Global Block Chain In Agriculture And Food Supply Chain Market

Market Size in USD Million

CAGR :

%

USD

909.10 Million

USD

8,379.21 Million

2024

2032

USD

909.10 Million

USD

8,379.21 Million

2024

2032

| 2025 –2032 | |

| USD 909.10 Million | |

| USD 8,379.21 Million | |

|

|

|

|

Block Chain in Agriculture and Food Supply Chain Market Size

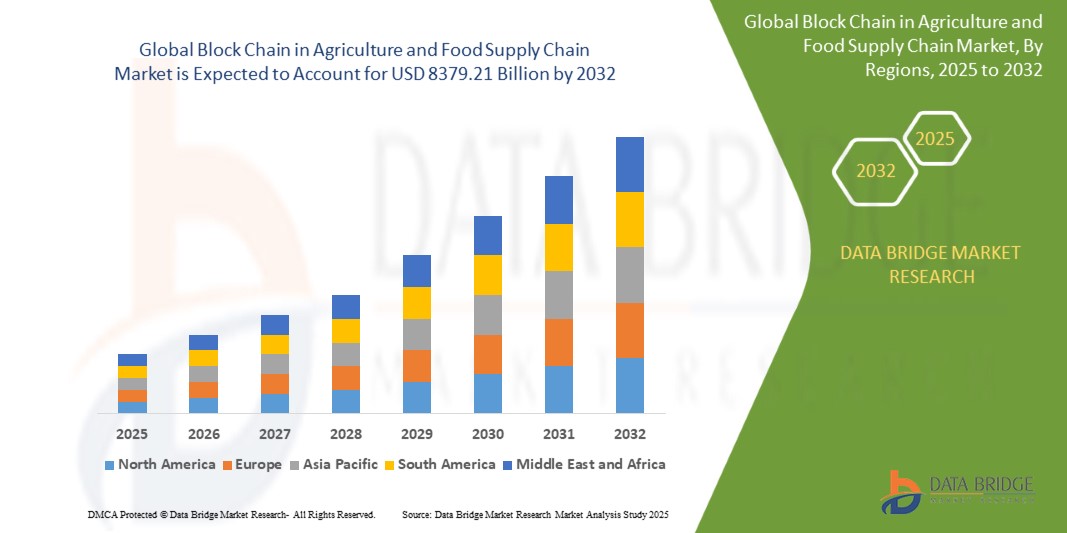

- The global block chain in agriculture and food supply chain market was valued at USD 909.1 million in 2024 and is expected to reach USD 8379.21 million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 32.00%, primarily driven by enhanced supply chain efficiency

- This growth is driven by factors such as real-time data & visibility, lower costs & faster transactions and optimized inventory & logistics

Block Chain in Agriculture and Food Supply Chain Market Analysis

- The blockchain in agriculture and food supply chain market encompasses a diverse range of solutions aimed at enhancing transparency, efficiency, and security across the food supply chain. By integrating blockchain technology, stakeholders can ensure real-time traceability, fraud prevention, and automated transactions, improving overall supply chain integrity

- The market is expanding due to the growing demand for food safety, regulatory compliance, and consumer awareness regarding product origins. As the industry seeks secure and efficient solutions, companies are leveraging blockchain to streamline logistics, reduce food fraud, and enhance supply chain visibility, driving widespread adoption

- The integration of smart contracts, IoT-enabled tracking, and decentralized ledgers is transforming the sector by enabling automated payments, real-time data sharing, and improved inventory management

- For instance, companies such as IBM Food Trust and AgriDigital have implemented blockchain solutions to enhance traceability, reduce transaction delays, and ensure food authenticity, strengthening trust among consumers and businesses

- The blockchain in agriculture and food supply chain Market is poised for sustained growth, driven by increasing digitalization, regulatory support, and advancements in agri-tech. The rising demand for secure, efficient, and transparent food supply networks will continue to shape the industry, with businesses focusing on scalability, interoperability, and sustainability to remain competitive

