Global Cocoa Butter Equivalent Market

Market Size in USD Billion

CAGR :

%

USD

1.23 Billion

USD

1.70 Billion

2024

2032

USD

1.23 Billion

USD

1.70 Billion

2024

2032

| 2025 –2032 | |

| USD 1.23 Billion | |

| USD 1.70 Billion | |

|

|

|

|

Cocoa Butter Equivalent Market Size

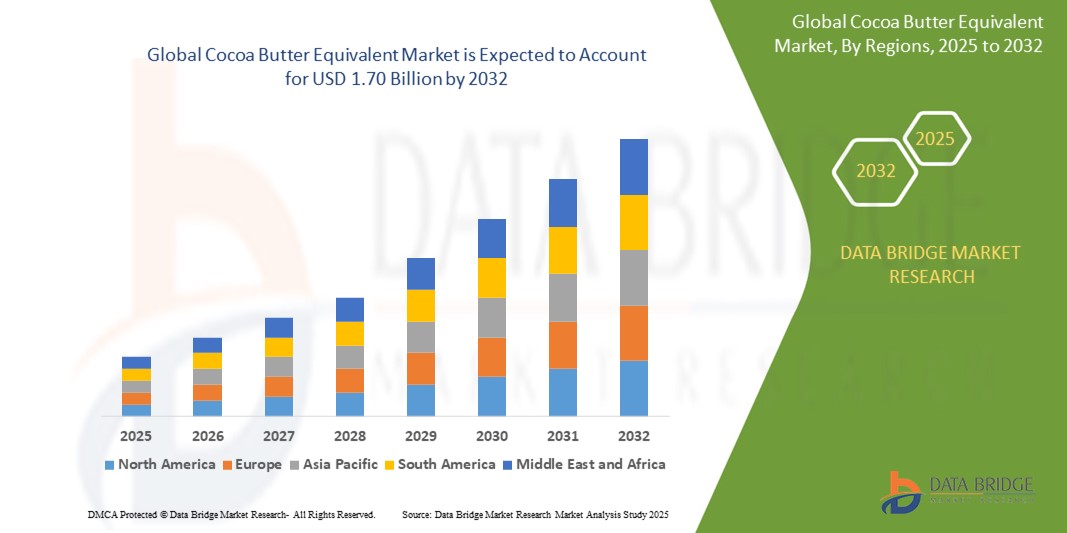

- The global cocoa butter equivalent market size was valued at USD 1.23 billion in 2024 and is expected to reach USD 1.70 billion by 2032, at a CAGR of 4.06% during the forecast period

- The market growth is largely fuelled by the increasing demand for cost-effective and sustainable alternatives to cocoa butter, especially in chocolate and confectionery production

- Rising consumer preference for plant-based and allergen-free products is also propelling the demand for cocoa butter equivalents made from shea, palm, sal, and kokum butters

Cocoa Butter Equivalent Market Analysis

- The market is driven by strong demand from the food and beverage industry, particularly for use in chocolate formulations where CBE can replace cocoa butter without compromising texture or taste

- Manufacturers are increasingly investing in research and development to enhance the functionality and compatibility of cocoa butter equivalents, ensuring better thermal resistance and extended shelf life

- Europe dominated the cocoa butter equivalent market with the largest revenue share of 38.9% in 2024, driven by strong demand from the confectionery and cosmetics industries, particularly in countries such as Germany, France, and the U.K.

- Asia-Pacific region is expected to witness the highest growth rate in the global cocoa butter equivalent market, driven by rapidly growing economies, increased consumption of confectionery products, and surging demand from emerging markets such as China, India, and Indonesia. Expanding middle-class populations and changing dietary preferences also play a significant role in market expansion

- The palm and palm kernel oil segment dominated the market with the largest revenue share of 39.6% in 2024, primarily due to their wide availability, cost-effectiveness, and ease of processing. These oils provide a close mimic to cocoa butter’s melting profile and are heavily used in large-scale chocolate and confectionery manufacturing. Their scalability and consistent quality make them a favorable choice for multinational food companies looking to optimize production costs.

