Saudi Arabian Functional Mushroom Market, By Species (White Button Mushrooms, Chestnut Mushrooms, Portobello Mushrooms, Reishi, Lion’s Mane, Turkey Tail, Chaga, Shiitake, Maitake, Cordyceps, Tremella, and Others), Category (Fresh and Chilled), Product Type (Wild and Cultivated), Nature (Organic and Conventional), Cultivation Method (Log/Wood Cultivated and Bed Cultivated), End User (Household/Retail, Food Service Industry, and Food Processors), Distribution Channel (Direct Sales Channel and Indirect Sales Channel) - Industry Trends and Forecast to 2030.

Saudi Arabian Functional Mushroom Market Analysis and Insights

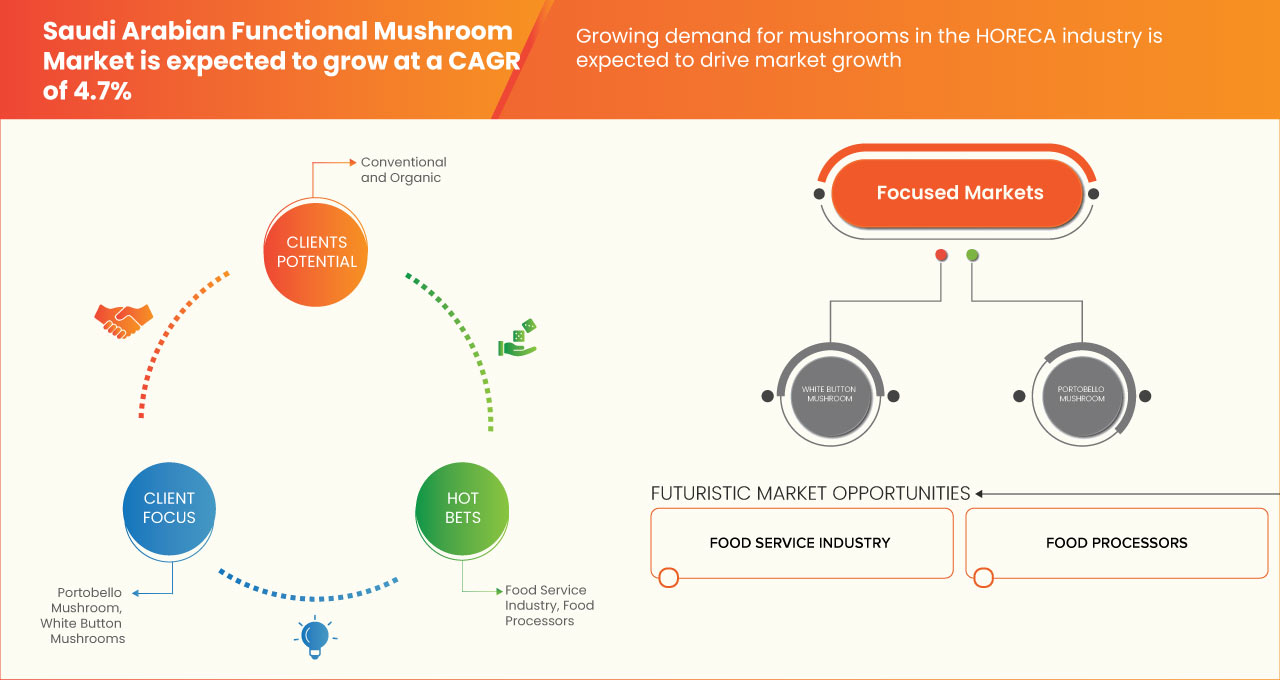

Shifting preference and rising awareness towards functional mushrooms are driving market growth. Increasing disposable income is acting as a potential market driver for market growth. Also, the increasing acceptability of mushrooms for medicinal properties increases the sales and profit of players operating in the market.

The major restraint impacting the market growth is the strong market reach of other protein substitutes. Further, high product prices will also restrain market growth. The opportunities for market growth are the increasing R&D spending on exotic mushroom variants. Some of the significant drivers associated with market growth are the emerging role of mushrooms in the food industry.

