Global Laboratory Developed Tests Ldts Market

Market Size in USD Billion

CAGR :

%

USD

13.42 Billion

USD

30.28 Billion

2024

2032

USD

13.42 Billion

USD

30.28 Billion

2024

2032

| 2025 –2032 | |

| USD 13.42 Billion | |

| USD 30.28 Billion | |

|

|

|

|

Laboratory-Developed Tests (LDTs) Market Size

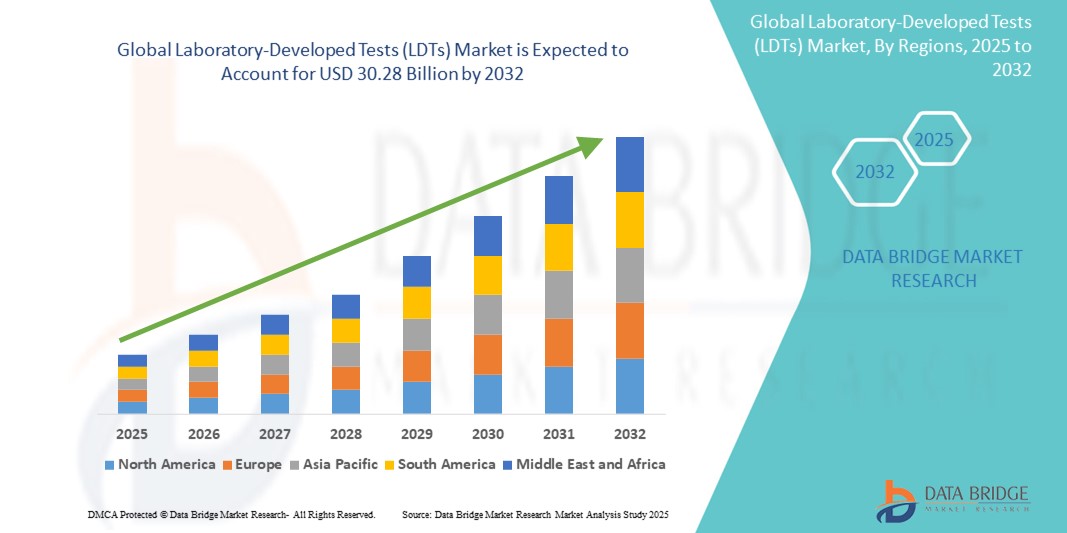

- The global laboratory-developed tests (LDTs) market size was valued at USD 13.42 billion in 2024 and is expected to reach USD 30.28 billion by 2032, at a CAGR of 10.70% during the forecast period

- The market growth is largely fueled by the increasing demand for personalized medicine, rare disease diagnostics, and oncology profiling, driving the adoption of Laboratory-Developed Tests (LDTs) across clinical laboratories and research institutions. LDTs offer tailored testing capabilities that are often unavailable through standard FDA-approved kits, enabling precise diagnostic insights for complex or low-prevalence conditions

- Furthermore, advancements in molecular diagnostics, next-generation sequencing (NGS), and bioinformatics are enhancing the accuracy, scalability, and speed of LDTs. As healthcare systems shift toward value-based care and precision diagnostics, the flexibility and rapid development cycle of LDTs are positioning them as critical tools in clinical decision-making, significantly accelerating market expansion

Laboratory-Developed Tests (LDTs) Market Analysis

- Laboratory-Developed Tests (LDTs), which are in vitro diagnostics designed, manufactured, and used within a single laboratory, are becoming increasingly vital in the landscape of personalized medicine, oncology, and rare disease diagnostics due to their flexibility, faster turnaround times, and ability to address unmet clinical needs not served by FDA-approved tests

- The escalating demand for LDTs is primarily fueled by the growing prevalence of complex diseases such as cancer and genetic disorders, the rapid advancement in molecular diagnostics and genomic technologies, and increased demand for tailored testing solutions across clinical and research laboratories

- North America dominated the laboratory-developed tests (LDTs) market with the largest revenue share of 36.9% in 2024, characterized by robust healthcare infrastructure, high adoption of precision medicine, favourable regulatory frameworks, and strong presence of leading diagnostic laboratories and research institutions across the U.S. and Canada

- Asia-Pacific is expected to be the fastest-growing region in the laboratory-developed tests (LDTs) market, with a projected CAGR of 23.8% from 2025 to 2032, driven by expanding healthcare access, increasing investments in genomics and clinical diagnostics, and growing awareness regarding early disease detection across countries such as China, India, and Japan