Report Scope and Cocoa Butter Equivalent Market Segmentation

|

Attributes |

Cocoa Butter Equivalent Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Expansion of Plant-Based Confectionery Applications • Increasing Demand for Cost-Effective Cocoa Alternatives |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cocoa Butter Equivalent Market Trends

“Rising Preference for Sustainable and Ethically Sourced Ingredients”

- Consumers are increasingly demanding sustainably and ethically sourced cocoa butter equivalents due to rising awareness about environmental and labor issues

- Brands are reformulating products with RSPO-certified palm oil and other traceable vegetable fats to enhance transparency and build consumer trust

- Clean-label trends and eco-conscious purchasing behavior among millennials and Gen Z are accelerating the shift toward sustainable CBEs

- Retailers are pressuring suppliers to meet sustainability standards, influencing CBE producers to adopt ethical sourcing practices

- For instance, Barry Callebaut has committed to 100% sustainable ingredient sourcing by 2025, including responsibly sourced CBEs for its chocolate production

Cocoa Butter Equivalent Market Dynamics

Driver

“Cost Efficiency and Functional Versatility of Cocoa Butter Equivalents”

- CBEs are significantly more cost-effective than cocoa butter, helping manufacturers reduce production costs without sacrificing product quality

- These alternatives mimic cocoa butter’s melting behavior and texture, making them ideal for various confectionery and bakery applications

- CBEs enhance product stability and shelf life, which is particularly valuable in tropical regions where cocoa butter may degrade faster

- Their compatibility with existing cocoa butter blends provides manufacturers flexibility in formulation and scalability in production

- For instance, Nestlé has used palm-based CBEs in multiple product lines across Asia to optimize production costs while maintaining consumer-acceptable taste and texture

Restraint/Challenge

“Regulatory Limitations and Consumer Perception Issues”

- Many regions have strict regulations on the maximum allowable percentage of CBEs in chocolate, often capping it at 5%, which limits formulation freedom

- Mandatory disclosure and labeling of CBEs may affect product image and influence consumer perception of quality negatively

- Some consumers view CBEs as artificial or inferior substitutes for cocoa butter, especially in premium and organic product categories

- Technical challenges arise from maintaining consistency in taste and texture across different types of CBEs and applications

- For instance, In the European Union, chocolate products using CBEs must adhere to strict compositional rules and labeling standards, which has slowed the adoption of CBEs in premium chocolate segments

Cocoa Butter Equivalent Market Scope

The market is segmented on the basis of product type and application.

- By Product Type

On the basis of product type, the cocoa butter equivalent market is segmented into kokum butter, mango butter, palm and palm kernel oil, sal fat, and shea butter. The palm and palm kernel oil segment dominated the market with the largest revenue share of 39.6% in 2024, primarily due to their wide availability, cost-effectiveness, and ease of processing. These oils provide a close mimic to cocoa butter’s melting profile and are heavily used in large-scale chocolate and confectionery manufacturing. Their scalability and consistent quality make them a favorable choice for multinational food companies looking to optimize production costs.

The shea butter segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand in both confectionery and cosmetics industries. Shea butter is valued for its moisturizing properties and functional resemblance to cocoa butter, making it a popular alternative in skincare and gourmet chocolates. The growing consumer preference for natural and ethically sourced ingredients is also boosting the adoption of shea butter as a sustainable cocoa butter substitute.

- By Application

On the basis of application, the cocoa butter equivalent market is segmented into confectionery, cosmetics, food and beverage, and others. The confectionery segment held the largest market revenue share in 2024, attributed to the widespread use of CBEs in chocolates, fillings, and coatings. CBEs enhance product consistency and shelf life, particularly in warm climates where cocoa butter alone may compromise texture.

The cosmetics segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the surging popularity of natural emollients and plant-based alternatives in skincare formulations. Cosmetic manufacturers increasingly prefer CBEs such as mango and kokum butter due to their nourishing properties and compatibility with organic product lines, aligning with evolving consumer preferences for clean beauty solutions.

Cocoa Butter Equivalent Market Regional Analysis

- Europe dominated the cocoa butter equivalent market with the largest revenue share of 38.9% in 2024, driven by strong demand from the confectionery and cosmetics industries, particularly in countries such as Germany, France, and the U.K.

- The region benefits from a mature chocolate manufacturing sector and a rising trend toward sustainable and cost-effective ingredients, positioning cocoa butter equivalents as a viable solution

- Increased health awareness and demand for plant-based ingredients are further supporting the use of natural and alternative fats in food and personal care products across Europe

Germany Cocoa Butter Equivalent Market Insight

The Germany cocoa butter equivalent market dominated the cocoa butter equivalent market with the largest revenue share in 2024, owing to the country’s large-scale chocolate production and rising demand for clean label ingredients. The presence of global confectionery brands, coupled with Germany's focus on food quality and innovation, is accelerating the shift toward cocoa butter substitutes derived from palm kernel oil, shea butter, and other natural sources. The country’s robust supply chain infrastructure and growing awareness around ingredient sustainability continue to shape favorable market conditions.

U.K. Cocoa Butter Equivalent Market Insight

The U.K. cocoa butter equivalent market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand for plant-based ingredients in both food and personal care products. The U.K.’s strong confectionery tradition, combined with increasing consumer preference for sustainable and ethical sourcing, is encouraging manufacturers to adopt cocoa butter alternatives such as shea butter and mango butter. The country’s regulatory emphasis on clean labeling and natural formulations further supports the market’s growth trajectory.

