Global Computer Aided Detection Cad Market

Market Size in USD Million

CAGR :

%

USD

981.40 Million

USD

2,028.43 Million

2024

2032

USD

981.40 Million

USD

2,028.43 Million

2024

2032

| 2025 –2032 | |

| USD 981.40 Million | |

| USD 2,028.43 Million | |

|

|

|

|

Computer Aided Detection (CAD) Market Size

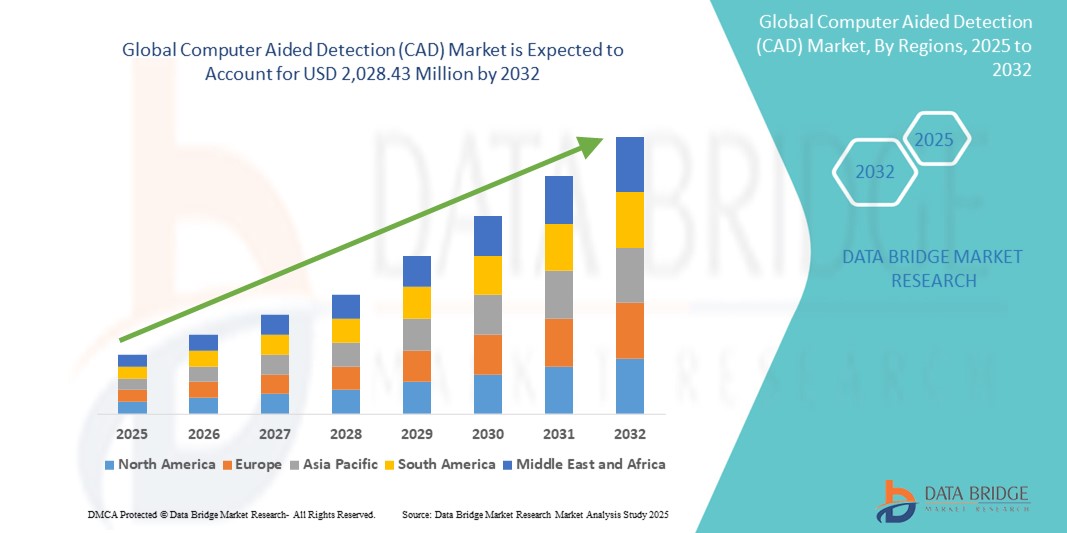

- The global computer aided detection (CAD) market size was valued at USD 981.40 million in 2024 and is expected to reach USD 2,028.43 million by 2032, at a CAGR of 9.50% during the forecast period

- The market growth is primarily driven by the increasing prevalence of chronic diseases and cancer, along with the rising need for early and accurate diagnosis across healthcare systems

- In addition, the integration of advanced imaging technologies and AI algorithms into diagnostic workflows is elevating the precision and efficiency of CAD systems. These developments, coupled with a growing awareness of preventive healthcare, are accelerating the adoption of CAD solutions globally and significantly propelling market expansion

Computer Aided Detection (CAD) Market Analysis

- Computer aided detection (CAD) systems, which assist radiologists and medical professionals in interpreting medical images by highlighting potential abnormalities, are becoming indispensable in modern diagnostic workflows due to their ability to enhance accuracy, reduce oversight, and improve clinical outcomes

- The rising adoption of CAD solutions is primarily fueled by the growing global burden of chronic diseases especially cancer alongside increasing demand for early diagnosis, and the expanding use of AI and machine learning in medical imaging

- North America dominated the computer aided detection (CAD) market with the largest revenue share of 46.4% in 2024, characterized by advanced healthcare infrastructure, high diagnostic imaging volumes, and strong R&D investments, with the U.S. witnessing accelerated integration of CAD tools in oncology, mammography, and chest imaging driven by regulatory support and technological innovation

- Asia-Pacific is expected to be the fastest growing region in the computer aided detection (CAD) market during the forecast period due to increasing healthcare expenditure, growing awareness of early detection, and rapid digitalization of medical facilities

- Breast Cancer segment dominated the computer aided detection (CAD) market with a market share of 67.6% in 2024, driven by its widespread use in mammography screening programs and the critical need for early and accurate breast cancer detection

Report Scope and Computer Aided Detection (CAD) Market Segmentation

|

Attributes |

Computer Aided Detection (CAD) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Computer Aided Detection (CAD) Market Trends

“AI-Powered Precision and Workflow Optimization”

