Global Closed System Transfer Devices Market

Market Size in USD Billion

CAGR :

%

USD

1.52 Billion

USD

2.74 Billion

2024

2032

USD

1.52 Billion

USD

2.74 Billion

2024

2032

| 2025 –2032 | |

| USD 1.52 Billion | |

| USD 2.74 Billion | |

|

|

|

|

Closed System Transfer Devices Market Size

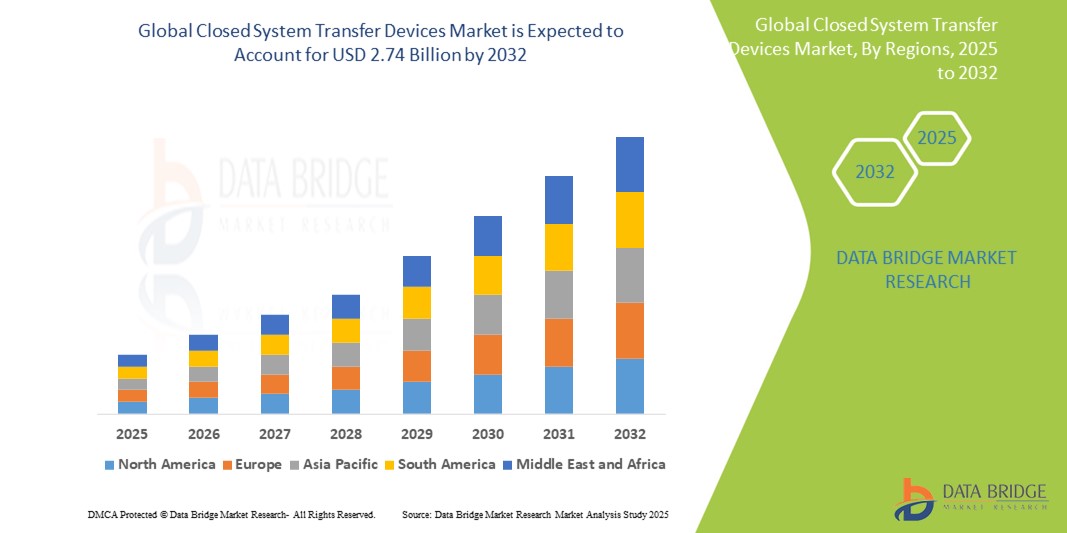

- The global closed system transfer devices market size was valued at USD 1.52 billion in 2024 and is expected to reach USD 2.74 billion by 2032, at a CAGR of 7.65% during the forecast period

- The market growth is largely fueled by the growing adoption and technological advancements in chemotherapy drug handling and hazardous drug containment systems, leading to increased safety protocols across hospital and oncology settings

- Furthermore, rising healthcare worker safety concerns and stringent regulatory mandates from agencies such as the U.S. FDA and NIOSH are establishing Closed System Transfer Devices (CSTDs) as the standard for safe handling of cytotoxic and other hazardous drugs. These converging factors are accelerating the uptake of closed system transfer devices solutions, thereby significantly boosting the industry's growth

Closed System Transfer Devices Market Analysis

- Closed system transfer devices (CSTDs) are medical devices designed to prevent environmental contamination and the escape of hazardous drugs or vapours during drug preparation and administration, particularly for hazardous medications such as chemotherapy. They are increasingly vital components of modern healthcare safety protocols in various settings due to their enhanced protection for healthcare workers and patients

- The escalating demand for CSTDs is primarily fueled by the rising incidence of cancer and the subsequent increase in chemotherapy treatments, growing awareness of occupational safety among healthcare professionals, and stringent regulatory requirements for the safe handling of hazardous drugs

- North America dominated the closed system transfer devices market with the largest revenue share of 43.5%, characterized by advanced medical technology landscapes, stringent regulatory frameworks that mandate the use of CSTDs, and a strong focus on safety and compliance

