Global Laboratory Information Management Systems Market

Market Size in USD Billion

CAGR :

%

USD

2.49 Billion

USD

5.26 Billion

2024

2032

USD

2.49 Billion

USD

5.26 Billion

2024

2032

| 2025 –2032 | |

| USD 2.49 Billion | |

| USD 5.26 Billion | |

|

|

|

|

Laboratory Information Management Systems (LIMS) Market Size

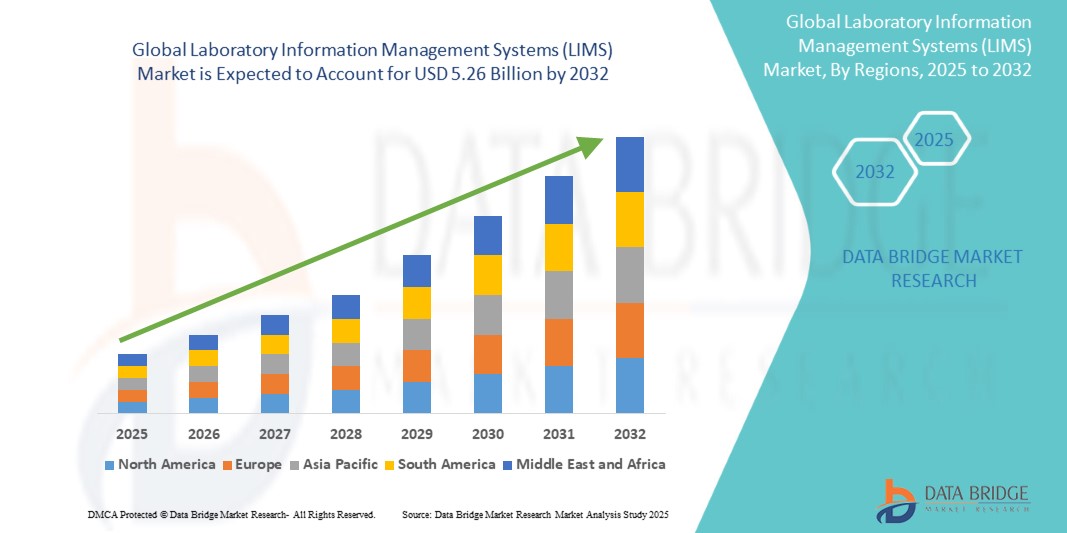

- The global Laboratory Information Management Systems (LIMS) market was valued at USD 2.49 billion in 2024 and is expected to reach USD 5.26 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 9.80%, primarily driven by the by increasing demand for lab automation

- This growth is driven by factors such as the efficient data management in laboratories, growing demand for automation in research and development and diagnostic labs

Laboratory Information Management Systems (LIMS) Market Analysis

- Laboratory Information Management Systems (LIMS) are essential software tools that streamline laboratory workflows by managing samples, data, instruments, and compliance requirements. They are widely used in clinical laboratories, pharmaceutical research, environmental testing, and biotechnology sectors

- The demand for LIMS is significantly driven by the growing need for lab automation, increasing volumes of diagnostic testing, and the rising stringency of regulatory compliance across industries. In addition, the shift toward cloud-based LIMS solutions is enabling better scalability and remote access, further boosting adoption

- North America stands out as one of the dominant regions in the LIMS market, supported by its well-established laboratory infrastructure, strong focus on research and development, and early adoption of digital lab solutions

- For instance, pharmaceutical companies and research institutions in the U.S. are increasingly adopting LIMS to improve data accuracy, ensure compliance with FDA regulations, and support high-throughput screening and drug discovery processes

- Globally, LIMS rank among the most critical components of digital laboratory ecosystems, following laboratory automation systems, and play a pivotal role in ensuring data integrity, operational efficiency, and regulatory readiness

Report Scope and Laboratory Information Management Systems (LIMS) Market Segmentation

|

Attributes |

Laboratory Information Management Systems (LIMS) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Laboratory Information Management Systems (LIMS) Market Trends

“Integration of AI, Cloud Computing, and Advanced Analytics”

- One prominent trend in the global LIMS market is the integration of artificial intelligence (AI), cloud computing, and advanced analytics to enhance laboratory efficiency and decision-making

- These technologies enable real-time data access, predictive maintenance of lab equipment, and improved workflow automation, resulting in higher throughput and data accuracy

