Global Food Safety Testing Market

Market Size in USD Billion

CAGR :

%

USD

32.49 Billion

USD

58.37 Billion

2024

2032

USD

32.49 Billion

USD

58.37 Billion

2024

2032

| 2025 –2032 | |

| USD 32.49 Billion | |

| USD 58.37 Billion | |

|

|

|

|

Food Safety Testing Market Size

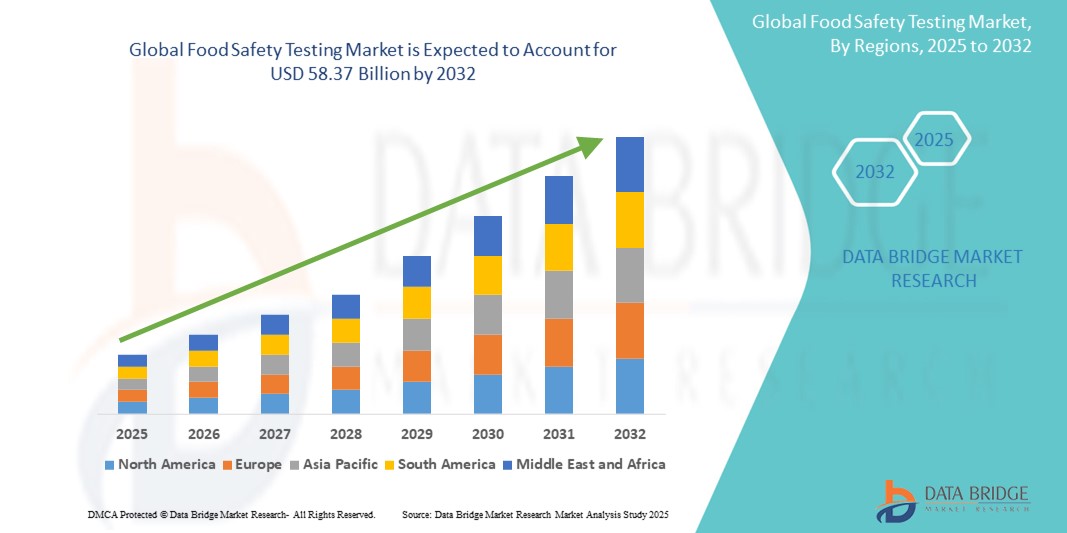

- The global food safety testing market size was valued at USD 32.49 billion in 2024 and is expected to reach USD 58.37 billion by 2032, at a CAGR of 7.60% during the forecast period

- This growth is driven by factors such as rising incidence of foodborne illnesses, stricter global regulations, and growing consumer awareness of food quality

Food Safety Testing Market Analysis

- Food safety testing is a critical process that ensures the safety and quality of food by identifying contaminants such as pathogens, allergens, chemical residues, and GMOs. It plays a key role in preventing foodborne illnesses and maintaining public health by verifying compliance with safety regulations throughout the food supply chain

- The food safety testing market is witnessing consistent growth, fueled by increasing incidences of food contamination, stringent regulatory requirements, rising consumer awareness, technological advancements in testing methods, and the expanding global trade of food products

- North America is expected to dominate the food safety testing market with a share of 31.7%, due to the well-established presence of major industry players offering specific product lines and high-quality food safety testing services

- Asia-Pacific is expected to be the fastest growing region in the food safety testing market during the forecast period due to growing implementation of stringent food safety regulations and increasing awareness of foodborne illnesses

- Meat, poultry, & seafood products segment is expected to dominate the market with a market share of 30.8% due to increasing concerns over foodborne illnesses, strict government regulations, and the rising demand for high-quality and safe protein sources. In addition, the growing awareness among consumers about food safety and the implementation of rigorous testing standards by producers further contribute to this segment's dominance

Report Scope and Food Safety Testing Market Segmentation

|

Attributes |

Food Safety Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Food Safety Testing Market Trends

“Increasing Adoption of Automated Testing Technologies”

- One prominent trend in the global food safety testing market is the increasing adoption of automated testing technologies

- This trend is driven by the need for faster, more accurate detection of contaminants, growing demand for high-throughput testing, and advancements in technologies such as PCR, biosensors, and immunoassays

- For instance, companies such as Thermo Fisher Scientific and bioMérieux have developed automated platforms such as the SureTect PCR System and GENE-UP, respectively, enabling food manufacturers to conduct rapid and reliable pathogen detection while improving efficiency and compliance with regulatory standards

- The demand for automated testing solutions is rising in both developed markets such as North America and Europe, as well as emerging markets where modernization of food processing and testing infrastructure is gaining momentum

