Global Circadian Rhythm Lighting Market

Market Size in USD Million

CAGR :

%

USD

376.37 Million

USD

1,618.33 Million

2024

2032

USD

376.37 Million

USD

1,618.33 Million

2024

2032

| 2025 –2032 | |

| USD 376.37 Million | |

| USD 1,618.33 Million | |

|

|

|

|

Circadian Rhythm Lighting Market Size

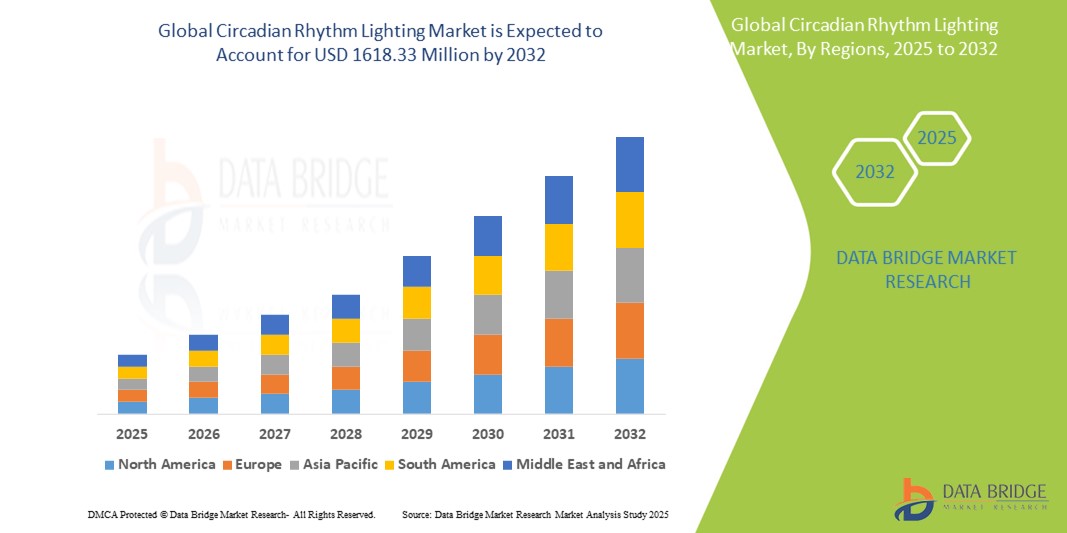

- The global circadian rhythm lighting market was valued at USD 376.37 million in 2024 and is expected to reach USD 1618.33 million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 20.00%, primarily driven by rising awareness of the health benefits associated with human-centric lighting

- This growth is driven by growing emphasis on employee well-being in corporate and industrial settings, coupled with increasing implementation of circadian lighting in healthcare facilities, educational institutions, and senior living centres

Circadian Rhythm Lighting Market Analysis

- Circadian Rhythm Lighting is emerging as a critical component in architectural and wellness-focused design, especially in environments such as offices, hospitals, schools, and residential spaces. These systems mimic natural daylight cycles to regulate human biological rhythms, promoting better sleep, improved mood, and cognitive function, thus becoming increasingly valued in health-centric infrastructure development

- The market is primarily driven by rising health consciousness, increasing integration of smart home and building automation systems, and regulatory support for energy-efficient and human-centric lighting. In addition, growth in the senior care sector, expanding applications in workplace wellness programs, and adoption of LED-based tunable white lighting systems are accelerating the market trajectory

- For instance, in North America and Europe, hospitals and educational institutions are implementing circadian lighting systems to improve patient recovery times and student performance, reflecting the growing evidence base for light-based wellness strategies

- Globally, the circadian rhythm lighting market is witnessing a shift toward AI-integrated lighting solutions, IoT-enabled automation, and customizable daylight-mimicking fixtures, ensuring long-term adoption in both commercial and residential sectors while promoting holistic health and sustainability goals

Report Scope and Circadian Rhythm Lighting Market Segmentation

|

Attributes |

Circadian Rhythm Lighting Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Circadian Rhythm Lighting Market Trends

“Integration of Circadian Lighting in Smart Building and IoT Ecosystems”

- The growing shift toward smart building technologies and wellness-centered design is accelerating the integration of circadian rhythm lighting systems with IoT-enabled platforms, allowing for automated lighting adjustments based on time of day, occupancy, and user preferences

