Global Collision Avoidance Sensors Market

Market Size in USD Billion

CAGR :

%

USD

7.49 Billion

USD

18.85 Billion

2024

2032

USD

7.49 Billion

USD

18.85 Billion

2024

2032

| 2025 –2032 | |

| USD 7.49 Billion | |

| USD 18.85 Billion | |

|

|

|

|

Collision Avoidance Sensor Market Size

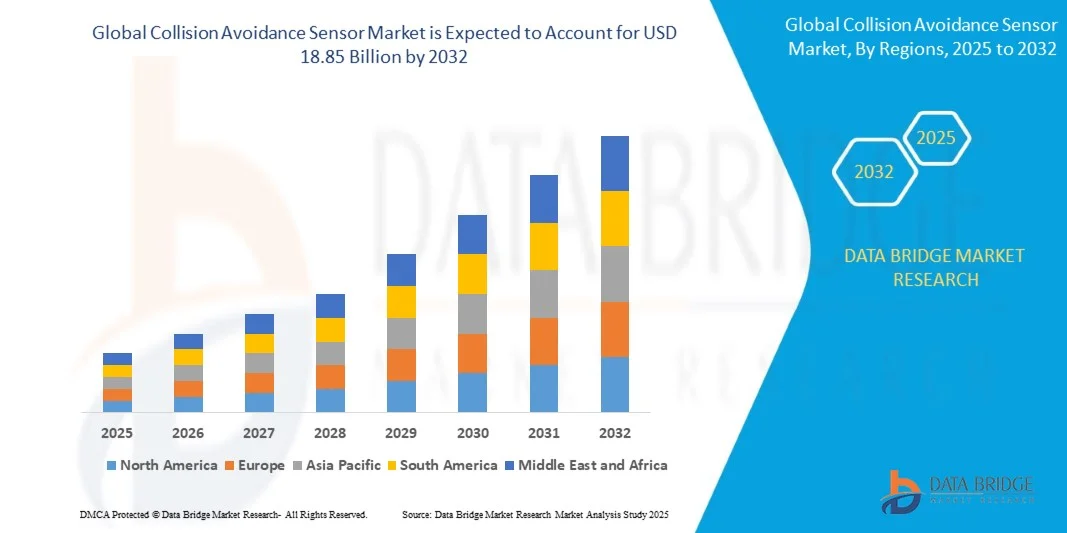

- The Collision Avoidance Sensor Market was valued at USD 7.49 billion in 2025 and is projected to reach USD 18.85 billion by 2032, growing at a CAGR of 14% during the forecast period.

- Market growth is driven by the rising demand for advanced driver-assistance systems (ADAS), increasing vehicle safety regulations, and growing automation in industrial and construction sectors. The integration of technologies such as radar, LiDAR, and ultrasonic sensors is enhancing collision detection capabilities, reducing accidents, and improving operational efficiency across multiple industries.

Collision Avoidance Sensor Market Analysis

- Collision avoidance sensors play a critical role in enhancing safety by detecting potential obstacles and preventing collisions in real-time. These sensors are increasingly integrated into vehicles, industrial equipment, drones, and autonomous systems to reduce accidents and enhance operational efficiency.

- Radar and LiDAR technologies lead the market due to their high precision and reliability in various environmental conditions. Ultrasonic sensors are widely used for close-range detection in parking assistance and low-speed maneuvers, especially in the automotive sector.

- The automotive and industrial segments dominate the application landscape, driven by stringent safety norms and automation trends. Aerospace and construction sectors are also adopting collision avoidance technologies to ensure worker and equipment safety in high-risk environments.

- Sensor fusion, combining data from multiple sensor types, is emerging as a key innovation, enabling smarter and more adaptive collision avoidance systems across dynamic operational scenarios.

- Advanced features such as object classification, AI-based predictive analysis, and real-time data processing are transforming collision avoidance solutions into proactive safety systems, reducing response times and minimizing human error.

Report Scope and Collision Avoidance Sensor Market Segmentation

|

Attributes |

Collision Avoidance Sensor Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Collision Avoidance Sensor Market Trends

“Automation, Sensor Fusion, and AI Integration Reshaping Collision Avoidance Systems”

- A key and rapidly advancing trend in the Collision Avoidance Sensor Market is the integration of sensor fusion technology—combining data from radar, LiDAR, ultrasonic, and cameras—to improve detection accuracy, reduce false alarms, and enhance decision-making in real time across automotive and industrial applications.

- With the rise of autonomous vehicles and smart industrial systems, collision avoidance solutions are increasingly powered by AI and machine learning algorithms. These technologies enable predictive analysis, adaptive response, and improved object recognition, significantly enhancing safety and system reliability.

- Automotive manufacturers are adopting advanced driver-assistance systems (ADAS) with embedded collision sensors to meet evolving safety regulations such as Euro NCAP and NHTSA standards. This regulatory push is accelerating innovation and mass deployment of sensor-based safety features.

