Global Advanced Gear Shifter System Market

Market Size in USD Billion

CAGR :

%

USD

14.05 Billion

USD

19.16 Billion

2024

2032

USD

14.05 Billion

USD

19.16 Billion

2024

2032

| 2025 –2032 | |

| USD 14.05 Billion | |

| USD 19.16 Billion | |

|

|

|

|

Advanced Gear Shifter System Market Size

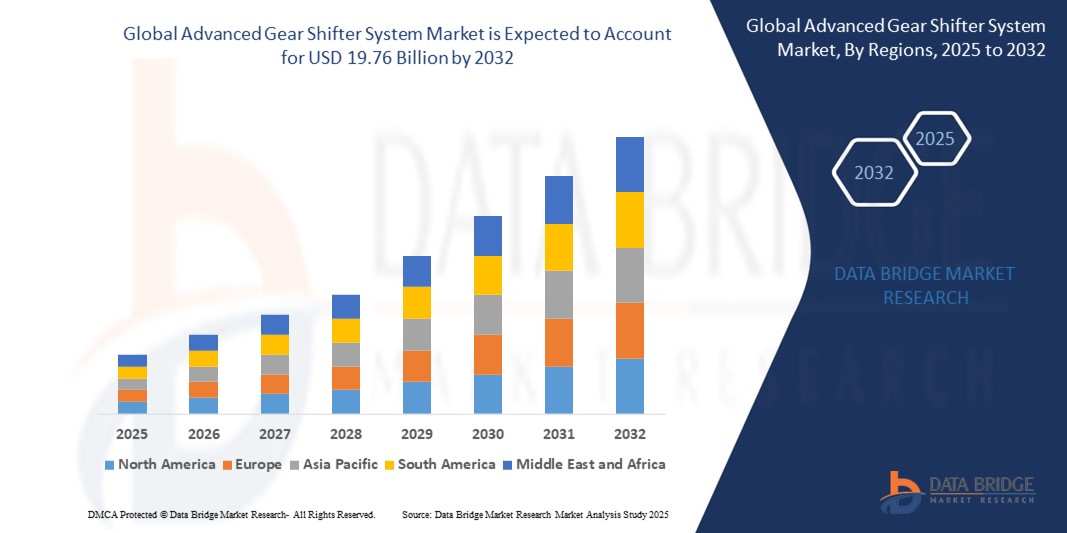

- The global advanced gear shifter system market size was valued at USD 14.05 billion in 2024 and is expected to reach USD 19.76 billion by 2032, at a CAGR of 4.35% during the forecast period

- Market expansion is being driven by the increasing integration of electronics and software in automotive systems, especially in modern transmission systems for enhanced driving comfort and fuel efficiency

- Moreover, the rise in electric vehicles (EVs), automated driving technologies, and consumer preference for vehicles with enhanced ergonomic designs is accelerating the adoption of advanced gear shifter systems, fueling steady industry growth

Advanced Gear Shifter System Market Analysis

- Advanced Gear Shifter Systems, which include electronic, wire-based, or mechatronic gear shifting mechanisms, are becoming crucial in modern vehicles for achieving space optimization, weight reduction, and smooth transmission control

- The growing demand is largely attributed to OEM emphasis on vehicle electrification, driver safety, and customizable cabin layouts, especially in luxury and EV segments

- As consumers seek modern, user-friendly vehicle interfaces, and as automakers increasingly transition to shift-by-wire systems, the advanced gear shifter system market is poised for sustained global growth across passenger and commercial vehicle segments

- Asia-Pacific dominates the advanced gear shifter system market with the largest revenue share of 42.35% in 2024, driven by rapid industrialization, growing automotive production, and increased EV adoption across key economies such as China, Japan, South Korea, and India

- North America is projected to grow at the fastest CAGR of 18.9% during the forecast period (2025–2032), fueled by rising adoption of luxury vehicles, electric trucks, and high-performance SUVs that rely on electronic gear shifter systems

- The Shift-by-Wire (SBW) segment dominated the market with the largest revenue share of 58.6% in 2024, driven by its precision control, elimination of mechanical linkages, and compatibility with modern electric and autonomous vehicle architectures

Report Scope and Advanced Gear Shifter System Market Segmentation

|

Attributes |

Advanced Gear Shifter System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Advanced Gear Shifter System Market Trends