- Asia-Pacific is expected to be the fastest-growing region in the closed system transfer devices market during the forecast period with a CAGR of 12.23%. This growth is due to rapid economic development, expanding healthcare infrastructure, increasing awareness of drug safety, and a rising number of cancer cases coupled with growing investments in healthcare facilities

- The membrane-to-membrane systems segment dominated the Closed system transfer devices market. With a revenue share of 63.2% in 2024, due to their ease of usage and reduced chance of contamination

Report Scope and Closed System Transfer Devices Market Segmentation

|

Attributes |

Closed System Transfer Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Closed System Transfer Devices Market Trends

“Enhanced Safety and Workflow Optimization in Hazardous Drug Handling”

- A significant and accelerating trend in the global closed system transfer devices (CSTDs) market is the integration of advanced engineering controls and automated handling systems, which are enhancing both safety and workflow efficiency in oncology and hazardous drug compounding environments

- For instance, leading manufacturers are developing CSTDs that seamlessly integrate with automated pharmacy compounding robots and negative pressure isolators, enabling contamination-free transfer of cytotoxic drugs. This integration supports adherence to USP <800> and NIOSH guidelines, significantly reducing occupational exposure

- Modern CSTDs are being designed to ensure minimal drug leakage, offer leak-proof connections, and include safety features such as air-cleaning mechanisms and double-membrane systems. Some systems even include data-logging features that help pharmacy managers track usage and monitor compliance

- The seamless integration of CSTDs with broader pharmacy automation systems facilitates centralized control over drug preparation processes. With this integration, hospitals and cancer centers can standardize workflows, enhance patient safety, and minimize drug waste — thereby improving operational and cost efficiency

- This trend toward more intelligent, compliant, and integrated drug transfer systems is fundamentally reshaping expectations for occupational safety in healthcare. Consequently, companies such as B. Braun, ICU Medical, and Equashield are focusing on R&D for next-generation CSTDs that combine ease of use with superior contamination prevention

- The demand for Closed System Transfer Devices that offer advanced safety, compatibility with automation, and regulatory compliance is growing rapidly across hospital pharmacies, oncology centers, and outpatient infusion facilities, as institutions increasingly prioritize healthcare worker protection and treatment accuracy

Closed System Transfer Devices Market Dynamics

Driver

“Growing Need Due to Rising Exposure Risks and Regulatory Enforcement”

- The increasing awareness of occupational hazards associated with handling hazardous drugs, coupled with stricter enforcement of safety regulations by organizations such as NIOSH, OSHA, and USP <800>, is significantly driving demand for closed system transfer devices (CSTDs)

- For instance, in April 2024, ICU Medical announced enhancements to its ChemoLock CSTD platform to support seamless integration with cleanroom workflows and comply with updated USP <800> mandates. Such strategic moves by key industry players are expected to propel CSTDs market growth during the forecast period

- As healthcare facilities become more aware of the long-term risks of hazardous drug exposure—including reproductive toxicity and carcinogenicity—they are increasingly adopting CSTDs to protect healthcare workers in pharmacies, oncology centers, and infusion clinics

- Furthermore, the emphasis on safety, efficiency, and compliance is making CSTDs an integral component in hazardous drug preparation and administration protocols. These devices help eliminate leaks, reduce contamination risks, and support safe drug compounding in both inpatient and outpatient care settings

- The convenience of closed systems in limiting drug aerosolization, coupled with growing adoption in developing countries and increasing investments in oncology care, is accelerating the use of CSTDs across healthcare facilities. The rising availability of user-friendly, cost-effective CSTDs is also contributing to the widespread adoption across both large hospitals and smaller clinics

Restraint/Challenge

“Concerns Regarding High Cost and Limited Compatibility”

- The relatively high initial cost of closed system transfer devices, especially advanced models with integrated safety and tracking features, remains a significant barrier to adoption—particularly for smaller healthcare facilities and in price-sensitive markets