- A significant and accelerating trend in the global computer aided detection (CAD) market is the integration of artificial intelligence (AI) and deep learning algorithms to enhance diagnostic precision and streamline radiology workflows. These advancements are enabling more accurate, consistent, and early identification of abnormalities across imaging modalities such as mammography, CT, and MRI

- For instance, iCAD’s ProFound AI platform uses deep learning to improve lesion detection and risk assessment in breast cancer screening, significantly reducing false positives and radiologist workload. Similarly, Aidoc offers AI-based CAD tools that assist in identifying urgent conditions such as intracranial hemorrhage and pulmonary embolism in real time

- AI integration in CAD systems enhances the sensitivity and specificity of medical image analysis, helping to detect subtle lesions that may be missed by the human eye. These systems also prioritize cases with suspected pathology, allowing radiologists to act more quickly and allocate resources efficiently

- The seamless integration of CAD software into PACS (Picture Archiving and Communication System) and hospital information systems enables radiologists to access AI insights directly within their existing workflows. This integration minimizes disruption and boosts productivity while ensuring clinical relevance

- This trend toward intelligent, real-time decision support tools is reshaping diagnostic radiology and elevating the standard of care. Leading players such as Zebra Medical Vision and Lunit are actively developing AI-powered CAD platforms that support multi-disease detection and clinical decision-making

- The demand for AI-enhanced CAD solutions is rapidly growing across healthcare facilities, particularly in oncology and neurology, as providers seek to improve diagnostic outcomes, reduce interpretation time, and manage increasing imaging volumes effectively

Computer Aided Detection (CAD) Market Dynamics

Driver

“Rising Demand for Early Diagnosis and AI Integration in Medical Imaging”

- The growing global burden of chronic diseases, particularly cancer, and the urgent need for early and accurate diagnosis are key drivers propelling the adoption of computer aided detection (CAD) systems in modern healthcare

- For instance, in March 2024, Lunit INSIGHT CXR, an AI-powered chest X-ray analysis tool, received regulatory approval in multiple countries, reinforcing the global trend of integrating CAD solutions with advanced imaging systems for real-time diagnostic support

- As healthcare providers seek to improve patient outcomes and reduce diagnostic errors, CAD systems offer significant advantages by augmenting radiologists' capabilities through consistent, high-accuracy image interpretation and prioritization of critical cases

- Moreover, the increasing integration of AI and deep learning algorithms into CAD platforms is enabling more precise detection of abnormalities across a variety of imaging modalities, thereby expanding CAD applications beyond oncology into cardiology, neurology, and emergency medicine

- The growing availability of cloud-based CAD solutions, combined with seamless integration into hospital PACS and electronic health records (EHRs), enhances accessibility and efficiency. This is further supported by a rising focus on value-based care models, which emphasize early detection, cost-efficiency, and improved patient outcomes across global healthcare systems

Restraint/Challenge

“Data Privacy Concerns and Regulatory Compliance Barriers”

- Concerns regarding patient data privacy and stringent regulatory requirements pose significant challenges to the broader adoption of computer aided detection (CAD) systems in healthcare environments. Since CAD platforms process sensitive medical images and data, ensuring compliance with regional data protection laws such as HIPAA in the U.S. and GDPR in the EU is critical

- For instance, delays in regulatory approvals for AI-based CAD solutions can slow down market entry, particularly in regions with complex or evolving medical device regulations, impacting manufacturers' ability to scale globally

- Ensuring robust data encryption, secure cloud infrastructure, and adherence to medical data handling standards is essential for building trust among healthcare providers and patients. Leading companies such as Aidoc and Lunit actively emphasize their compliance with international standards to reassure stakeholders

- In addition, the high cost of advanced CAD systems and the need for specialized infrastructure and training can be a barrier for adoption, particularly in resource-limited settings. Smaller clinics and hospitals may struggle to integrate these technologies without significant investment

- Addressing these challenges through improved regulatory harmonization, clearer guidelines for AI in medical imaging, and developing cost-effective, scalable CAD solutions tailored for diverse healthcare environments will be crucial for sustained global market expansion

Computer Aided Detection (CAD) Market Scope

The market is segmented on the basis of application, breast CAD imaging modalities, imaging modalities, and end user.