- The oncology/Cancer segment dominated the laboratory-developed tests (LDTs) market with a market share of 43.2% in 2024, driven by the increasing demand for cancer biomarker testing, companion diagnostics, and personalized treatment planning. The rise of liquid biopsies and NGS-based panels in oncology care has significantly boosted the adoption of LDTs in this segment

Report Scope and Laboratory-Developed Tests (LDTs) Market Segmentation

|

Attributes |

Laboratory-Developed Tests (LDTs) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Laboratory-Developed Tests (LDTs) Market Trends

“Increased Adoption of Advanced Molecular Diagnostic Techniques”

- A major and rapidly accelerating trend in the global laboratory-developed tests (LDTs) market is the growing adoption of advanced molecular diagnostic techniques such as next-generation sequencing (NGS), polymerase chain reaction (PCR), and liquid biopsy. These technologies are enabling high-precision diagnostics for a wide range of conditions, including cancer, infectious diseases, and genetic disorders

- For instance, the use of NGS-based LDTs allows for comprehensive genomic profiling of tumors, helping clinicians tailor targeted therapies and improve treatment outcomes. Similarly, PCR-based LDTs are extensively utilized for the rapid detection of pathogens such as SARS-CoV-2, supporting timely clinical decision-making during pandemics and outbreaks

- These advanced diagnostic platforms provide critical benefits, such as faster turnaround times, higher sensitivity, and the ability to detect low-abundance biomarkers. As a result, healthcare providers are increasingly relying on them for early diagnosis, disease monitoring, and personalized treatment planning

- The integration of such cutting-edge techniques into LDT workflows also facilitates multiplex testing—simultaneous detection of multiple targets from a single patient sample—enhancing laboratory efficiency and reducing costs

- Moreover, innovations in sample preparation, reagent development, and automation are further streamlining these diagnostic processes, enabling laboratories to scale testing capabilities and maintain high throughput

- Driven by the need for more accurate, efficient, and scalable diagnostic solutions, the demand for LDTs incorporating advanced molecular technologies is witnessing significant growth across clinical laboratories, academic research centers, and specialized diagnostic facilities globally

Laboratory-Developed Tests (LDTs) Market Dynamics

Driver

“Growing Need Due to Rising Demand for Personalized and Rapid Diagnostics”

- The increasing prevalence of chronic diseases, infectious outbreaks, and rare genetic disorders, coupled with the push toward precision medicine, is significantly driving demand for Laboratory-Developed Tests (LDTs). These tests offer tailored diagnostic solutions that are not always available through conventional IVD tests

- For instance, in April 2024, Quest Diagnostics expanded its LDT offerings in oncology and hereditary disease testing, reflecting the rising demand for customized diagnostic panels in clinical settings. Such strategies by major players are expected to drive the Laboratory-Developed Tests (LDTs) market growth over the forecast period

- As clinicians seek rapid, sensitive, and specific diagnostic tools to support timely decision-making, LDTs provide the flexibility and scalability needed to address emerging healthcare challenges, particularly in areas lacking FDA-approved tests

- Furthermore, LDTs are increasingly being used in clinical research, companion diagnostics, and biomarker discovery, owing to their adaptability and ability to be quickly modified as new insights emerge

- The growing need for laboratory flexibility in customizing panels for specific patient populations and the demand for same-day or next-day results are accelerating LDT adoption across hospitals, specialty clinics, and academic medical centers

Restraint/Challenge

“Regulatory Uncertainty and Limited Reimbursement Policies”

- One of the primary challenges limiting the expansion of the laboratory-developed tests (LDTs) market is the lack of consistent regulatory frameworks. LDTs have traditionally operated under enforcement discretion by the U.S. FDA, but increasing scrutiny is leading to uncertainty among test developers and laboratories

- For instance, proposals such as the VALID Act in the U.S. aim to tighten regulatory oversight over LDTs, creating concerns about increased compliance costs and extended approval timelines. This unpredictability may hinder innovation and discourage smaller labs from developing novel tests

- Moreover, limited and inconsistent reimbursement policies for LDTs—especially in the areas of genetic testing and rare diseases—pose a financial barrier for laboratories and patients. Without clear coverage criteria and payment mechanisms, access to critical diagnostic tests can remain limited

- Addressing these challenges will require a balanced regulatory approach that ensures patient safety while preserving innovation. In addition, expanding reimbursement policies and demonstrating cost-effectiveness through real-world evidence will be crucial in making LDTs more accessible and sustainable for the global healthcare ecosystem

Laboratory-Developed Tests (LDTs) Market Scope

The market is segmented on the basis of test type, product type, sample type, therapeutic area, gender, age group, end users, and distribution channel.

