Global Dispersant Dispersing Agents Market

Market Size in USD Billion

CAGR :

%

USD

7.41 Billion

USD

11.65 Billion

2024

2032

USD

7.41 Billion

USD

11.65 Billion

2024

2032

| 2025 –2032 | |

| USD 7.41 Billion | |

| USD 11.65 Billion | |

|

|

|

|

Dispersant-Dispersing Agents Market Size

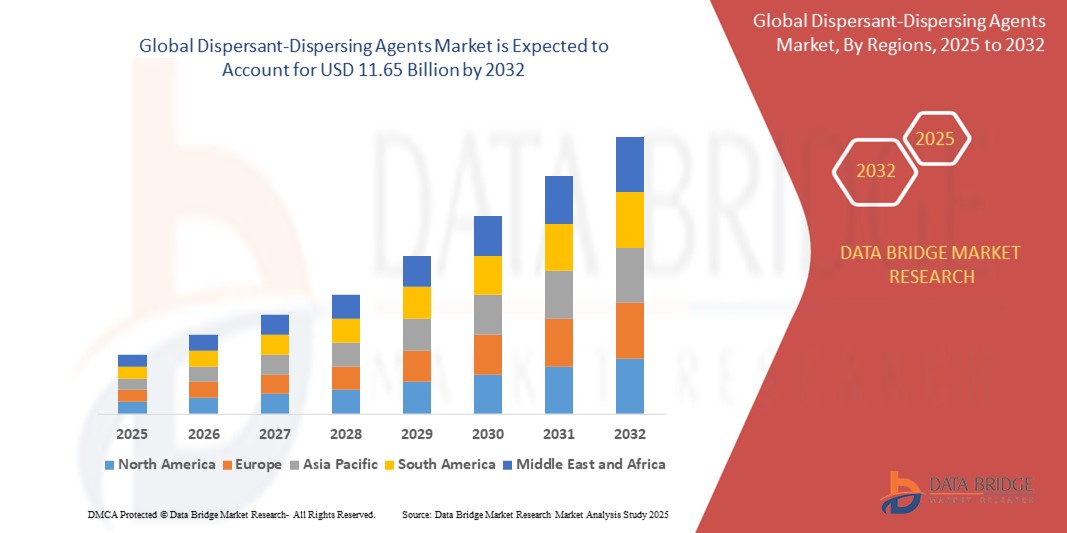

- The global dispersant-dispersing agents market size was valued at USD 7.41 billion in 2024 and is projected to reach USD 11.65 billion by 2032, growing at a CAGR of 5.84% during the forecast period.

- Market expansion is fueled by the growing demand for high-performance dispersing systems across diverse applications such as paints & coatings, pharmaceuticals, oil & gas, and agriculture, along with a rising preference for environmentally friendly and biodegradable dispersants.

Dispersant-Dispersing Agents Market Analysis

- Dispersant-dispersing agents are surface-active chemical substances that enhance the separation of particles in suspensions. They play a crucial role in maintaining stability, improving process efficiency, and enhancing product performance across diverse end-use sectors.

- The market is witnessing consistent growth, driven by rapid urbanization and infrastructure development, especially in emerging economies, alongside growing emphasis on sustainable formulations and low-VOC technologies in the coatings and detergents segments.

- Asia-Pacific holds the largest market share of approximately 39.76%, driven by high consumption across paints & coatings, paper, and agriculture in countries like China, India, and Southeast Asian nations, due to their expanding manufacturing sectors and growing consumer demand.

- North America is anticipated to be the fastest-growing region during the forecast period owing to the strong regulatory push for biodegradable dispersants, coupled with technological advancements in pharmaceutical and oilfield applications.

- Among the types, anionic dispersants dominate the market with a share of 42.51%, primarily due to their cost-effectiveness, high solubility, and wide applicability in sectors such as detergents, coatings, and pulp & paper. They are preferred for formulations requiring effective dispersion in water-based systems.

