Global Tissue Processing Systems Market

Market Size in USD Million

CAGR :

%

USD

579.51 Million

USD

1,025.89 Million

2024

2032

USD

579.51 Million

USD

1,025.89 Million

2024

2032

| 2025 –2032 | |

| USD 579.51 Million | |

| USD 1,025.89 Million | |

|

|

|

|

Tissue Processing Systems Market Size

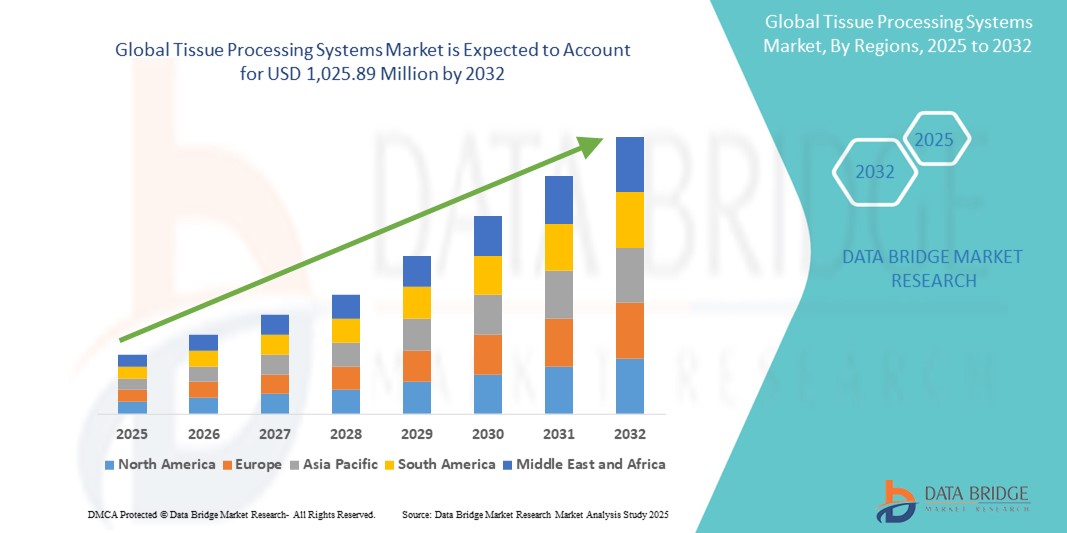

- The global tissue processing systems market size was valued at USD 579.51 million in 2024 and is expected to reach USD 1,025.89 million by 2032, at a CAGR of 7.40% during the forecast period

- The market expansion is primarily driven by the increasing prevalence of chronic diseases and the rising volume of biopsy procedures, necessitating efficient and automated tissue processing solutions for accurate diagnosis

- In addition, advancements in histopathology techniques, coupled with growing demand for high-throughput and standardized processing systems in diagnostic laboratories and research settings, are propelling the market forward. These dynamics are fostering adoption across healthcare institutions, supporting sustained industry growth

Tissue Processing Systems Market Analysis

- Tissue processing systems, essential for preparing biopsy and surgical tissue samples for microscopic examination, are becoming increasingly vital in pathology and diagnostic laboratories due to their ability to automate, standardize, and accelerate sample preparation with high precision and consistency

- The growing demand for tissue processing systems is primarily driven by the rising global incidence of cancer and other chronic diseases, leading to a surge in biopsy procedures and the need for efficient diagnostic workflows

- North America dominated the tissue processing systems market with the largest revenue share of 40.1% in 2024, characterized by advanced healthcare infrastructure, increasing investments in pathology labs, and high adoption rates of automated systems, especially in the U.S., where early cancer detection programs and research initiatives are boosting market penetration

- Asia-Pacific is expected to be the fastest growing region in the tissue processing systems market during the forecast period due to improving healthcare access, rising patient awareness, and increasing government funding for diagnostic services in emerging economies

- Rapid high volume tissue processors segment dominated the tissue processing systems market with a market share of 45.2% in 2024, driven by its ability to handle large sample volumes efficiently and reduce turnaround time in high-throughput laboratories

Report Scope and Tissue Processing Systems Market Segmentation

|

Attributes |

Tissue Processing Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Tissue Processing Systems Market Trends

