Global Honeycomb Core Materials Market

Market Size in USD Billion

CAGR :

%

USD

3.42 Billion

USD

7.13 Billion

2024

2032

USD

3.42 Billion

USD

7.13 Billion

2024

2032

| 2025 –2032 | |

| USD 3.42 Billion | |

| USD 7.13 Billion | |

|

|

|

|

Honeycomb Core Materials Market Size

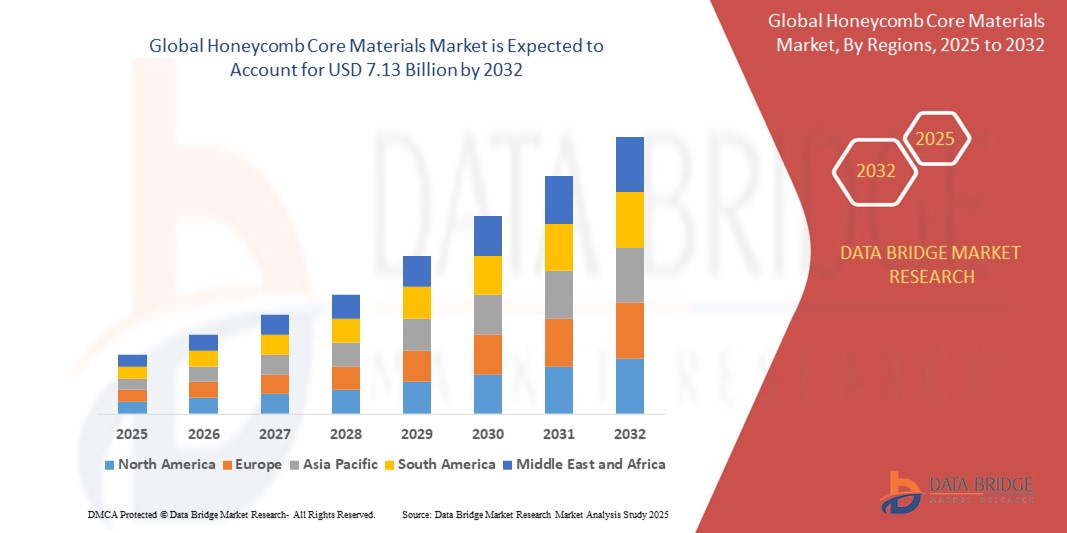

- The global honeycomb core materials market size was valued at USD 3.42 billion in 2024 and is expected to reach USD 7.13 billion by 2032, at a CAGR of 9.62% during the forecast period

- The market growth is largely fueled by the increasing demand for lightweight and high-strength materials across various end-use industries such as aerospace, automotive, transportation, construction, and packaging

- Furthermore, the growing adoption of honeycomb core materials in innovative applications such as electric vehicles for weight reduction and in the construction industry for lightweight panels is accelerating market growth. The increasing focus on sustainable materials and energy efficiency also contributes to the rising demand for honeycomb core materials

Honeycomb Core Materials Market Analysis

- Honeycomb core materials are lightweight cellular structures offering an exceptional strength-to-weight ratio, making them increasingly vital components in modern applications across various industries such as aerospace, automotive, marine, construction, and packaging. Their unique properties, including high stiffness and energy absorption capabilities, make them essential for critical processes requiring lightweight yet robust materials

- The escalating demand for honeycomb core materials is primarily fueled by the growing need for weight reduction and improved performance in transportation industries, especially aerospace and automotive. The increasing focus on fuel efficiency and reducing emissions necessitates the use of lightweight materials

- North America dominates the honeycomb core materials market with the largest revenue share in 2024, characterized by its robust aerospace and defense sectors.

- Asia-Pacific is expected to be the fastest growing region in the Honeycomb Core Materials market during the forecast period due to the increasing need for lightweight, high-strength, and environmentally friendly packaging solutions across the region

- The aluminum segment dominates the largest market revenue share in 2024, attributed to its superior strength-to-weight ratio, corrosion resistance, and wide applicability in aerospace, automotive, and construction industries. Aluminum cores are preferred in high-performance composite applications where both durability and lightweight properties are crucial

Report Scope and Honeycomb Core Materials Market Segmentation

|

Attributes |

Honeycomb Core Materials Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Honeycomb Core Materials Market Trends

“Increasing Use in Lightweighting across Industries”

- A significant and accelerating trend in the global Honeycomb Core Materials market is their increasing adoption as a primary solution for lightweighting across various industries, including aerospace, automotive, and marine. The need to reduce weight for fuel efficiency and performance enhancement is driving this trend

