Global Wearable Sensors Market

Market Size in USD Billion

CAGR :

%

USD

5.69 Billion

USD

122.39 Billion

2024

2032

USD

5.69 Billion

USD

122.39 Billion

2024

2032

| 2025 –2032 | |

| USD 5.69 Billion | |

| USD 122.39 Billion | |

|

|

|

|

Wearable Sensors Market Size

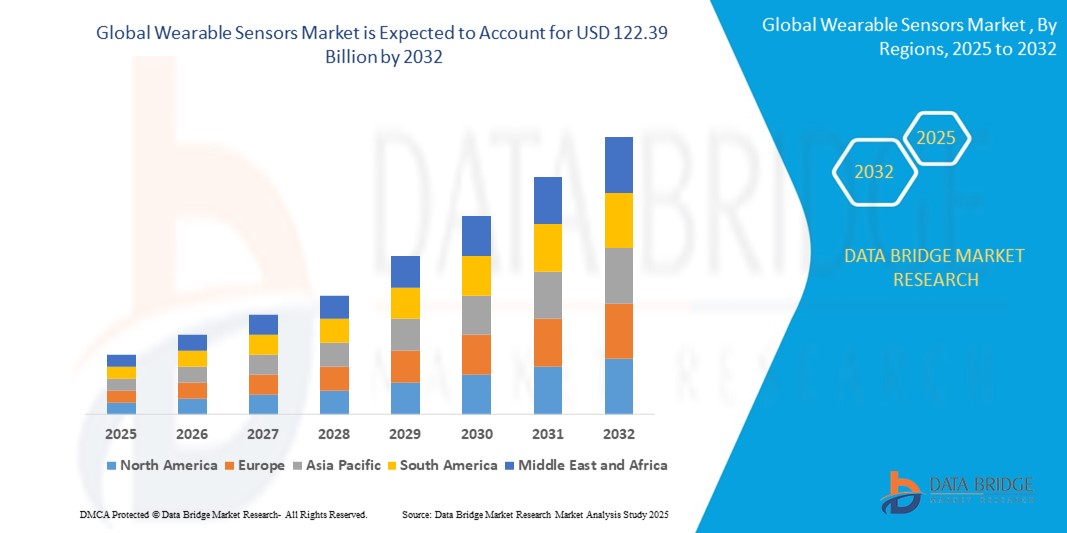

- The global Wearable Sensors market was valued at USD 5.69 billion in 2024 and is expected to reach USD 122.39 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 46.75%, primarily driven by the increasing demand for health and fitness monitoring devices

- This growth is driven by factors such as the rising adoption of wearable devices for chronic disease management and advancements in sensor technology

Wearable Sensors Market Analysis

- The global wearable sensors market is experiencing significant expansion, with projections indicating a substantial increase

- Innovations in sensor technology, including miniaturization and enhanced accuracy, are enhancing the functionality of wearable devices

- Wearable sensors are being integrated into various devices such as smartwatches, fitness trackers, and smart clothing, catering to a wide range of consumer needs

- There is a growing consumer interest in health and fitness monitoring, driving the adoption of wearable devices equipped with advanced sensors

- The market is witnessing increased competition among key players, leading to continuous innovation and the introduction of new products to meet consumer demands

- For instance, companies such as Ōura are gaining attention for their innovative wearable devices that offer continuous monitoring of sleep, temperature, and general wellness, setting them apart from basic fitness trackers

Report Scope and Wearable Sensors Market Segmentation

|

Attributes |

Wearable Sensors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Wearable Sensors Market Trends

“Integration of Smart Rings in Wearable Technology”

- The wearable sensors market is witnessing a notable trend with the resurgence of smart rings

- These compact devices offer functionalities beyond traditional wearables, such as continuous health monitoring, sleep tracking, and seamless integration with other smart devices

- For instance, Samsung's introduction of the Galaxy Ring in 2024 signifies a shift towards more discreet and versatile wearable solutions

- For Instance, Ōura, a company specializing in smart rings, has experienced significant growth, doubling its sales annually and attracting substantial investments,

- This trend indicates a growing consumer preference for wearable devices that combine functionality with comfort and style

Wearable Sensors Market Dynamics

Driver

“Increasing Prevalence of Chronic Diseases”

- The rising incidence of chronic diseases such as diabetes, cardiovascular conditions, and hypertension is a significant driver for the wearable sensors market

- Wearable devices equipped with sensors enable continuous monitoring of vital health parameters, allowing for early detection and management of these conditions

