Gcc Food Safety Testing Market

Market Size in USD Billion

CAGR :

%

USD

10.60 Billion

USD

12.90 Billion

2024

2032

USD

10.60 Billion

USD

12.90 Billion

2024

2032

| 2025 –2032 | |

| USD 10.60 Billion | |

| USD 12.90 Billion | |

|

|

|

|

Food Safety Testing Market Size

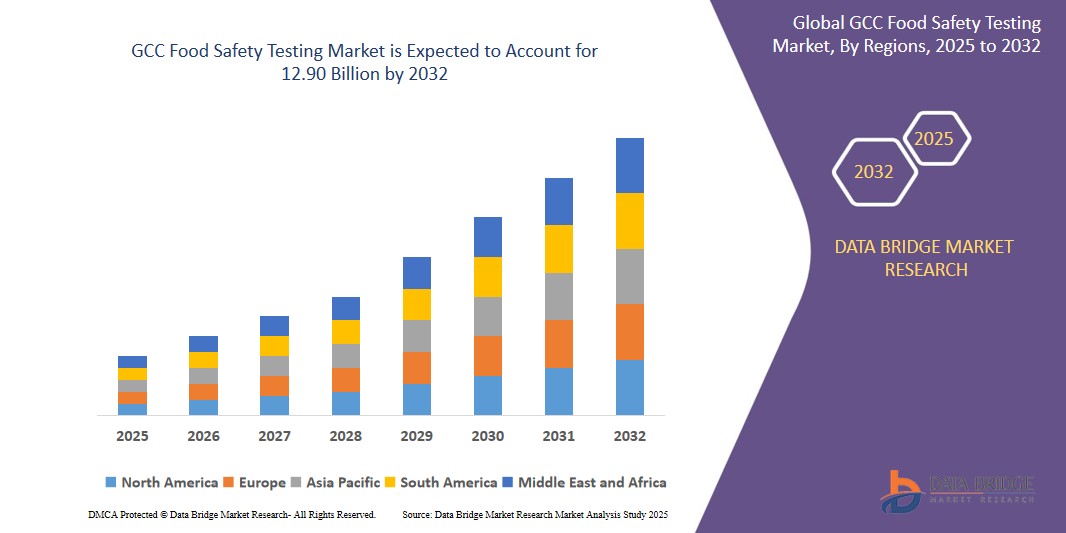

- The GCC food safety testing size was valued at USD 10.60 billion in 2024 and is expected to reach USD 12.90 billion by 2032, at a CAGR of 4.8% during the forecast period

- The market growth is largely fueled by the increasing adoption of digital technologies and automation across testing laboratories and food inspection systems. This shift is being driven by a need to enhance testing speed, accuracy, and traceability while ensuring compliance with stringent safety regulations such as GCC’s Safe Food for GCCs Regulations (SFCR)

- Furthermore, increasing prevalence of foodborne illnesses in GCC, coupled with the enforcement of stringent food safety regulations, is also significantly driving the demand for comprehensive food safety testing

Food Safety Testing Market Analysis

- Food safety testing, encompassing various testing types such as allergen, pathogen, GMO, and mycotoxin testing, is a critical component in ensuring the safety and quality of food products across the supply chain in GCC. The market is driven by stringent food safety regulations, rising consumer awareness, and the growing demand for transparent labeling.

- The escalating demand for food safety testing is primarily fueled by increasing incidences of foodborne illnesses, growing regulatory compliance requirements, and rising consumer preference for safe and high-quality food products.

- Among testing types, allergen testing is expected to dominate the market with a revenue share of approximately 36.4% in 2025, driven by heightened consumer awareness about allergies and mandatory allergen labeling regulations.

- By technology, polymerase chain reaction (PCR) methods are anticipated to lead the market share in 2025, owing to their high sensitivity and specificity in detecting pathogens and GMOs.

- In terms of food categories, meat and meat products testing is projected to hold the largest market share of about 25% in 2025, reflecting the high regulatory scrutiny and demand for safety assurance in this sector.

