Asia-Pacific Functional Mushroom Market, By Species (Shiitake, Reishi, Chaga, Lion's Mane, Cordyceps, Maitake, Turkey Tail, Tremella, Others), Product Type (Cultivated, Wild), Category (Regular, Full Spectrum), Nature (Conventional, Organic), Cultivation Method (Bed Cultivated, Log/Wood Cultivated), Application (Pharmaceutical, Food & Beverages, Dietary Supplements, Nutraceutical, Sports Nutrition, Personal Care, Others) Industry Trends and Forecast to 2029.

Asia-Pacific Functional Mushroom Market Analysis and Insights

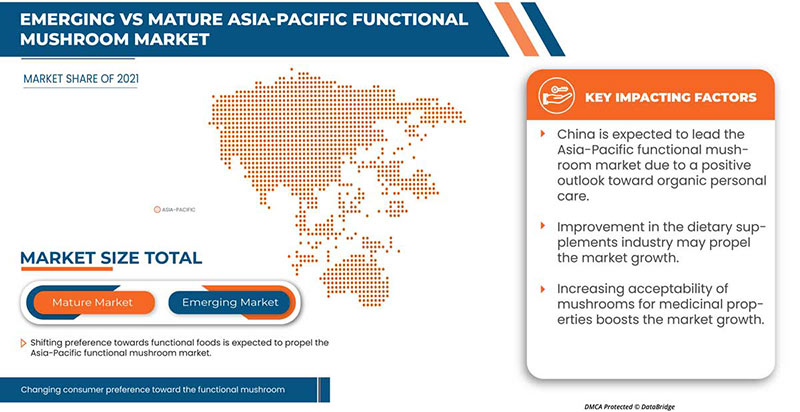

The Asia-Pacific functional mushroom market is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 6.6% in the forecast period of 2022 to 2029 and is expected to reach USD 248,818.08 thousand by 2029. The major factor driving the growth of the Asia-Pacific functional mushroom market is shifting preference towards functional foods, positive outlook towards organic personal care, improvement in the dietary supplements industry, increasing acceptability of mushroom for medicinal properties, and the emerging role of mushrooms in the food industry. The rising alternatives for proteins may hamper the market growth.

The Asia-Pacific functional mushroom market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief; our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2019 - 2014)

|

|

Quantitative Units

|

Revenue in USD Thousands

|

|

Segments Covered

|

By Species (Shiitake, Reishi, Chaga, Lion's Mane, Cordyceps, Maitake, Turkey Tail, Tremella, Others), Product Type (Cultivated, Wild), Category (Regular, Full Spectrum), Nature (Conventional, Organic), Cultivation Method (Bed Cultivated, Log/Wood Cultivated), Application (Pharmaceutical, Food & Beverages, Dietary Supplements, Nutraceutical, Sports Nutrition, Personal Care, Others).

|

|

Countries Covered

|

Japan, China, South Korea, India, Australia, Singapore, Thailand, Indonesia, Malaysia, Philippines, and the Rest of the Asia-Pacific

|

|

Market Players Covered

|

YUKIGUNI MAITAKE CO., LTD., Shandong Qihe Biotech Co., Ltd., VLD Food Products Pvt. Ltd., Wuling (Fuzhou) Biotechnology Co., Ltd., Lianfeng (Suizhou) Food Co., Ltd, Biobritte Agro Solutions Pvt Ltd, Ojas Farms, among others.

|

Market Definition

Functional mushrooms are packed with antioxidants and nutritional value, with many health claims. These mushrooms have been widely used due to their medicinal properties and superfood benefits. Functional mushrooms help to strengthen immune systems and are also used as a dietary option that is low in calories and high in protein which is great for those lacking protein in their diet, in addition to providing multiple vitamins and essential minerals. The most widely used mushrooms for medicinal purposes are shiitake and reishi, among others.

Shiitake

The demand for shiitake is increasing in the functional mushroom market as it has a rich, savory taste and diverse health benefits. Compounds in shiitake may help fight cancer, boost immunity, and support heart health.

Reishi

The demand for reishi is increasing in the functional mushroom market owing to its medicinal properties. It can also be used in coffee and cocoa to enhance taste and health.