Data Bridge Market Research analyzes that the Saudi Arabian functional mushroom market is expected to reach a value of USD 96.32 million by 2030, at a CAGR of 4.7% during the forecast period of 2023 to 2030. This market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Year

|

2021 (Customisable to 2015-2020)

|

|

Quantitative Units

|

Revenue in USD Million

|

|

Segments Covered

|

By Species (White Button Mushrooms, Chestnut Mushrooms, Portobello Mushrooms, Reishi, Lion’s Mane, Turkey Tail, Chaga, Shiitake, Maitake, Cordyceps, Tremella, and Others), Category (Fresh and Chilled), Product Type (Wild and Cultivated), Nature (Organic and Conventional), Cultivation Method (Log/Wood Cultivated and Bed Cultivated), End User (Household/Retail, Food Service Industry, and Food Processors), Distribution Channel (Direct Sales Channel and Indirect Sales Channel)

|

|

Countries Covered

|

Saudi Arabia

|

|

Market Players Covered

|

California Garden Products Inc., Markal, La Vie Claire, Shiitake-Ya. , Giorgio Fresh Co., South Mill Mushrooms Sales, and Monterey Mushrooms, LLC among others

|

Market Definition

Functional mushrooms are known to be packed with antioxidants and nutritional value, with a plethora of health claims for each. These mushrooms have been widely used due to their medicinal properties and superfood benefits. Functional mushrooms help to strengthen immune systems and are also used as a dietary option that is low in calories and high in protein which is great for those who are lacking protein in their diet, in addition to providing multiple vitamins and essential minerals. The demand for mushroom is increasing in the functional mushroom market as it has a rich, savory taste, and diverse health benefits. Compounds in mushrooms may help fight cancer, boost immunity, and support heart health.

Saudi Arabian Functional Mushroom Market Dynamics

Drivers

- Rising Awareness Regarding Functional Mushroom

With this growing trend, consumers these days have been significantly adopting products such as functional mushrooms, as they are nutrition dense and gluten-free in nature and have low calories, reducing the risk of various health issues. Functional foods have a specific set of added nutrients such as fiber, probiotics, prebiotics, minerals, and others. Also, these types of food help overcome nutritional deficiencies. Consumers today are more prone to food products that are healthy in nature and rich in nutrients. Due to this reason, consumers have taken a shift toward food that is low in calories, rich in protein, gluten-free, and plant-based food. In addition to this growing awareness, consumers have been specifically interested in checking the nutrition, labels to verify the healthy nature of the products. Rising health consciousness among consumers has contributed to a dramatic increase in the consumption of a protein-rich diet in recent years.

For instance,

- In April 2021, according to a study published in the MDPI journal, mushrooms are regarded as the next generation of nutritious food ingredients. They are appropriate for use in the creation of low-calorie functional foods due to their low-fat content, high-quality proteins, dietary fiber, and inclusion of nutraceuticals. The inclusion of mushrooms in muscle foods is significant since they are well-liked by consumers and have a fibrous structure that matches the texture of meat analogs while providing a unique taste and umami flavor.

As this trend is reaching its peak in the market, consumers have increased the consumption of functional mushrooms, which is driving market growth.

- Increase in Adaptability of Mushroom for Medicinal Property

Mushrooms contain an excellent variety of bioactive metabolites that can be successful in both the prevention and treatment of various human health hazards. They are a great source of prebiotics, which helps in the growth of healthy gut bacteria. They also help to regulate the thyroid system, and their high copper concentration helps to produce collagen, which is important for skin elasticity as well as joint and bone health. They are suitable for people suffering from high blood pressure, and diabetics. In diabetics, the high fiber content of mushrooms helps to normalize blood sugar levels. Additionally, research has shown that more than 40% of the Saudi population is suffering from obesity, which will also raise the uptake of mushrooms in the area as they are one of the nutritious food items that have much lower calories when compared to other foods. One cup of Crimini mushroom consists of 15-20 calories.

Thus, medicinal mushrooms help with a wide variety of ailments through a myriad of mechanisms, but they are perhaps most demanded due to their actions in supporting the immune system, reducing inflammation, and treating various diseases has increased the acceptability of mushrooms for medicinal properties, which is driving the market growth.

OPPORTUNITY

- Technological Advancements in Mushroom Cultivation

Mushroom growing is a potential activity to convert waste into the best nutritional food with high protein conversion efficiency. Technological advancements in the mushroom industry have resulted in increased production capacity, innovations in cultivation technology, improvements in harvesting technologies, and the use of mushrooms' natural qualities for environmental benefits. Due to the quick growth of mushroom farming, there are more growing technologies being utilized globally for various mushroom species in the food, industrial, and pharmaceutical industries.

Mushrooms are increasingly being "value-added" or "biofortified" to improve their quality and shelf life. As a result, mushroom farming has greatly expanded. It has demonstrated potential as a source of food security, nutrition, and medical safety. Using advanced cultivation technologies such as IoT and automated systems to control temperature and humidity has shown a positive impact on mushroom cultivation.

For instance,

- In December 2022, according to a study published in AIP Publishing LLC using the IoT for milky mushroom monitoring makes things easier and better by obtaining the best conditions for mushroom cultivation at the appropriate time, which can increase the yield with minimal cost and effort

Thus, advancements in mushroom cultivation and the adoption of advanced pest management systems to control damage can further ensure high yields, which ultimately boosts market growth.

