Global Modular Laboratory Automation Market

Market Size in USD Billion

CAGR :

%

USD

8.98 Billion

USD

15.15 Billion

2024

2032

USD

8.98 Billion

USD

15.15 Billion

2024

2032

| 2025 –2032 | |

| USD 8.98 Billion | |

| USD 15.15 Billion | |

|

|

|

|

Modular Laboratory Automation Market Analysis

The modular laboratory automation market is experiencing significant growth, driven by advancements in technology and the increasing demand for efficient, scalable solutions in laboratory environments. As laboratories face rising pressure to improve productivity, reduce human error, and handle complex workflows, modular automation systems offer a flexible approach by allowing labs to integrate various modules according to specific needs.

Key factors driving the market include the growing focus on precision and accuracy in scientific research, as well as the need for laboratories to cope with high-throughput demands. Automation systems enable faster sample processing, enhanced data management, and consistent results, making them essential in fields such as pharmaceuticals, biotechnology, and academic research.

In addition, the demand for personalized and customizable solutions has encouraged vendors to develop highly adaptable platforms, capable of supporting multiple tasks such as liquid handling, sample preparation, and data analysis. As the market continues to evolve, automation solutions are expected to become increasingly sophisticated, integrating artificial intelligence and machine learning for improved decision-making and efficiency.

The modularity of these systems also ensures scalability, allowing laboratories to expand or modify their automation setups with minimal disruption. This flexibility, along with cost and time-saving benefits, is expected to continue driving the market forward in the coming years.

Modular Laboratory Automation Market Size

The global modular laboratory automation market size was valued at USD 8.98 billion in 2024 and is projected to reach USD 15.15 billion by 2032, with a CAGR of 6.76% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Modular Laboratory Automation Market Trends

“Demand for Increased Efficiency and Accuracy in Laboratory Processes”

The modular laboratory automation market is trending because of the growing demand for increased efficiency and accuracy in laboratory processes. As laboratories are handling more complex experiments, larger volumes of samples, and a greater need for precision, traditional manual methods are no longer sufficient. Modular automation systems address these challenges by streamlining workflows, reducing human error, and significantly speeding up repetitive tasks such as sample preparation, testing, and data analysis.

These systems can be easily customized and scaled, allowing laboratories to start with essential modules and expand as needed without overhauling entire setups. This flexibility is especially appealing to labs in industries such as pharmaceuticals, biotechnology, and academic research, where the ability to quickly adapt to changing demands is crucial. As such, modular laboratory automation not only boosts productivity but also helps ensure high-quality, consistent results, making it a highly attractive solution for modern laboratories.

Report Scope and Modular Laboratory Automation Market Segmentation

|

Attributes |

Modular Laboratory Automation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico, Germany, France, U.K., Italy, Russia, Spain, Denmark, Sweden, Norway, Rest of Europe, China, Japan, India, South Korea, Australia, Thailand, Rest of Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Nigeria, Egypt, Kuwait, Rest of Middle East and Africa, Brazil, Argentina and Rest of South America |

|

Key Market Players |

Abbott (U.S.), Agilent Technologies, Inc. (U.S.), Aurora Biomed Inc. (Canada), BD (U.S.), BIOMÉRIEUX (France), BioTek Instruments, Inc. (U.S.), Brooks Automation US, LCC (U.S.), Danaher Corporation (U.S.), Eppendorf SE (Germany), F. Hoffmann-La Roche Ltd (Switzerland), Honeywell International Inc. (U.S.), Hudson Robotics (U.S.), Hamilton Company (U.S.), Interscience (France), Oracle (U.S.), PerkinElmer (U.S.), QIAGEN (Germany), Synchron (The Netherlands), Siemens (Germany) and Thermo Fisher Scientific Inc. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Modular Laboratory Automation Market Definition

Modular Laboratory Automation refers to a flexible and customizable system designed to automate various laboratory processes by using interchangeable and scalable modules. These modules can be combined and configured to perform specific tasks such as sample preparation, liquid handling, analysis, and data management, depending on the laboratory’s requirements. The modular approach allows labs to start with basic automation and expand their system incrementally as needs grow, without requiring a complete overhaul. This adaptability enhances efficiency, reduces human error, and improves accuracy, making it particularly useful in high-throughput environments or research settings where precision and consistency are critical.