- By Application

On the basis of application, the computer aided detection (CAD) market is segmented into breast cancer, lung cancer, colon/rectal cancer, prostate cancer, liver cancer, bone cancer, and neurological/musculoskeletal/cardiovascular cancer. The breast cancer segment dominated the market with the largest market revenue share of 67.6% in 2024, driven by the extensive use of CAD in mammography screening programs and the increasing global incidence of breast cancer. The effectiveness of CAD systems in detecting microcalcifications and subtle masses has made them a critical tool in early breast cancer diagnosis.

The lung cancer segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the rising adoption of low-dose CT screening and the growing awareness of early-stage lung cancer detection. Enhanced imaging analysis through AI-driven CAD systems is contributing to improved detection sensitivity and accuracy in pulmonary diagnostics.

- By Breast CAD Imaging Modalities

On the basis of breast CAD imaging modalities, the computer aided detection (CAD) market is segmented into mammography, magnetic resonance imaging (MRI), ultrasound imaging, tomosynthesis, and nuclear imaging. The mammography segment held the largest market share in 2024, attributed to its role as the standard imaging technique in breast cancer screening and widespread integration of CAD tools into digital mammography systems.

The tomosynthesis segment is expected to grow at the fastest rate during forecast period, supported by increasing adoption of 3D breast imaging and the enhanced diagnostic performance of CAD tools when applied to tomographic datasets.

- By Imaging Modalities

On the basis of imaging modalities, the computer aided detection (CAD) market is segmented into X-ray imaging, computed tomography (CT), ultrasound imaging, magnetic resonance imaging (MRI), and nuclear medicine imaging. The X-ray imaging segment dominated the market in 2024, primarily due to its central role in screening procedures such as mammography and chest radiography.

The computed tomography (CT) segment is projected to experience robust growth during forecast period, driven by the increased use of CAD in lung, colon, and cardiovascular imaging, along with the growing implementation of AI-assisted tools for volumetric analysis and lesion detection in CT scan

- By End User

On the basis of end user, the computer aided detection (CAD) market is segmented into hospitals, diagnostic centers, and research centers. The hospitals segment held the largest share in 2024, benefiting from widespread implementation of advanced diagnostic infrastructure and growing emphasis on early detection across inpatient and outpatient settings. Integration of CAD systems into hospital PACS and electronic health records enhances workflow efficiency and diagnostic accuracy.

The diagnostic centers segment is anticipated to witness the highest CAGR during the forecast period, as these centers increasingly adopt CAD technologies to enhance throughput, reduce interpretation times, and provide value-added diagnostic services across a range of specialties.

Computer Aided Detection (CAD) Market Regional Analysis

- North America dominated the computer aided detection (CAD) market with the largest revenue share of 46.4% in 2024, driven by advanced healthcare infrastructure, high diagnostic imaging volumes, and strong R&D investments

- Healthcare providers in the region value the precision, workflow efficiency, and early diagnostic capabilities offered by CAD systems, particularly in oncology and radiology applications

- This widespread adoption is further supported by substantial R&D investments, favorable regulatory frameworks for AI in healthcare, and increasing emphasis on preventive care, positioning CAD as a critical tool in improving diagnostic accuracy and patient outcomes across hospitals and diagnostic centers

U.S. Computer Aided Detection (CAD) Market Insight

The U.S. CAD market captured the largest revenue share of 83% in 2024 within North America, driven by high diagnostic imaging volumes and early adoption of AI-enhanced diagnostic tools. The increasing burden of cancer and other chronic conditions has propelled the demand for CAD systems in hospitals and diagnostic centers. Regulatory support from the FDA for AI-based imaging tools, along with strong R&D investment and partnerships between tech firms and healthcare providers, further accelerate the market’s growth trajectory.

Europe Computer Aided Detection (CAD) Market Insight

The Europe CAD market is projected to expand at a substantial CAGR throughout the forecast period, fueled by rising healthcare expenditure, a growing emphasis on early disease detection, and a strong focus on AI integration within healthcare systems. Countries across the region are investing in digital health infrastructure, and the widespread availability of advanced imaging technologies supports CAD adoption. The region’s regulatory support for innovative medical technologies is also contributing to the market expansion across both public and private healthcare facilities.

U.K. Computer Aided Detection (CAD) Market Insight

The U.K. CAD market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by the National Health Service’s (NHS) digital transformation strategy and increasing adoption of AI-assisted diagnostics. Efforts to reduce diagnostic backlogs and improve cancer screening rates are prompting investments in CAD tools. Moreover, the U.K.’s robust health tech ecosystem and growing emphasis on preventive healthcare are creating favorable conditions for sustained market growth.