- For Instance, wearable biosensors can monitor biochemical markers in body fluids without invasive procedures, facilitating continuous screening and real-time health data collection

- This capability is particularly beneficial for managing chronic diseases, where regular tracking is crucial for effective treatment and intervention

Opportunity

“Expansion in Personalized Healthcare”

- The shift towards personalized healthcare presents a significant opportunity for the wearable sensors market

- Consumers are increasingly seeking tailored health solutions that cater to their individual needs. Wearable sensors provide real-time health insights, enabling personalized health monitoring and early disease detection

- For instance, advancements in sensor technology allow for the integration of multiple sensors within a single device, enhancing the accuracy and reliability of health data

- This personalization fosters proactive health management and empowers individuals to make informed decisions about their well-being

Restraint/Challenge

“Privacy and Security Concerns”

- Despite the advancements in wearable sensor technology, privacy and security concerns remain significant challenges

- Wearable devices collect sensitive personal data, including health metrics, location, and activity patterns, raising apprehensions about data protection

- Unauthorized access to this information or potential misuse by third parties can undermine consumer trust and hinder widespread adoption

- For example, incidents of data breaches in connected devices have heightened awareness and concern among users regarding the security of their personal information

- Addressing these concerns through robust data protection measures and transparent privacy policies is crucial for the continued growth of the wearable sensors market

Wearable Sensors Market Scope

The market is segmented on the basis type, application, and end-user.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Application |

|

|

By End-User |

|

Wearable Sensors Market Regional Analysis

“North America is the Dominant Region in the Wearable Sensors Market”

- North America leads the global wearable sensors market, holding a significant revenue share

- The U.S. is the primary contributor

- Key factors driving this dominance include high disposable income, advanced healthcare infrastructure, and a strong consumer base for fitness and health monitoring devices

- The presence of major technology companies and continuous innovation in wearable sensor technologies further bolster the region's market position

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is experiencing rapid growth in the wearable sensors market

- China leads the region, benefiting from its robust manufacturing capabilities and large consumer base

- India is also a significant contributor, driven by increasing digitalization, health awareness, and adoption of wearable devices

- The region's growth is supported by urbanization, rising disposable incomes, and government initiatives promoting digital health solutions

Wearable Sensors Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- TE Connectivity (Switzerland)

- Panasonic Corporation (Japan)

- Infineon Technologies AG (Germany)

- ams-OSRAM AG (Austria)

- Robert Bosch GmbH (Germany)

- STMicroelectronics (Switzerland)

- Analog Devices, Inc. (U.S.)

- Asahi Kasei Corporation (Japan)

- Knowles Electronics, LLC. (U.S.)

- Broadcom (U.S.)

- NXP Semiconductors (Netherlands)

- ARM Holdings PLC. (U.K.)

- Texas Instruments Inc. (U.S.)

- mCube (U.S.)

- Sensirion AG (Switzerland)

- Invensense, Inc. (U.S.)

- Shenzhen Emeno Technology Co., Ltd. (China)

- Novus International (U.S.)

Latest Developments in Global Wearable Sensors Market

- In March 2025, IdentifyHer Introduces Peri, a Wearable for Perimenopause: At CES 2025, health startup identifyHer unveiled Peri, a wearable designed to help users track and manage perimenopause symptoms. Unlike typical reproductive health wearables focused on period tracking and fertility, Peri addresses the transitional phase before menopause, providing objective data on symptoms, lifestyle, and sleep

- In October 2024, Oura Health announced the launch of the Oura Ring 4, featuring new hardware and software updates. The ring now includes sensors for blood oxygen, heart rate, and sleep respiration, all embedded inside the ring's body. Additionally, Oura signed a USD 96 million deal to supply smart rings to U.S. military personnel, including data analytics services for the Pentagon's health department

- In May 2024, Sensirion introduced SLD3x series, miniature liquid flow sensor platform, for delivering drugs subcutaneously. Sensirion’s customizable solutions ensure optimal closing, thereby enhancing patient safety for therapies requiring subcutaneous drug delivery

- In May 2023, the engineers at the University of California (San Diego) developed the first fully integrated wearable ultrasound system for deep tissue monitoring. It facilitates potentially life-saving cardiovascular monitoring and marks a major breakthrough for one of the world's leading wearable ultrasound labs

- In April 2023, Knowles Electronics introduced the Trio of Sisonic MEMS microphones for ear and wearable solutions. The new SiSonic microphones help raise the standard of audio for today’s on-the-go lifestyle

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Wearable Sensors Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Wearable Sensors Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Wearable Sensors Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.