Modular Laboratory Automation Market Dynamics

Drivers

- Increased Demand for High-Throughput Testing

The growing need for high-throughput testing across industries such as pharmaceuticals, biotechnology, and healthcare is a significant driver of the modular laboratory automation market. As scientific research advances, laboratories face the challenge of processing larger volumes of samples efficiently while maintaining high accuracy and precision. Modular automation systems enable labs to streamline repetitive tasks such as sample preparation, analysis, and data management, boosting throughput without compromising quality. For instance, in pharmaceutical research, where drug discovery and clinical testing require extensive sample testing, modular automation systems can quickly process thousands of samples, allowing researchers to focus on analysis rather than manual labor. Similarly, in clinical diagnostics, automation enables faster and more accurate testing for diseases, enhancing productivity and reducing waiting times for results. These capabilities address the growing need for efficiency in modern labs, driving the adoption of modular automation solutions that offer flexibility and scalability, thereby fueling market growth.

- Reduction of Human Error and Improved Accuracy

A critical factor fueling the growth of the market is reducing human error and enhancing the accuracy of lab results. Manual tasks, such as sample handling and data analysis, are prone to inconsistencies, leading to unreliable results and potential risks in scientific research or clinical diagnoses. Modular automation systems significantly minimize the chance of error by automating repetitive processes, ensuring precision, and maintaining consistency. For instance, in research laboratories conducting experiments with complex protocols, human mistakes can lead to costly setbacks. Modular systems such as liquid handling robots can ensure exact volumes are measured every time, preventing errors related to human fatigue or oversight. In the biotechnology industry, where sample contamination or inaccurate measurements can compromise results, automation provides a higher level of control, reliability, and reproducibility. This enhanced accuracy is especially important in highly regulated fields such as pharmaceuticals and medical diagnostics, further driving the market growth.

Opportunities

- Integration of Artificial Intelligence and Machine Learning

One major opportunity in the modular laboratory automation market is the integration of artificial intelligence and machine learning to enhance decision-making and streamline lab processes. AI and ML can help automate complex data analysis, optimize workflows, and even predict future trends based on experimental data, offering a new level of intelligence to automation systems. For instance, in drug development, AI-driven automation can analyze large datasets from multiple experiments to identify patterns that might otherwise go unnoticed, enabling researchers to make faster, data-backed decisions. Similarly, in diagnostics, AI can assist in interpreting results more accurately and even flag potential anomalies, enhancing the overall reliability and efficiency of testing. As these technologies continue to evolve, integrating them into modular laboratory automation systems opens new possibilities for the market.

- Rising Demand for Personalized Medicine

The increasing focus on personalized medicine presents a significant opportunity for the market. Personalized medicine requires precise, tailored approaches to healthcare, which often involves high-throughput screening and testing of individual patient data. Modular automation systems, which can be easily customized and scaled, offer the flexibility needed to handle these diverse and complex tasks efficiently. For instance, in genomic research, automation can expedite the analysis of DNA sequences, enabling researchers to identify genetic variations specific to individual patients. Similarly, in oncology, automated systems can accelerate the testing of various drug responses on patient-specific cancer cells, allowing for more targeted treatment regimens. The ability of modular systems to adapt to the growing complexity of personalized medicine, combined with their ability to process vast amounts of data quickly, makes them invaluable tools in advancing personalized healthcare solutions and offers new growth opportunities for the market.

Restraints/Challenges

- High Initial Investment Costs

A significant restraint for the modular laboratory automation market is the high initial investment required for purchasing and implementing automated systems. While these systems offer long-term efficiency gains, the upfront costs, including equipment, installation, and staff training, can be prohibitive for smaller laboratories or organizations with limited budgets. This is particularly challenging for academic institutions, research labs, or smaller pharmaceutical companies that may struggle to allocate resources for automation. For instance, a small biotech startup may be hesitant to invest in a fully automated modular system, fearing that the financial burden will outweigh the anticipated benefits. Even with the scalability of modular systems, the initial outlay can still be a barrier. This could delay the adoption of automation in certain markets, limiting the overall growth potential of the modular laboratory automation sector.

