Global Curing Agents Market

Market Size in USD Billion

CAGR :

%

USD

6.30 Billion

USD

10.82 Billion

2024

2032

USD

6.30 Billion

USD

10.82 Billion

2024

2032

| 2025 –2032 | |

| USD 6.30 Billion | |

| USD 10.82 Billion | |

|

|

|

|

Curing Agents Market Size

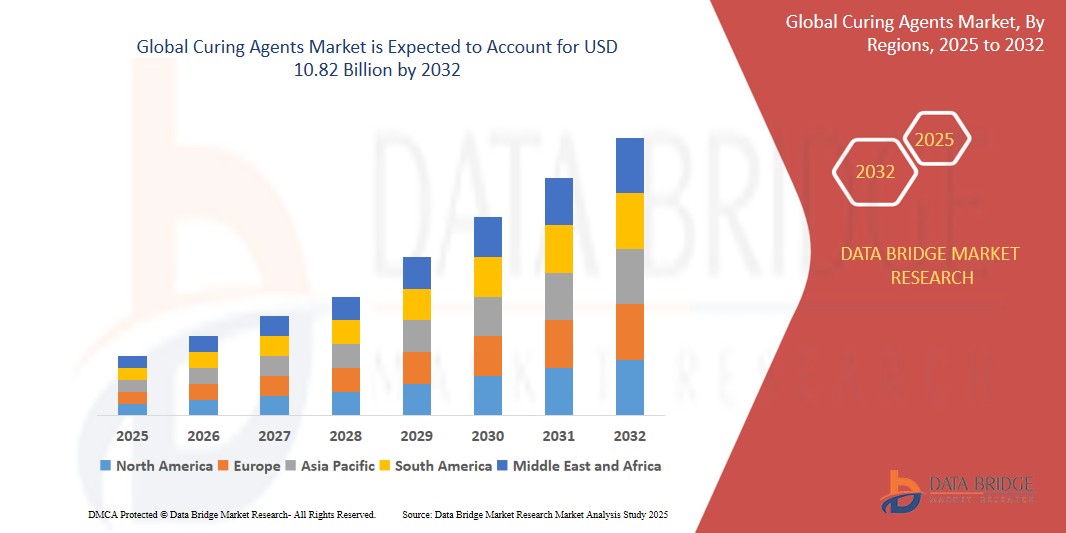

- The global curing agents market size was valued at USD 6.30 billion in 2024 and is expected to reach USD 10.82 billion by 2032, at a CAGR of 7.00% during the forecast period

- This growth is driven by factors such as demand from construction and automotive, growth in wind energy and electronics, and eco-friendly curing solutions

Curing Agents Market Analysis

- Curing agents are essential chemical components used to harden or set polymer materials such as epoxies, polyurethanes, and unsaturated polyesters. They are critical in enhancing the performance, strength, and durability of coatings, adhesives, and composites across various industries

- The market is experiencing steady growth, driven by increasing demand from construction, automotive, and electronics sectors, coupled with the shift toward high-performance, environmentally friendly materials

- Asia-Pacific is expected to dominate the curing agents market with a share of 36.34% due to its growing population and rapid industrialization, which are driving demand across various end-use industries such as construction, automotive, and electronics

- North America is expected to be the fastest growing region in the curing agents market during the forecast period due to increasing demand for advanced materials in sectors such as wind energy, automotive, and aerospace

- Epoxy curing agent segment is expected to dominate the market with a market share of 40.93% due to its widespread use in construction, automotive, and electronics industries, driven by its superior mechanical properties, strong adhesion, and chemical resistance, making it a preferred choice for high-performance applications

Report Scope and Curing Agents Market Segmentation

|

Attributes |

Smart Lock Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Curing Agents Market Trends

“Rising Demand for Eco-Friendly, Low-VOC Curing Agents”

- One prominent trend in the global curing agents market is the rising demand for eco-friendly, low-VOC curing agents

- This trend is driven by the stricter environmental regulations, growing sustainability goals across industries, and the need to minimize harmful emissions during manufacturing and application processes

For instance, companies such as Huntsman Corporation and BASF are developing water-based and bio-based curing agents to meet green building standards and support environmentally responsible production

- The focus on eco-conscious formulations is also encouraging innovation in curing technologies that maintain high performance while adhering to environmental guidelines

- As industries increasingly prioritize sustainable practices and regulatory compliance, the adoption of low-VOC curing agents is expected to play a key role in market expansion

Curing Agents Market Dynamics

Driver

“Rising Demand for High-Performance Materials”

- The rising demand for high-performance materials is a significant driver for growth in the curing agents market, as industries seek materials with superior strength, durability, and resistance to harsh environments