- Advanced research and development are leading to the creation of honeycomb core materials with improved strength-to-weight ratios and enhanced performance characteristics, making them more attractive for critical structural applications

- The trend towards using honeycomb core materials in innovative applications such as electric vehicles for battery enclosures and body structures, as well as in high-speed trains for interior and exterior panels, is growing rapidly

- The development of sustainable and cost-effective manufacturing processes for honeycomb core materials, including the use of recycled materials and automation technologies, is expanding their adoption

- The increasing focus on reducing carbon emissions and improving fuel economy is driving the demand for lightweight materials such as honeycomb cores as a key strategy across multiple transportation sectors. For instance, Airbus's A350 XWB aircraft extensively incorporates honeycomb core materials to reduce weight and improve fuel efficiency

Honeycomb Core Materials Market Dynamics

Driver

“Rising Demand from Aerospace and Automotive Sectors”

- The increasing global demand from the aerospace and automotive industries for lightweight and high-strength materials is a significant driver for the heightened adoption of Honeycomb Core Materials

- In the aerospace sector, the need to improve fuel efficiency and reduce emissions is driving the use of honeycomb core materials in aircraft structures, interior components, and cargo flooring

- Similarly, in the automotive industry, the trend towards electric vehicles and the need to extend driving range are increasing the demand for lightweight materials such as honeycomb cores in vehicle bodies and interiors

- The superior properties of honeycomb core materials, including their excellent strength-to-weight ratio, energy absorption capabilities, and design flexibility, make them a preferred choice for demanding applications in these sectors

- For instance, North America’s strong aerospace and defense industries utilize honeycomb core materials extensively in aircraft due to these properties

Restraint/Challenge

“Higher Manufacturing Costs and Material Limitations”

- The relatively higher manufacturing costs associated with certain types of honeycomb core materials, especially advanced composites such as Nomex, can be a restraint, particularly in cost-sensitive applications where traditional materials might be more economical

- Material limitations, such as susceptibility to moisture absorption in some types of paper-based honeycomb cores and potential for damage from concentrated loads or impacts, can pose challenges in specific applications requiring high durability or resistance to harsh environments

- Addressing these limitations through the development of more cost-effective manufacturing techniques and innovative material modifications is crucial for wider adoption of honeycomb core materials across a broader range of applications

Honeycomb Core Materials Market Scope

The market is segmented on the basis of type, application, and end use.

• By Type

On the basis of type, the Honeycomb Core Materials market is segmented into paper, aluminum, thermoplastic, Nomex, and others. The aluminum segment dominates the largest market revenue share in 2024, attributed to its superior strength-to-weight ratio, corrosion resistance, and wide applicability in aerospace, automotive, and construction industries. Aluminum cores are preferred in high-performance composite applications where both durability and lightweight properties are crucial.

The Nomex segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by its excellent fire resistance, thermal stability, and lightweight characteristics. Nomex honeycomb cores are gaining traction in aerospace and defense applications, particularly in interiors and structural panels that demand stringent safety standards and weight optimization.

• By Application

On the basis of application, the Honeycomb Core Materials market is segmented into non-composites and composites. The composites segment accounted for the largest market revenue share in 2024, owing to its extensive use in aerospace, automotive, and construction sectors. Composite honeycomb cores offer structural reinforcement, vibration dampening, and enhanced performance, making them a preferred choice for lightweight engineered materials.

The non-composites segment is also expected to show consistent growth during the forecast period, driven by cost-effectiveness and applicability in low-load structural and packaging applications. Their use is expanding in sectors where simpler fabrication and material recycling are prioritized.

• By End Use

On the basis of end use, the Honeycomb Core Materials market is segmented into packaging, aerospace, defense, transportation, automobiles, construction and infrastructure, and others. The aerospace segment leads the market revenue share in 2024, driven by the increasing demand for lightweight, high-strength materials in aircraft structures, interiors, and wings. The use of honeycomb cores helps improve fuel efficiency and payload capacity.

The automobiles segment is projected to witness the fastest CAGR from 2025 to 2032, supported by the rise in electric vehicles (EVs) and emphasis on vehicle weight reduction for improved range and performance. Honeycomb cores in this segment are gaining attention for energy absorption, structural support, and crash resistance.