- As the global food supply chain becomes more complex and the focus on traceability and safety intensifies, the adoption of automated testing technologies is expected to play a central role in shaping the future of the food safety testing market

Food Safety Testing Market Dynamics

Driver

“Increasing Incidences of Foodborne Illnesses”

- The increasing incidences of foodborne illnesses are a major driver for the food safety testing market, as regulatory bodies and food producers prioritize contamination detection to protect public health and prevent outbreaks

- This concern is escalating globally, with heightened efforts from governments, food safety authorities, and industry stakeholders to strengthen monitoring and testing practices across the food supply chain

- With the rising burden of illnesses caused by pathogens such as Salmonella, E. coli, and Listeria, there is a growing shift toward adopting more comprehensive and rapid testing solutions that can be implemented across processing, packaging, and distribution stages

- Industry leaders are investing in advanced food testing technologies that enhance detection accuracy, reduce turnaround times, and ensure regulatory compliance

- Furthermore, consumer demand for transparency and clean-label food products is compelling manufacturers to adopt rigorous testing protocols, reinforcing food safety as a key competitive differentiator

For instance,

- Eurofins Scientific offers an extensive portfolio of microbiological and chemical testing services that help food companies meet safety standards and prevent contamination-related recalls

- Neogen Corporation provides rapid food safety testing kits for pathogens, allergens, and toxins, supporting proactive risk management in the food industry

- As foodborne illnesses remain a global concern, the need for consistent, reliable testing will continue to drive sustained growth in the food safety testing market

Opportunity

“Increased Focus on Food Fraud Detection”

- Increased focus on food fraud detection presents a significant opportunity for the food safety testing market, as companies and regulators seek to ensure product authenticity, quality, and consumer trust in a globalized food supply chain

- Testing solution providers are leveraging this opportunity by developing advanced analytical tools capable of identifying adulteration, mislabeling, and counterfeit ingredients across various food categories

- This aligns with the broader movement toward transparency and traceability in the food industry, as manufacturers, retailers, and regulatory bodies adopt high-precision technologies such as DNA-based authentication, isotope analysis, and spectrometry to detect fraud and ensure compliance

For instance,

- Intertek offers a range of food fraud detection services, utilizing techniques such as mass spectrometry and DNA barcoding to identify fraudulent ingredients and ensure product integrity

- Bureau Veritas provides food authentication solutions through advanced testing methods that help manufacturers and suppliers safeguard against food fraud, ensuring the traceability and authenticity of their products

- As consumer demand for clean-label and ethically sourced products grows, and incidents of economically motivated adulteration rise, the food safety testing market is well-positioned to capitalize on this opportunity by delivering robust, science-driven solutions that safeguard brand reputation and consumer health

Restraint/Challenge

“Complex Regulatory Environment”

- The complex regulatory environment presents a significant challenge for the food safety testing market, as varying standards, requirements, and enforcement levels across regions create inconsistencies in testing protocols and compliance

- Navigating this complexity requires overcoming differences in regulatory frameworks, testing methodologies, and enforcement mechanisms, leading to potential delays, compliance issues, and increased costs for food manufacturers and testing service providers

- Addressing these challenges involves adapting testing technologies and processes to meet the diverse regulations and requirements of different regions, which can increase operational costs and complicate the implementation of food safety measures across global supply chains

For instance,

- In emerging markets, companies such as Intertek and SGS may need to implement additional testing measures to comply with stringent international food safety standards, such as those set by the FDA or EFSA, creating logistical and financial challenges

- Without harmonizing regulatory practices and ensuring consistent standards across regions, the complexity of compliance may hinder market growth and increase the burden on food safety testing providers

Food Safety Testing Market Scope

The market is segmented on the basis of test and application.

|

Segmentation |

Sub-Segmentation |

|

By Test |

|

|

By Application |

|

In 2025, the meat, poultry, & seafood products is projected to dominate the market with a largest share in application segment

The meat, poultry, & seafood products segment is expected to dominate the food safety testing market with the largest share of 30.8% in 2025 due to increasing concerns over foodborne illnesses, strict government regulations, and the rising demand for high-quality and safe protein sources. In addition, the growing awareness among consumers about food safety and the implementation of rigorous testing standards by producers further contribute to this segment's dominance.

The microbiological testing is expected to account for the largest share during the forecast period in test segment

In 2025, the microbiological testing segment is expected to dominate the market with the largest market share of 29.3% due to increasing prevalence of foodborne pathogens, such as Salmonella and E. coli, which pose significant health risks. In addition, rising consumer demand for safe and hygienic food products, along with stricter food safety regulations globally, drives the adoption of microbiological testing. This segment is essential for ensuring food safety, particularly in sectors such as meat, poultry, seafood, and dairy.