- For instance, healthcare providers in low- and middle-income countries often struggle to allocate budget for premium CSTDs, despite increasing demand for safe oncology drug handling

- In addition, compatibility issues between CSTDs and different drug vial configurations, IV bags, and administration sets pose operational challenges. The lack of standardization across product designs can lead to workflow inefficiencies and additional training requirements

- Addressing these concerns through product standardization, improved device interoperability, and cost-reduction strategies such as bulk procurement and local manufacturing will be crucial to expanding market access

- Furthermore, limited awareness among healthcare professionals regarding proper usage and benefits of CSTDs in some regions continues to hinder adoption. Manufacturers must invest in clinical training, safety education, and regulatory advocacy to overcome these knowledge and infrastructure gaps

Closed System Transfer Devices Market Scope

The closed system transfer devices (CSTDs) market is segmented on the basis of type, component, closing mechanism, technology, end user, and distribution channel.

- By Type

On the basis of type, the closed system transfer devices market is segmented into membrane-to-membrane systems and needle-free closed system transfer devices. The membrane-to-membrane systems segment dominated the market with a revenue share of 63.2% in 2024, owing to its widespread adoption in hospitals and oncology centers for its reliable drug containment performance and ease of use. These systems are highly effective in preventing drug aerosolization and contamination during transfer.

The needle-free closed system transfer devices segment is expected to witness the fastest CAGR of 8.9% from 2025 to 2032, driven by growing safety concerns, regulatory push for needleless systems, and reduced need for sharps waste management.

- By Component

On the basis of component, the closed system transfer devices market is segmented into devices and accessories. The devices segment held the largest market revenue share of 71.8% in 2024, as core CSTD components such as vial adaptors, syringes, and IV connectors are essential for safe drug transfer operations. Their high usage frequency and central role in hazardous drug preparation contribute to market dominance.

The accessories segment is projected to grow at the fastest CAGR of 9.3% during the forecast period, supported by rising demand for customized kits, add-ons, and compatible connectors that enhance workflow efficiency and system integration.

- By Closing Mechanism

On the basis of closing mechanism, the closed system transfer devices market is segmented into push-to-turn systems, color-to-color alignment systems, luer-lock systems, and click-to-lock systems. The luer-lock system segment accounted for the largest market share of 38.6% in 2024, due to its universal compatibility with standard IV and syringe setups, making it a preferred choice in hospitals and compounding pharmacies.

The click-to-lock systems segment is expected to record the highest CAGR of 9.1% from 2025 to 2032, as it offers intuitive, secure locking mechanisms that minimize the risk of user error during hazardous drug transfers.

- By Technology

On the basis of technology, the closed system transfer devices market is segmented into diaphragm-based devices, compartmentalized devices, and air cleaning/filtration devices. The diaphragm-based devices segment led the market with a share of 52.4% in 2024, attributed to its simple design, reliable performance, and widespread compatibility with various drug containers and administration systems.

The air cleaning/filtration devices segment is projected to grow at the fastest CAGR of 9.5%, driven by increasing regulatory scrutiny and the demand for advanced solutions that offer maximum protection for both healthcare workers and patients by filtering drug vapors and particles.

- By End User

On the basis of end user, the closed system transfer devices market is segmented into hospitals, oncology centers & clinics, ambulatory surgical centers, and academic and research institutes. The hospitals segment dominated with a 59.8% revenue share in 2024, as hospitals remain the largest users of cytotoxic drugs and require high-volume CSTD implementation to comply with occupational safety standards.

The oncology centers & clinics segment is projected to grow at the fastest CAGR of 8.7% over the forecast period, owing to the rising number of outpatient chemotherapy services and the increasing focus on decentralized cancer care delivery.

- By Distribution Channel

On the basis of distribution channel, the closed system transfer devices market is segmented into direct tender and retail sales. The direct tender segment accounted for the largest share of 73.5% in 2024, primarily due to bulk purchasing by government hospitals and healthcare systems through centralized procurement contracts.