• By Test Type

On the basis of test type, the laboratory-developed tests (LDTs) market is segmented into clinical chemistry and immunology, critical care, hematology, molecular diagnostics, microbiology, and other tests. The molecular diagnostics segment dominated the market with a revenue share of 29.6% in 2024, driven by its precision, sensitivity, and growing demand in oncology and infectious disease testing.

The critical care segment is expected to witness the fastest CAGR of 9.2% from 2025 to 2032, due to its growing relevance in ICU and emergency testing scenarios.

• By Product Type

On the basis of product type, the laboratory-developed tests (LDTs) market is segmented into consumables, analyzers and instruments, and accessories. The consumables segment accounted for the largest share of 52.4% in 2024, owing to the recurring demand for reagents, test kits, and assay consumables.

The analyzers and instruments segment is projected to grow at a CAGR of 8.5% from 2025 to 2032, supported by advancements in lab automation and diagnostics technology.

• By Sample Type

On the basis of sample type, the laboratory-developed tests (LDTs) market is segmented into blood, urine, tissue, cerebrospinal fluid (CSF), and others. The blood sample segment dominated with a revenue share of 48.1% in 2024, being the most common and versatile sample type for LDTs.

The urine segment is projected to grow at a CAGR of 7.8% from 2025 to 2032, driven by its non-invasive nature and application in metabolic and drug testing.

• By Therapeutic Area

On the basis of therapeutic area, the market is segmented into infections, genetic disorders, oncology/cancer, autoimmune disease, urology, gynecology, and others. The oncology/cancer segment held the largest share of 43.2% in 2024, propelled by rising cancer prevalence and demand for early detection and monitoring tests.

The genetic disorders segment is expected to grow at the fastest CAGR of 9.6% from 2025 to 2032, due to advancements in genomics and personalized medicine.

• By Gender

On the basis of gender, the laboratory-developed tests (LDTs) market is segmented into male and female. The female segment accounted for 53.8% of the market share in 2024, driven by increased diagnostic testing in gynecology, prenatal care, and hormonal assessments.

The male segment is expected to grow at the fastest CAGR from 2025 to 2032, with growth tied to increased focus on prostate, genetic, and metabolic testing.

• By Age Group

On the basis of age group, the laboratory-developed tests (LDTs)market is segmented into geriatrics, adult, and pediatric. The adult segment dominated with 61.3% market share in 2024, due to the higher prevalence of lifestyle and chronic conditions.

The pediatric segment is projected to grow at a CAGR of 8.7% from 2025 to 2032, driven by increased early screening and genetic testing programs.

• By End Users

On the basis of end users, the laboratory-developed tests (LDTs)market is segmented into hospital-based labs, stand-alone labs, diagnostic chains, academic institutes, clinical research organizations, specialty diagnostic centers, and others. The hospital-based labs segment held the largest share of 38.4% in 2024, supported by infrastructure, patient flow, and comprehensive test offerings.

The stand-alone labs segment is expected to grow at a CAGR of 9.1% from 2025 to 2032, due to decentralization and consumer preference for fast and personalized diagnostics.

• By Distribution Channel

On the basis of distribution channel, the laboratory-developed tests (LDTs)market is segmented into direct tender, retail sales, third-party distributors, and others. The direct tender segment accounted for 45.9% of the market in 2024, as hospitals and labs procure in bulk via contracts.

The third-party distributors segment is forecast to grow at a CAGR of 8.3% from 2025 to 2032, thanks to expanding access in emerging markets and rural areas.

Laboratory-Developed Tests (LDTs) Market Regional Analysis

- North America dominated the laboratory-developed tests (LDTs) market with the largest revenue share of 36.9% in 2024, driven by strong healthcare infrastructure, rising demand for personalized medicine, and a favorable regulatory framework supporting high-complexity LDTs

- The region's growing reliance on molecular diagnostics and precision medicine for oncology, infectious diseases, and genetic disorders further enhances market growth

- Leading clinical labs and research institutes are advancing LDT innovation, with major investments in lab automation, data integration, and genomic platforms

U.S. Laboratory-Developed Tests (LDTs) Market Insight

The U.S. laboratory-developed tests (LDTs) market accounted for 70% of North America's market share in 2024, driven by widespread adoption in clinical laboratories and the strong presence of CLIA-certified labs. A favorable environment for R&D, high healthcare spending, and rising demand for advanced diagnostics in oncology and infectious diseases are key contributors. In addition, the FDA’s evolving regulatory stance and NIH-funded genomic initiatives are further encouraging innovation in LDTs.