Food Safety Testing Market Regional Analysis

“North America Holds the Largest Share in the Food safety testing Market”

- North America dominates the food safety testing market with a share of 31.7%, driven by the well-established presence of major industry players offering specific product lines and high-quality food safety testing services

- U.S. holds a significant share due to its advanced infrastructure, strict regulatory environment, and significant investments in food safety technologies

- The region’s market growth is further supported by growing consumer demand for high-quality, safe food products and an increased focus on ensuring food safety across various sectors, including meat, poultry, and seafood

- North America's leadership in food safety testing is supported by continuous technological innovations, a strong public-private partnership in research and development, and enhanced awareness surrounding the need for safer food products, positioning the region to maintain its dominance through 2032

“Asia-Pacific is Projected to Register the Highest CAGR in the Food safety testing Market”

- Asia-Pacific is expected to witness the highest growth rate in the food safety testing market, driven by growing implementation of stringent food safety regulations and increasing awareness of foodborne illnesses

- India holds a significant share due to rising demand for processed foods, growing public health concerns, and strengthened government initiatives to regulate food safety standards

- The region’s market growth is further supported by increasing cases of food contamination, greater focus on food quality control, and growing investments in food safety infrastructure and technologies

- As the region continues to urbanize and demand for high-quality, safe food rises, Asia-Pacific is positioned for substantial market growth, with continued emphasis on improving food safety standards and adopting advanced testing technologies. Through 2032, Asia-Pacific is expected to outpace other regions, becoming a leading force in the global food safety testing market

Food Safety Testing Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Eurofins Scientific (Luxembourg)

- Shimadzu Corporation (Japan)

- Thermo Fisher Scientific Inc. (U.S.)

- PerkinElmer Inc. (U.S.)

- FOSS (Denmark)

- ALS (Australia)

- LexaGene (U.S.)

- ROKA BIO SCIENCE (U.S.)

- Biorex Food Diagnostics (BFD) (Finland)

- Randox Food Diagnostics (U.K.)

- Omega Diagnostics Group PLC (U.K.)

- Romer Labs Division Holding GmbH (Austria)

- SGS Société Générale de Surveillance SA (Switzerland)

- 3M (U.S.)

- Clear Labs, Inc. (U.S.)

- Invisible Sentinel (U.S.)

- Ring Biotechnology Co Ltd. (South Korea)

- BIOMÉRIEUX SA (France)

- Agilent Technologies, Inc. (U.S.)

- NEOGEN Corporation (U.S.)

- Spectro Analytical Labs Ltd. (India)

- Noack (Germany)

Latest Developments in Global Food Safety Testing Market

- In March 2025, the Ministry of Food Processing Industries announced the establishment of 100 new food testing labs with financial support, a move that is expected to significantly enhance the food safety testing market. This expansion will increase testing capacity, improve regulatory compliance, and foster innovation in food safety technologies, ultimately driving market growth

- In October 2024, the health department plans to engage the public in its food adulteration crackdown by installing food testing kits in two malls for consumer use. Food Safety Commissioner Srinivas K shared with TOI that these "food safety magic boxes" are set to launch next week. This initiative is expected to raise awareness about food safety, drive demand for testing solutions, and further stimulate the growth of the food safety testing market

- In May 2024, following an investigation into alleged violations of norms in branded spices, the Food Safety and Standards Authority of India (FSSAI) announced plans to expand its surveillance to include other food items such as fortified rice, dairy products, and spices sold in the domestic market. This move is expected to drive demand for food safety testing services as regulatory scrutiny intensifies, creating opportunities for growth within the food safety testing market

- In April 2022, Mérieux NutriSciences completed the acquisition of Hortec Pty Ltd (Hortec) in South Africa and Laboratorios Bromatológicos Araba SA (Aralab) in Spain. These acquisitions are part of Mérieux NutriSciences' strategic efforts to expand its regional presence in Spain and enter the pesticide industry in South Africa. These moves align with the company's strategic objectives, enhancing its capabilities and market reach in these regions

- In July 2021, Intertek entered the lucrative Agri-Food and Beverage market in Brazil by acquiring a prominent food testing company. The demand for comprehensive Total Quality Assurance (TQA) solutions in these sectors is expected to rise as supply chains become increasingly complex, driven by heightened consumer standards. This acquisition provides an attractive opportunity to tap into Brazil's rapidly expanding agri-food and beverage testing market, given its status as one of the world's largest food producers and exporters

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Food Safety Testing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Food Safety Testing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Food Safety Testing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.