Global Exhaust System Market

Market Size in USD Million

CAGR :

%

USD

32.40 Million

USD

59.09 Million

2024

2032

USD

32.40 Million

USD

59.09 Million

2024

2032

| 2025 –2032 | |

| USD 32.40 Million | |

| USD 59.09 Million | |

|

|

|

|

Exhaust System Market Size

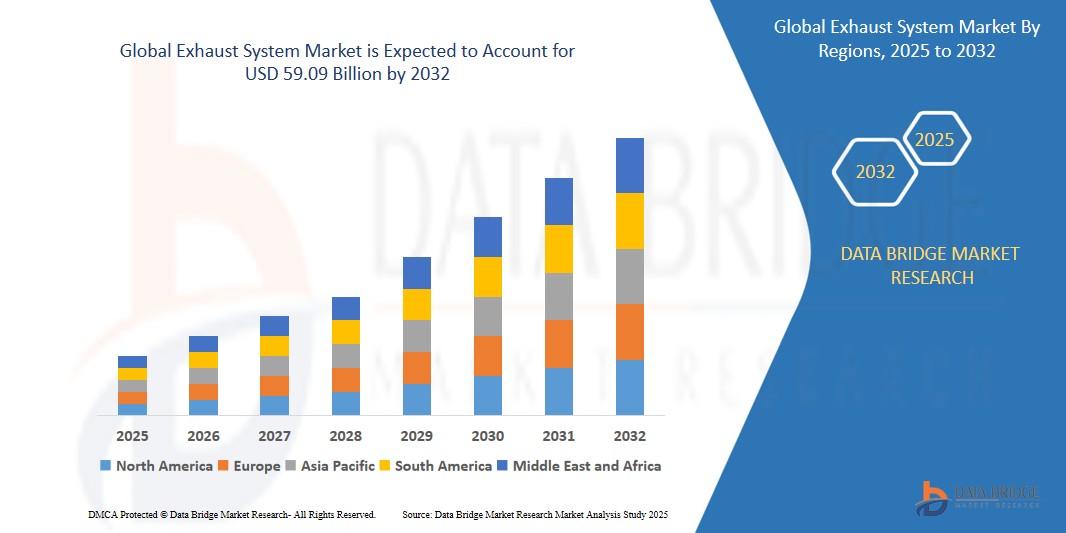

- The Global Exhaust System Market size was valued at USD 32.4 billion in 2024 and is expected to reach USD 59.09 billion by 2032, at a CAGR of 9.0% during the forecast period

- This growth is driven by factors such as the Stringent Emission Regulations, Advancements in Exhaust Technologies, and Rising Vehicle Production and Sales

Exhaust System Market Analysis

- An exhaust system can usually be defined as the piping system that directs the harmful and toxic gases away from the engine and user of the vehicles. The entire system of pipes usually contains two or more directing system of pipes that flows the harmful gases away from the engine and user while directing the fuel towards the engine

- The high rate of vehicle emissions and pollution is the main driving force in the growth of the emissions system. Strict regulation that appeals to automakers and ventilation systems to develop products and related technologies is also a driving force in the venture market market. The ongoing R&D activities for the production of production systems are also an opportunity for the growth of the production system market

- Asia-Pacific will dominate the exhaust system market due to the increasing production of the vehicles. Availability of low cost skilled labour, reduced import duties, and benefits for setting up manufacturing plants also helps the growth of market in this region

- North America will witness its growth rate due to the growing government regulations regarding the emissions of the harmful gases

- Diesel Oxidation Catalyst (DOC) segment is expected to dominate the market with a market share of 54.27% due to its effectiveness in reducing harmful emissions and meeting stringent environmental regulations

Report Scope and Exhaust System Market Segmentation

|

Attributes |

Exhaust System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Exhaust System Market Trends

“Shift Toward Lightweight Exhaust Systems for Enhanced Fuel Efficiency”

- Reducing vehicle weight is a primary strategy to improve fuel efficiency and reduce emissions. Automakers are increasingly adopting lightweight materials such as high-strength stainless steel alloys and aluminum in exhaust system components. These materials offer durability and corrosion resistance while contributing to overall vehicle weight reduction.

- By lowering weight, vehicles require less energy to operate, leading to improved fuel economy and reduced CO₂ emissions. This trend aligns with global regulatory pressures and consumer demand for more eco-friendly vehicles.