- This shift is particularly prominent in sectors such as automotive, aerospace, and construction, where advanced materials are critical for product reliability and performance

- With the increasing need for materials that can withstand extreme conditions and provide long-lasting durability, there is a growing demand for curing agents that enhance the properties of coatings, adhesives, and composites

- Manufacturers are responding by developing innovative curing agents that offer faster curing times, better chemical resistance, and improved mechanical strength to meet the high-performance requirements of these industries

- As industries prioritize the use of materials that offer superior performance and longevity, the demand for high-performance curing agents is expected to continue driving market growth

For instance,

Huntsman Corporation has introduced advanced epoxy curing agents that provide enhanced mechanical properties and chemical resistance for demanding applications in the automotive and aerospace industries

BASF has developed polyurethane curing agents that improve the durability and flexibility of coatings used in construction and automotive industries

- Curing agents market is set for strong growth, driven by demand for high-performance materials, eco-friendly solutions, and stricter environmental regulations. Industries such as automotive and construction will continue to fuel this demand, while innovations and industrial expansion in emerging markets

Restraint/Challenge

“High Cost of Raw Materials”

- The high cost of raw materials presents a significant challenge for the curing agents market, particularly with the rising demand for high-performance and eco-friendly curing solutions

- The use of expensive raw materials and complex manufacturing processes for bio-based and low-VOC curing agents increases the overall production costs, limiting accessibility for industries seeking cost-effective solutions

- This challenge is especially pressing in industries such as construction and automotive, where cost pressures are high, and budget constraints may hinder the adoption of advanced curing agents

For instance, manufacturers producing eco-friendly curing agents face increased operational costs due to the need for specialized raw materials and more intricate production techniques, which may impact pricing competitiveness

- The high cost of raw materials, coupled with the need for more sustainable solutions, may slow market growth, particularly in regions where affordability and cost-efficiency are critical concerns

Curing Agents Market Scope

The market is segmented on the basis of type, and application.

- By Type

On the basis of type, the Curing Agents Market is segmented into Epoxy Curing Agent, Polyurethane-Based Curing Agents, Silicone Rubber, and Others. The Epoxy Curing Agent segment dominates the largest market revenue share of 42.2% in 2025, due to its widespread use in coatings, adhesives, composites, and construction applications, offering strong mechanical properties and excellent chemical resistance.

However, the Polyurethane-Based Curing Agents segment is expected to grow with the highest CAGR of 7.12% during the forecast period of 2025-2032. This anticipated growth is driven by increasing demand in industries such as automotive, electronics, and construction, where polyurethane curing agents are favored for their flexibility, weather resistance, and superior bonding

- By Application

On the basis of communication protocol, the Curing Agents market is segmented into Coatings, Electrical and Electronics, Wind Energy, Construction, Composites, Adhesives, and Others. the coatings segment held the largest market share of 24.33% in the curing agents market, primarily driven by its extensive use in industrial and protective coatings, automotive refinishes, and marine applications, where high-performance durability and chemical resistance are critical. Coatings continue to dominate due to ongoing infrastructure development and demand for protective surfaces in harsh environments. However, during the forecast period, the wind energy segment is expected to witness the highest CAGR of 7.12%. This growth is attributed to the increasing global focus on renewable energy sources, particularly wind power, which relies heavily on curing agents in composite materials used for turbine blades and structural components. The demand for lightweight, durable, and weather-resistant materials in wind energy applications is expected to drive significant growth in this segment.

Global Curing Agents Market Regional Analysis

North America Curing Agents Market Insight

• North America holds a dominant position in the global curing agents market, accounting for a significant revenue share in 2024, primarily driven by the robust demand from end-use industries such as construction, automotive, aerospace, and electronics.

• The region’s emphasis on durable, high-performance materials has fostered strong adoption of curing agents in protective coatings, adhesives, and composites. Rising infrastructure modernization efforts and increasing preference for advanced polymer solutions are also accelerating market expansion.

- U.S. Curing Agents Market Insight

The U.S. curing agents market captured the largest revenue share in North America in 2025, fueled by the growing consumption of epoxy-based systems in construction, industrial coatings, and automotive repair applications. Increasing investments in renewable energy infrastructure, such as wind turbines and solar components, are also contributing to demand. Moreover, the U.S. boasts a strong base of chemical manufacturers and R&D innovation, supporting advancements in low-VOC and environmentally friendly curing agents.

- Canada Curing Agents Market Insight

The Canadian curing agents market is projected to grow steadily during the forecast period, supported by the nation’s ongoing infrastructure development and expansion of the manufacturing sector. With increasing adoption of lightweight composites in automotive and aerospace applications, demand for efficient and temperature-resistant curing agents is on the rise. Sustainability concerns and regulatory pressure are further driving innovation toward eco-friendly formulations across the coatings and adhesives industry.