- In industrial and construction environments, proximity detection systems are being integrated with telematics and IoT platforms to ensure safer navigation of heavy machinery, reduce human-machine collisions, and support remote operation safety protocols.

- The development of compact, energy-efficient sensors with higher detection range and real-time responsiveness is enabling broader adoption in drones, forklifts, robotics, and wearables—extending the application of collision avoidance beyond traditional transportation sectors.

Collision Avoidance Sensor Market Dynamics

Driver

“Strict Safety Regulations and Rising Demand for Accident Prevention Systems”

- Governments and regulatory bodies worldwide are mandating the integration of advanced safety technologies in vehicles and industrial equipment to reduce accidents and enhance operator safety. These mandates are significantly driving the adoption of collision avoidance sensors across multiple sectors.

- For example, regulatory frameworks like Euro NCAP in Europe and FMVSS in the U.S. require the inclusion of collision warning and automatic emergency braking systems in passenger and commercial vehicles. This has led to a surge in demand for radar, LiDAR, and camera-based sensing technologies.

- In the industrial sector, agencies such as OSHA are encouraging the use of proximity detection systems and automation technologies to reduce workplace accidents involving heavy machinery, forklifts, and automated guided vehicles (AGVs).

- Automotive OEMs are under increasing pressure to meet stringent crash prevention standards and improve vehicle safety ratings. As a result, they are heavily investing in sensor-driven ADAS solutions to remain competitive and compliant in safety-focused markets.

- Additionally, growing public awareness and insurance incentives for vehicles equipped with safety technologies are influencing consumer preferences. This market shift is prompting manufacturers to standardize collision avoidance sensors even in mid-range and entry-level vehicle models.

Restraint/Challenge

“High Cost and Integration Challenges of Advanced Sensor Systems”

- One of the primary challenges limiting the widespread adoption of collision avoidance sensors is the high initial cost associated with deploying advanced technologies such as LiDAR, radar, and AI-based processing units. These components can significantly increase the overall cost of vehicles and industrial machinery, making them less accessible to cost-sensitive markets.

- For example, LiDAR systems—while offering precise 3D environment mapping—remain expensive and are often only used in premium vehicle models or specialized industrial applications. This cost barrier delays mass adoption, especially in low- and mid-range product segments.

- In addition, integration of multiple sensor types with existing vehicle or machine control systems can be complex and resource-intensive. Manufacturers need to ensure compatibility between hardware, software, and embedded systems, often requiring custom calibration and testing.

- Many industries also face a shortage of skilled professionals capable of handling the sensor integration, calibration, and maintenance processes. This increases reliance on third-party vendors and raises the total cost of ownership.

- Environmental factors such as weather conditions, dust, or electromagnetic interference can also limit sensor reliability, requiring additional investment in sensor shielding, software filtering, or redundant systems—adding to the technical and financial burden. These challenges collectively slow down large-scale deployment of collision avoidance systems, especially in developing markets.

Collision Avoidance Sensor Market Scope

The market is segmented on the basis of sensor type, technology, application, and end user.

• By Sensor Type

The Collision Avoidance Sensor Market is segmented into Radar, LiDAR, Ultrasonic, and Camera sensors. Radar sensors hold the largest market share in 2025 due to their robustness in adverse weather conditions and long-range detection capabilities. LiDAR is gaining traction in autonomous vehicles and high-precision applications, while ultrasonic and camera sensors are widely used in close-range and vision-based systems, respectively, particularly in automotive safety and parking assistance.

• By Technology

Technologies include Infrared, GPS, and Others. Infrared sensors are commonly used in low-light and night-time applications for enhanced visibility. GPS-based collision avoidance is widely used in aviation, construction, and mining sectors to track and prevent equipment collisions. Other emerging technologies, including sensor fusion and AI-powered algorithms, are enabling smarter, real-time decision-making in complex environments.

• By Application

Applications span across Automotive, Industrial, Aerospace, Construction, and Marine sectors. The automotive segment dominates the market due to rising demand for ADAS and vehicle safety technologies. Industrial and construction applications are rapidly growing as automated machinery and robotics increasingly rely on sensors to prevent accidents. Aerospace and marine sectors utilize these sensors to enhance navigation safety and collision prevention in dynamic operational settings.

• By End User

End users are categorized into OEMs and Aftermarket. OEMs account for the largest market share in 2025, driven by the integration of collision avoidance technologies into new vehicle and equipment designs. The aftermarket segment is also expanding as industries retrofit existing fleets with advanced sensor systems to comply with evolving safety regulations and improve operational safety standards.

Collision Avoidance Sensor Market Regional Analysis

- North America dominates the Collision Avoidance Sensor Market with the largest revenue share in 2025, driven by strong demand across automotive, aerospace, construction, and industrial sectors. The region benefits from early adoption of ADAS technologies, strict safety regulations, and substantial R&D investments in sensor innovation. High vehicle safety awareness and government mandates for collision prevention systems further support market growth.