“Automation and Digital Workflow Integration for Enhanced Laboratory Efficiency”

- A significant and accelerating trend in the global tissue processing systems market is the integration of advanced automation technologies and digital workflow solutions to improve laboratory efficiency, consistency, and diagnostic accuracy. This trend is transforming traditional histopathology workflows into more streamlined, scalable, and error-resistant operations

- For instance, the Leica PELORIS 3 Premium Tissue Processor offers seamless integration with Laboratory Information Systems (LIS), allowing laboratories to achieve complete digital traceability, protocol customization, and improved quality control. Similarly, the Tissue-Tek VIP® 6 AI from Sakura Finetek provides high-throughput capabilities with user-friendly automation, enabling faster sample processing with minimal human intervention.

- Digital connectivity in tissue processors enables remote monitoring, real-time alerts, and automated data logging, which enhances compliance, audit readiness, and operational transparency. These features are becoming essential in busy diagnostic settings where accuracy and speed are critical

- Advancements in smart automation, such as self-cleaning mechanisms, automated reagent management, and intuitive touch interfaces, are helping laboratories reduce manual labor, minimize contamination risks, and improve overall throughput

- Furthermore, the integration of tissue processors with other automated histopathology systems, including embedding centers and digital scanners, is fostering the development of fully digital, end-to-end pathology workflows. This comprehensive approach supports faster diagnoses and more effective patient management

- The demand for intelligent, connected, and automation-ready tissue processing systems is rising rapidly across hospitals, diagnostic laboratories, and research centers. Companies such as Thermo Fisher Scientific, Milestone Medical, and Roche are actively developing solutions that align with digital pathology initiatives and next-generation laboratory automation standards

Tissue Processing Systems Market Dynamics

Driver

“Increasing Cancer Incidence and Demand for Timely Diagnostics”

- The rising global burden of cancer and other chronic diseases is a major driver fueling the demand for advanced tissue processing systems. The need for accurate, timely, and efficient histopathological diagnosis has increased significantly as early detection plays a critical role in effective treatment planning and patient outcomes

- For instance, the World Health Organization estimates a consistent rise in cancer cases worldwide, particularly in developing regions, where improved access to diagnostics is boosting demand for automated and reliable tissue processing equipment

- As healthcare providers and diagnostic laboratories seek to enhance operational efficiency and diagnostic accuracy, there is growing adoption of automated tissue processors that offer faster turnaround times, consistent results, and reduced human error

- Furthermore, the integration of tissue processing systems with digital pathology platforms and laboratory information systems (LIS) supports a more connected and streamlined diagnostic workflow, driving further investment in advanced tissue processing solutions

- The shift towards high-throughput laboratories and centralized diagnostic centers is also contributing to the growing demand for rapid, high-volume tissue processors capable of handling increasing sample loads with minimal operator intervention

Restraint/Challenge

“High Equipment Cost and Limited Access in Resource-Constrained Settings”

- The relatively high cost of advanced tissue processing systems, particularly those offering automation and digital integration, remains a key challenge for market penetration in low- and middle-income regions. Budget limitations in smaller laboratories and public healthcare facilities can hinder procurement and adoption of these systems

- For instance, premium models with integrated digital capabilities and high-capacity throughput can be cost-prohibitive for labs in developing countries, where funding for diagnostic infrastructure is often limited or inconsistent

- In addition, the requirement for trained personnel to operate and maintain sophisticated tissue processors, as well as the ongoing cost of reagents and consumables, adds to the operational burden and deters adoption in under-resourced settings

- Manufacturers must address these challenges by offering cost-effective models, scalable solutions, and supportive service programs to enhance accessibility. Furthermore, strategic partnerships with governments, NGOs, and healthcare organizations may help expand reach in underserved regions

- Bridging this gap will be essential to achieving wider implementation of tissue processing technologies globally, especially in areas with rising diagnostic demands but constrained resources

Tissue Processing Systems Market Scope

The market is segmented on the basis of product type, modality, technology, and end-users.

