Global Cocoa Powder Market

Market Size in USD Billion

CAGR :

%

USD

12.18 Billion

USD

17.99 Billion

2024

2032

USD

12.18 Billion

USD

17.99 Billion

2024

2032

| 2025 –2032 | |

| USD 12.18 Billion | |

| USD 17.99 Billion | |

|

|

|

|

Cocoa Powder Market Analysis

The cocoa powder market is experiencing significant growth driven by increased demand across various industries, including chocolate production, beverages, bakery, functional foods, and pharmaceuticals. The market is expected to expand at a steady rate due to the rising popularity of chocolate and cocoa-based products globally, particularly in emerging economies. Advancements in cocoa processing technologies, such as improved extraction methods that preserve the nutritional value and enhance flavor, are contributing to the market’s expansion. Companies are also exploring innovations in cocoa powder formulations, such as organic and prebiotic cocoa powders, which cater to the growing health-conscious consumer base. In addition, the use of cocoa in functional foods and beverages is gaining momentum due to its potential health benefits, including antioxidant properties and heart-healthy effects.

The rising demand for clean-label and ethically sourced products is another key factor driving market growth, as consumers are becoming more conscious of the environmental and social impact of cocoa farming. Leading players in the market are focusing on sustainability initiatives and innovations in product offerings to meet these consumer demands. Overall, the cocoa powder market is set to witness continued expansion, fueled by both consumer preferences and industry advancements.

Cocoa Powder Market Size

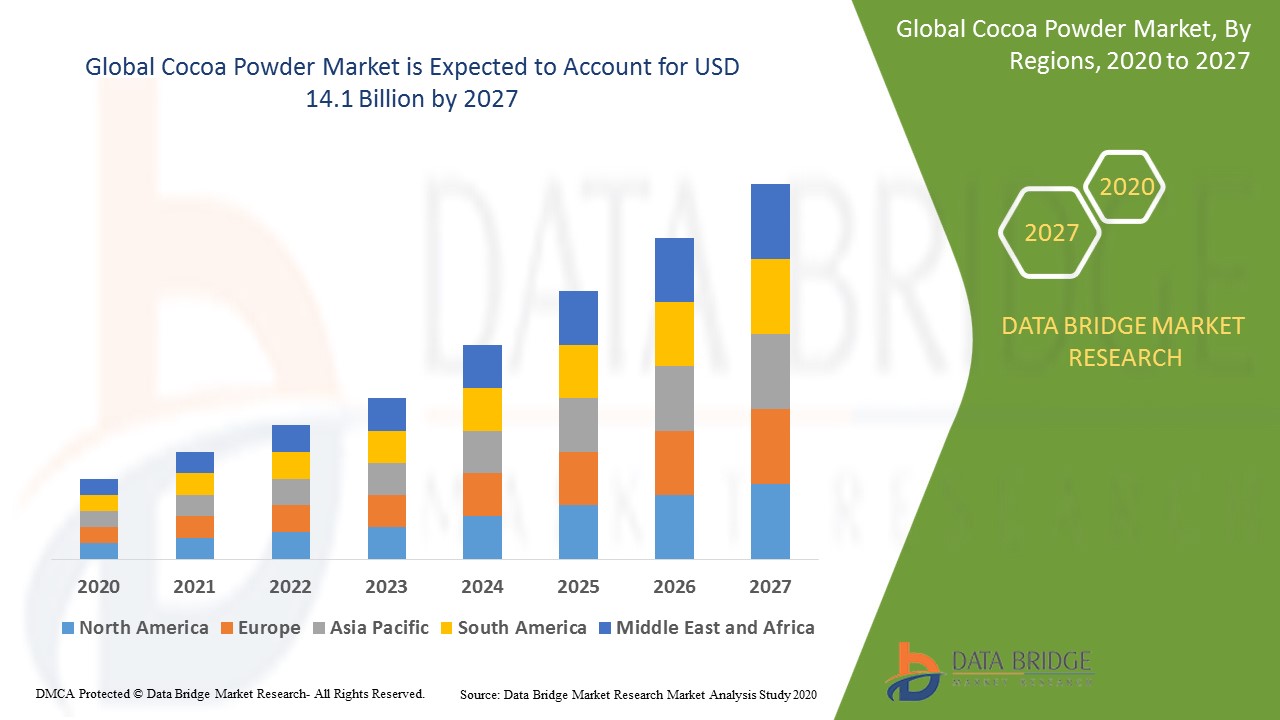

The global cocoa powder market size was valued at USD 12.18 billion in 2024 and is projected to reach USD 17.99 billion by 2032, with a CAGR of 5.00 % during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Cocoa Powder Market Trends