The retail sales segment is expected to grow at the fastest CAGR of 8.3%, as private hospitals and smaller clinics increasingly prefer direct purchasing through distributors, especially in developing markets where tender systems are less prevalent.

Closed System Transfer Devices Market Regional Analysis

- North America dominated the closed system transfer devices (CSTDs) market with the largest revenue share of 43.5% in 2024, driven by stringent occupational safety regulations, increasing oncology drug usage, and widespread adoption of advanced drug compounding and handling technologies

- Healthcare facilities in the region, particularly in the U.S. and Canada, prioritize the protection of healthcare workers through adherence to USP <800> and NIOSH guidelines, which mandate the use of CSTDs during the preparation and administration of hazardous drugs

- This high regional demand is further supported by strong government healthcare infrastructure, higher healthcare spending, and a proactive stance on the adoption of innovative safety technologies. The presence of major market players and robust distribution networks also facilitates widespread availability and awareness of CSTDs in North America

U.S. Closed System Transfer Devices Market Insight

The U.S. closed system transfer devices market captured a largest revenue share of 75.6% within North America. This dominance is driven by stringent regulatory mandates such as USP <800>, increased oncology drug usage, and institutional focus on healthcare worker safety. Hospitals and oncology centers are actively implementing CSTDs to comply with hazardous drug handling protocols and mitigate occupational exposure risks. Moreover, the strong presence of major CSTD manufacturers such as ICU Medical and Becton, Dickinson and Company, coupled with increased government and private sector investments in oncology infrastructure, continues to fuel market growth.

Europe Closed System Transfer Devices Market Insight

The Europe closed system transfer devices market accounted for a substantial portion of the global revenue. Growth in the region is primarily driven by strict occupational safety standards enforced by EU agencies, coupled with a rising burden of cancer across countries such as Germany, France, and the U.K. (Europe experiences over 3.7 million new cancer cases and 1.9 million cancer deaths each year). The growing demand for protective drug administration systems and an increasing shift toward outpatient chemotherapy services are accelerating the adoption of CSTDs.

U.K. Closed System Transfer Devices Market Insight

The U.K. closed system transfer devices market is anticipated to grow at a noteworthy CAGR from 2025 to 2032. This growth is supported by rising cancer treatment procedures and the country’s proactive regulatory environment focused on workplace safety. NHS hospitals and private oncology centers are prioritizing investments in advanced compounding safety tools, including CSTDs, to align with European directives. In addition, a strong pharmaceutical research base and early adoption of safe drug handling technologies further contribute to market growth.

Germany Closed System Transfer Devices Market Insight

The Germany closed system transfer devices market is expected to grow at a considerable CAGR from 2025 to 2032, driven by the country’s well-established healthcare infrastructure and high awareness of contamination-free drug handling practices. Germany's strong regulatory framework, investments in cancer centers, and increasing preference for automated and standardized compounding procedures are encouraging hospitals and pharmacies to adopt CSTDs widely. Local manufacturers and collaborations with international players are also boosting accessibility and product development.

Asia-Pacific Closed System Transfer Devices Market Insight

The Asia-Pacific closed system transfer devices market is projected to grow at the fastest CAGR of 12.23% from 2025 to 2032. This growth is owing to rapidly expanding cancer treatment infrastructure (cancer cases in Asia increased by 35% between 2020-2023), rising healthcare expenditure, and improving awareness about occupational safety in drug handling. Countries such as China, India, and Japan are witnessing a surge in the number of oncology centers, leading to increased demand for contamination-free drug delivery systems. Government initiatives promoting safer hospital environments and local production of CSTDs components are further driving affordability and adoption in this region.