- By Product Type

On the basis of product type, the tissue processing systems market is segmented into small volume tissue processors, medium volume tissue processors, and rapid high volume tissue processors. The rapid high volume tissue processors segment dominated the market with the largest revenue share of 45.2% in 2024, owing to their ability to handle a large number of samples efficiently and reduce turnaround times in high-throughput laboratories. These systems are especially critical in large diagnostic labs and hospitals that manage high biopsy volumes, supporting timely diagnosis and streamlined workflows.

The medium volume tissue processors segment is expected to register the fastest growth rate from 2025 to 2032, as mid-sized pathology labs increasingly shift from manual to semi-automated solutions to improve efficiency and reduce operator dependency. Their balance of capacity, cost, and automation makes them an attractive solution in emerging markets and regional medical centers.

- By Modality

On the basis of modality, the tissue processing systems market is segmented into stand-alone tissue processing units and bench-top tissue processing units. The stand-alone tissue processing unit segment held the largest market share of 51.2% in 2024, attributed to their wide usage in large hospitals and centralized labs, offering fully automated operation, higher throughput, and advanced features such as reagent management and touchscreen interfaces.

The bench-top tissue processing unit segment is anticipated to grow rapidly through 2032, particularly among smaller laboratories and clinics that require compact, space-efficient solutions without compromising processing quality. These systems cater to facilities with limited space or lower sample volumes while still providing consistent processing outcomes.

- By Technology

On the basis of technology, the tissue processing systems market is segmented into microwave tissue processors and vacuum tissue processors. The vacuum tissue processors segment dominated with a market share of 56.4% in 2024, driven by their superior tissue infiltration, reduced processing times, and widespread adoption across research and diagnostic settings. These systems offer high-quality results and are essential in labs aiming for precise and reproducible diagnostics.

The microwave tissue processors segment is projected to grow at the fastest rate from 2025 to 2032, due to their ability to significantly reduce processing times and improve workflow efficiency. They are increasingly used in time-sensitive clinical environments where rapid diagnosis is critical.

- By End Users

On the basis of end-users, the market is segmented into hospitals, diagnostic laboratories, and others. The hospitals segment led the market with the largest share of 48.9% in 2024, owing to the rising number of surgical procedures and cancer screenings that necessitate histopathological evaluations. Hospitals often invest in high-performance, automated tissue processors to handle large sample volumes efficiently within integrated diagnostic departments.

The diagnostic laboratories segment is expected to witness the fastest growth from 2025 to 2032, supported by the global expansion of private pathology labs and the increasing trend of outsourcing diagnostic services. These labs prioritize scalability, automation, and precision, driving adoption of advanced processing systems to meet growing diagnostic demands.

Tissue Processing Systems Market Regional Analysis

- North America dominated the tissue processing systems market with the largest revenue share of 40.1% in 2024, driven by advanced healthcare infrastructure, increasing investments in pathology labs, and high adoption rates of automated systems

- The region’s strong emphasis on early cancer detection and precision diagnostics has driven demand for high-throughput and reliable tissue processors in hospitals and diagnostic laboratories

- Favorable reimbursement policies, significant investments in pathology lab modernization, and the presence of key market players contribute to North America's leadership in the market, ensuring rapid integration of innovative tissue processing technologies into routine clinical practice

U.S. Tissue Processing Systems Market Insight

The U.S. tissue processing systems market captured the largest revenue share of 78.4% in 2024 within North America, driven by the high prevalence of cancer and chronic diseases, along with advanced laboratory infrastructure. The demand for faster diagnostic turnaround and standardized tissue preparation protocols has led to widespread adoption of automated processing units in pathology labs. In addition, strong investments in digital pathology and centralized lab facilities support continuous upgrades in tissue processing technologies.

Europe Tissue Processing Systems Market Insight

The Europe tissue processing systems market is projected to witness a robust CAGR throughout the forecast period, primarily driven by increasing cancer screening programs, improved healthcare infrastructure, and growing demand for accurate histopathological evaluations. The adoption of automation in laboratory workflows and compliance with strict regulatory standards across the region is fueling the integration of high-efficiency tissue processors in hospitals and diagnostic labs.

U.K. Tissue Processing Systems Market Insight

The U.K. tissue processing systems market is anticipated to grow at a steady CAGR from 2025 to 2032, supported by the National Health Service’s (NHS) commitment to improving pathology services and streamlining cancer diagnostics. Government funding for diagnostic modernization and early detection programs enhances the uptake of automated and high-throughput tissue processing systems.

