Global Conveyor System Market

Market Size in USD Billion

CAGR :

%

USD

10.36 Billion

USD

15.07 Billion

2024

2032

USD

10.36 Billion

USD

15.07 Billion

2024

2032

| 2025 –2032 | |

| USD 10.36 Billion | |

| USD 15.07 Billion | |

|

|

|

|

Conveyor System Market Size

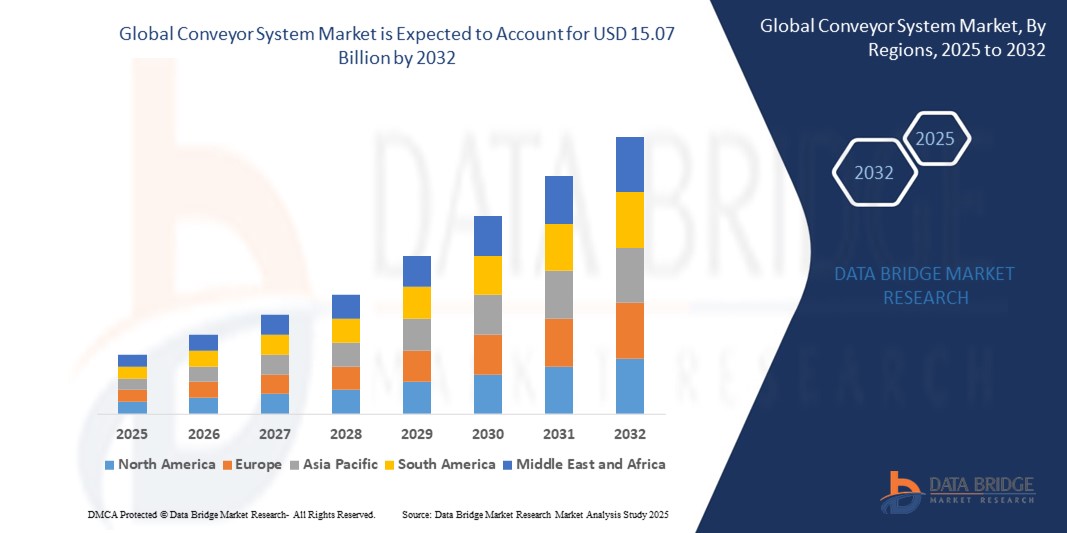

- The Global Conveyor System Market size was valued at USD 10.36 billion in 2024 and is expected to reach USD 15.07 billion by 2032, at a CAGR of 5.5% during the forecast period

- The Global Conveyor System Market is growing due to rising demand for automation across industries like manufacturing, food & beverage, and e-commerce. Companies are focusing on streamlining operations and reducing labor costs, which drives conveyor adoption

Conveyor System Market Analysis

- Conveyor system is a type of automated machine handling operation that involves transportation of equipment, materials, product from one position to another. They are majorly utilized in transferring and transportation of heavy-weighted items, as they can perform this task with ease and high effectiveness.

- It is also used in production lines, as well as in sorting procedures in a number of warehouses, manufacturing facilities and factories.

- Asia Pacific dominates the Conveyor System Market with the largest revenue share of 46.21% in 2025, growing mining activities around the globe, increasing passenger handling capacities of airports & freight, rising ecommerce trend to fuel the demand for conveyor systems in the industry

- North America is the second largest region in terms of growth in conveyor system market due to rising demand for processed food to boost the demand for food & beverage conveyor systems and rising awareness about personal wellness to increase demand for conveyor systems in the industry in this region

- Warehouse & Distribution segment is expected to dominate the Conveyor System Market with a market share of 51.2% in 2025, driven by rising ecommerce trend to fuel the demand for conveyor systems in the industry

Report Scope and Conveyor System Market Segmentation

|

Attributes |

Conveyor System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Conveyor System Market Trends

“Growing Integration of Modular and Scalable Conveyor Designs”

- A significant trend shaping the market is the growing preference for modular and scalable conveyor systems. As production lines and warehouse operations become more dynamic, businesses need conveyor systems that can adapt quickly to changing requirements. Modular systems allow easy expansion, reconfiguration, or relocation without major disruptions or investments. This flexibility is particularly useful for industries like food & beverage, pharmaceuticals, and e-commerce where layouts often change. Companies also benefit from reduced downtime during system upgrades or maintenance. These modular conveyors are designed with plug-and-play components, making them user-friendly and easy to maintain.

- The scalability of these systems supports both small operations and large, multi-site enterprises. In fast-growing regions like Asia-Pacific, where industrial growth is rapid, this adaptability is crucial. Overall, the trend reflects a broader movement toward more agile, future-proof industrial solutions.