North America Cocoa Butter Equivalent Market Insight

The North America cocoa butter equivalent market is expected to witness the fastest growth rate from 2025 to 2032, supported by expanding applications in the personal care and cosmetics segments. Consumers are increasingly leaning toward skincare and beauty products formulated with natural and nourishing alternatives such as mango butter and shea butter. The U.S. leads the regional demand, driven by a thriving wellness market and continuous product innovation by local and multinational manufacturers focusing on sustainability and skin-friendly ingredients.

U.S. Cocoa Butter Equivalent Market Insight

The U.S. cocoa butter equivalent market is expected to witness the fastest growth rate from 2025 to 2032, supported by increased usage of cocoa butter alternatives in both food and personal care formulations. Companies in the U.S. are investing in research and development of non-GMO and organic fat blends to meet evolving consumer preferences. As demand for vegan, allergen-free, and affordable chocolate products grows, the U.S. market is expected to remain at the forefront of cocoa butter equivalent innovation.

Asia-Pacific Cocoa Butter Equivalent Market Insight

The Asia-Pacific cocoa butter equivalent market is expected to grow at the fastest CAGR of 5.6% from 2025 to 2032, driven by increased chocolate consumption, rising cosmetic exports, and expanding food processing industries in countries such as China, India, and Indonesia. The affordability and local availability of palm and sal fats make them preferred choices for regional manufacturers. Government support for industrial development and foreign investments in the food sector are further contributing to market growth across the region.

China Cocoa Butter Equivalent Market Insight

China is emerging as a major player in the cocoa butter equivalent market, supported by increasing consumer demand for chocolate-based snacks and skin care products. As the country's middle-class population expands, there is a growing appetite for premium yet cost-effective offerings. Manufacturers are adopting shea butter and other plant-based oils to diversify formulations, reduce reliance on cocoa butter, and meet the country's evolving regulatory and consumer standards. China’s dynamic retail landscape and rapid product innovation are expected to further boost market expansion.

Japan Cocoa Butter Equivalent Market Insight

The Japan cocoa butter equivalent market is expected to grow at the fastest CAGR of 5.6% from 2025 to 2032, supported by the country’s emphasis on high-quality ingredients in confectionery and skincare products. Japanese consumers value purity and functionality, which has led to increasing adoption of premium cocoa butter alternatives such as kokum butter and sal fat. The cosmetics sector in Japan is especially contributing to the market's expansion, as brands incorporate these natural substitutes to meet demand for effective, skin-friendly formulations.

Cocoa Butter Equivalent Market Share

The Cocoa Butter Equivalent industry is primarily led by well-established companies, including:

- 3F GROUP (India)

- AAK AB (Sweden)

- Cargill, Incorporated (U.S.)

- FUJI OIL ASIA PTE. LTD. (Singapore)

- Bunge Loders Croklaan (Netherlands)

- Manorama Industries Limited (India)

- Mewah Group (Singapore)

- INTERCONTINENTAL SPECIALTY FATS SDN. BHD. (Malaysia)

- Olam International (Singapore)

- Wilmar International Ltd (Singapore)

- Musim Mas (Indonesia)

- FGV IFFCO SDN BHD (Malaysia)

- ADM (U.S.)

- Makendi WorldWide (U.S.)

- EFKO Group (Russia)

- Mallinath Group (India)

- USHA INTERNATIONAL (India)

- Wild Oils (Australia)

- GEF India (India)

- PT. WILMAR CAHAYA INDONESIA (Indonesia)

Latest Developments in Global Cocoa Butter Equivalent Market

- In February 2024, SheaMoisture has launched its inaugural deodorant collection, featuring six antiperspirants and two full-body deodorants tailored for individuals with higher melanin levels in their skin. Developed in collaboration with Black dermatologists, these products address specific concerns, including enhancing skin tone, moisturizing, and promoting smooth skin texture. In addition, they offer effective protection against body odor and sweat, catering to the unique needs of their target demographic

- In February 2022, AAK AB announced a significant investment of approximately USD 54.7 million to install biomass boilers at its manufacturing facility in Aarhus. This initiative is expected to dramatically reduce CO2 emissions by up to 90%. The biomass boilers will utilize shea meal, a byproduct of shea-based food production, contributing to AAK’s commitment to sustainability and environmental responsibility within the food industry

- In June 2021, AAK has expanded its product offerings by providing cocoa butter substitutes made from shea butter to Mars for use in chocolate and confectionery products. This innovation not only meets the industry's need for high-quality alternatives but also emphasizes the versatility of shea butter. It serves as a sustainable option for manufacturers seeking to enhance their products while addressing consumer preferences for health-conscious ingredients

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cocoa Butter Equivalent Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cocoa Butter Equivalent Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cocoa Butter Equivalent Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.