- Leading lighting manufacturers are developing tunable white LED systems and smart lighting controls that dynamically simulate natural light patterns, improving occupant well-being in homes, offices, hospitals, and schools

- These intelligent lighting systems are increasingly being embedded with AI algorithms, sensor-based automation, and cloud-connected controls to enhance energy efficiency, personalization, and synchronization with the user's biological clock

For instance,

- In January 2024, Signify partnered with Cisco to deploy Power-over-Ethernet (PoE) connected circadian lighting in smart office environments, optimizing lighting schedules to align with employee circadian rhythms

- In September 2023, Acuity Brands introduced its Light AIR autonomous system, offering adaptive circadian lighting features integrated with occupancy sensors and daylight harvesting

- In July 2023, Nanoleaf launched a new series of Matter-compatible circadian lighting panels, enabling seamless integration into multi-brand smart home systems with synchronized lighting based on natural light cycles

- As demand grows for health-optimized indoor environments, the integration of circadian lighting into IoT-driven smart buildings will be a major trend, enhancing occupant health, building energy efficiency, and overall user experience, thereby reshaping the future of lighting design and infrastructure

Circadian Rhythm Lighting Market Dynamics

Driver

“Growing Emphasis on Employee Wellness and Productivity in Workspaces”

- The rising awareness of the link between light exposure and circadian health is driving adoption of circadian rhythm lighting in commercial and corporate environments to enhance employee wellness, mood, and productivity

- Employers are increasingly investing in human-centric lighting systems that mimic natural daylight patterns, helping to regulate melatonin levels, reduce fatigue, and improve overall workplace satisfaction

- Regulatory frameworks and green building standards such as WELL Building Standard and LEED certification are encouraging the implementation of circadian lighting systems to promote healthier indoor environments

For instance,

- In November 2024, USAI Lighting collaborated with Delos to introduce circadian lighting products aligned with the WELL Building Standard for offices and wellness centers

- In September 2024, WSP (Canada) deployed tunable LED lighting across its smart office projects, designed to simulate daylight and optimize employee alertness throughout the workday

- In August 2024, Glamox (U.K.) installed circadian lighting in a series of Scandinavian schools and offices to support biological rhythms and enhance cognitive function

- As organizations prioritize employee-centric infrastructure, circadian rhythm lighting is emerging as a key solution for creating health-optimized, productive, and sustainable workspaces—driving its demand across commercial sectors globally

Opportunity

“Integration of Circadian Rhythm Lighting in Smart Homes and IoT-Enabled Devices”

- The rising demand for smart homes and connected living solutions is opening new opportunities for circadian rhythm lighting integration into IoT-enabled lighting systems that adapt to user behavior, time of day, and environmental cues

- Lighting manufacturers are partnering with smart tech companies to develop automated circadian lighting products compatible with home assistants (such as Alexa and Google Home), offering personalized lighting experiences that promote sleep quality and mental well-being

- Growing consumer awareness about the impact of artificial lighting on sleep cycles and long-term health is driving adoption of biologically adaptive lighting systems in residential spaces

For instance,

- In March 2025, Nanoleaf (Canada) unveiled its new line of smart lighting panels featuring built-in circadian rhythm settings and ambient light sensors for optimal day-to-night transitions.

- In December 2024, Signify Holding (India) expanded its Philips Hue product line with a circadian lighting feature that auto-adjusts brightness and color temperature based on natural light cycles

- In September 2024, Versa (U.S.) introduced a home lighting solution with AI-based circadian controls integrated into smart thermostats and energy management systems

- As smart home ecosystems become more advanced and health-conscious, the integration of circadian rhythm lighting with IoT technology will emerge as a major opportunity, reshaping home environments into healthier, more responsive living spaces

Restraint/Challenge

“Lack of Standardization and Technical Compatibility in Circadian Rhythm Lighting Systems”

- The absence of unified industry standards for circadian rhythm lighting design, color temperature regulation, and timing protocols hampers widespread adoption across residential, commercial, and healthcare sectors

- Many lighting systems struggle with interoperability issues, as proprietary platforms from different manufacturers often fail to integrate seamlessly with existing building management systems (BMS), IoT networks, or third-party smart controls

- Inconsistent definitions and varying performance metrics around “circadian-effective lighting” confuse consumers and specifiers, leading to slower market penetration and reduced buyer confidence