China Closed System Transfer Devices Market Insight

The China closed system transfer devices held the largest market share within Asia-Pacific from 2025 to 2032. China's National Cancer Center documented a 28% increase in cancer treatment facilities from 2020-2023, with over 75% implementing hazardous drug safety protocols. This is driven by the rising burden of cancer, expanding middle class, and significant investments in hospital infrastructure. The government’s promotion of smart healthcare facilities and favorable reimbursement policies for oncology treatments are spurring demand for safety-enhancing products such as CSTDs. In addition, domestic manufacturers are offering affordable solutions, making CSTDs more accessible to Tier II and Tier III cities as well.

India Closed System Transfer Devices Market Insight

The India closed system transfer devices is projected to grow at a considerable CAGR from 2025 to 2032, making it one of the most promising markets in Asia-Pacific. The growth is attributed to an increasing incidence of cancer, improving oncology care infrastructure, and rising government and private investment in hospital safety equipment. Although awareness of CSTDs is still developing, initiatives by organizations such as the Indian Association of Clinical Pharmacologists and rising training programs on hazardous drug handling are expected to significantly boost adoption. The expanding pharmaceutical and healthcare manufacturing sector also supports domestic production and cost-effective distribution.

Closed System Transfer Devices Market Share

The closed system transfer devices industry is primarily led by well-established companies, including:

- B. Braun SE (U.S.)

- ICU Medical, Inc. (U.S.)

- BD (U.S.)

- EQUASHIELD (U.S.)

- Simplivia (Israel)

- Cormed (U.S.)

- YUKON MEDICAL (U.S.)

- Caragen Ltd. (Ireland)

- Baxter (U.S.)

- JMS North America Corporation (U.S.)

- Vygon (France)

- Epic Systems Corporation (U.S.)

Latest Developments in Global Closed System Transfer Devices Market

- In April 2023, leading CSTD manufacturers continued to focus on expanding their product portfolios with new designs and features aimed at enhancing ease of use and compatibility across various drug preparation and administration systems. This strategic initiative underscores the industry's dedication to delivering innovative, reliable solutions tailored to the diverse needs of healthcare settings globally. By leveraging advanced materials and engineering, companies are reinforcing their position in the rapidly growing global Closed System Transfer Devices market

- In March 2023, a key trend was the introduction of next-generation CSTD systems with improved needleless access and enhanced containment capabilities, specifically engineered for safer handling of hazardous drugs in hospitals and oncology centers. These innovative systems are designed to enhance security protocols by minimizing exposure risks for healthcare professionals. This advancement highlights manufacturers' commitment to developing cutting-edge safety technologies that safeguard personnel and patients, ensuring greater protection and peace of mind for institutions and their communities

- In March 2023, pharmaceutical and medical technology companies were increasingly engaged in collaborative projects aimed at integrating CSTDs more seamlessly into broader drug compounding and administration workflows. This initiative harnesses state-of-the-art solutions to create a more secure and efficient drug handling environment, underscoring the dedication to utilizing expertise in innovative safety systems. The projects highlight the increasing significance of integrated technology in pharmaceutical safety, contributing to the development of safer, smarter drug delivery processes

- In February 2023, a growing number of CSTD providers announced strategic partnerships with Group Purchasing Organizations (GPOs) and healthcare networks to streamline procurement and enhance accessibility of CSTDs for hospitals and clinics. This collaboration is designed to enhance supply chain efficiency and facilitate more widespread adoption of safe drug handling practices. The initiative underscores the commitment to driving innovation and improving operational effectiveness within the hazardous drug management sector

- In January 2023, companies were unveiling new CSTD solutions at major medical conferences and trade shows, featuring advanced connectivity and integration with electronic health records (EHRs). These innovative systems enable better tracking of drug administration and compliance, allowing users to manage hazardous drug handling more effectively through dedicated systems. These developments highlight the industry’s commitment to integrating advanced technology into drug safety systems, offering healthcare providers enhanced control and ensuring robust protection against occupational exposure

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.