- For instance, In January 2024, Tenneco Inc. introduced a new integrated thermal management system designed to enhance the efficiency of exhaust systems in hybrid and conventional vehicles. This system maintains optimal temperatures for efficient operation and emission control. By utilizing lightweight materials, the system contributes to overall vehicle weight reduction. Tenneco's innovation supports the industry's move towards more fuel-efficient and environmentally friendly vehicles. The system's design emphasizes both performance and sustainability

Exhaust System Market Dynamics

Driver

“Growing Vehicle Production and Sales in Emerging Markets”

- The increasing production and sales of vehicles in emerging markets, such as China, India, and Brazil, are significantly contributing to the demand for automotive exhaust systems. Factors such as rapid urbanization, rising disposable incomes, and improved road infrastructure are driving the growth of the automotive industry in these regions.

- As the number of vehicles on the road increases, so does the need for efficient and compliant exhaust systems to manage emissions and ensure environmental standards are met. This trend presents a substantial opportunity for exhaust system manufacturers to expand their market presence and cater to the growing demand in these regions.

For instance,

- In 2022, China had 300 million motor vehicles, excluding two-wheelers, making it the largest holder of the fleet of motor vehicles in the world. The rapid expansion of vehicle production and sales in China is driving the demand for exhaust systems. Manufacturers are focusing on improving vehicle performance and ensuring compliance with regulatory requirements. The growing vehicle fleet necessitates efficient exhaust systems to manage emissions. This trend underscores the significant market potential in emerging economies.

Opportunity

“Demand for Lightweight Exhaust Systems to Enhance Fuel Efficiency”

- Reducing vehicle weight is a key strategy for improving fuel efficiency and lowering emissions. By adopting lightweight materials such as high-grade stainless steel alloys, manufacturers can create robust yet lighter exhaust systems.

- This approach not only meets stringent emission standards but also contributes to better fuel economy and reduced CO₂ emissions. As consumers and regulators increasingly prioritize environmental sustainability, the demand for lightweight exhaust systems is expected to grow, presenting a significant opportunity for manufacturers to innovate and expand their product offerings.

For instance,

- In February 2024, Tenneco Inc. received a grant for developing a vehicle exhaust system with a pre-heating burner assembly aimed at reducing emissions during start-up. This innovation focuses on enhancing air quality by decreasing harmful pollutant discharges during engine start-up. The system's design emphasizes lightweight materials to improve fuel efficiency and thermal management. Tenneco's initiative aligns with global trends towards reducing vehicle weight and emissions. This development underscores the industry's commitment to sustainable automotive solutions.

Restraint/Challenge

“High Costs of Advanced Emission Control Technologies”

- The integration of advanced emission control technologies, such as Selective Catalytic Reduction (SCR) systems, Diesel Particulate Filters (DPF), and Gasoline Particulate Filters (GPF), has become essential to meet stringent global emission standards. However, these technologies come with significant costs due to the use of precious metals like platinum, palladium, and rhodium in catalytic converters. For instance, the price of palladium has seen substantial fluctuations, impacting the overall cost structure of exhaust systems. Additionally, the complexity of designing and manufacturing these systems adds to the expenses. This financial burden can deter manufacturers, especially in price-sensitive markets, from adopting these technologies, potentially hindering the growth of the exhaust system market.

For instance,

- In March 2024, a report highlighted that the rising costs of raw materials, particularly precious metals used in catalytic converters, have led to increased production costs for automotive exhaust systems. Manufacturers are facing challenges in balancing compliance with emission standards and maintaining competitive pricing. The volatility in metal prices has made it difficult for companies to forecast costs accurately. This situation underscores the financial strain on the industry and the need for cost-effective solutions. The report suggests that without stabilization in raw material prices, the adoption of advanced emission control technologies may be limited.

Exhaust System Market Scope

The market is segmented on the basis after-treatment device, component, vehicle type, aftermarket vehicle type and off-highway vehicle type.

|

Segmentation |

Sub-Segmentation |

|

After-treatment device |

|

|

Component |

|

|

Vehicle type |

|

|

Aftermarket vehicle type |

|

|

Off-highway vehicle type |

|

In 2025, the Diesel Oxidation Catalyst (DOC) is projected to dominate the market with a largest share in segment

In 2025, the Diesel Oxidation Catalyst (DOC) is projected to dominate the market with the largest share of 54.27% in the segment, owing to its effectiveness in reducing harmful emissions like carbon monoxide and hydrocarbons, and its widespread adoption in diesel-powered vehicles to meet stringent global emission regulations.

The Diesel Particulate Filter (DPF) is expected to account for the largest share during the forecast period in market

The Diesel Particulate Filter (DPF) is expected to account for the largest share of 49.38% during the forecast period in the market, driven by rising diesel vehicle sales and stringent emission norms requiring efficient filtration of particulate matter.

Exhaust System Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the Exhaust System Market”

- Asia-Pacific holds the largest share in the exhaust system market due to its high vehicle production volume, rapidly expanding automotive industry, and growing implementation of emission regulations in countries like China, India, and Japan.

