standards, which can be financially burdensome for smaller laboratories and research institutions. In addition, the complex and often restrictive reimbursement pathways in many countries can limit patient access to these therapies, further impacting market growth

For instance,

- In December 2024, according to a whitepaper by the National Institute of Standards and Technology (NIST), the cost of maintaining and validating filtration systems for pharmaceutical manufacturing can account for a significant portion of operational expenses, impacting overall profitability. The need for specialized training, complex quality control processes, and regulatory documentation further adds to the financial burden

- These factors can limit the adoption of advanced filtration technologies, particularly in emerging markets with limited healthcare budgets, potentially hindering the overall growth of the laboratory filtration market

Laboratory Filtration Market

The market is segmented on the basis of product type, technology and end user

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Technology |

|

|

By End User |

|

In 2025, the filtration media is projected to dominate the market with a largest share in product type segment

The filtration media segment is expected to dominate the laboratory filtration market with the largest share of 53.5% in 2025 due to its extensive use in various laboratory applications. Filtration media, including membrane filters, filter papers, and syringe filters, play a critical role in removing particles, pollutants, and impurities from fluids, ensuring the desired level of purity. Their essential function in drug discovery, biotechnology, and environmental testing, where accuracy and cleanliness are paramount, further supports their market dominance.

The microfiltration is expected to account for the largest share during the forecast period in technology market

In 2025, the microfiltration technology segment is expected to dominate the market with the largest market share of 36.5%. Microfiltration employs membrane filters with pore sizes typically ranging from 0.1 to 10 micrometers, effectively removing bacteria, suspended solids, and larger particles from fluids. Its widespread application in producing drugs, biologics, and vaccines, as well as in sample preparation and environmental testing, underscores its prominence in the market.

Laboratory Filtration Market Regional Analysis

“North America Holds the Largest Share in the Laboratory Filtration Market”

- North America dominates the laboratory filtration market, accounting for approximately 45.6% of the global market share, driven by a well-established biotechnology and pharmaceutical industry, advanced healthcare infrastructure, and significant R&D investments in drug development and diagnostics

- U.S. alone accounts for around 40.2% of the global market share, primarily due to the high adoption of advanced filtration technologies, extensive pharmaceutical research, and the presence of major industry players focused on innovative filtration solutions

- In addition, the U.S. leads in technological advancements, including the development of high-performance filtration membranes, microfiltration, and ultrafiltration systems, further strengthening the market

- The availability of advanced laboratory infrastructure, a strong focus on quality control, and supportive government regulations, such as the U.S. Food and Drug Administration (FDA) standards, are key factors driving market growth in this region

“Asia-Pacific is Projected to Register the Highest CAGR in the Laboratory Filtration Market”

- Asia-Pacific is expected to witness the highest growth rate in the laboratory filtration market, accounting for 30.9% of the global market share, driven by rapid industrialization, increasing healthcare spending, and the expanding biotechnology and pharmaceutical sectors

- Countries such as China, India, and Japan are emerging as key markets due to their large manufacturing base, rising investments in drug discovery, and growing focus on quality control in food and pharmaceutical industries

- Japan, known for its advanced filtration technologies and precision engineering, remains a crucial market for laboratory filtration, with high adoption rates for ultrafiltration, nanofiltration, and reverse osmosis systems

- India is projected to register the highest CAGR of 6.3% in the region, driven by significant investments in biotechnology, expanding pharmaceutical manufacturing, and increasing demand for high-purity water and sterile filtration solutions in the life sciences industry

Laboratory Filtration Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

-

- ALFA LAVAL (Sweden)

- Merck KGaA (Germany)

- Danaher Corporation (U.S.)

- Sartorius AG (Germany)

- 3M (U.S.)

- GEA Group Aktiengesellschaft (Germany)

- STERIS (Ireland)

- Thermo Fisher Scientific Inc. (U.S.)

- Veolia Water Technologies (France)

- Avantor, Inc (U.S.)

- GVS S.p.A (Italy)

- MANN+HUMMEL (Germany)

- Agilent Technologies, Inc. (U.S.)

- Ahlstrom (Finland)

- MACHEREY-NAGEL GmbH & Co. KG (Germany)

- AMD Manufacturing Inc. (Canada)

- Kovalus Separation Solutions (U.S.)

- Cole-Parmer Instrument Company, LLC. (U.S.)

- Aquaporin A/S (Denmark)

- Sterlitech Corporation (U.S.)

Latest Developments in Global Laboratory Filtration Market

- In January 2025, Thermo Fisher Scientific announced the acquisition of Solventum's purification and filtration business for approximately USD 4.1 billion. This strategic move aims to enhance Thermo Fisher's presence in the bioprocessing filtration sector, complementing its existing bioprocessing segment and expanding its tools and services for drug development in the biopharmaceutical industry

- In October 2023, Cytiva, a subsidiary of Danaher Corporation, opened a 33,000-square-foot manufacturing facility in Pune, India. This facility focuses on producing bioprocessing equipment, including tangential flow, virus filtration, and inactivation systems, to cater to the growing demand in the region

- In September 2023, MilliporeSigma introduced the Millex GV Syringe Filters, designed to deliver high throughput and minimize protein binding, making them ideal for various laboratory filtration applications

- In August 2023, GE Healthcare launched the Xcellerex XDR Single-Use Filters, specifically designed to offer high efficiency and minimal extractables, catering to the demanding requirements of biopharmaceutical manufacturing applications

- In July 2023, 3M introduced the Emphaze Filter Capsules, tailored for biopharmaceutical manufacturing. These capsules are engineered to ensure high purity and minimal extractables, meeting the stringent standards of the industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.