“Increasing Demand for Organic and Sustainably Sourced Cocoa Powders”

One key trend in the cocoa powder market is the increasing demand for organic and sustainably sourced cocoa powders. Consumers are becoming more conscious of the environmental and ethical implications of their food choices, driving a shift towards products that are both eco-friendly and health-conscious. For instance, brands such as OFI have responded to this trend by launching 100% segregated organic cocoa powder, which ensures traceability and sustainability in the supply chain. This product caters to the growing interest in clean-label ingredients and functional foods, as it aligns with consumer preferences for products free from artificial additives and chemicals. In addition, the rise in prebiotic cocoa powders, such as the product introduced by Lil’Goodness in India, further underscores this trend. This cocoa powder offers added health benefits, supporting digestive health while maintaining the rich flavor and antioxidant properties that cocoa is known for. The integration of sustainability and health benefits is thus propelling the cocoa powder market forward.

Report Scope and Cocoa Powder Market Segmentation

|

Attributes |

Cocoa Powder Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

THE HERSHEY COMPANY (U.S.), Ghirardelli Chocolate Company (U.S.), Nestlé (Switzerland), Mars, Incorporated (U.S.), ECOM Agroindustrial Corp. Limited. (Switzerland), Cocoa Processing Company Limited (CPC) (Ghana), Ferrero (Italy), Cargill Cocoa & Chocolate (U.S.), Guan Chong Berhad (Malaysia), Organic Commodity Products Inc. (U.S.), Newtown Foods USA (U.S.), The Kraft Heinz Company (U.S.), Delfi Limited. (Singapore), Touton S.A. (France), Blommer Chocolate Company (U.S.), BELCOLADE (Belgium), Olam Group (Singapore), Cargill, Incorporated (U.S.), Barry Callebaut (Switzerland), Swiss Chalet Fine Foods (U.S.), and Dutched Cocoa (Netherlands) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Cocoa Powder Market Definition

Cocoa powder is a fine, dry powder derived from cocoa beans, which are the seeds of the cacao tree (Theobroma cacao). The beans are processed by fermenting, drying, roasting, and then grinding them to extract cocoa butter, leaving behind a solid mass that is further processed into cocoa powder.

Cocoa Powder Market Dynamics

Drivers

- Growing Demand for Chocolate Products

The growing demand for chocolate products is a significant driver of the cocoa powder market. As global consumption of chocolate and cocoa-based items increases, there is a corresponding rise in the need for cocoa powder, which is a fundamental ingredient in chocolate production. With the growing popularity of artisanal chocolates, premium chocolate bars, and cocoa-infused desserts, brands are looking for high-quality cocoa powder to enhance flavor and texture. For instance, companies such as Ghirardelli and Lindt rely heavily on cocoa powder for crafting their signature chocolate products. As consumers demand more innovative chocolate offerings, including sugar-free, dark, and plant-based varieties, the market for cocoa powder expands accordingly. This surge in demand for chocolate products directly boosts the cocoa powder market, as it serves as a crucial component in traditional chocolate bars and in beverages, confectionery, and other cocoa-based treats. Thus, the rising popularity of chocolate products acts as a key driver for cocoa powder market growth.

- Rising Health and Wellness Trends

Health and wellness trends are significantly driving the cocoa powder market, as consumers become more conscious of their dietary choices and the potential health benefits of the products they consume. Many are now seeking cocoa powders that offer added health benefits, such as antioxidants known to promote heart health and improve digestion. This demand has led to the rise in popularity of organic, prebiotic, and functional cocoa powders. For instance, brands such as Lil'Goodness in India have introduced prebiotic cocoa powders, which are free from added sugars and rich in natural fibers that support gut health. In addition, cocoa powders that highlight their high antioxidant content are appealing to consumers looking for heart-healthy options. This shift toward health-conscious cocoa products is driving the market, as consumers increasingly opt for functional foods that offer more than just flavor. As a result, the cocoa powder market is evolving, with more companies focusing on offering healthier alternatives to meet the growing demand for nutritious and wellness-oriented products.