RESTRAINT

- High Price Fluctuation

Mushrooms are less affordable due to health benefits, intense flavor & texture, and the majority of import-export of mushrooms. Another reason for the higher price of functional mushrooms is that their cultivation is complicated and expensive. The weather fluctuations and specific temperature requirements of mushroom cultivation have been a reason for the decreased production of functional mushrooms across the region. The decrease in cultivation in Saudi Arabia makes it highly dependent on the export of mushrooms which ultimately increases the prices of mushrooms. This increased price of mushrooms makes them less popular among consumers, which results in consumers opting for other varieties of substitutes.

For instance,

- In 2023, according to the article published by Selina Wamucii, Over time, Saudi Arabia's mushroom prices have varied. Before 2019, the price of 1 kg of mushrooms was USD 1.31 in 2017 and USD 2.83 in 2018. The export price increased by 323.529% in 2019 to USD 12.00 per kilo

- In 2023, the cost of mushrooms in Saudi Arabia was between USD 5.44 and USD 1.28 per pound or between USD 12.00 and USD 2.83 per kg

Disruptions in the supply chain have a negative effect on Functional mushroom Market production and trade. Labor shortage, higher oil prices, Import and export rules and fees also have an impact on prices of mushroom which will ultimately hamper the growth of Saudi Arabian functional mushroom market.

CHALLENGE

- Availability of Other Protein Substitutes in the Market

Factors including urbanization, advancements in food technology, high nutritional value, and an increase in environmental sustainability with the production and use of alternative protein all contribute to the increase in the availability of protein substitutes. There are many substitutes available in the market for a mushroom that have similar taste or texture. Tofu is one of the most popular substitutes for mushrooms in the market. Mainly because the texture of tofu is slightly similar to mushrooms.

Nutritional yeast also acts as a substitute for mushrooms, it brings a powerful dose of essential nutrients. It provides a hefty dose of meaty flavor but without the sharpness of parmesan. It contains large amounts of vitamins and minerals like riboflavin, niacin, and zinc which have their own health benefits. Also, it is in demand as it has long been a popular condiment among fans of healthy food. It is often referenced as a vegan substitute for parmesan cheese and its flavor is sometimes described as cheesy which is driving its demand. Tempeh is another mushroom substitute made from fermented soybeans.

Monosodium glutamate is referred to as the king of all umami seasonings and will work in any dish that can do with some savory enhancement as a substitute in any recipe and get the rich meatiness.

Thus, the availability of substitute products for mushrooms and allergies associated with mushroom consumption is restraining the market growth in the forecast period.

Saudi Arabian Functional Mushroom Market Scope

Saudi Arabian functional mushroom market is segmented into seven notable segments based on species, category, product type, nature, cultivation method, end user, and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Species

- Portobello Mushroom

- Lion’s Mane

- White Button Mushrooms

- Shiitake

- Chaga

- Reishi

- Cordyceps

- Tremella

- Chestnut Mushroom

- Maitake

- Turkey Tail

- Others

Based on species, the market is segmented into Portobello Mushroom, Lion’s Mane, White Button Mushrooms, Shiitake, Chaga, Reishi, Cordyceps, Tremella, Chestnut Mushroom, Maitake, Turkey Tail, and Others.

Category

- Fresh

- Chilled

Based on category, the market is segmented into fresh and chilled.

Product Type

- Wild

- Cultivated

Based on product type, the market is segmented into wild and cultivated.

Nature

- Conventional

- Organic

Based on nature, the market is segmented into conventional and organic.

Cultivation method

- Log/Wood Cultivated

- Bed Cultivated

Based on cultivation method, the market is segmented into log/wood cultivated and bed cultivated

End User

- Food Service Industry

- Food Processors

- Household/Retail

Based on end user, the market is segmented into food service industry, food processor, and household/retail

Distribution Channel

- Direct Sales Channel

- Indirect Sales Channel

Based on distribution channel, the market is segmented into direct sales channel and indirect sales channel

Saudi Arabian Functional Mushroom Market Regional Analysis/Insights

Saudi Arabian functional mushroom market is segmented into seven notable segments based on species, category, product type, nature, cultivation method, end user, and distribution channel.

Saudi Arabian functional mushroom market is growing extensively. The demand for functional mushrooms is anticipated to be sparked by the expansion of the food and beverages sector, rising consumer disposable incomes, and additional health advantages of mushroom consumption.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Saudi Arabia brands and the challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Saudi Arabian Functional Mushroom Market Share Analysis

Saudi Arabian functional mushroom market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the market.

Some of the prominent market players operating in the Saudi Arabian functional mushroom market are California Garden Products Inc., Markal, La Vie Claire, Shiitake-Ya., Giorgio Fresh Co., South Mill Mushrooms Sales, and Monterey Mushrooms, LLC among others.

SKU-