- Integration with Existing Laboratory Infrastructure

A key challenge in the adoption of modular laboratory automation is ensuring seamless integration with existing laboratory infrastructure and workflows. Many laboratories rely on legacy equipment, instruments, or manual processes, which may not be compatible with modern automation systems. Integrating new automation solutions with older technologies can be complex, requiring significant adjustments to the lab's setup, protocols, and even employee skillsets. For instance, a laboratory using traditional manual pipetting or sample handling systems may struggle to integrate a new automated liquid handling module without substantial reorganization of workflows. This can lead to inefficiencies during the transition period and disrupt ongoing projects. The challenge of ensuring smooth integration requires careful planning, investment in system compatibility, and potentially modifying existing infrastructure, which can delay implementation and increase costs.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Modular Laboratory Automation Market Scope

The market is segmented on the basis of equipment and software and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Equipment and Software

- Automated Liquid Handlers

- Automated Plate Handlers

- Robotic Arms

- ASRS

- Software and Analysers

Application

- Drug Discovery

- Genomics

- Proteomics

- Clinical Diagnostics

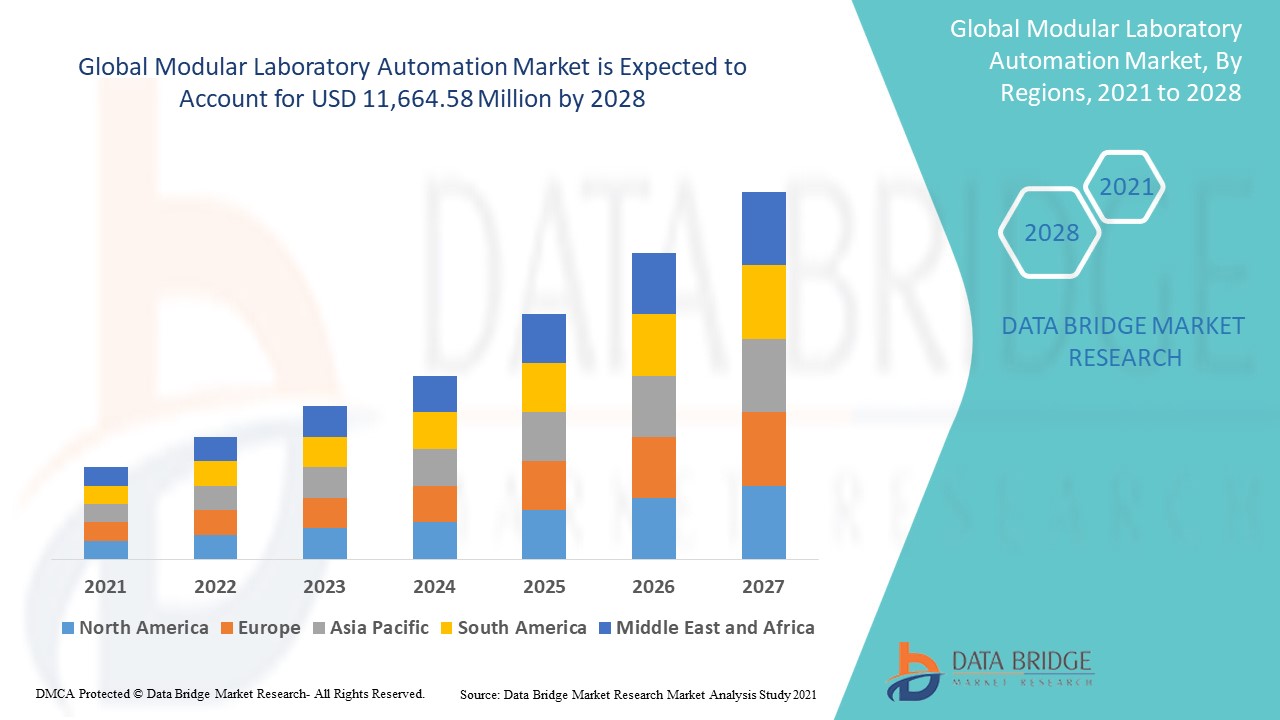

Modular Laboratory Automation Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, equipment and software, and application as referenced above.

The countries covered in the market report are U.S., Canada and Mexico, Germany, France, U.K., Italy, Russia, Spain, Denmark, Sweden, Norway, Rest of Europe, China, Japan, India, South Korea, Australia, Thailand, Rest of Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Nigeria, Egypt, Kuwait, Rest of Middle East and Africa, Brazil, Argentina and Rest of South America.