Opportunities

- Increasing Demand for Cocoa-Based Beverages

The rise in demand for cocoa-based beverages presents a significant market opportunity for the cocoa powder industry. As consumers shift toward healthier drink options, the popularity of beverages such as hot chocolate, energy drinks, and protein shakes continues to increase, driving demand for high-quality cocoa powder. For instance, companies such as Nestlé and Hershey’s have capitalized on this trend by expanding their product lines to include cocoa-infused beverages, catering to both traditional tastes and health-conscious consumers. The growing preference for plant-based, low-sugar, or fortified drinks has further spurred the demand for cocoa powder, particularly in functional beverages that promote energy, wellness, or recovery. With cocoa powder known for its rich flavor and antioxidant properties, its inclusion in health drinks enhances their appeal by providing natural benefits, such as improved digestion and heart health. This shift towards cocoa-based functional beverages presents a major opportunity for cocoa powder manufacturers to innovate and tap into the expanding market for health-focused drinks.

- Increasing Innovation in Product Offerings

Innovation in product offerings is creating a significant market opportunity within the cocoa powder industry, as companies develop specialized cocoa powders to cater to the evolving preferences of health-conscious and dietary-restricted consumers. The rise in demand for sugar-free, gluten-free, and vegan options has led to the introduction of innovative cocoa powder varieties that meet these needs. For instance, brands such as Cacao Barry and Ghirardelli have launched sugar-free cocoa powders, catering to consumers following low-sugar or keto diets, while Lil’Goodness in India has introduced a vegan-friendly, prebiotic cocoa powder that appeals to those following plant-based lifestyles. These innovations are responding to consumer preferences and positioning cocoa powder as an ingredient in more diverse product categories, such as health bars, protein shakes, and gluten-free baked goods. By tapping into these specialized markets, cocoa powder manufacturers can capture a larger consumer base and cater to the growing demand for clean-label, allergen-free, and diet-friendly products, thus presenting a strong market opportunity for growth.

Restraints/Challenges

- Health and Safety Regulations

Health and safety regulations are a significant challenge in the Cocoa Powder market, especially given the stringent standards in sectors such as food, pharmaceuticals, and cosmetics. Cocoa Powder is commonly used as a food additive, emulsifier, or thickener, and it must adhere to various regulatory frameworks set by authorities such as the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA). These regulations ensure that the starch is safe for consumption and free from contaminants, such as pesticides, heavy metals, and microbiological hazards. Manufacturers must invest in rigorous testing and quality control measures to meet these standards, which can be both costly and time-consuming. For instance, the FDA’s GRAS (Generally Recognized as Safe) certification process for Cocoa Powder requires manufacturers to provide extensive safety data. Failing to comply with these health and safety regulations can lead to legal issues, product recalls, and damage to brand reputation. As a result, manufacturers must stay updated on evolving regulations and invest in research and development to ensure their products continue to meet safety requirements.

- Competition from Alternative Starches

Competition from alternative starches presents a significant challenge in the Cocoa Powder market, as there are various other options available, such as corn, potato, and tapioca starch, which are often more readily available and cheaper to produce. These alternatives are gaining popularity in industries such as food and beverages, particularly as consumers seek gluten-free, plant-based, and allergen-free products. For instance, tapioca starch is widely used in gluten-free baking because it can mimic the texture and properties of wheat starch while being suitable for those with gluten sensitivities. In addition, corn starch, a low-cost and versatile ingredient, is often favored in many processed food products due to its availability and low production costs. As consumer demand for gluten-free and plant-based alternatives continues to rise, manufacturers of Cocoa Powder must find ways to differentiate their products, either by focusing on specific applications where wheat-based starches excel, such as certain textures or binding properties, or by innovating to create more sustainable, health-conscious, or functional alternatives. This increasing competition from non-wheat starches makes it essential for manufacturers to remain agile and continuously adapt to consumer preferences and industry trends.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Cocoa Powder Market Scope

The market is segmented on the basis of product type, cocoa variety, distribution channel, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Black Cocoa