“Shift toward Compact, Integrated, and Electric-Ready Solutions”

- A key trend reshaping the advanced gear shifter system market is the increased demand for compact, integrated systems that support electric vehicle (EV) architectures and autonomous driving features. Automakers are progressively replacing traditional mechanical linkages with electronic and shift-by-wire systems that allow greater flexibility in vehicle interior design and improved fuel efficiency

- For instance, in 2024, ZF Friedrichshafen AG introduced its next-generation electronic gear shifter system, optimized for electric vehicles with integrated park-by-wire functionality and customizable software interfaces to support varying vehicle platforms

- The trend is being further accelerated by the transition to electric mobility, where traditional hydraulic systems are being replaced by lightweight, space-efficient, and electronically actuated gear shifters. These new systems support modular platforms, reduce mechanical complexity, and enhance overall vehicle safety

- Advanced gear shifters are also being integrated with driver-assistance systems (ADAS) to enable features such as predictive shifting and autonomous parking, leading to smarter and more responsive drive experiences

- As automakers seek to deliver streamlined cabin designs, multi-function shift modules are replacing gear levers with buttons, rotary dials, and touchpads, enabling more intuitive interfaces and aligning with modern interior aesthetics

- This ongoing innovation toward intelligent, compact, and EV-compatible gear shifter systems is expected to redefine gear control in next-generation vehicles, driving long-term demand across global markets

Advanced Gear Shifter System Market Dynamics

Driver

“Rising Demand from EV Adoption and Vehicle Electrification Trends”

- The global shift toward electrification of vehicles is a major growth driver for the advanced gear shifter system market, as EV platforms demand electronic and shift-by-wire solutions to replace conventional mechanical linkages

- For instance, in February 2024, Continental AG unveiled a new electronic gear shifter designed specifically for battery electric vehicles (BEVs), highlighting the industry's movement toward wire-controlled gear actuation in EVs and autonomous vehicles

- Advanced Gear Shifter Systems offer seamless integration with electric drivetrains, providing precise control, lower weight, and simplified assembly processes features that are critical for OEMs optimizing for EV production

- In addition, government mandates on emissions reduction and fuel efficiency are pushing automakers to adopt lightweight, electronically controlled systems, making advanced gear shifters a key component in their vehicle design strategies

- The ability to offer modular, scalable, and programmable gear shift solutions provides OEMs with cost-effective platforms adaptable across vehicle segments, further boosting market adoption in the coming years

Restraint/Challenge

“System Complexity and Reliability Concerns in Extreme Conditions”

- Despite their benefits, advanced gear shifter systems face challenges related to system complexity, potential electrical failure, and reliability concerns under extreme driving conditions, such as high temperatures, humidity, or vibration exposure

- For instance, automotive testing reports from 2023 noted performance degradation in certain shift-by-wire modules under high-stress environments, prompting OEMs to focus on ruggedizing their components for better durability

- As these systems rely on multiple electronic control units (ECUs), sensors, and actuators, the risk of malfunction due to electrical or software failure may impact customer confidence, particularly in commercial and heavy-duty applications where downtime is costly

- Moreover, system calibration and integration with other vehicle systems (e.g., ADAS, EV controls) requires substantial engineering effort and costs, especially for mid-sized or cost-sensitive manufacturers

- To mitigate these concerns, companies are investing in rigorous validation testing, enhanced thermal management systems, and fail-safe architectures to ensure reliability and safety, even in adverse operating conditions

- Continuous innovation in software redundancy, automated diagnostics, and real-time failure detection will be essential for ensuring widespread acceptance and long-term reliability of these advanced systems

Advanced Gear Shifter System Market Scope

The market is segmented on the basis of technology, component, vehicle type, and electric vehicle type.

• By Technology

On the basis of technology, the advanced gear shifter system market is segmented into Automatic Shifter and Shift-by-Wire (SBW). The Shift-by-Wire (SBW) segment dominated the market with the largest revenue share of 58.6% in 2024, driven by its precision control, elimination of mechanical linkages, and compatibility with modern electric and autonomous vehicle architectures. Automakers are increasingly adopting SBW systems due to their space-saving benefits, enhanced driving experience, and seamless integration with electronic systems.