Report Scope and Dispersant-Dispersing Agents Market Segmentation

|

Attributes |

Dispersant-Dispersing Agents Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dispersant-Dispersing Agents Market Trends

“Rising Adoption of Sustainable and Bio-Based Dispersants”

- A key trend shaping the global dispersant-dispersing agents market is the increasing adoption of sustainable and bio-based dispersants, driven by regulatory mandates, corporate sustainability goals, and environmental consciousness among end users.

- Stricter regulations on VOC emissions and toxic chemical usage are prompting manufacturers to innovate with eco-friendly formulations that minimize environmental impact while maintaining performance standards.

- For instance, companies like Clariant and Evonik Industries are developing bio-based dispersing agents derived from renewable raw materials, which are being increasingly utilized in paints, coatings, and agricultural applications to meet green chemistry principles.

- Additionally, the growing demand for biodegradable dispersants in oil & gas and detergents segments is reshaping R&D priorities across the chemical industry.

- As sustainability becomes integral to product development strategies, the market is witnessing a paradigm shift from petroleum-based to greener dispersants, paving the way for long-term growth driven by environmentally conscious innovation.

Dispersant-Dispersing Agents Market Dynamics

Driver

“Growing Demand from Paints & Coatings and Agriculture Sectors”

- The global dispersant-dispersing agents market is experiencing strong momentum due to increasing demand from the paints & coatings and agriculture industries, both of which rely heavily on effective dispersion technology to maintain product stability and functionality.

- In the paints & coatings sector, dispersants are vital for even pigment distribution, improved rheology, and enhanced durability of coatings. With the surge in construction and infrastructure projects, especially in emerging markets, demand for high-performance dispersants is steadily rising.

- Similarly, in agriculture, dispersing agents play a key role in the formulation of pesticides and fertilizers, ensuring uniform suspension and delivery of active ingredients.

- Manufacturers are developing tailored dispersant chemistries that address industry-specific needs such as low-foam profiles, compatibility with bioactive ingredients, and enhanced thermal or UV stability.

For instance:

- BASF offers dispersants tailored for water-based coatings that improve color strength and reduce viscosity.

- Lubrizol Corporation has introduced dispersing agents specifically formulated for high-concentration agrochemical suspensions, enhancing their shelf-life and application efficiency.

- This diversified demand base—spanning from architectural coatings to crop protection—continues to fuel steady growth in the dispersant market across regions.

Restraint/Challenge

“Fluctuations in Raw Material Prices and Supply Chain Constraints”

- One of the key challenges in the dispersant-dispersing agents market is the volatile pricing and limited availability of key raw materials, especially those derived from petrochemicals and specialty surfactants.

- Disruptions in global supply chains—driven by geopolitical tensions, trade restrictions, or logistical bottlenecks—can significantly impact production schedules and cost structures for dispersant manufacturers.

- Moreover, the rising costs of bio-based alternatives, driven by the complexity of extraction and purification processes, further exacerbate pricing pressures, particularly for companies aiming to shift toward greener formulations.

- For instance, the production of non-ionic polymer dispersants often relies on ethylene oxide and propylene oxide derivatives, which are subject to price volatility linked to crude oil and natural gas markets.

- These factors pose a major challenge, especially for small and medium-sized enterprises (SMEs) trying to remain cost-competitive in sectors such as detergents or paper, where margins are tight and price sensitivity is high.

- Therefore, raw material dependency and cost fluctuations remain a pressing concern that may limit broader adoption and affect long-term profitability in the dispersant-dispersing agents market.

Dispersant-Dispersing Agents Market Scope

The market is segmented on the basis of type, application, and end-use industry.

- By Type

On the basis of type, the Water Softeners Market is segmented into Anionic Dispersants, Cationic Dispersants, Non-Ionic Dispersants, and Polymer Dispersants. The Polymer Dispersants segment dominates the largest market revenue share of 39.8% in 2025, owing to their broad applicability across multiple industries including water treatment, paints & coatings, and pulp & paper. Their superior performance in dispersing inorganic particles, maintaining stability in complex formulations, and reducing sedimentation makes them highly sought after in both industrial and domestic water softening systems.