- For instance, AI-powered LIMS can identify patterns in lab results to support early diagnostics and streamline research processes, particularly in high-volume testing environments such as clinical diagnostics and pharmaceutical research and development

- Cloud-based LIMS platforms also offer improved scalability, data security, and remote access, which is especially valuable for multi-site labs and global research collaborations

- This trend is transforming laboratory operations by enabling smarter, faster, and more collaborative science, thereby increasing demand for next-generation LIMS solutions worldwide

Laboratory Information Management Systems (LIMS) Market Dynamics

Driver

“Rising Demand for Laboratory Automation and Regulatory Compliance”

- The growing complexity and volume of laboratory data, coupled with the increasing pressure to meet strict regulatory standards, are significantly driving the adoption of LIMS across various industries

- Modern laboratories, particularly in pharmaceuticals, biotechnology, clinical diagnostics, and environmental testing require efficient data management systems to maintain accuracy, ensure traceability, and support data integrity

- Regulations such as FDA 21 CFR Part 11, HIPAA, and ISO standards necessitate secure, validated systems for managing sensitive laboratory data, making LIMS a critical solution

- The automation enabled by LIMS not only reduces human errors but also enhances operational efficiency by streamlining sample tracking, test scheduling, and results reporting

- As labs transition toward digital workflows and paperless environments, the demand for integrated, customizable, and cloud-based LIMS platforms continues to grow across global markets

For instance,

- In January 2023, a report by the Regulatory Affairs Professionals Society (RAPS) emphasized the growing regulatory scrutiny in clinical trials and drug development, leading to increased investments in digital lab infrastructure, including LIMS platforms

- In March 2022, Thermo Fisher Scientific noted a significant uptick in LIMS adoption among CROs (Contract Research Organizations) and pharmaceutical firms to meet rising demand for efficient, compliant research data handling

- As laboratories worldwide face mounting pressure for accuracy, traceability, and faster turnaround times, LIMS adoption is becoming essential for operational excellence and compliance assurance

Opportunity

“Enhancing Laboratory Operations with Artificial Intelligence and Advanced Analytics””

- AI integration in Laboratory Information Management Systems (LIMS) is revolutionizing lab operations by enabling real-time data interpretation, predictive analytics, and automated decision-making to enhance research accuracy and efficiency

- AI algorithms can analyze vast datasets from laboratory experiments, identify patterns, flag anomalies, and optimize workflows, reducing turnaround times and minimizing human error

- In addition, AI-powered LIMS can assist in predictive maintenance of lab instruments, sample tracking, and data validation, making them indispensable in high-throughput research and clinical environments

For instance,

- In February 2024, a report published in Nature Biotechnology highlighted the use of AI-enhanced LIMS in genomics labs to streamline variant analysis and accelerate drug target identification, significantly improving research efficiency

- In October 2023, according to The Journal of Laboratory Automation, AI-integrated LIMS platforms helped clinical labs reduce diagnostic result processing times by up to 40%, while maintaining compliance with regulatory standards such as CLIA and HIPAA

- The adoption of AI in LIMS is poised to transform laboratory data management by offering smarter insights, enhancing operational efficiency, and enabling more accurate and timely decision-making across the scientific and healthcare sectors

Restraint/Challenge

“High Implementation and Maintenance Costs Limiting Adoption”

- The high initial investment required for purchasing, customizing, and implementing laboratory information management systems (LIMS) poses a significant barrier, particularly for small and mid-sized laboratories in cost-sensitive regions

- In addition to the software itself, expenses related to system integration, training, validation, and ongoing maintenance can significantly increase the total cost of ownership, making LIMS adoption less feasible for resource-constrained facilities

For instance,

- In August 2023, according to a report published by Lab Manager Magazine, many smaller labs cited cost as the primary reason for delaying LIMS implementation, noting that long-term return on investment is often overshadowed by upfront and hidden costs associated with configuration and compliance validation

- In a 2022 survey conducted by BioInformatics LLC, over 40% of laboratory decision-makers in emerging markets identified budget constraints as a major obstacle to adopting advanced informatics systems such as LIMS, despite recognizing their operational benefits. However, the specific month of this survey was not disclosed in the available sources