The Automatic Shifter segment is expected to witness steady growth through 2032, propelled by its continued use in conventional internal combustion vehicles and gradual transition toward semi-automated systems in mid-range models.

• By Component

On the basis of component, the advanced gear shifter system market is segmented into CAN Module, Electronic Control Unit (ECU), Solenoid Actuator, and Others. The Solenoid Actuator segment held the largest revenue share of 59.9% in 2024, due to the rapid evolution of automotive electronics has paved the way for sophisticated transmission systems. Enhanced microcontrollers, sensors, and software algorithms enable more efficient and reliable gear shifting, making solenoid actuator-based systems more attractive.

The CAN module segment is anticipated to register a significant growth during the forecast period. Increasing focus on safety and stringent regulatory standards are driving the demand for the segment, as CAN modules contribute to enhancing safety features in gear shifters by enabling precise control and real-time monitoring of transmission systems.

• By Vehicle Type

On the basis of vehicle type, the advanced gear shifter system market is segmented into Light-Duty Vehicle (LDV) and Commercial Vehicle. The Light-Duty Vehicle (LDV) segment dominated the market with the largest revenue share of 67.3% in 2024, attributed to the high production volume, increased consumer preference for passenger vehicles, and rising adoption of advanced driving technologies in the segment.

The Commercial Vehicle segment is anticipated to grow at the fastest CAGR during the forecast period, driven by the demand for durable, efficient, and electronically controlled gear systems to enhance fleet performance, reduce maintenance, and improve driver comfort in logistics and transport operations.

• By Electric Vehicle Type

On the basis of electric vehicle type, the advanced gear shifter system market is segmented into Battery Electric Vehicle (BEV), Fuel Cell Electric Vehicle (FCEV), and Plug-In Hybrid Electric Vehicle (PHEV). The Battery Electric Vehicle (BEV) segment accounted for the largest market share of 49.4% in 2024, driven by the global push toward zero-emission vehicles, extensive government incentives, and increasing consumer interest in sustainable transportation.

The Plug-In Hybrid Electric Vehicle (PHEV) segment is projected to witness the fastest growth rate from 2025 to 2032, as automakers position PHEVs as a transitional technology combining traditional fuel range with electric drive benefits.

Advanced Gear Shifter System Market Regional Analysis

- Asia-Pacific dominates the advanced gear shifter system market with the largest revenue share of 42.35% in 2024, driven by rapid industrialization, growing automotive production, and increased EV adoption across key economies such as China, Japan, South Korea, and India

- The region benefits from strong OEM presence, favorable government initiatives promoting EVs and smart automotive technologies, and a rising middle-class population demanding high-performance vehicles equipped with advanced transmission systems

- The proliferation of electric mobility and autonomous vehicle development is fueling demand for shift-by-wire and mechatronic gear shifter systems, especially in technologically progressive nations such as China and Japan

- The availability of cost-effective manufacturing, skilled labor, and strategic production hubs further consolidates Asia-Pacific’s leadership in the global market

China Advanced Gear Shifter System Market Insight

China accounted for the largest revenue share in the Asia-Pacific advanced gear shifter system market in 2024, underpinned by its role as a global automotive manufacturing hub and strong government policies promoting new energy vehicles (NEVs). The rise in domestic EV sales, growing investment in smart drivetrain systems, and robust demand for modular shift-by-wire solutions have established China as a critical contributor to market growth.

Japan Advanced Gear Shifter System Market Insight

Japan’s market is advancing steadily, propelled by its technological leadership, automotive innovation, and emphasis on miniaturized, high-precision components. Japanese automakers are prioritizing shift-by-wire and compact electronic shifter solutions to support next-gen hybrid and EV models. Japan’s focus on automated driving and vehicle-to-everything (V2X) integration is further supporting the adoption of advanced shifter systems.

India Advanced Gear Shifter System Market Insight

India is emerging as a high-growth market due to rapid vehicle electrification, government-backed initiatives such as FAME-II, and increasing consumer demand for automated transmission systems in mid-segment cars. The growing presence of global automotive players, local production capabilities, and a push toward affordable electric vehicles are expected to bolster demand for advanced and compact gear shifting mechanisms.