Report Scope and Food Safety Testing Market Segmentation

|

Attributes |

Food Safety Testing Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East & Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Food Safety Testing Market Trends

“Digital Transformation and Automation in Food Testing”

- A major and evolving trend in the GCC food safety testing market is the increasing adoption of digital technologies and automation across testing laboratories and food inspection systems. This shift is being driven by a need to enhance testing speed, accuracy, and traceability while ensuring compliance with stringent safety regulations.

- For instance: In March 2022, Bureau Veritas inaugurated its fifth GCC microbiology laboratory in Winnipeg, Manitoba. This ISO 17025 accredited facility offers rapid pathogen testing for E. coli O157:H7, Salmonella, and Listeria, enhancing GCC's capacity for swift and reliable food safety assessments

- GCC food testing labs are implementing advanced digital platforms that automate sample tracking, test scheduling, and result reporting, reducing manual intervention and minimizing human error. For instance, GCC's Bureau Veritas introduced upgraded digital laboratory services that offer end-to-end testing workflow automation, improving efficiency for food producers and processors.

- The integration of digital LIMS (Laboratory Information Management Systems) in food safety labs allows real-time data sharing, secure record keeping, and faster regulatory reporting, especially important for companies exporting to markets with strict food safety protocols.

- Furthermore, technologies such as AI-powered analytics and machine learning are beginning to be used to detect anomalies, predict contamination risks, and generate actionable insights from historical food safety data.

- Automation is also advancing within sample preparation and testing instruments, with robotics being deployed in microbiological and chemical testing to boost sample throughput without compromising precision.

- This trend toward digitization and automation is not only improving operational efficiency but also strengthening the reliability and transparency of food safety assurance processes. As GCC consumers and regulators demand greater accountability and responsiveness in food safety, businesses across the agri-food supply chain are increasingly investing in digital and automated testing solutions.

Food Safety Testing Market Dynamics

Driver

“Rising Incidence of Foodborne Illnesses and Strengthening Regulatory Compliance”

- The increasing prevalence of foodborne illnesses in GCC, coupled with the enforcement of stringent food safety regulations, is significantly driving the demand for comprehensive food safety testing

- For instance according to Health GCC, approximately 4 million GCCs suffer from foodborne illnesses each year, leading to an estimated 11,600 hospitalizations and 238 deaths. These alarming statistics have heightened public concern and underscored the critical need for rigorous food safety measures

- In response, the GCC Food Inspection Agency has implemented robust regulatory frameworks, such as the Safe Food for GCCs Regulations (SFCR), mandating that food businesses adopt preventive controls and demonstrate compliance through regular testing. These regulations aim to enhance food safety standards and protect public health

- The combination of rising foodborne illness cases and stringent regulatory requirements is compelling food producers and processors to invest in advanced testing technologies, such as real-time PCR and whole-genome sequencing, to ensure product safety and maintain consumer trust

- Furthermore, the CFIA's commitment to transparency and accountability in food safety has led to increased surveillance and inspection activities, reinforcing the importance of compliance and the role of testing in preventing foodborne outbreaks.

Restraint/Challenge

“High Cost and Complexity of Advanced Testing Technologies”

- The increasing sophistication of food safety threats—such as pathogen mutations, chemical residues, and cross-contamination—has driven demand for advanced testing technologies. However, the high cost and operational complexity of these methods pose a significant challenge for many food businesses, especially small and medium-sized enterprises (SMEs)

- For instance, technologies like next-generation sequencing (NGS) and real-time PCR require substantial capital investment in equipment, skilled personnel, and laboratory infrastructure. A 2023 report by the GCC Institute for Food Safety noted that many SMEs in GCC struggle to keep up with the rising costs of compliance testing, leading to delays or minimal testing coverage in some operations

- Moreover, the lack of standardized protocols across provincial jurisdictions adds complexity, as food processors operating in multiple provinces may face different testing requirements or regulatory interpretations, increasing the burden on compliance teams

- In addition, turnaround times for certain lab-based tests can delay supply chain operations, particularly in perishable categories such as fresh produce or meat. This challenge is exacerbated in remote or rural areas of GCC where access to accredited laboratories is limited

- While government programs such as the GCC Agricultural Partnership offer some financial support, the gap between large corporations with in-house labs and resource-constrained SMEs continues to impact the overall testing efficiency and risk mitigation efforts across the food industry

Food Safety Testing Market Scope

The market is segmented on the basis of testing type, technology and food categories.