Report Scope and Block Chain in Agriculture and Food Supply Chain Market Segmentation

|

Attributes |

Block Chain in Agriculture and Food Supply Chain Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Block Chain in Agriculture and Food Supply Chain Market Trends

“Growing Use of Smart Contracts for Automation and Compliance”

- One prominent trend in the global block chain in agriculture and food supply chain market is the growing use of smart contracts for automation and compliance

- This trend is driven by the need for efficiency, transparency, and trust in agricultural trade, leading businesses to implement self-executing contracts that ensure secure, instant, and dispute-free transactions between farmers, suppliers, and retailers

- For instance, AgriDigital has developed a blockchain-based smart contract system that streamlines grain trading, reducing fraud and eliminating transaction delays

- As the industry shifts towards digitized and automated supply chains, companies are integrating smart contracts with IoT and AI to enhance data accuracy, ensure fair trade, and optimize supply chain operations

- This transformation is expected to drive market expansion, with businesses focusing on scalability, security, and interoperability to stay competitive in an evolving agri-tech landscape

Block Chain in Agriculture and Food Supply Chain Market Dynamics

Driver

“Emerging Tech Adoption for Supply Chain Transparency”

- The growing integration of emerging technologies is a key driver of growth in the blockchain in agriculture and food supply chain market.

- As the industry prioritizes transparency and efficiency, businesses are increasingly adopting blockchain, IoT, and AI to enhance traceability and streamline operations

- With a focus on real-time tracking, automated compliance, and secure transactions, companies are implementing blockchain-based systems that ensure tamper-proof records, instant data sharing, and improved supply chain visibility

- The rising demand for digitized and transparent food supply networks has led to significant investments in AI-driven analytics, IoT-enabled monitoring, and decentralized ledgers, enabling stakeholders to detect fraud, optimize logistics, and maintain regulatory compliance

- As supply chain transparency becomes a critical factor in food safety and sustainability, businesses are leveraging emerging technologies to enhance trust, reduce inefficiencies, and support ethical sourcing

For instance,

- IBM Food Trust utilizes blockchain and AI-powered traceability to ensure food authenticity and safety

- TE-FOOD integrates IoT tracking systems with blockchain to monitor real-time conditions of perishable goods

- With increasing regulatory demands and consumer awareness, the blockchain in agriculture and food supply chain market will continue expanding, driving innovation, efficiency, and sustainability across the global food ecosystem

Opportunity

“Expansion of Food Traceability Solutions”

- The increasing demand for transparent and traceable food sourcing presents a significant opportunity for the blockchain in agriculture and food supply chain market. As consumers and regulators emphasize food safety and authenticity, businesses are adopting blockchain-powered traceability solutions to enhance supply chain visibility

- With the growing need for real-time tracking, companies are integrating blockchain to monitor product movement, verify origin, and ensure quality control across the supply chain. This technology helps combat food fraud, mislabeling, and contamination risks, strengthening consumer trust

- The demand for digitized traceability systems is also rising, as businesses seek solutions that provide secure, immutable records of food production, processing, and distribution. Blockchain-enabled QR codes, RFID tags, and IoT sensors are being used to improve tracking accuracy and efficiency

For instance,

- IBM Food Trust has partnered with major food producers and retailers to implement blockchain-based traceability systems, allowing consumers to track products from farm to table

- Walmart has integrated blockchain to enhance fresh produce traceability, reducing the time needed for food recall investigations from days to seconds

- As global food traceability regulations become more stringent, businesses have the opportunity to develop innovative blockchain solutions that enhance supply chain transparency, compliance, and consumer confidence, ensuring long-term market growth

Restraint/Challenge

“Lack of Common Set of Standards”

- The absence of universally accepted standards presents a significant challenge for the blockchain in agriculture and food supply chain market. With various stakeholders operating across different regions, the lack of uniform blockchain protocols, data formats, and regulatory guidelines creates interoperability issues and slows adoption