Honeycomb Core Materials Market Regional Analysis

- North American market for honeycomb core materials dominates the global market, driven by its robust aerospace and defense sectors

- These industries heavily rely on the lightweight and high-strength properties of these materials in aircraft and military applications

- Furthermore, the increasing demand for lightweight materials in other sectors such as vehicle manufacturing and architecture is contributing to the market's expansion across the region

U.S. Honeycomb Core Materials Market Insight

The U.S. market is a key contributor to the overall North American demand for honeycomb core materials. Their utility in diverse applications within the automotive, aerospace and defense, construction, and infrastructure industries fuels the market. The focus on reducing weight in transportation and construction sectors is expected to further propel the adoption of these materials across the United States.

Europe Honeycomb Core Materials Market Insight

The European market for honeycomb core materials is experiencing growth due to the increasing preference for lightweight solutions in industries such as automotive and aerospace. While the COVID-19 pandemic initially impacted production in these sectors, the market is anticipated to recover as demand for these materials rises in various applications.

U.K. Honeycomb Core Materials Market Insight

The U.K. market is seeing increased demand for honeycomb core materials, particularly in packaging solutions. This growth is supported by the expanding e-commerce sector, which requires lightweight yet protective materials for shipping goods. The focus on sustainable packaging options also favors the adoption of honeycomb core materials.

Germany Honeycomb Core Materials Market Insight

The German market for honeycomb core materials is benefiting from the country's strong industrial base, especially in the automotive and aerospace sectors. The need for lightweight and high-performance materials in these industries, along with a growing emphasis on resource efficiency, is driving the adoption of honeycomb core materials in Germany.

Asia-Pacific Honeycomb Core Materials Market Insight

The Asia-Pacific market is expected to witness the fastest growth rate in honeycomb core materials market. This is driven by the increasing need for lightweight, high-strength, and environmentally friendly packaging solutions across the region. The expanding manufacturing sector and growing awareness of the benefits of these materials are key factors in this growth.

Japan Honeycomb Core Materials Market Insight

The Japanese market for honeycomb core materials is observing a steady increase in demand. The need for lightweight and high-strength materials in industries such as aerospace and packaging is contributing to this growth. The focus on technological advancements and material innovation also plays a role in the adoption of honeycomb core materials in Japan.

China Honeycomb Core Materials Market Insight

China represents a substantial market for honeycomb core materials within the Asia Pacific region. The increasing demand for lightweight, high-strength, and recyclable packaging solutions is a significant driver. The country's large manufacturing base and the growing emphasis on sustainable material usage are propelling the adoption of honeycomb core materials in China.

Honeycomb Core Materials Market Share

The Honeycomb Core Materials industry is primarily led by well-established companies, including:

- Hexcel Corporation (U.S.)

- Honicel (Netherlands)

- Packaging Corporation of America (U.S.)

- Argosy International Inc. (U.S.)

- Dufaylite (U.K.)

- CGI Corinth Group of Companies (U.S.)

- Axxion USA Inc. (U.S.)

- TenCate Protective Fabrics (Netherlands)

- ThermHex (Germany)

- The Gill Corporation (U.S.)

- Samia Canada (Canada)

- LSQUARE ECO PRODUCTS PVT LTD. (India)

Latest Developments in Global Honeycomb Core Materials Market

- In March 2024, Schutz Composites advanced its innovation efforts by introducing Cornmaster, a new lightweight construction material aimed at enhancing structural efficiency across various end-use sectors. This development is expected to strengthen the company's position in sustainable and high-performance material solutions

- In December 2022, Hexcel Corporation entered into a joint venture with Toray Advanced Composites to establish a manufacturing operation focused on producing honeycomb core materials for aerospace applications. This collaboration marks a strategic move to meet the increasing global demand for lightweight and durable aerospace components

- In November 2022, EconCore, a global leader in cost-effective honeycomb core production technologies, launched a new production line for lightweight honeycomb cores made from rPET (recycled polyethylene terephthalate). The material utilizes 100% recycled industrial and post-consumer waste. This initiative reflects a major step forward in sustainable construction and infrastructure material development

- In June 2022, Collins Aerospace unveiled its aeroBASE honeycomb multi-use floor panels, engineered to offer increased durability and weight reduction, making them ideal for aerospace and defense applications. This innovation enhances product longevity and contributes to overall aircraft efficiency and performance

- In January 2022, FITS Air, an advanced honeycomb paneling solution, was under development with a target of reaching Technology Readiness Level (TRL) 6. The panels, measuring 1.28 m x 1.48 m, are optimized for superior mechanical properties. This development highlights ongoing efforts to produce next-generation materials for aerospace and transport applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Honeycomb Core Materials Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Honeycomb Core Materials Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Honeycomb Core Materials Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.