Global Led Materials Market

Market Size in USD Billion

CAGR :

%

USD

16.62 Billion

USD

35.20 Billion

2024

2032

USD

16.62 Billion

USD

35.20 Billion

2024

2032

| 2025 –2032 | |

| USD 16.62 Billion | |

| USD 35.20 Billion | |

|

|

|

|

Light-Emitting Diode (LED) Materials Market Size

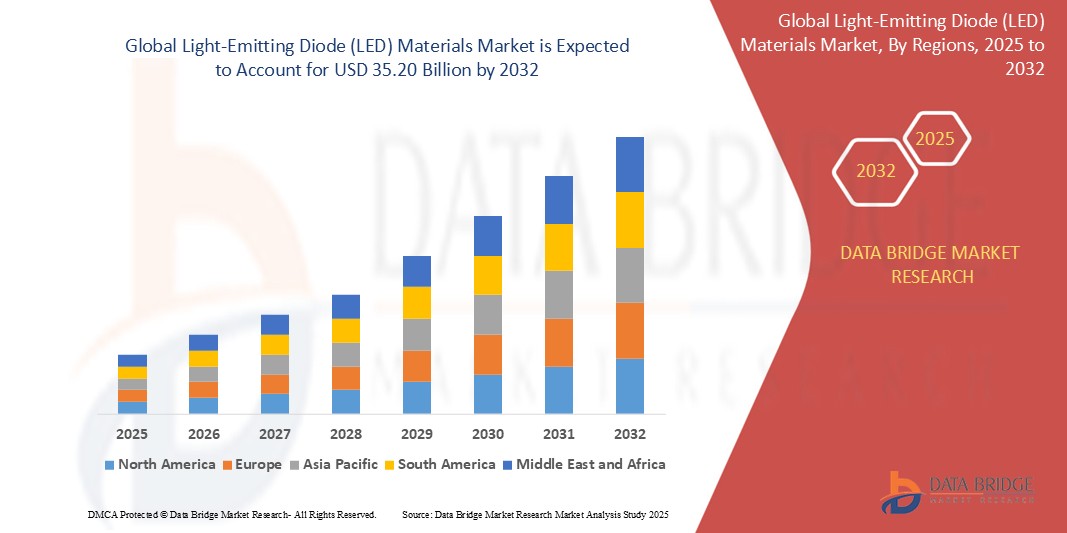

- The global light-emitting diode (LED) materials market size was valued at USD 16.62 billion in 2024 and is expected to reach USD 35.20 billion by 2032, at a CAGR of 9.83% during the forecast period

- This growth is driven by factors such as advancements in LED technology, and the rising adoption of LED products in various industries, including automotive, consumer electronics, and general lighting

Light-Emitting Diode (LED) Materials Market Analysis

- The global market for light-emitting diode materials is experiencing steady growth, driven by the increased adoption of energy-efficient lighting solutions across various sectors. The market is characterized by continuous innovations in materials and technological advancements

- As demand for high-performance LED products rises, key market players are focusing on enhancing the quality of LED materials to offer improved energy efficiency and longer-lasting solutions. This trend is creating a competitive landscape with ongoing product developments and innovations

- North America is expected to dominate the light-emitting diode (LED) materials market due to its advanced technological infrastructure, strong regulatory support for energy-efficient lighting, and the presence of key industry players

- Asia-Pacific is expected to be the fastest growing region in the light-emitting diode (LED) materials market during the forecast period due to rapid urbanization, increasing infrastructure investments, and supportive government initiatives promoting LED adoption

- The wafer segment is expected to dominate the light-emitting diode (LED) materials market with the largest share in 2025 due to its critical role in the production of LED chips. Wafer materials, particularly gallium nitride and sapphire, are essential for high-performance LEDs used in various applications.