For instance,

- In January 2025, several healthcare facilities in Southeast Asia reported delayed deployment of circadian lighting systems due to compatibility issues with legacy control infrastructures

- As circadian rhythm lighting becomes increasingly central to wellness-driven design, the industry must prioritize standardization, cross-platform compatibility, and clearer product guidelines to boost adoption and consumer trust globally

Circadian Rhythm Lighting Market Scope

The market is segmented on the basis of effects, functions, and end-users.

|

Segmentation |

Sub-Segmentation |

|

By Effects |

|

|

By Function |

|

|

By End-Users |

|

Circadian Rhythm Lighting Market Regional Analysis

“North America is the Dominant Region in the Circadian Rhythm Lighting Market”

- North America leads the circadian rhythm lighting market due to rising consumer awareness about the health benefits of aligning lighting with natural biological rhythms

- Companies across sectors such as manufacturing, retail, and hospitality are increasingly investing in circadian lighting to improve employee well-being and productivity

- Increased healthcare spending and emphasis on workplace wellness are further supporting the adoption of circadian lighting systems in the region

- As a result, North America is expected to maintain its dominant position in the circadian rhythm lighting market during the forecast period

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is projected to grow at the highest rate due to the modernization of educational, healthcare, and commercial infrastructures across emerging economies

- Increasing focus on healthy, well-illuminated building environments is driving demand for advanced lighting technologies, including circadian rhythm lighting

- Growth in regional R&D activities and infrastructure refurbishment initiatives is supporting innovation and adoption of human-centric lighting solutions

- With these developments, Asia-Pacific is poised to become the fastest-growing region in the circadian rhythm lighting market during the forecast period of 2025 to 2032

Circadian Rhythm Lighting Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- TRILUX Lighting Ltd (India)

- Biological Innovation and Optimization Systems, LLC (U.S.)

- Glamox (U.K.)

- Novus Biologicals (U.S.)

- Halla, a.s. (South Korea)

- WSP (Canada)

- WLS Lighting Systems, Inc (U.S.)

- USAI Lighting, LLC (U.S.)

- Acuity Inc (U.S.)

- Nanoleaf (Canada)

- Versa (U.S.)

- Signify Holding (India)

- SMARTCORE Inc. (South Korea)

- Light Engine Limited (Hong Kong)

- WalaLight (U.S.)

- Kenall Manufacturing (U.S.)

- KURTZON Lighting Inc. (U.S.)

Latest Developments in Global Circadian Rhythm Lighting Market

- In August 2023, Juno, a prominent manufacturer of down and track lighting solutions, introduced its new Trac-Master Narrow Profile LED Wall Wash Track Fixtures. These fixtures are designed to provide 90° vertical aiming and 360° horizontal rotation, minimizing visual clutter and blending smoothly into modern interiors. This launch enhances Juno's portfolio with flexible and discreet lighting solutions ideal for commercial and residential spaces.

- In June 2023, Mark Architectural Lighting launched Magellan, a large-format architectural luminaire offering soft illumination for intimate environments and the capacity to fill expansive spaces from elevated positions. It also supports nLight and nLight AIR control options for an enhanced user experience. This innovation reinforces the brand's commitment to merging architectural elegance with smart lighting control systems.

- In April 2023, Luminaire LED unveiled its Vandal Resistant Downlight (VRDL) Series, specially engineered for harsh and challenging outdoor environments. The series combines durability with architectural aesthetics, delivering a balanced and secure lighting solution. This release strengthens Luminaire LED's position in the rugged outdoor and security lighting market.

- In October 2022, Juno expanded its track lighting product line by upgrading the Trac T381L and T261L fixtures with WarmDim technology. These enhanced fixtures offer smooth dimming, consistent color output, and high energy efficiency, making them ideal for ambient and task lighting. This update highlights Juno’s focus on energy-efficient innovations with aesthetic appeal.

- In December 2021, Lucidity Lights, Inc., based in Boston, announced the acquisition of strategic assets from Evolution Lighting Inc., headquartered in Miami, Florida. This transaction allowed Lucidity to expand its lighting technology expertise and improve its distribution and manufacturing capabilities. This acquisition marks a significant step in strengthening Lucidity’s market presence and operational footprint

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.