Germany Tissue Processing Systems Market Insight

The Germany tissue processing systems market is expected to expand at a notable CAGR from 2025 to 2032, driven by its strong focus on technological innovation, precision diagnostics, and centralized pathology services. The country’s high diagnostic testing rates and structured hospital systems promote the adoption of efficient, environmentally friendly, and automated processing technologies.

Asia-Pacific Tissue Processing Systems Market Insight

The Asia-Pacific tissue processing systems market is projected to grow at the fastest CAGR from 2025 to 2032, driven by rising cancer incidence, expanding healthcare access, and increased investments in lab automation in countries such as China, India, and Japan. Government healthcare reforms, improved diagnostic infrastructure, and growing awareness of early disease detection are encouraging adoption across both public and private pathology labs.

Japan Tissue Processing Systems Market Insight

The Japan tissue processing systems market is witnessing steady growth from 2025 to 2032, propelled by the country’s aging population and increased demand for high-quality diagnostic services. The emphasis on automation, compact lab devices, and sustainable technologies aligns with Japan’s preference for efficient, space-saving systems. Integration with digital pathology platforms also supports market expansion.

India Tissue Processing Systems Market Insight

The India tissue processing systems market is anticipated to expand at a rapid CAGR from 2025 to 2032, fueled by increasing cancer cases, growing public and private investments in diagnostic laboratories, and a rising focus on healthcare infrastructure in tier-2 and tier-3 cities. Affordable and rapid tissue processing units are gaining traction, especially in diagnostic labs catering to high patient volumes and limited pathologist availability.

Tissue Processing Systems Market Share

The tissue processing systems industry is primarily led by well-established companies, including:

- Leica Biosystems Nussloch GmbH (Germany)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Thermo Fisher Scientific Inc. (U.S.)

- BioGenex (U.S.)

- JOKOH (Germany)

- Bio Optica Milano Spa (Italy)

- MEDITE Medical GmbH (Germany)

- Agar Scientific Ltd. (U.K.)

- MILESTONE MEDICALS (Italy)

- Sakura Finetek USA, Inc. (U.S.)

- Veolia (France)

- Siemens (Germany)

- General Electric Company (U.S.)

- SLB (U.S.)

- Halliburton (U.S.)

- Weatherford (U.S.)

- Baker Hughes Company (U.S.)

- Ovivo (U.S.)

What are the Recent Developments in Global Tissue Processing Systems Market?

- In May 2024, Leica Biosystems, a global leader in pathology workflow solutions, introduced the HistoCore PEGASUS Plus Tissue Processor, designed to optimize efficiency and reproducibility in histopathology laboratories. This next-generation system offers enhanced reagent management, energy efficiency, and real-time process monitoring, underscoring Leica’s commitment to precision diagnostics and workflow automation in tissue processing

- In April 2024, Thermo Fisher Scientific Inc. expanded its histology product line with the launch of PathStor XT, a compact tissue processing system aimed at improving turnaround time for small to mid-sized laboratories. By combining user-friendly design with smart process control, the innovation reinforces the company's strategy to deliver adaptable and scalable solutions across varying laboratory settings

- In March 2024, Sakura Finetek USA, Inc. unveiled its upgraded Tissue-Tek VIP 6 AI, featuring intelligent protocol optimization and remote connectivity. This release integrates AI-powered features to minimize operator intervention and ensure consistent tissue quality, demonstrating the company’s continued focus on automation and digitization in pathology workflows

- In February 2024, Milestone Medical Technologies, a key player in histopathology innovation, announced the global rollout of LOGOS One EVO, a hybrid tissue processor combining microwave and conventional technologies. This advanced system is aimed at reducing processing times without compromising specimen quality, reflecting Milestone's drive to modernize laboratory practices with energy-efficient, high-speed alternatives

- In January 2024, Epredia, a subsidiary of PHC Holdings Corporation, partnered with PathAI to enhance its automated tissue processing platforms with AI-enabled diagnostic support. The collaboration is focused on integrating digital tools into traditional histology systems, enabling better decision-making and standardization across labs. This initiative represents a significant step towards the convergence of tissue processing and digital pathology for improved clinical outcomes

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.