- Consequently, high costs continue to hinder market penetration, especially in developing regions, limiting the modernization of lab operations and widening the gap between high-tech and traditionally operated laboratories

Laboratory Information Management Systems (LIMS) Market Scope

The market is segmented on the basis of component, product type, delivery, industry type, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Product Type |

|

|

By Delivery |

|

|

By Industry Type

|

|

|

By Distribution Channel

|

|

Laboratory Information Management Systems (LIMS) Market Regional Analysis

“North America is the Dominant Region in the LIMS Market”

- North America dominates the LIMS market due to its robust research infrastructure, high digital adoption in laboratories, and strong regulatory frameworks that drive the need for compliance-focused lab informatics solutions

- U.S. accounts for the largest market share, driven by the presence of numerous pharmaceutical companies, contract research organizations (CROs), and academic institutions that heavily rely on advanced data management systems

- The region also benefits from consistent investments in research and development, a strong focus on personalized medicine, and widespread implementation of cloud-based LIMS platforms to streamline lab operations and enhance data security

- In addition, increasing demand for efficient data handling in genomics, clinical diagnostics, and biobanking, along with the early adoption of AI and automation in labs, supports continuous market growth across North America

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is anticipated to experience the highest growth in the LIMS market, driven by expanding pharmaceutical and biotechnology sectors, growing focus on research and development, and improving lab digitization across emerging economies

- Countries such as China, India, South Korea, and Japan are witnessing increased adoption of LIMS due to rising government investments in healthcare IT and growing participation in global clinical trials

- Japan’s advanced life sciences sector, paired with its aging population and demand for precision diagnostics, fuels the need for efficient lab data management tools such as LIMS

- In India and China, the growing number of diagnostic labs, increased focus on quality assurance, and efforts to meet international regulatory standards are propelling the demand for scalable and cost-effective LIMS solutions

Laboratory Information Management Systems (LIMS) Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Thermo Fisher Scientific Inc. (U.S.)

- PerkinElmer (U.S.)

- Autoscribe Informatics (U.S.)

- Novatek International (Canada)

- Benchling (U.S.)

- Agaram Technologies Pvt Ltd (India)

- Agilent Technologies, Inc. (U.S.)

- LabWare (U.S.)

- STARLIMS Corporation (U.S.)

- IBM (U.S.)

- Roper Technologies, Inc. (U.S.)

- Eusoft Srl (Italy)

- Illumina, Inc. (U.S.)

- McKesson Medical-Surgical Inc. (U.S.)

- Infors AG (Switzerland)

- Siemens (Germany)

- Zoho Corporation Pvt. Ltd. (India)

- LabVantage Solutions Inc. (U.S.)

- Shimadzu Corporation (Japan)

- Novatek International (Canada)

Latest Developments in Global Laboratory Information Management Systems (LIMS) Market

- In March 2025, LabVantage Solutions announced the launch of LabVantage Analytics 2.0, an advanced upgrade of its integrated analytics platform. This release introduces AI-powered predictive modeling and customizable dashboards, enabling laboratories to gain deeper insights from LIMS data and make data-driven decisions in real time. The update is particularly aimed at life sciences and pharmaceutical clients managing complex workflows

- In January 2025, Thermo Fisher Scientific expanded the capabilities of its SampleManager LIMS software, integrating it with enhanced compliance tools and cloud-native features. The update supports real-time remote access, advanced audit trails, and improved integration with electronic lab notebooks (ELNs), enhancing usability for CROs and regulated labs operating under FDA and EMA guidelines

- In November 2024, STARLIMS (an Abbott Informatics company) launched its STARLIMS Quality Manufacturing V12.2, introducing improved user experience, mobile compatibility, and streamlined integration with ERP systems. This version also supports multilingual environments, helping global manufacturers maintain consistent quality standards across regional sites

- In October 2024, LabWare introduced LabWare Pharma Solution (LPS) at the CPhI Worldwide Conference. This new industry-focused LIMS configuration is tailored for pharmaceutical and biotech companies, pre-configured with compliance templates for GMP and GLP standards, reducing deployment times and costs

- In August 2024, Agilent Technologies announced the integration of its OpenLab software suite with leading LIMS platforms to offer end-to-end data traceability. This development improves interoperability across laboratory instruments and data systems, supporting labs involved in regulated environments such as food safety, environmental testing, and clinical diagnostics

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.