However, the Non-Ionic Dispersants segment is expected to register the highest CAGR of 6.78% during the forecast period (2025–2032). This growth is largely fueled by the increasing preference for low-foaming and highly compatible dispersants in formulations used across pharmaceutical and detergent industries. Their neutral charge and excellent thermal and chemical stability make them ideal for high-purity and sensitive applications.

- By Application

On the basis of application, the Water Softeners Market is segmented into Suspension, Emulsion, and Solution. The Suspension segment held the largest market share of 36.5% in 2025, driven by its essential role in maintaining uniform particle distribution in water softening formulations, particularly in paints, fertilizers, and wastewater treatment products. Suspension-based dispersants help reduce sludge formation and improve the flow properties of high-solid-content fluids.

However, during the forecast period, the Solution segment is projected to grow at the fastest CAGR of 6.51%. This surge is attributed to the increasing demand for homogeneous water softening solutions in the oil & gas and pharmaceutical sectors, where solution-phase stability and clarity are critical for operational efficiency and product performance.

- By End-Use Industry

On the basis of end-use industry, the market is segmented into Paints & Coatings, Pulp & Paper, Detergents, Oil & Gas, Pharmaceuticals, Agriculture, and Others. The Paints & Coatings segment accounted for the largest revenue share of 27.4% in 2025, primarily due to the rising demand for dispersants that enhance pigment stability, viscosity control, and color uniformity. Continued investments in construction and infrastructure, particularly in Asia-Pacific and the Middle East, are driving sustained demand in this segment.

However, the Oil & Gas segment is anticipated to grow at the highest CAGR of 7.23% from 2025 to 2032, propelled by the increased use of dispersants in drilling fluids, sludge management, and enhanced oil recovery processes. These agents improve the operational efficiency of complex extraction processes by ensuring even particle distribution, reducing equipment wear, and improving fluid flow properties.

Global Dispersant-Dispersing Agents Market Regional Analysis

North America Dispersant-Dispersing Agents Market Insight

North America accounts for a prominent share in the global dispersant-dispersing agents market in 2025, largely due to its advanced industrial base and increasing demand across paints & coatings, oil & gas, and detergents sectors. The growing focus on high-performance formulations that ensure product stability and application efficiency continues to boost consumption in the region. The increasing adoption of water-based and eco-friendly dispersants across sectors, driven by regulatory compliance and consumer preference, is further supporting market expansion. Continuous innovation in the fields of nanotechnology and green chemistry is also influencing product development trends across North America.

- U.S. Dispersant-Dispersing Agents Market Insight

The U.S. holds the largest share in the North American dispersant market in 2025, supported by robust demand from industries such as paints & coatings, pharmaceuticals, and oil & gas. The shift toward low-VOC, sustainable dispersants is gaining momentum, especially in architectural coatings and specialty formulations. Additionally, significant R&D activity and presence of global chemical leaders are accelerating product innovation in dispersing technologies.

- Canada Dispersant-Dispersing Agents Market Insight

The Canadian dispersants market is projected to witness stable growth through the forecast period, fueled by environmental regulations and increasing investments in wastewater treatment, agriculture, and pulp & paper sectors. The rising demand for efficient dispersants in cold-weather formulations and compatibility with bio-based chemicals is driving innovation in the local market.

Europe Dispersant-Dispersing Agents Market Insight

The European dispersant market is expected to grow at a steady CAGR between 2025 and 2032, driven by sustainability mandates, green chemistry regulations, and industrial automation. The demand for dispersants is especially strong in coatings, agriculture, and pharmaceuticals, where product purity, performance, and environmental compliance are key.

With strong institutional backing for the circular economy and net-zero targets, Europe is seeing a transition toward biodegradable and polymer-based dispersants that align with REACH and other regulatory frameworks.