- Inconsistent data recording practices and differing blockchain frameworks make it difficult for companies to seamlessly integrate systems, share information, and ensure compatibility across the supply chain. This leads to inefficiencies in traceability, transaction validation, and compliance monitoring

- The market is also affected by varying government regulations, with some regions promoting blockchain adoption while others lack clear legal frameworks, causing uncertainty for businesses looking to invest in the technology

For instance,

- Different blockchain networks, such as IBM Food Trust, VeChain, and TE-FOOD, use varied protocols and governance models, making it challenging for companies to implement a single standardized solution across global supply chains

- As blockchain continues to evolve in the agriculture and food supply chain sector, the lack of standardized regulations and technological frameworks will remain a key obstacle, impacting scalability and industry-wide adoption

Block Chain in Agriculture and Food Supply Chain Market Scope

The market is segmented on the basis of application and provider.

|

Segmentation |

Sub-Segmentation |

|

By Application |

|

|

By Provider |

|

Block Chain in Agriculture and Food Supply Chain Market Regional Analysis

“North America is the Dominant Region in the Block Chain in Agriculture and Food Supply Chain Market”

- North America dominates the block chain in agriculture and food supply chain market, driven by its advanced technological infrastructure, strong regulatory framework, and high adoption rate of blockchain solutions across the food and agriculture sectors. The presence of major industry players, including IBM Food Trust, TE-FOOD, and Walmart, reinforces the region’s dominance in the global market

- The U.S. holds a significant share due to increasing integration of food companies and agricultural enterprises blockchain-based traceability and smart contract solutions to enhance transparency, reduce fraud, and improve supply chain efficiency

- Government regulations supporting food safety, sustainability, and digital transformation further accelerate blockchain adoption, as organizations seek compliance with standards set by the Food and Drug Administration (FDA) and the U.S. Department of Agriculture (USDA)

- The region's strong investment ecosystem and R&D activities enable continuous innovation in blockchain applications, positioning North America as a leader in agri-tech advancements and secure supply chain management

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the block chain in agriculture and food supply chain market, driven by government initiatives, increasing investment in digital agriculture, and the rising demand for food safety and traceability solutions

- Countries such as China, India, Japan, and Australia are experiencing rapid adoption of blockchain-enabled supply chain platforms, driven by the need to prevent food fraud, reduce waste, and enhance export quality standards

- The growing presence of agriculture-focused blockchain startups and collaborations between technology providers, food producers, and governments are accelerating market expansion

- Rising consumer demand for organic, sustainably sourced, and ethically produced food is also pushing retailers and supply chain stakeholders to adopt blockchain for product verification and transparency, further driving market growth in the region

Block Chain in Agriculture and Food Supply Chain Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- IBM (U.S.)

- Microsoft (U.S.)

- SAP SE (Germany)

- OriginTrail. (Slovenia)

- PROVENANCE (U.K.)

- Chainvine (U.K.)

- FULL PROFILE PTY LTD (Sydney)

- AgriChain Pty Ltd (Australia)

- Solar Impulse Foundation (Switzerland)

- Unilever PLC (U.K.)

- Walmart Inc. (U.S.)

Latest Developments in Global Block Chain in Agriculture and Food Supply Chain Market

- In June 2020, Atea, IBM and the Norwegian Seafood Association, announced a cross-industry collaboration to leverage blockchain technology for enhancing supply chain transparency in Norway's seafood industry. This initiative aims to streamline data sharing, improve traceability, and ensure safer, higher-quality seafood for consumers worldwide

- In April 2020, IBM and Nestlé partnered to integrate IBM Food Trust enterprise blockchain for tracking Nestlé’s Zoégas coffee brand. Through this initiative, Zoégas coffee packaging includes a QR code, allowing consumers to scan and trace the coffee beans back to their origin. The blockchain platform securely records key data, including farmer details, harvest time, transaction certificates for specific shipments, and roasting periods, enhancing supply chain transparency and consumer trust

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Block Chain In Agriculture And Food Supply Chain Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Block Chain In Agriculture And Food Supply Chain Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Block Chain In Agriculture And Food Supply Chain Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.