Germany Computer Aided Detection (CAD) Market Insight

The Germany CAD market is expected to expand at a considerable CAGR during the forecast period, driven by strong healthcare infrastructure and increased funding for AI in medical imaging. Germany’s emphasis on data privacy and precision medicine aligns with the capabilities of CAD systems, making them highly attractive for diagnostic accuracy. The country’s support for innovation in healthcare technologies and increasing demand for early detection tools in oncology are key contributors to market growth.

Asia-Pacific Computer Aided Detection (CAD) Market Insight

The Asia-Pacific CAD market is poised to grow at the fastest CAGR from 2025 to 2032, driven by rising cancer prevalence, improving healthcare infrastructure, and rapid digitalization in countries such as China, India, and Japan. Government initiatives promoting AI in healthcare, combined with increased adoption of diagnostic imaging tools, are accelerating the uptake of CAD systems. The region’s large patient population and increasing access to health services present significant growth opportunities for CAD providers.

Japan Computer Aided Detection (CAD) Market Insight

The Japan CAD market is gaining momentum due to the country’s aging population, high incidence of cancer, and strong adoption of AI-based medical technologies. The integration of CAD tools into national screening programs and smart hospital systems is boosting demand. Japan’s focus on early detection and precision diagnostics, supported by well-established healthcare infrastructure, is a major driver for CAD deployment in both urban and regional medical centers.

India Computer Aided Detection (CAD) Market Insight

The India CAD market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, expanding diagnostic networks, and a rising burden of cancer and cardiovascular diseases. Government-backed healthcare reforms and increasing investments in digital diagnostics are fostering CAD adoption. In addition, the growing availability of cost-effective, AI-driven imaging solutions and collaborations with domestic health tech companies are helping bridge the diagnostic gap in urban and semi-urban regions.

Computer Aided Detection (CAD) Market Share

The computer aided detection (CAD) industry is primarily led by well-established companies, including:

- Hologic, Inc. (U.S.)

- iCAD, Inc. (U.S.)

- GE HealthCare (U.S.)

- Siemens Healthineers AG (Germany)

- Agfa-Gevaert Group (Belgium)

- Koninklijke Philips N.V. (Netherlands)

- Canon Medical Systems Corporation (Japan)

- Fujifilm Corporation (Japan)

- EDDA Technology, Inc. (U.S.)

- Riverain Technologies (U.S.)

- Therapixel (France)

- ScreenPoint Medical B.V. (Netherlands)

- Zebra Medical Vision Ltd. (Israel)

- Qlarity Imaging, LLC (U.S.)

- Median Technologies (France)

- Lunit Inc. (South Korea)

- Koios Medical, Inc. (U.S.)

- Carestream Health, Inc. (U.S.)

- Beijing Infervision Technology Co., Ltd. (China)

- Vuno Inc. (South Korea)

What are the Recent Developments in Global Computer Aided Detection (CAD) Market?

- In April 2025, RadNet, a major diagnostic imaging provider, announced an all‑stock acquisition of iCAD (a breast-health AI leader), valuing the deal at approximately USD 103 million. The merger aims to accelerate RadNet’s AI-powered breast cancer screening and diagnostic capabilities by integrating iCAD’s ProFound Breast Health Suite into its DeepHealth portfolio

- In March 2025, CAD announced a strategic partnership with RamSoft to embed its ProFound AI Breast Health Suite into RamSoft’s RIS/PACS platform across North America. The integration, expanding to over 750 imaging sites (starting with Mammolink), enhances workflow efficiency and improves breast cancer detection rates

- In March 2025, At the European Congress of Radiology (ECR) 2025, iCAD presented clinical performance and new real‑world data for its ProFound AI Breast Health Suite. The showcase included AI‑powered modules for detection, density assessment, and risk evaluation, building on 20+ years of breast‑health innovation

- In March 2022, EDDA Technology entered into a formal collaboration with the Society of Interventional Oncology (SIO) for the ACCLAIM trial—a study evaluating microwave ablation with real-time 3D margin assessment for colorectal liver metastases—using its IQQA-BodyImaging software to ensure precise ablation margins during the procedure

- In November 2021, Fujifilm began clinical deployment of its REiLI AI platform, which incorporates tools for detecting intracranial hemorrhage in stroke patients and supporting breast cancer diagnosis using mammography and other imaging modalities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.