- The growing emphasis on worker safety, autonomous systems, and industrial automation in the United States has fueled the demand for advanced collision avoidance sensors. The country leads in implementing radar, LiDAR, and ultrasonic sensors in vehicles and equipment across industries, supported by strong regulatory frameworks, insurance incentives, and innovation hubs for ADAS and robotics technologies.

United States Collision Avoidance Sensor Market Insight

The U.S. Collision Avoidance Sensor Market captured the largest revenue share within North America in 2025. Strong federal safety mandates such as FMVSS, high adoption of ADAS in passenger and commercial vehicles, and rising use of proximity detection systems in industrial machinery are key growth drivers. Leading automotive OEMs and tech innovators are headquartered in the U.S., further advancing domestic sensor development and deployment.

Europe Collision Avoidance Sensor Market Insight

The Europe Collision Avoidance Sensor Market is projected to grow steadily through the forecast period, fueled by strict safety regulations, including Euro NCAP and UNECE mandates. The region’s focus on zero-accident vision and sustainability drives adoption of LiDAR, radar, and AI-enhanced safety systems in both vehicles and industrial automation. Public-private investments in smart transportation and robotics also enhance market potential.

Germany Collision Avoidance Sensor Market Insight

Germany leads the European market due to its robust automotive and industrial base. The country’s early focus on autonomous vehicle development and Industry 4.0 initiatives has accelerated adoption of collision avoidance sensors. Integration of smart sensors in logistics, robotics, and factory automation is rapidly expanding as manufacturers aim to meet both safety and efficiency benchmarks.

France Collision Avoidance Sensor Market Insight

France’s Collision Avoidance Sensor Market is expanding steadily due to government incentives for workplace safety technologies and the growing penetration of ADAS in electric and hybrid vehicles. The country's construction and industrial sectors are adopting sensor-based safety systems to prevent machinery collisions and reduce human error, supported by national digital transformation policies.

Asia-Pacific Collision Avoidance Sensor Market Insight

The Asia-Pacific Collision Avoidance Sensor Market is set to grow at the fastest CAGR through 2032, fueled by rapid urbanization, rising automotive production, and increasing investments in infrastructure automation. Countries like China, Japan, and India are leading regional demand, driven by government mandates for vehicle safety and technological upgrades in smart factories and autonomous systems.

Japan Collision Avoidance Sensor Market Insight

Japan’s market is characterized by high-quality manufacturing standards, technological leadership, and a strong focus on autonomous mobility. The country is investing heavily in ADAS development, robotics, and smart industrial safety systems. Collision avoidance sensors are widely integrated across vehicles, drones, and factory robots to meet stringent domestic and export safety expectations.

China Collision Avoidance Sensor Market Insight

China dominates the Asia-Pacific region in terms of revenue in 2025. The country’s leadership in electric vehicle production, aggressive automation of logistics and manufacturing, and strong regulatory enforcement for workplace and road safety drive widespread adoption of collision avoidance sensors. Large-scale industrial projects and expansion in AI and smart sensing technology also contribute to rapid market growth.

Collision Avoidance Sensor Market Share

The Collision Avoidance Sensor Market is primarily led by a combination of established automotive technology providers and specialized sensor manufacturers, including:

- Delphi Automotive LLP

- Continental AG

- Robert Bosch GmbH

- DENSO CORPORATION

- Texas Instruments

- Infineon Technologies AG

- Murata Manufacturing Co. Ltd.

- ALSTOM

- NXP Semiconductors

- Siemens AG

- Rockwell Collins

Latest Developments in Collision Avoidance Sensor Market

- In February 2025, Bosch unveiled its next-generation long-range radar sensor designed for advanced driver-assistance systems (ADAS). The new sensor enhances object detection accuracy at greater distances and supports 360-degree environmental awareness, improving collision mitigation in both highway and urban driving scenarios.

- In January 2025, Velodyne Lidar introduced the Velarray M4, a compact, solid-state LiDAR sensor optimized for integration into automotive safety platforms. It supports advanced perception for autonomous emergency braking (AEB) and blind-spot monitoring, contributing to higher safety ratings in new vehicle models.

- In November 2024, Mobileye (an Intel company) announced a partnership with Volkswagen Group to co-develop next-gen vision-based collision avoidance systems using Mobileye's EyeQ6 chips and AI-driven visual recognition algorithms, enabling real-time object classification and predictive risk analysis.

- In September 2024, Continental AG launched its Next-Gen Surround Radar, a short- and mid-range radar platform designed for applications in both urban and highway environments. It supports enhanced cross-traffic alert functions and autonomous emergency steering, expanding safety coverage in complex driving conditions.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Collision Avoidance Sensors Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Collision Avoidance Sensors Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Collision Avoidance Sensors Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.