North America Advanced Gear Shifter System Market Insight

North America is projected to grow at the fastest CAGR of 18.9% during the forecast period (2025–2032), fueled by rising adoption of luxury vehicles, electric trucks, and high-performance SUVs that rely on electronic gear shifter systems. Consumers in the U.S. and Canada are increasingly seeking innovative in-vehicle experiences, with demand surging for customizable, software-driven gear shifting modules. Automakers are integrating driver-assistance features and touch-based shift controls, particularly in EVs, further driving market expansion.

U.S. Advanced Gear Shifter System Market Insight

The U.S. dominates the North American market in 2024, propelled by strong consumer preference for shift-by-wire systems, rising sales of electric and autonomous vehicles, and robust investments from major OEMs in vehicle electronics. The trend toward software-defined vehicles (SDVs) is driving further adoption of programmable and integrated gear shifter solutions.

Europe Advanced Gear Shifter System Market Insight

Europe is witnessing steady growth, backed by the region’s strict emission regulations, high EV adoption, and the presence of top-tier automotive OEMs such as BMW, Mercedes-Benz, and Volkswagen. Advanced Gear Shifter Systems are gaining traction due to their ability to reduce weight and enhance energy efficiency in electric drivetrains. Regulatory support for carbon neutrality and intelligent transmission systems is also encouraging market penetration across both new and existing vehicle platforms.

Germany Advanced Gear Shifter System Market Insight

Germany remains a key contributor in Europe, owing to its advanced automotive engineering ecosystem, continuous R&D investments, and growing emphasis on connected car solutions. The adoption of intelligent shift modules, integrated with ADAS and telematics, is expanding across premium and commercial vehicle segments.

U.K. Advanced Gear Shifter System Market Insight

The U.K. market is growing at a noteworthy CAGR, supported by the country’s commitment to EV adoption, digital vehicle interiors, and strong demand for eco-efficient mobility solutions. Innovations in compact shifter design and regulatory incentives for clean transportation are expected to enhance the growth trajectory.

Advanced Gear Shifter System Market Share

The advanced gear shifter system industry is primarily led by well-established companies, including:

- ZF Friedrichshafen AG (Germany)

- KA Group AG (Norway)

- Stoneridge (U.S.)

- DURA (U.S.)

- Ficosa Internacional SA (Spain)

- Eissmann Group Automotive (Germany)

- KÜSTER Group (Germany)

- Leopold Kostal GmbH & Co. KG (Germany)

- Orscheln Products (U.S.)

- ATSUMITEC Co., Ltd. (Japan)

- SL Corporation (South Korea)

- REMSONS (India)

- SILA Group (Italy)

- DENSO CORPORATION (Japan)

- TOKAIRIKA, CO., LTD. (Japan)

- Sanjeev Group (India)

- Delta Kogyo Co., Ltd. (Japan)

Latest Developments in Global Advanced Gear Shifter System Market

- In September 2023, SRAM launched an advanced e-bike powertrain drive system, integrating cutting-edge motor technology with intelligent battery management to improve cycling efficiency and battery longevity. This innovation addresses the rising global demand for sustainable and high-performance urban mobility solutions, reinforcing SRAM’s position in the green transportation market

- In June 2023, Toyota Motor Corporation unveiled plans to appeal to driving purists by introducing a manual-like transmission system in its electric vehicles, featuring a simulated stick shift, clutch, and revving sounds. This unique feature aims to preserve the traditional driving experience within EVs, blending nostalgic control with futuristic performance

- In April 2023, BYD debuted the BYD Seal sports sedan equipped with the KOSTAL Gear Shifter, a multifunctional control element that manages gear shifting and integrates buttons for various comfort features. This launch reflects BYD's commitment to enhancing driving comfort and interior functionality in electric vehicles

- In September 2021, Hyundai Mobis revealed an innovative folding steering wheel system capable of retracting up to 25 centimeters (9.8 inches), creating more cabin space. In autonomous mode, this system allows the driver’s seat to rotate 180°, transforming the interior into a more social and spacious environment, signaling a new direction in automotive interior design

- In April 2021, Tesla introduced a touchscreen-based gear-shifting interface in its revamped Model X and Model S, enabling intuitive gear control through the central infotainment system. This interface elevates user convenience and interior minimalism, showcasing Tesla’s ongoing leadership in vehicle control innovation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.