Report Scope and Light-Emitting Diode (LED) Materials Market Segmentation

|

Attributes |

Light-Emitting Diode (LED) Materials Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Light-Emitting Diode (LED) Materials Market Trends

“Shift Towards Advanced Phosphor Materials in LED Manufacturing”

- A significant trend in the Light-Emitting Diode materials market is the shift towards advanced phosphor materials, which play a crucial role in enhancing LED color quality and brightness

- Phosphor materials, particularly those based on rare-earth elements such as cerium and europium, are being increasingly incorporated to achieve improved light output and energy efficiency

- Companies are investing in the development of phosphors that can generate pure white light, addressing the demand for better color rendering and visual experience in applications such as television displays and automotive lighting

- For instance, the adoption of cerium-based phosphors has led to improved efficacy and longer lifespans for white LED lighting used in both consumer electronics and general lighting

- This trend is also seen in the automotive industry, where advanced phosphor materials are helping to produce brighter, more efficient headlights and tail lights for vehicles

Light-Emitting Diode (LED) Materials Market Dynamics

Driver

“Growing Demand for Energy-Efficient Lighting Solutions”

- The global shift towards sustainability and energy conservation is driving the demand for energy-efficient lighting solutions such as LEDs. LED lighting is favored for its lower power consumption and longer lifespan compared to traditional lighting technologies

- Stricter regulations from governments, focused on reducing energy consumption and carbon emissions, are boosting the adoption of LED technology. Many countries have set specific targets to phase out incandescent and fluorescent lighting in favor of LEDs to meet sustainability goals

- Rapid urbanization and industrialization, especially in emerging economies, are fueling the need for efficient lighting systems in residential and commercial spaces

- For instance, as cities in India and China expand, LED lighting is being adopted in large-scale infrastructure projects

- LED technology is also gaining traction in various sectors, including street lighting, automotive lighting, and display systems. Smart city initiatives, such as in the U.S. and Europe, are pushing for the installation of LED street lights to reduce energy usage and enhance public safety

- Governments worldwide are offering incentives and rebates for adopting LED systems, further driving market growth. In the European Union

- For instance, several cities are incentivizing LED upgrades in public lighting systems as part of green urban planning initiatives

Opportunity

“Expanding Application in Automotive Industry”

- The automotive industry's growing adoption of LED technology presents significant growth opportunities for the LED materials market. LEDs offer advantages such as superior brightness, better energy efficiency, and longer lifespans compared to traditional halogen or incandescent lights

- LED applications in vehicles are expanding beyond headlights and taillights to include interior lighting, indicator lights, and vehicle displays. This broadening usage in automotive design is driving demand for specialized LED materials

- Premium and electric vehicles are increasingly using LEDs due to their aesthetic appeal, enhanced performance, and energy efficiency

- For instance, luxury car brands such as Audi and BMW are incorporating advanced LED lighting into both the exterior and interior of their vehicles

- The rise of autonomous and connected vehicles is further fueling the demand for LED technology. LEDs can be integrated with smart systems to improve safety, visibility, and driver assistance features in these next-generation vehicles

- As electric vehicles (EVs) become more widespread, the need for energy-efficient LED lighting solutions is set to grow. The demand for high-performance LEDs in EVs presents a new avenue for growth for companies supplying specialized LED materials to the automotive sector

Restraint/Challenge

“High Initial Cost of LED Materials”

- A key challenge in the Light-Emitting Diode materials market is the high initial cost of LED materials and products. Despite offering long-term energy savings, the upfront cost is still higher compared to traditional lighting technologies, discouraging some consumers and businesses from making the switch

- The manufacturing of LEDs requires expensive materials such as rare-earth elements and advanced phosphors, which significantly contribute to the overall production cost. This makes LEDs less affordable for certain consumers and industries

- Although the cost of LED technology has decreased over time, it remains a barrier, particularly in price-sensitive regions and markets

- For instance, small businesses or residential consumers in developing countries may hesitate to invest in LEDs despite the potential for long-term savings

- The complex and resource-intensive manufacturing process for high-quality LED materials further adds to the cost burden. This makes LED lighting systems less accessible to certain markets, especially in regions with lower economic development

- To address this challenge, companies in the LED materials market are focusing on technological advancements, mass production, and economies of scale to reduce production costs. However, price sensitivity remains a significant obstacle to the broader adoption of LED lighting systems

Light-Emitting Diode (LED) Materials Market Scope

The market is segmented on the basis of material type and application.

|

Segmentation |

Sub-Segmentation |

|

By Material Type |

|

|

By Application |

|

In 2025, the wafer is projected to dominate the market with a largest share in material type segment

The wafer segment is expected to dominate the light-emitting diode (LED) materials market with the largest share in 2025 due to its critical role in the production of LED chips. Wafer materials, particularly gallium nitride and sapphire, are essential for high-performance LEDs used in various applications.