- Double-Dutch Cocoa Blend

- Triple Cocoa Blend

- Bensdorp Dutch-Process Cocoa

- Cocoa Rouge

- Natural Cocoa

Cocoa Variety

- Forastero

- Criollo

- Trinitario

- Others

Distribution Channel

- Modern Trade

- Specialty Stores

- Convenience Stores

- Traditional Grocery Stores

- Online Stores

- Other

End User

- Chocolate and Confectionery

- Beverages

- Bakery

- Functional Food

- Cosmetics

- Pharmaceuticals

Cocoa Powder Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, product type, cocoa variety, distribution channel, and end user as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA)

North America is dominating the cocoa powder market during the forecast period. This growth is primarily driven by the increasing demand for cocoa powder in the production of cookies, chocolates, and various other confectionery products. In addition, the region has witnessed a significant rise in the use of cocoa in functional foods and beverages due to its health benefits. The expanding applications of cocoa in the pharmaceutical industry further contribute to its growing market presence in North America.

Asia-Pacific is the fastest growing region in the cocoa powder market, driven by increasing demand for chocolate-based products and a rising awareness of cocoa’s health benefits. Changing consumer preferences and the expansion of the confectionery and bakery industries are contributing to this trend. In addition, urbanization and a growing middle class in countries such as India and China are fueling the demand for cocoa products. This region's robust growth positions it as a key player in the global cocoa powder market.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Cocoa Powder Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Cocoa Powder Market Leaders Operating in the Market Are:

- THE HERSHEY COMPANY (U.S.)

- Ghirardelli Chocolate Company (U.S.)

- Nestlé (Switzerland)

- Mars, Incorporated (U.S.)

- ECOM Agroindustrial Corp. Limited. (Switzerland)

- Cocoa Processing Company Limited (CPC) (Ghana)

- Ferrero (Italy)

- Cargill Cocoa & Chocolate (U.S.)

- Guan Chong Berhad (Malaysia)

- Organic Commodity Products Inc. (U.S.)

- Newtown Foods USA (U.S.)

- The Kraft Heinz Company (U.S.)

- Delfi Limited. (Singapore)

- Touton S.A. (France)

- Blommer Chocolate Company (U.S.)

- BELCOLADE (Belgium)

- Olam Group (Singapore)

- Cargill, Incorporated (U.S.)

- Barry Callebaut (Switzerland)

- Swiss Chalet Fine Foods (U.S.)

- Dutched Cocoa (Netherlands)

Latest Developments in Cocoa Powder Market

- In April 2024, Barry Callebaut, a global leader in cocoa and chocolate production, introduced its innovative MALEO cocoa powder. This new cocoa powder offers a unique advantage by requiring less powder to achieve a more indulgent flavor. The standard "10/12 MALEO" range is distinguished by its rich brown color, which enhances the visual appeal of any cocoa-based creation

- In April 2023, Cacao Barry, headquartered in France, expanded its cocoa powder collection to offer more options for chefs. This new range introduces a fresh perspective on the science and chemistry of ingredients, enabling chefs to choose the perfect cocoa powder for each specific application. The Cacao Powder Alphabet, similar to the widely recognized Pastry Alphabet in Europe, is a comprehensive collection of fundamental recipes that showcase the unique qualities of cocoa powder, whether in sablé, madeleine, or gelato

- In July 2022, OFI, a subsidiary of Olam International, launched 100% segregated organic cocoa powder in Chicago at the IFT FIRST event, hosted by the Institute of Food Technologists. The product ensures its organic certification through a fully separated supply chain, from farming to processing. At the expo, the company also featured gluten-free double chocolate chip cookies made with deZaan Master 01 cocoa powder

- In July 2022, Lil'Goodness, an Indian health-focused food and snacking brand, launched the country’s first prebiotic cocoa powder. This zero-sugar, prebiotic cocoa powder is made from natural prebiotic fibers and antioxidant-rich cocoa, offering a heart- and gut-healthy option for popular homemade recipes. It is designed to make dark chocolates, chocolate desserts, smoothies, and chocolate mousse pudding healthier and more enjoyable, especially for families and children

- In February 2022, Olam Food Ingredients debuted its premium deZaan cocoa powder line in the U.S. This product range offers a broad flavor profile, from delicate fruity citrus notes to smooth chocolate and caramel undertones. The color selection includes vibrant hues such as crimson red and terracotta, as well as the deep, rich tone of carbon black

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Cocoa Powder Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Cocoa Powder Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Cocoa Powder Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.