North America is expected to dominate the modular laboratory automation market, driven by strong demand from industries such as pharmaceuticals, biotechnology, and healthcare. The region benefits from advanced research facilities, substantial investments in automation technologies, and a robust presence of leading market players. The U.S., in particular, is a key driver due to its focus on improving lab efficiency, reducing costs, and enhancing precision in research and diagnostics. In addition, innovations in AI and machine learning, along with favorable regulatory support, further strengthen North America's position as a leader in laboratory automation adoption.

Asia Pacific is expected to exhibit the highest growth rate in the modular laboratory automation market. The region is witnessing rapid advancements in life sciences, healthcare, and biotechnology, particularly in countries such as China, India, and Japan. Growing research and development activities, coupled with increasing investments in healthcare infrastructure, are driving demand for automation solutions. In addition, the rising focus on improving laboratory efficiency, reducing human error, and meeting high-throughput demands in emerging markets is fueling market growth. The region's expanding biotechnology sector and increasing adoption of automation technologies further contribute to its strong growth potential.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Modular Laboratory Automation Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Modular Laboratory Automation Market Leaders Operating in the Market Are:

- Abbott (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Aurora Biomed Inc. (Canada)

- BD (U.S.)

- BIOMÉRIEUX (France)

- BioTek Instruments, Inc. (U.S.)

- Brooks Automation US, LCC (U.S.)

- Danaher Corporation (U.S.)

- Eppendorf SE (Germany)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Honeywell International Inc. (U.S.)

- Hudson Robotics (U.S.)

- Hamilton Company (U.S.)

- Interscience (France)

- Oracle (U.S.)

- PerkinElmer (U.S.)

- QIAGEN (Germany)

- Synchron (The Netherlands)

- Siemens (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

Latest Developments in Modular Laboratory Automation Market

- In October 2024, Oracle announced the general availability of Oracle Health Clinical Data Exchange, a new cloud-based solution designed to streamline medical claims processing through secure, automated data exchange between healthcare providers and payers. Built on Oracle Cloud Infrastructure (OCI), this solution replaces the time-consuming manual transmission of medical records with a secure, centralized network. It aims to reduce administrative time and costs, speed up the approval of essential patient clinical services, and accelerate claims and payment processing.

- In June 2024, Roche announced the launch of its new analytical units, the cobas c 703 and cobas ISE neo, for the cobas pro integrated solutions in countries that accept the CE mark. The cobas pro integrated solutions is a modular and scalable diagnostic platform tailored for high-volume laboratories. The cobas c 703 and cobas ISE neo units feature advanced technology designed to address key challenges faced by diagnostic laboratories globally, such as the shortage of qualified staff and space constraints.

- In June 2024, bioMérieux announced that its VITEK REVEAL AST System, which reports results directly from positive blood cultures, has received 510(k) clearance from the U.S. Food and Drug Administration (FDA). Rapid and accurate antimicrobial susceptibility testing (AST) results and interpretation are essential for clinicians to quickly optimize therapy and improve patient care. In addition, fast AST supports antimicrobial stewardship (AMS) programs, which have the potential to combat antimicrobial resistance (AMR), a global threat recognized by the WHO.

- In January 2024, QIAGEN announced the launch of two new syndromic testing panels for its QIAstat-Dx instruments in India: the Gastrointestinal Panel 2 and the Meningitis/Encephalitis Panel. These panels join the Respiratory SARS-CoV-2 Panel, which was first authorized for emergency use in 2020. Both new panels have received regulatory approval from the Central Drugs Standard Control Organization (CDSCO), allowing healthcare providers in India to diagnose patients more accurately, quickly, and easily.

- In May 2023, MolGen announced its acquisition of Dutch automation company Synchron Instrumenten BV. This acquisition will enable MolGen to broaden its portfolio and enhance its ability to create advanced automation solutions for DNA/RNA purification, library preparation, and NGS setup, supporting its reagent business. Synchron's expertise in custom liquid handling platforms and rapid prototyping will be leveraged to further expand MolGen's automation offerings.

- In January 2023, BD (Becton, Dickinson and Company) launched a new robotic track system for the BD Kiestra microbiology laboratory solution, designed to automate lab specimen processing and potentially reduce manual labor and wait times for results. The new BD Kiestra 3rd Generation Total Lab Automation System enables laboratories to customize and create flexible automation configurations by connecting multiple BD Kiestra modules. It is also scalable to accommodate the unique and changing needs of different labs.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.