Asia-Pacific Functional Mushroom Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Shift in consumer preference toward functional foods

Functional foods have a specific set of added nutrients such as fiber, probiotics, prebiotics, minerals, and others—also, these types of food help overcome nutritional deficiencies. Functional foods are also useful in decreasing the risk of chronic diseases. Growing health concerns due to a rapidly changing lifestyle, especially in urban areas, are increasing consumers' preference for healthy and functional foods to a great extent. In addition, in the COVID-19 situation, consumers are looking for such functional food ingredients which help to increase their immunity level, so such a scenario positively impacts increasing preference for functional mushrooms.

- Positive outlook toward organic personal care

Functional mushroom has their specific benefits, and all functional mushrooms work to balance energy levels, strengthen immune function, smooth digestion, and enhance the skin's natural glow. Mushrooms are loaded with polyphenols, polysaccharides, beta-glucans, and antioxidant properties. Together and separately, all these compounds help support the immune system. Mushrooms also deliver a slew of dietary fiber, aiding in healthy digestion and increasing beneficial gut bacteria in the digestive system. As for skin-enhancing benefits, functional mushrooms have an overflowing amount of antioxidant properties. Glowing skin is also the result of whole-body health. Any dysfunction in the immune system or digestion will show up in the skin first. Supporting whole-body well-being with functional mushrooms often results in a smooth complexion. Mushroom ingredients find their way into skincare and supplements as the consumer quest for wellness endures. Beauty and wellness companies are increasingly tapping different types of mushrooms, including reishi, lion's mane, turkey tail, and Chaga, among others.

- Increase in acceptability of mushroom for medicinal properties

Mushrooms are a recognized component of the human diet, with versatile medicinal properties. Some mushrooms are popular worldwide for their nutritional and therapeutic properties. Mushrooms have long been valued as high medicinal and nutritional food by many societies worldwide. Mushrooms are consumed as a medicine in Asian countries, and much research works have been done on medicinal aspects. A large variety of mushrooms have been utilized traditionally in many different cultures for the maintenance of health and the prevention and treatment of diseases through their immunomodulatory and antineoplastic properties. In the last decade, the interest in mushrooms' pharmaceutical potential has increased rapidly, and it has been suggested that many mushrooms are like mini-pharmaceutical factories producing compounds with miraculous biological properties.

- Emerging role of mushrooms in the food industry

Consumers are increasingly interested in nutritious, safe, and healthy muscle food products with reduced salt and fat that benefit their well-being. Hence, food processors are constantly searching for natural bioactive ingredients that offer health benefits beyond their nutritional values without affecting the quality of the products. Mushrooms are considered next-generation healthy food components. Owing to their low-fat content, high-quality proteins, dietary fiber, and the presence of nutraceuticals, they are ideally preferred in the formulation of low-caloric functional foods. There is a growing trend to fortify muscle food with mushrooms to harness their goodness in terms of nutritional, bioactive, and therapeutic values. The incorporation of mushrooms in muscle foods assumes significance. Consumers favorably accept it because its fibrous structure mimics the texture of meat analogs, offering a unique taste and umami flavor.

Opportunities

- Increasing R&D spending on exotic mushroom variants

The demand for exotic varieties of mushrooms has been growing, driven by the increasing trend of eating healthy and natural food. Oyster mushrooms, enoki, and shiitake are a few examples of popular exotic mushrooms. The demand for exotic mushrooms has increased considerably over the past years. They can be canned, dried, or packed in frozen forms, including their usage in the food industry in mushroom pickles and sauces.

- Technological advancements and innovations in functional mushroom

Technological developments in the mushroom industry have witnessed increasing production capacities, innovations in cultivation technologies, improvements in final mushroom goods, and utilization of mushrooms' natural qualities for environmental benefits. The growing technologies used worldwide for mushroom species are increasing in food, processing, and pharmacological industries owing to the rapid development of mushroom farming.

- Supportive government policies on promoting investment in health-conscious diet

Consuming a healthy diet throughout the life course helps to prevent malnutrition in all its forms, as well as a range of non-communicable diseases (NCDs) and conditions. However, increased production of processed foods, rapid urbanization, and changing lifestyles have shifted dietary patterns. People are now consuming more foods high in energy, fats, free sugars, and salt/sodium, and many people do not eat enough fruit, vegetables, and other dietary fiber, such as whole grains. Investment by governments, the private sector, and other relevant stakeholders should support training for food producers, handlers, and processors to implement national, scientific, and evidence-based risk-based measures that can provide safe food while retaining its nutrient content.