- For instance, In January 2025, FlexLink (a Coesia company) launched a customizable conveyor solution aimed at manufacturers needing quick scalability. Their new system allows clients to reconfigure layout designs within days instead of weeks. FlexLink highlighted its usefulness for fast-growing businesses and seasonal operations. The system supports a mix of materials and production needs, offering both flexibility and efficiency. This launch showcases the market’s growing demand for modular, easily scalable conveyor solutions.

Conveyor System Market Dynamics

Driver

“Rapid Growth in E-Commerce and Warehouse Automation”

- The boom in e-commerce has dramatically increased demand for conveyor systems, especially in warehousing and order fulfillment operations. Online retailers need faster and more efficient ways to handle high volumes of packages, which is driving investment in automated material handling solutions. Conveyor systems streamline movement of goods, reduce human labor, and improve order accuracy, which is essential in this competitive space. Fulfillment centers require high-speed, adaptable conveyors to keep up with fast-changing consumer demands. The need to meet same-day and next-day delivery expectations further strengthens this trend.

- Additionally, global supply chain disruptions have encouraged companies to modernize their warehousing infrastructure. As businesses shift toward automation, conveyor systems are becoming a core component of warehouse design. The e-commerce sector’s continuous growth ensures long-term demand for efficient, scalable conveyor systems globally.

For instance,

- In March 2025, Interroll Group announced the expansion of its modular conveyor platform tailored for e-commerce fulfillment centers. This new line focuses on speed and adaptability, supporting same-day delivery demands. Interroll’s systems integrate easily with robotics and warehouse management software. The company highlighted major partnerships with online retailers across North America and Europe. This development reflects the surging demand for automated conveyors driven by the e-commerce boom.

Opportunity

“Rising Demand from E-Commerce and Warehousing Sectors”

- The rapid growth of e-commerce and the increasing demand for efficient logistics and warehousing operations present a major opportunity for the conveyor system market. Online retailers and third-party logistics providers are expanding their fulfillment centers, requiring automated systems to improve the movement and sorting of goods. Conveyor systems reduce human error, increase throughput, and enhance order accuracy, making them ideal for fast-paced, high-volume environments. As companies race to meet next-day delivery expectations, automated conveyor systems are becoming essential infrastructure.

- Additionally, the global shift toward omni-channel retailing further increases complexity, prompting investment in intelligent conveyor technologies. These systems offer flexibility, scalability, and real-time monitoring, all of which are crucial in modern supply chains. Markets in Asia-Pacific and North America, especially, are seeing high demand due to increased online shopping behavior.

For instance,

- In April 2025, Interroll Group announced new investments in modular conveyor systems tailored for e-commerce warehouses in North America. These systems are designed to meet the increasing demand for faster parcel sorting and reduced downtime. The company is focusing on expanding its footprint in fulfillment centers supporting major online retailers. Interroll's new solutions emphasize energy efficiency and adaptability to smaller warehouse footprints. This move reflects how growing e-commerce is shaping the need for advanced conveyor systems

- Customizable and modular conveyor systems are particularly attractive for small and mid-size warehouse operators. This opportunity is expected to expand further with the global push for automation.

Restraint/Challenge

“High Initial Investment and Maintenance Costs”

- One of the biggest challenges in the conveyor system market is the high initial cost involved in setting up automated material handling infrastructure. Installing conveyor systems—especially advanced ones with automation, sensors, or robotics—can be a major financial burden, particularly for small and medium-sized enterprises. These systems also require ongoing maintenance, spare parts, and technical expertise, which adds to the long-term expenses. For many businesses operating on thin margins, the cost-benefit ratio may not justify the investment, especially in regions with low labor costs.

- Additionally, frequent system upgrades and integration with software platforms can further strain budgets. This cost factor limits adoption, especially in developing economies or in industries where automation is not yet a top priority. Businesses may opt for manual or semi-automated solutions as a cheaper alternative. As a result, high capital and operational costs remain a barrier to market growth.

For instance,

- In January 2025, BEUMER Group acknowledged the rising concerns from small manufacturers over the upfront costs of its advanced conveyor solutions. Many clients, especially in Southeast Asia and Latin America, have requested scaled-down or modular systems. BEUMER responded by introducing a leasing model for their conveyor lines to reduce financial pressure. The company also launched training services to cut external maintenance needs. This shift highlights the financial barriers that prevent many businesses from adopting full-scale systems.

