Global Blowing Agents Market

Market Size in USD Billion

CAGR :

%

USD

1.91 Billion

USD

3.02 Billion

2024

2032

USD

1.91 Billion

USD

3.02 Billion

2024

2032

| 2025 –2032 | |

| USD 1.91 Billion | |

| USD 3.02 Billion | |

|

|

|

|

Blowing Agents Market Size

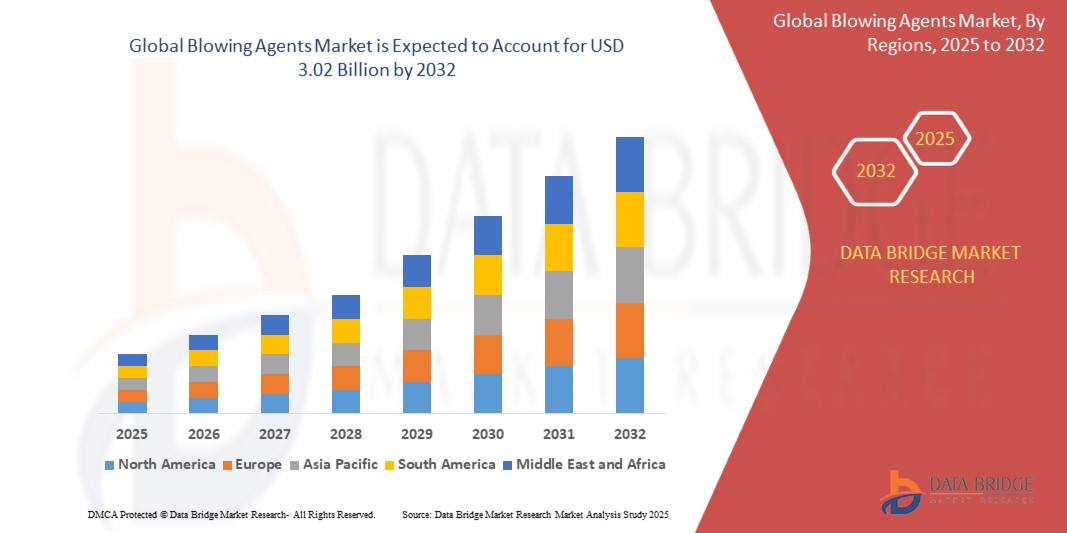

- The global Blowing Agents market was valued at USD 1.91 billion in 2024 and is expected to reach USD 3.02 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 5.96%, primarily driven by insulation demand, lightweight materials, and sustainability

- This growth is driven by factors such as rising construction activities, energy efficiency regulations, polymer foam demand, and eco-friendly blowing agents

Blowing Agents Market Analysis

- Blowing Agents are utilized in advanced applications across wind energy, aerospace, marine, and automotive industries to enhance structural integrity, weight reduction, fuel efficiency, and durability. These solutions enable extended component lifespans, lower maintenance costs, and reduced downtime. Blowing Agents foster collaborations among resin producers, composite manufacturers, and OEMs to drive innovation, meet evolving sustainability and performance standards, and comply with stringent industry regulations

- The demand for Blowing Agents is significantly driven by the rising need for lightweight composites, energy efficiency, and high-strength applications. Increased focus on renewable energy (especially wind power), aerospace safety regulations, and marine durability propels adoption. Advancements in resin systems, automated repair technologies, and core materials (foam, balsa, honeycomb) improve mechanical properties, reduce repair times, and enhance cost-efficiency. Government initiatives promoting renewable energy, carbon emission reduction, and sustainable construction further stimulate market growth, alongside rising investments in eco-friendly technologies and circular economy practices

- North America stands out as one of the dominant regions for Blowing Agents, driven by booming wind energy projects, expanding aerospace sector, and growing infrastructure development utilizing lightweight composite materials. The region benefits from strong government support, rapid industrialization, and increasing investments in renewable energy and transportation sectors

- For instance, U.S. leads in Blowing Agents adoption, with major aerospace, defense, and energy companies leveraging advanced core materials and repair technologies, supported by strong government initiatives, defense spending, renewable energy targets, and infrastructure modernization policies aimed at enhancing structural performance, sustainability, and operational efficiency

Globally, the Blowing Agents market ranks as a critical segment within the composites and advanced materials space, playing a pivotal role in enhancing product strength, reducing weight, improving energy efficiency, and supporting sustainability across industries such as energy, aerospace, marine, and automotive. The market continues to evolve with innovations in repair methodologies, automation, and environmentally friendly materials, positioning it as a key enabler of sustainable and cost-effective maintenance solutions

Report Scope and Blowing Agents Market Segmentation

|

Attributes |

Blowing Agents Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Blowing Agents Market Trends