Europe Curing Agents Market Insight

The European curing agents market is expected to grow at a significant CAGR through the forecast period, driven by stringent environmental regulations, industrial automation, and green building initiatives. Countries across the region are increasingly utilizing high-performance coatings and adhesives in sectors like construction, electronics, and wind energy. The demand for energy-efficient and VOC-compliant curing agents is accelerating market growth.

- Germany Curing Agents Market Insight

Germany represents one of the leading markets for curing agents in Europe due to its advanced manufacturing base and focus on engineering excellence. The automotive and industrial machinery sectors extensively utilize epoxy and polyurethane-based curing agents in adhesives and coatings. Furthermore, Germany’s emphasis on sustainable construction and regulatory compliance is encouraging the adoption of bio-based and low-emission curing technologies.

- France Curing Agents Market Insight

The French curing agents market is set to witness considerable growth, supported by the country’s ongoing transition toward energy-efficient buildings and industrial modernization. Increasing deployment of wind and solar energy projects is also spurring demand for composite materials that rely on advanced curing agents. The local emphasis on sustainable construction practices and circular economy principles is boosting the use of innovative, low-toxicity curing solutions.

Asia-Pacific Curing Agents Market Insight

The Asia-Pacific curing agents market is poised to register the fastest CAGR of over 23% in 2025, driven by rapid urbanization, industrial growth, and infrastructure expansion in emerging economies. Key sectors such as construction, transportation, and consumer electronics are creating substantial demand for high-performance coatings, adhesives, and composites. Rising awareness of product durability, alongside supportive government policies for green infrastructure, is further fueling adoption across the region.

- China Curing Agents Market Insight

China holds the largest market share in the Asia-Pacific curing agents market, owing to its expansive construction and industrial sectors. The widespread use of curing agents in paints, coatings, and composites for infrastructure, automotive, and consumer goods is driving robust growth. Government-led initiatives promoting sustainable buildings and clean manufacturing processes are encouraging the adoption of advanced, environmentally friendly curing technologies.

- India Curing Agents Market Insight

The Indian curing agents market is anticipated to grow at a remarkable CAGR, supported by rising infrastructure investment, booming residential construction, and expansion of manufacturing. The shift toward lightweight materials in transportation and the push for wind energy installations are creating new opportunities for curing agent usage in composite applications. Additionally, the growing presence of global chemical manufacturers and increasing regulatory awareness are accelerating the transition to sustainable and compliant curing solutions.

Curing Agents Market Share

The smart lock industry is primarily led by well-established companies, including:

- Evonik Industries AG (Germany)

- Hexion Inc. (U.S.)

- Huntsman International LLC (U.S.)

- Cardolite Corporation (U.S.)

- BASF (Germany)

- Arnette Polymers, LLC (U.S.)

- Atul Ltd (India)

- Gabriel Performance Products (U.S.)

- KUKDO Chemical Co., Ltd. (South Korea)

- Kumiai Chemical Industry Co., Ltd. (Japan)

- Mitsubishi Chemical Corporation (Japan)

- Olin Corporation (U.S.)

- Shandong Deyuan Epoxy Resin Co., Ltd. (China)

- Trans Oceanic Chemicals Pvt. Ltd. (India)

- Cargill, Incorporated (U.S.)

- Aditya Birla Group (India)

Latest Developments in Global Curing Agents Market

- In March 2025, BASF and Sika introduced a jointly developed amine building block for curing epoxy resins, launched under BASF’s Baxxodur EC 151 brand. This advancement is expected to strengthen their position in the curing agents market by addressing growing demand in flooring applications across industrial and commercial settings, such as production facilities, storage areas, and parking structures, with enhanced performance and reliability

- In September 2024, Evonik expanded its curing agent portfolio in the Americas by introducing two new polyamide-based epoxy curing agents, Ancamide 2853 and Ancamide 2865. By offering enhanced flexibility, strength, and environmental safety, this launch is expected to boost Evonik’s market presence and competitiveness in the curing agents market, reinforcing its role as a key provider of high-performance solutions for the coatings industry

- In April 2024, Evonik expanded its curing agent portfolio with the addition of Ancamine 2844, a high-functional aliphatic amine hardener specifically designed for multi-component spray applications. With its ultra-fast curing capabilities and reliable performance in low temperatures and high humidity, this innovation strengthens Evonik’s position in the curing agents market, particularly in the marine and protective coatings segment where rapid property development is critical

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Curing Agents Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Curing Agents Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Curing Agents Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.