- By Testing Type

On the basis of testing type, the GCC food safety testing market is segmented into allergen testing, pathogens testing, GMO testing, mycotoxins testing, nutritional labelling, heavy metals testing, pesticides testing, organic contaminants testing, and others. The allergen testing segment dominates the market with the largest revenue share of approximately 36.4% in 2025, driven by the high prevalence of foodborne illnesses linked to bacteria such as Salmonella, Listeria monocytogenes, and E. coli. This segment’s dominance is further supported by regulatory mandates requiring routine microbial testing in meat, poultry, and dairy products.

The pathogens testing segment is anticipated to witness the fastest growth rate of 9.8% from 2025 to 2032, propelled by the rise in consumer-reported food allergies and Health GCC's stringent labeling and safety requirements. The increasing demand for clear allergen labeling and precautionary testing in processed and packaged foods contributes to the expansion of this segment.

- By Technology

On the basis of technology, the market is segmented into culture media, polymerase chain reaction (PCR), immunoassay, chromatography, biochip/biosensor, microarrays, flow cytometry, and others. polymerase chain reaction (PCR) segment leads with the largest market share of in 2025, due to its accuracy, speed, and sensitivity in detecting genetic material from pathogens. PCR is widely used in regulatory and industry testing frameworks due to its ability to deliver reliable results even from small or degraded samples.

The biochip/biosensor segment is projected to grow at the fastest CAGR of 22.3% from 2025 to 2032, driven by rising adoption of miniaturized, rapid, and real-time testing technologies in food processing plants. These innovations enable faster on-site decision-making and align with industry trends toward digitization and real-time monitoring.

- By Food Categories

On the basis of food categories, the market is segmented into meat & meat products, egg & poultry products, fish and seafood, bakery products, cereals, grains & pulses, tea & coffee, herbs & spices, beverages, fruits & vegetables, milk & dairy products, honey, nuts and dried fruits, convenience foods, baby food, tobacco, and others. The meat & meat products segment held the largest market revenue share in 2025 in 2025, owing to high consumption levels, susceptibility to microbial contamination, and strict regulatory oversight in GCC. Continuous inspection protocols and routine testing for pathogens such as Listeria and Salmonella further reinforce this segment’s dominance.

The convenience foods segment is expected to exhibit the fastest growth rate from 2025 to 2032, fueled by the increasing demand for ready-to-eat and minimally processed packaged foods. With a broader range of ingredients and processing steps, this category requires comprehensive testing for allergens, GMOs, and preservatives to ensure compliance and safety.

GCC Food safety testing Insight

The GCC food safety testing is projected to account for approximately 14.6% of the Middle East & Africa market revenue in 2025, supported by rising consumer awareness of home security, increasing adoption of smart home ecosystems, and growing interest in contactless access control. The demand is particularly strong in urban centers such as Toronto, Vancouver, and Montreal, where tech-savvy homeowners and property managers are turning to smart locks for added convenience and security. Government-led initiatives supporting energy-efficient and secure smart infrastructure—along with rising penetration of voice assistants like Amazon Alexa and Google Assistant—are further accelerating adoption. Additionally, the GCC market benefits from high internet penetration and the popularity of DIY home improvement trends, encouraging uptake of user-friendly, retrofit-compatible smart lock solutions. The commercial sector, particularly in hospitality and multi-unit residential buildings, is also increasingly adopting smart locks to streamline operations and enhance guest/resident experience.

Food Safety Testing Market Share

The smart lock industry is primarily led by well-established companies, including:

- SGS SA (Switzerland)

- Bureau Veritas (France)

- Intertek Group plc (U.K)

- AsureQuality Ltd (New Zealand)

- LabCorp (U.S.)

- Eurofins Scientific (Luxembourg)

- TUV SUD (Germany)

- ALS Limited (Australia)

- TÜV NORD GROUP (Germany)

- Mérieux NutriSciences (U.S.)

- Genetic ID NA, Inc (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Gcc Food Safety Testing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Gcc Food Safety Testing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Gcc Food Safety Testing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.