“Growing demand for energy-efficient insulation materials”

- One prominent trend in the advancement of energy-efficient insulation materials is the rising emphasis on thermal insulation in construction and refrigeration to reduce energy consumption and carbon emissions, which is significantly boosting demand for sustainable, high-performance insulating solutions

- Energy-efficient insulation materials provide essential benefits such as reducing heat transfer, improving indoor thermal comfort, lowering HVAC loads, and cutting operational energy costs, making them critical for achieving green building certifications and meeting regulatory energy-efficiency standards

- For instance, BASF’s Neopor graphite-enhanced expanded polystyrene (EPS) offers up to 20% better thermal insulation than conventional EPS by reflecting heat radiation within the foam, thereby reducing building energy demand while allowing thinner insulation layers. Neopor has been widely adopted in passive house and zero-energy building projects across Europe

- The widespread integration of advanced insulation materials in construction and refrigeration contributes to lower energy bills, reduced greenhouse gas emissions, and enhanced building envelope performance, aligning with international sustainability goals and driving compliance with building codes such as LEED, BREEAM, and Energy Star

- These developments are transforming energy management practices in the built environment, spurring innovation in material science, promoting circular economy principles through recyclable and low-impact materials, and supporting the global transition toward net-zero carbon buildings

Blowing Agents Market Dynamics

Driver

“Stringent environmental regulations promoting low-GWP blowing agents”

- The global phase-out of HCFCs and HFCs under environmental protocols is significantly driving the growth of the low-GWP (Global Warming Potential) Blowing Agents market across multiple industries, especially in insulation and refrigeration applications

- As manufacturers face stringent environmental regulations aimed at reducing ozone depletion and greenhouse gas emissions, they are increasingly adopting eco-friendly alternatives such as hydrofluoroolefins (HFOs) and natural blowing agents (e.g., CO₂, hydrocarbons) to comply with international standards like the Montreal Protocol and Kigali Amendment

- Low-GWP Blowing Agents are widely used in the production of rigid polyurethane and polyisocyanurate foams for building insulation, appliances, and cold storage systems due to their ability to maintain high thermal insulation performance while reducing environmental impact

- These eco-friendly solutions not only help manufacturers meet compliance requirements but also contribute to achieving sustainability goals, improving energy efficiency, and reducing long-term carbon footprints across the product lifecycle

- As global climate policies tighten and demand for sustainable building and refrigeration solutions grows, the adoption of next-generation Blowing Agents is poised to accelerate, driving innovation in formulation, processing, and application technologies.

For instance,

- Honeywell’s Solstice LBA (based on HFO-1233zd(E)) offers a GWP of 1, 99.9% lower than traditional HFC blowing agents, while delivering similar or better insulation performance in spray foam and panel applications. Solstice LBA has been adopted in major building projects worldwide to meet green building certifications.

- Arkema’s Forane 1233zd is being used as a low-GWP blowing agent in high-performance insulation panels for commercial refrigeration systems, enabling compliance with EU F-Gas regulations while maintaining superior insulation properties

Opportunity

“Aerospace and marine applications expansion”

- The rising use of structural foams and composites in the aerospace and marine industries is significantly driving the adoption of advanced Blowing Agents to enable lightweight, high-strength components that improve performance, fuel efficiency, and durability under demanding service conditions

- These Blowing Agents are essential for producing structural sandwich panels, core materials, and insulated composite parts used in aircraft interiors, fuselage panels, wing structures, as well as hulls, decks, and superstructures in marine vessels, offering weight savings without compromising mechanical strength or thermal properties

- Additionally, the integration of Blowing Agent-based materials aligns with industry efforts to reduce emissions, improve payload capacity, and extend service intervals, supporting regulatory compliance and sustainability goals in both aerospace and marine transportation sectors

For instance,

- Boeing’s 787 Dreamliner utilizes advanced structural foams in the interior cabin and fuselage panels to achieve a 20% reduction in weight compared to conventional aluminum designs, contributing to enhanced fuel efficiency and longer range. The company partnered with suppliers using polyurethane foams with low-GWP blowing agents to meet environmental regulations

Restraint/Challenge

“High cost of eco-friendly alternatives”

- While the transition to low-GWP blowing agents is crucial for sustainability, the high cost of eco-friendly alternatives presents a challenge that may hinder market growth, especially in industries with tight margins

- The shift to low-GWP blowing agents involves significant investments in new production processes, compliance with stricter environmental regulations, and higher material costs, which can increase manufacturing expenses for end products such as foams and composites

- These increased costs can discourage the widespread adoption of eco-friendly blowing agents—especially in industries like construction, refrigeration, and automotive, where cost-efficiency is a major driver of product decisions. As a result, companies may delay or reduce the use of low-GWP alternatives, potentially slowing overall market expansion in the short to medium term