- The presence of major automobile manufacturers, along with rising consumer demand for personal and commercial vehicles, further supports this dominance.

- Additionally, government initiatives to curb pollution are pushing the adoption of advanced exhaust technologies. The region’s strong supply chain and cost-effective manufacturing capabilities make it a global hub for automotive components. This collective momentum positions Asia-Pacific as the market leader in exhaust systems.

“North America is Projected to Register the Highest CAGR in the Exhaust System Market”

- North America is projected to register the highest Compound Annual Growth Rate (CAGR) in the automotive exhaust system market during the forecast period. This growth is driven by several factors, including stringent emission regulations, increased demand for low-emission vehicles, and a robust automotive manufacturing base.

- The U.S., in particular, is experiencing significant growth due to its large vehicle production volume and the presence of major Original Equipment Manufacturers (OEMs) such as General Motors, Ford, and Stellantis. These companies are investing heavily in research and development to meet regulatory requirements and consumer demand for cleaner vehicles.

- Additionally, the aftermarket sector is expanding as consumers seek replacement parts and maintenance services for their vehicles. Overall, North America's commitment to environmental sustainability and technological innovation positions it as a leader in the automotive exhaust system market.

Exhaust System Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Faurecia,

- Tenneco Inc., Continental AG,

- Eberspächer,

- FUTABA INDUSTRIAL CO.LTD.,

- Benteler International,

- Friedrich Boysen GmbH & Co. KG,

- Yutaka Giken Company Limited,

- Sejong Industrial Co.Ltd.,

- BOSAL,

- MAGNAFLOW,

- KATCON GLOBAL,

- Grand Rock Co. Inc.,

- Magneti Marelli S.p.A.,

- FennoSteel,

- Eminox,

- European Exhaust and Catalyst Ltd,

- SANGO Co. Ltd.,

- Calsonic Kansei Corporation,

- Sharda Motor Industries Ltd.,

- DENSO CORPORATION

Latest Developments in Global Exhaust System Market

- In March 2025, Continental AG introduced the Conti EfficientPro 5 and Conti Urban NXT tires, marking significant advancements in energy efficiency and sustainability for commercial vehicles. The Conti EfficientPro 5 boasts a 10% improvement in rolling resistance compared to its predecessor, achieving an EU tire label Class A rating. Designed for both combustion and electric trucks, it enhances fuel efficiency and extends battery range. The Conti Urban NXT, tailored for urban transport, incorporates up to 59% renewable and recycled materials, offering reduced rolling resistance and increased mileage, making it ideal for electrified city buses and delivery vehicles. Both tires are set to be commercially available from the start of 2025.

- In April 2025, At bauma Eberspächer unveiled the Falkon Dualtronic, an innovative heat pump system designed for off-highway vehicles. This system provides efficient heating and cooling for the cabin, battery, and engine, optimizing energy use in electric and hybrid vehicles. The Dualtronic heat pump offers up to 6 kW of heating and 7 kW of cooling, significantly enhancing energy efficiency and comfort in construction machinery. Eberspächer's integrated thermal management solutions aim to improve overall vehicle performance and range, aligning with the industry's shift towards electrification.

- In December 2024, Continental AG announced plans to spin off its Automotive group sector by the end of 2025. The decision, subject to supervisory board approval in March 2025, aims to create a leaner, more focused organizational structure. Preparations for the spin-off are expected to be completed by the end of the third quarter of 2025. This strategic move is intended to enhance the company's focus on its profitable Tires and ContiTech sectors, allowing for greater independence and agility in the automotive market.

- In January 2025, DENSO CORPORATION announced its participation in the Bharat Mobility Global Expo 2025, held at Bharat Mandapam, Pragati Maidan, New Delhi. As a leading global mobility supplier, DENSO showcased its latest advancements in electrification, advanced driver assistance systems, and data-driven solutions. The company's exhibition, located under the NASSCOM Pavilion, highlighted its commitment to driving innovation that enhances safety and sustainability in the mobility sector. DENSO's participation underscored its dedication to contributing significantly to creating safer roads and reducing carbon footprints in the evolving Indian automotive landscape

- In October 2024, European Exhaust and Catalyst Ltd. (EEC) announced the addition of 14 new part numbers to their extensive product lineup. These new offerings include 89 Catalysts, 32 Diesel Particulate Filters (DPFs), and 32 Exhaust applications, significantly expanding their coverage in the emissions control market. This development reinforces EEC’s dedication to providing high-quality, innovative solutions for both modern and older vehicles, ensuring compliance with increasingly stringent environmental standards. With this expansion, EEC continues to support the automotive industry’s efforts to reduce emissions, delivering reliable and efficient products that meet the growing demands of their customers across various applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.