Restraints/Challenges

- Strong market reach of other protein substitutes

The rise in the availability of protein substitutes is majorly driven by factors such as growing urbanization, innovation in food technology, high nutritional value, and a rise in environmental sustainability with the production and consumption of alternative protein.

- High product prices

Medicinal mushrooms are becoming more popular daily as researchers unravel new psilocybin benefits. These benefits are drawing more consumers to mushroom-related products. The rising demand for mushroom-related products is surging the prices to a higher rate due to everyday rising Asia-Pacific demand. The high cost of functional mushroom products is rising due to its high cost of production since mushrooms for the retail market are hand-picked. Picker training courses have contributed enormously to labor costs. Harvesting costs alone account for over 30% of the cost of production. The requirement of the modern cold storage facility and well-equipped processing units also cost extra, leading to rising end-product prices.

Recent Developments

- In July 2019, Shandong Qihe Biotechnology Co., Ltd. and Korea MODERNDAY Company signed an agreement in which Shandong Qihe Biotechnology authorized MODERNDAY to sell the mushroom spawn in Korea and be responsible for after-sales service. With this agreement, the company was able to reach the Korean market and able to expand its market share.

- In September 2019, Biobritte Agro Solutions Pvt Ltd was awarded the ISO 9001:2015 QMS for meeting all the requirements, such as location, services, quality, and others. With this development company can enhance its brand value in the market.

Asia-Pacific Functional Mushroom Market Scope

The Asia-Pacific functional mushroom market is categorized based on species, product type, category, nature, cultivation method, and application. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Species

- Shiitake

- Reishi

- Chaga

- Lion's Mane

- Cordyceps

- Maitake

- Turkey Tail

- Tremella

- Others

Based on species, the Asia-Pacific functional mushroom market is classified into shiitake, reishi, chaga, lion's mane, cordyceps, maitake, turkey tail, tremella, others.

Product Type

- Cultivated

- Wild

Based on product type, the Asia-Pacific functional mushroom market is classified into cultivated and wild.

Category

- Regular

- Full Spectrum

Based on the category, the Asia-Pacific functional mushroom market is classified into regular, and full spectrum.

Nature

- Conventional

- Organic

Based on nature, the Asia-Pacific functional mushroom market is segmented into conventional, and organic.

Cultivation Method

- Bed Cultivated

- Log/Wood Cultivated

Based on cultivation method, the Asia-Pacific functional mushroom market is segmented into bed cultivated, and log/wood cultivated.

Application

- Pharmaceutical

- Food & Beverages

- Dietary Supplements

- Nutraceutical

- Sports Nutrition

- Personal Care

- Others

Based on application, the Asia-Pacific functional mushroom market is segmented into pharmaceutical, food & beverages, dietary supplements, nutraceutical, sports nutrition, personal care, and others.

Asia-Pacific Functional Mushroom Market Regional Analysis/Insights

The Asia-Pacific functional mushroom market is segmented by country, species, product type, category, nature, cultivation method, and application.

Some countries in the Asia-Pacific functional mushroom market are Japan, China, South Korea, India, Australia, Singapore, Thailand, Indonesia, Malaysia, Philippines, and the Rest of Asia-Pacific. China is expected to dominate the Asia-Pacific functional mushroom market in terms of market share and revenue because of the shifting preference towards functional foods in the region.

The country section of the report also provides individual market-impacting factors and market regulation changes that impact the market's current and future trends. Data points downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Functional Mushroom Market Share Analysis

The Asia-Pacific functional mushroom market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies' focus related to the Asia-Pacific functional mushroom market.

Some of the prominent participants operating in the Asia-Pacific functional mushroom market are YUKIGUNI MAITAKE CO., LTD., Shandong Qihe Biotech Co., Ltd., VLD Food Products Pvt. Ltd., Wuling (Fuzhou) Biotechnology Co., Ltd., Lianfeng (Suizhou) Food Co., Ltd, Biobritte Agro Solutions Pvt Ltd, Ojas Farms, among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning grids, Market Time Line Analysis, Market Overview and Guide, Company Positioning grids, Company Market Share Analysis, Standards of Measurement, Asia-Pacific Vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-