Conveyor System Market Scope

The market is segmented on the basis industry and type.

|

Segmentation |

Sub-Segmentation |

|

Industry |

|

|

Type |

|

In 2025, the Warehouse & Distribution is projected to dominate the market with a largest share in segment

In 2025, the Warehouse & Distribution segment is expected to lead the Global Conveyor System Market, capturing the largest share of 51.2%. This dominance is driven by the booming e-commerce sector and increasing demand for faster order fulfillment. Warehouses are investing heavily in conveyor automation to streamline sorting, packaging, and inventory handling. Efficient material flow and reduced labor dependency are key advantages fueling this growth. As global logistics expand, this segment will remain a major revenue contributor

The Automotive is expected to account for the largest share during the forecast period in market

The Automotive segment is projected to hold the largest share of 47.32% in the Global Conveyor System Market during the forecast period. This is due to rising vehicle production and the increasing need for automation in assembly lines. Automakers are adopting conveyor systems to improve precision, reduce manual labor, and enhance production speed. The shift toward electric vehicles (EVs) is also accelerating demand for flexible conveyor technologies. Overall, automotive manufacturing remains a core driver of market expansion.

Conveyor System Market Regional Analysis

“Asia Pacific Holds the Largest Share in the Conveyor System Market”

- Asia Pacific holds the largest share in the Global Conveyor System Market, driven by rapid industrialization and the expansion of key industries such as automotive, food & beverage, and e-commerce.

- Countries like China, India, and Japan are investing heavily in manufacturing and logistics infrastructure. The region's growing consumer base has also led to a surge in retail and warehouse automation. Additionally, government initiatives supporting smart factory development are boosting conveyor adoption.

- Labor cost efficiency and rising demand for faster production processes further support market growth. With increasing foreign investments and technological advancements, Asia Pacific continues to lead globally. Its strategic position in global supply chains strengthens its dominance in the conveyor system landscape.

“North America is Projected to Register the Highest CAGR in the Conveyor System Market”

- North America is projected to register the highest CAGR in the Global Conveyor System Market, fueled by growing investments in automation and smart manufacturing. The region's strong presence of advanced industries, including automotive, aerospace, and logistics, is driving the adoption of efficient conveyor solutions. E-commerce growth in the U.S. and Canada has also led to increased demand for automated warehousing and material handling systems.

- Moreover, the push toward Industry 4.0 and the integration of IoT in manufacturing are further accelerating market growth. Companies are focusing on optimizing productivity and reducing labor dependency through advanced conveyor technologies.

- Environmental sustainability and energy-efficient systems are gaining traction. The rising trend of robotics integration in material flow processes supports market expansion. As digital transformation reshapes industrial operations, North America is poised for substantial growth in conveyor system deployment.

Conveyor System Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- WESTFALIA TECHNOLOGIES INC.,

- Schaefer Systems International Inc.,

- Emerson Electric Co.,

- Dematic,

- Continental AG,

- Bastian Solutions Inc.,

- Somi Conveyor Beltings Ltd.,

- TGW Logistics Group,

- Fives,

- Siemens,

- Honeywell Intelligrated,

- Vanderlande Industries B.V.,

- Invata Intralogisitcs,

- Taikisha Ltd.,

- Daifuku Co. Ltd.,

- Swisslog Holding Ltd.,

- Conveyor Systems Ltd,

- PHOENIX CBS GmbH

- Khare Agromech Industries Pvt.Ltd.

Latest Developments in Global Conveyor System Market

- In February 2025, Daifuku introduced the AS-35 at ProMat 2025. This advanced sortation system features an innovative slat tracking mechanism, eliminating tracking errors and ensuring precise carton diverting. Designed for high-speed operations, it offers scalability, quiet operation, and simplified maintenance, making it ideal for diverse intralogistics environments.

- In February 2025, Siemens unveiled the Industrial Copilot for Operations, an AI-driven solution integrated with the TIA Portal. This innovation enables real-time decision-making on the shop floor, enhancing productivity and minimizing downtime. By bringing AI tasks closer to machines, it facilitates rapid, data-driven operations across various industrial sectors.

- In January 2025, TGW Logistics showcased the SmartPocket and Quba robots at LogiMAT 2025. The SmartPocket utilizes mobile robots moving autonomously along intersecting rails, offering scalable and flexible sortation solutions. The Quba robots, developed in partnership with SAFELOG, provide rapid and flexible transport solutions, meeting the demands of modern logistics.

- In March 2025, Dematic featured the Eurofork 4es and Autonomous Mobile Robots (AMRs). These innovations enhance operational efficiency and adaptability in supply chains. Dematic's commitment to sustainability was also highlighted, showcasing efforts to reduce energy consumption and improve performance across its solutions.

- In January 2025, Siemens launched the MACHINUM portfolio at IMTEX 2025. This suite of machine tool solutions, part of the Siemens Xcelerator platform, aims to streamline digital transformation in manufacturing. With features like the SINUMERIK Run MyVirtual Machine, it reduces setup time and minimizes production risks, supporting sustainable and efficient manufacturing processes.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.