Europe Laboratory-Developed Tests (LDTs) Market Insight

The Europe laboratory-developed tests (LDTs) market accounted for a significant 29.3% of the global LDTs market share in 2024, with steady growth driven by increasing demand for high-accuracy diagnostic solutions and rising prevalence of chronic conditions. The shift toward decentralized testing and the adoption of LDTs in specialized fields such as reproductive health, oncology, and rare genetic disorders are fueling market growth. Supportive national health policies, particularly in Western Europe, and strong emphasis on early disease detection continue to drive uptake.

U.K. Laboratory-Developed Tests (LDTs) Market Insight

The U.K. laboratory-developed tests (LDTs) market is projected to grow at a notable CAGR during the forecast period, driven by the growing adoption of genomics in public healthcare and personalized screening initiatives under the NHS. Increasing demand for non-invasive prenatal testing (NIPT), infectious disease diagnostics, and cancer screening using LDTs is boosting adoption across public and private diagnostic labs. Strong academic research partnerships and regulatory support from the MHRA foster ongoing innovation.

Germany Laboratory-Developed Tests (LDTs) Market Insight

The Germany laboratory-developed tests (LDTs) market is expected to expand at a steady CAGR, driven by the country’s robust laboratory infrastructure and high demand for advanced diagnostic modalities. A growing aging population, combined with a rise in chronic disease diagnosis, supports strong market fundamentals. The adoption of molecular LDTs, particularly for oncology and rare diseases, is further strengthened by public health insurance coverage and rising investment in personalized diagnostics.

Asia-Pacific Laboratory-Developed Tests (LDTs) Market Insight

The Asia-Pacific laboratory-developed tests (LDTs) market is poised to grow at the fastest CAGR of 23.8% from 2025 to 2032, fueled by increasing healthcare spending, expanding molecular diagnostics capabilities, and the rising burden of infectious and genetic diseases. Countries such as China, India, and Japan are witnessing rapid growth in decentralized and home-based testing solutions, creating opportunities for innovation in LDTs. Government initiatives supporting genomics, local biopharma partnerships, and improving healthcare infrastructure are enhancing accessibility to LDTs.

Japan Laboratory-Developed Tests (LDTs) Market Insight

The Japan laboratory-developed tests (LDTs) market is gaining traction due to strong demand for advanced diagnostics in oncology, infectious disease, and aging-related conditions. Japan’s emphasis on preventive care, combined with high health awareness and national genomics programs, is bolstering the use of LDTs in hospital-based and academic labs. Regulatory clarity from PMDA and integration with digital diagnostics platforms are creating long-term market growth potential.

China Laboratory-Developed Tests (LDTs) Market Insight

The China laboratory-developed tests (LDTs) market captured the largest share within Asia-Pacific, accounting for 42.6% of the regional LDTs market in 2024, supported by an expanding middle class, government focus on precision medicine, and large-scale infectious disease surveillance. Rapid urbanization, increasing laboratory automation, and rising demand for genetic testing in oncology and reproductive health are driving LDT adoption. The strong presence of local diagnostic manufacturers and government-backed public health initiatives are accelerating market expansion.

Laboratory-Developed Tests (LDTs) Market Share

The laboratory-developed tests (LDTs) industry is primarily led by well-established companies, including:

- F. Hoffmann-La Roche Ltd (Switzerland)

- bioMérieux (France)

- Sysmex Corporation (Japan)

- Biomerica, Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- BD (U.S.)

- Quest Diagnostics Incorporated (U.S.)

- Hologic, Inc. (U.S.)

- Siemens Medical Solutions USA, Inc. (U.S.)

- Abbott (U.S.)

- Eurofins Scientific (U.S.)

- Beckman Coulter, Inc. (U.S.)

- 23andMe, Inc. (U.S.)

- OPKO Health, Inc. (U.S.)

Latest Developments in Global Laboratory-Developed Tests (LDTs) Market

- In March 2025, a U.S. District Court (Eastern District of Texas) vacated the FDA’s final rule that would have classified most LDTs as medical devices—and notably, the agency declined to appeal this decision—meaning LDTs remain regulated under CLIA rather than by the FDA. This judgment provides legal clarity and regulatory relief for clinical labs relying on LDTs

- In May 2024, the FDA issued a final rule to gradually phase in oversight of certain LDTs as in vitro diagnostic (IVD) devices—marking a shift toward increasing regulatory scrutiny, with compliance deadlines beginning from May 6, 2025

- In March 2025, ARUP Laboratories publicly welcomed the court’s decision to vacate FDA oversight, emphasizing that LDTs play a "vital role in delivering the best patient care"—especially for rare diseases and personalized diagnostics

- In June 2025, Johns Hopkins researchers demonstrated a multicancer early detection (MCED) LDT via ultrasensitive cell-free DNA sequencing that detected cancers up to three years before symptoms appeared—highlighting the potential of LDTs in proactive diagnostics

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.