The general lighting is expected to account for the largest share during the forecast period in application segment

In 2025, the general lighting segment is expected to dominate the market with the largest market share due to its widespread adoption in both residential and commercial sectors.

Light-Emitting Diode (LED) Materials Market Regional Analysis

“North America Holds the Largest Share in the Light-Emitting Diode (LED) Materials Market”

- The U.S. held a dominant share of 78.7% in the North American LED lighting market, indicating its significant contribution to the regional market

- The U.S. has experienced a rise in public construction spending, including street and highway construction, which supports the adoption of energy-efficient LED lighting solutions

- Canada is expanding its LED market with a projected growth rate, driven by real estate development and government policies promoting energy-efficient lighting

- The presence of major companies such as Cree, Inc., Acuity Brands, and GE Lighting fosters innovation and widespread adoption of LED technologies in North America

“Asia-Pacific is Projected to Register the Highest CAGR in the Light-Emitting Diode (LED) Materials Market”

- Asia Pacific is the fastest growing region in the LED materials market

- Countries such as China, South Korea, and Taiwan are leading in LED production, benefiting from substantial government subsidies and incentives that bolster domestic manufacturing capabilities

- Rapid urbanization and infrastructure expansion in emerging economies are driving the need for efficient lighting systems in residential and commercial spaces

- Advancements in research and development across Asia-Pacific countries are fostering innovation in LED technologies, further propelling the market's growth and global competitiveness

Light-Emitting Diode (LED) Materials Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- AkzoNobel N.V. (Netherlands)

- Cree, Inc. (U.S.)

- EPISTAR Corporation (Taiwan)

- Hitachi Metals, Ltd. (Japan)

- II-VI Incorporated (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- NICHIA CORPORATION (Japan)

- OSRAM Opto Semiconductors GmbH (Germany)

- Sumitomo Electric Industries, Ltd. (Japan)

- UBE INDUSTRIES, LTD. (Japan)

- Addison Engineering, Inc. (U.S.)

- DOWA Electronic Materials Co. Ltd (Japan)

- Freiberger Compound Materials GmbH (Germany)

- Lake Materials Co., Ltd. (China)

- MACOM (U.S.)

- MTI Corporation (U.S.)

- Seoul Semiconductors Co., Ltd. (South Korea)

- SixPoint Materials, Inc. (U.S.)

- R K Lighting India (India)

- SORAA (U.S.)

Latest Developments in Global Light-Emitting Diode (LED) Materials Market

- In September 2023, Evonik launched TEGO® RC 2000 LCF, a UV LED-curable release coating made from recycled silicone feedstocks. This new product is designed for label producers seeking sustainable solutions, offering easy-to-control release performance and high stability with pressure-sensitive adhesives. It enables curing with energy-efficient UV LED or traditional UV Arc lamps, reducing energy consumption and carbon footprints. This innovation positions Evonik at the forefront of sustainability in the labelling industry, benefiting both the environment and manufacturers

- In October 2023, LEDVANCE introduced the NATURELOOP product range, featuring lamps and luminaires made from at least 40% post-consumer recycled plastics. This initiative aligns with LEDVANCE's sustainability goals under the LEDVANCE LOOP concept, aiming to reduce plastic use and CO₂ emissions during production. The first wave includes 20 new lamp types available from mid-November 2023 and six damp-proof luminaires launching in January 2024. These products cater to both residential and professional lighting needs, supporting the transition to a more sustainable lighting industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Led Materials Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Led Materials Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Led Materials Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.