Blowing Agents Market Scope

The market is segmented on the basis of type, chemistry, foaming agent process, product type, foam, and application.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Chemistry |

|

|

By Foaming Agent Process |

|

|

By Product Type |

|

|

By Foam |

|

|

By Application |

|

Blowing Agents Market Regional Analysis

“North America is the Dominant Region in the Blowing Agents Market”

- The North American region is a key growth driver in the Blowing Agents market, fueled by advanced aerospace manufacturing, robust automotive production, and significant investments in renewable energy infrastructure

- The United States holds a leading position in the market due to its extensive commercial and defense aerospace fleets, as well as growing offshore and onshore wind energy projects. Major operators leverage lightweight Blowing Agents to optimize performance, reduce maintenance costs, and meet sustainability goals. This is particularly evident in industries like aerospace and construction, where energy efficiency is a major concern

- Canada’s expanding aerospace MRO (Maintenance, Repair, and Overhaul) facilities, increasing adoption of composite-intensive electric vehicles, and infrastructure rehabilitation initiatives—such as bridge strengthening with fiber-reinforced polymers—create a favorable landscape for Blowing Agents growth in North America. The country is also driving advancements in the green building sector, which encourages the use of low-GWP alternatives

- Furthermore, stringent safety and emissions regulations, alongside government incentives for clean energy and advanced manufacturing, continue to drive the adoption of Blowing Agents across key industries in North America, including construction, automotive, and aerospace. These regulatory frameworks push manufacturers to adopt more sustainable solutions to stay competitive and comply with environmental policies

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is poised for significant growth in the Blowing Agents market, driven by rapid industrialization, expanding automotive and aerospace manufacturing hubs, and a rising focus on sustainability in various sectors

- China leads the regional market, leveraging its massive wind energy deployments and burgeoning electric-vehicle production to adopt honeycomb cores and foam-infusion repairs for enhanced efficiency and durability. Additionally, China’s large-scale manufacturing capabilities in the construction and refrigeration sectors further contribute to the growth of eco-friendly blowing agents, as companies push for cost-effective and energy-efficient solutions

- Japan and South Korea, with advanced aerospace supply chains and high-volume auto OEMs, increasingly utilize automated patching techniques and UV-curable resins to minimize downtime and meet stringent performance standards. These technologies enable efficient repairs in aerospace and automotive industries, where high-performance materials are critical for maintaining safety and operational readiness

- Government initiatives promoting renewable energy expansion, infrastructure modernization, and emissions reduction are fueling demand for eco-friendly Blowing Agents across Asia-Pacific, particularly in the construction, automotive, and energy sectors. These efforts are accelerating the adoption of low-GWP and sustainable materials as part of broader environmental strategies, helping to propel market expansion in the region

Blowing Agents Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- The Chemours Company (U.S.)

- Honeywell International Inc. (U.S.)

- Solvay (Blgium)

- Huntsman International LLC (U.S.)

- Akzo Nobel N.V (Netherlands)

- BASF SE (Germany)

- 3M (U.S.)

- Exxon Mobil Corporation (U.S.)

- DAIKIN INDUSTRIES, Ltd. (Japan)

- Arkema (France)

- CHEMSPEC Ltd. (U.K)

- Dow (U.S.)

- DuPont (U.S.)

- HCS Group (Germany)

Latest Developments in Global Blowing Agents Market

- In December 2023, BASF successfully completed the expansion of its production capacity for key specialty amines at its Geismar, Louisiana facility. This expansion enables BASF to increase the production of essential polyetheramines and amine catalysts, which are marketed under its Baxxodur and Lupragen brands. Blowing agents are part of the Lupragen product line

- In November 2023, The Chemours Company announced a 20 percent increase in the production of Chemours HFC-152a. HFC-152a is a versatile, low-GWP, non-VOC aerosol propellant and foam blowing agent, widely used across personal care, household, industrial, and construction applications

- In June 2021, Arkema revealed plans to boost the production capacity of hydro-fluoro olefin 1233zd (HFO-1233zd), an insulation foam blowing agent, in both China and the U.S. The company intends to invest US$ 60 million to add 15 kilotons per year of HFO production capacity at its plant in Calvert City, Kentucky, U.S. Additionally, through a collaboration with Aofan, Arkema expects to produce 5 kilotons per year of HFO in China by 2022

- In November 2020, Nouryon introduced an upgraded version of its Expancel expandable microspheres, which function as both fillers and blowing agents to lighten products and reduce overall costs. These microspheres are primarily used in specialty thin coatings to enhance the printability of thermal paper labels and tickets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Blowing Agents Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Blowing Agents Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Blowing Agents Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.