- Germany Dispersant-Dispersing Agents Market Insight

Germany leads the European dispersant market owing to its large paints & coatings and automotive sectors. The growing demand for pigment dispersants in automotive and industrial coatings, alongside innovation in nano-dispersant technology, is propelling the market forward. The country’s focus on emission control and energy-efficient buildings is also promoting low-toxicity dispersing solutions.

- France Dispersant-Dispersing Agents Market Insight

The French dispersant market is experiencing healthy growth, supported by government policies on sustainable agriculture, energy efficiency, and clean manufacturing. The rising demand for dispersants in crop protection formulations and low-VOC paints is notable. France’s progressive stance on replacing traditional surfactants with bio-based dispersants is further enhancing market opportunities.

Asia-Pacific Dispersant-Dispersing Agents Market Insight

The Asia-Pacific dispersant-dispersing agents market is poised to record the fastest CAGR of over 20% in 2025, backed by rapid industrialization, infrastructure development, and growing consumer demand for durable, eco-friendly products. The expansion of end-use industries such as detergents, coatings, and agriculture is fueling regional market growth.

Additionally, rising environmental awareness and government incentives to adopt green chemicals are accelerating the penetration of polymer and non-ionic dispersants across multiple sectors.

- China Dispersant-Dispersing Agents Market Insight

China commands the largest market share in Asia-Pacific, driven by large-scale production and consumption in sectors such as paints & coatings, textiles, and agriculture. Increasing focus on water-based systems, environmental safety, and export-quality formulation standards is supporting strong demand for efficient dispersing agents. Local and international players are investing in new capacities and technologies to meet growing domestic and global demand.

- India Dispersant-Dispersing Agents Market Insight

The Indian dispersants market is projected to grow at a robust CAGR during the forecast period, supported by expanding construction activity, rapid urbanization, and rising demand in detergents and agriculture. With increased government support for clean technologies and “Make in India” manufacturing initiatives, demand for high-efficiency and eco-friendly dispersants is steadily increasing. The growing base of local formulators and multinational partnerships is also enhancing the country’s market presence.

Dispersant-Dispersing Agents Market Share

The Dispersant-Dispersing Agents industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Evonik Industries AG (Germany)

- Clariant AG (Switzerland)

- Croda International Plc (UK)

- Lubrizol Corporation (U.S.)

- Arkema Group (France)

- Ashland Inc. (U.S.)

- Elementis Plc (UK)

- Stepan Company (U.S.)

- Kao Corporation (Japan)

- Altana AG (Germany)

- King Industries, Inc. (U.S.)

- Synthron (Protex International Group) (France)

- Nagase & Co., Ltd. (Japan)

- Rudolf GmbH (Germany)

- Tennants Textile Colours Ltd. (UK)

- Daito Kasei Kogyo Co., Ltd. (Japan)

Latest Developments in Global Dispersant-Dispersing Agents Market

- In February 2025, Clariant AG (Switzerland) launched a new range of biodegradable dispersing agents under the Dispersogen® PLF series, specifically formulated for use in waterborne coatings and pigment preparations. This development aligns with increasing demand for sustainable and eco-friendly solutions in decorative and industrial coatings, reinforcing Clariant’s commitment to green chemistry and enhancing its competitive edge in the dispersants market.

- In November 2024, BASF SE (Germany) unveiled its next-generation polymeric dispersants under the Sokalan® HP line, designed for use in high-performance laundry and automatic dishwashing formulations. These dispersants improve scale inhibition and offer excellent formulation stability in concentrated formats, further consolidating BASF’s leadership in the home care and industrial cleaning sectors.

- In May 2024, Croda International Plc (UK) introduced Cithrol™ DPHS, a new high-performance dispersant for oil-in-water emulsions aimed at the pharmaceutical and personal care industries. The product supports enhanced drug delivery and stability in topical formulations. This launch is expected to boost Croda’s footprint in life sciences, where demand for specialty dispersants continues to rise due to innovations in drug and cosmetic delivery systems.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Dispersant Dispersing Agents Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Dispersant Dispersing Agents Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Dispersant Dispersing Agents Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.