A crescente procura de betume como aditivo na indústria de solventes e tintas está a tornar-se um importante impulsionador do mercado de betume da Arábia Saudita. O betume é conhecido pelas suas propriedades adesivas e impermeabilizantes e está a ser cada vez mais reconhecido pela sua versatilidade para além das utilizações tradicionais na construção de estradas. Esta mudança na aplicação está a abrir novos caminhos para o crescimento no setor do betume.

Na indústria de solventes e tintas, o betume é utilizado principalmente pelas suas qualidades de ligação e proteção. A inclusão de betume nas formulações aumenta a durabilidade e o desempenho de vários produtos, tornando-se uma opção atrativa para os fabricantes. À medida que a urbanização acelera e os projectos de construção aumentam na Arábia Saudita, aumenta também a procura de tintas e revestimentos de alta qualidade. Estes produtos são essenciais para fins estéticos e funcionais, proporcionando camadas de proteção para edifícios, infraestruturas e equipamentos industriais.

Aceda ao relatório completo em https://www.databridgemarketresearch.com/reports/saudi-arabia-bitumen-market

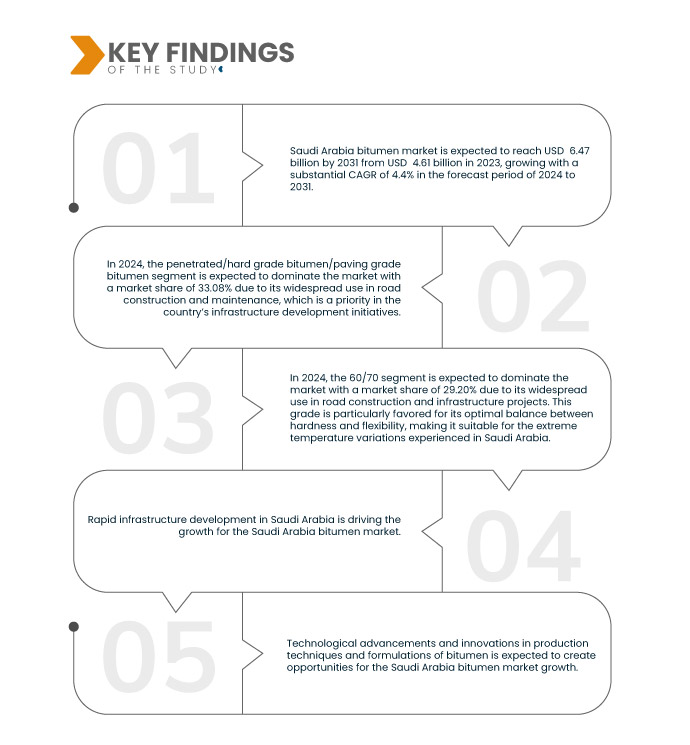

A Data Bridge Market Research analisa que o mercado de betume da Arábia Saudita deverá atingir os 6,47 mil milhões de dólares até 2031, face aos 4,61 mil milhões de dólaresMil

Principais conclusões do estudo

Desenvolvimento rápido de infraestruturas na Arábia Saudita

O rápido desenvolvimento de infraestruturas na Arábia Saudita é um factor-chave para o mercado do betume, influenciando significativamente a procura e o crescimento do sector. No âmbito da sua iniciativa Visão 2030, o governo saudita comprometeu-se a diversificar a economia e a investir fortemente em projectos de infra-estruturas, incluindo estradas, pontes, aeroportos e desenvolvimento urbano. Esta estratégia abrangente visa melhorar a conectividade, estimular o crescimento económico e melhorar a qualidade de vida dos cidadãos. A construção de extensas redes rodoviárias é particularmente crítica. Com vastas paisagens desérticas e centros urbanos em crescimento, uma infraestrutura de transportes eficiente é essencial para facilitar o comércio e a mobilidade. O betume, um material crucial utilizado na produção de asfalto, é necessário para a construção e manutenção de estradas. À medida que o governo implementa projectos ambiciosos, a procura de betume deverá aumentar substancialmente.

Âmbito do Relatório e Segmentação de Mercado

Métrica de Reporte

|

Detalhes

|

Período de previsão

|

2024 a 2031

|

Ano base

|

2023

|

Anos Históricos

|

2022 (personalizável para 2016 - 2021)

|

Unidades quantitativas

|

Receita em biliões de dólares americanos

|

Segmentos abrangidos

|

Produto (Betume penetrado/de grau duro/betume de grau de pavimentação, betume modificado por polímero , betume de corte, emulsão de betume, betume oxidado , betume misturado especial e outros), grau (60/70, 50/70, 70/100, 80/100, 160/220 e outros), forma (semi-sólido e líquido), categoria (regular e premium), método de processamento (procedimento de sopro contínuo e procedimento de sopro descontínuo), tipo de embalagem (saco plástico derretível, tambor , caixa de papelão, saco artesanal, barril, palete de caixa e outros), composição ( hidrocarbonetos saturados , aromáticos de nafta, aromáticos polares e asfaltenos), aplicação ( estradas , impermeabilização [telhados], adesivo (isolamento térmico), tintas, vedação, revestimentos de tubos , mástiques, Cerâmica, Elétrica, Produção de Tinta de Jornal e Outros)

|

Participantes do mercado abrangidos

|

Saudi Arabian Oil Co. (Arábia Saudita), Shell plc (Reino Unido), Exxon Mobil Corporation (EUA), TotalEnergies (França), Repsol (Espanha), Bitumat Company Limited (Arábia Saudita), Al Majwal Group (Arábia Saudita), SaudiBitumen (Arábia Saudita), RAHABitumen Inc. (Emirados Árabes Unidos) e Reda National (Arábia Saudita), entre outros.

|

Pontos de dados abordados no relatório

|

Para além dos insights sobre os cenários de mercado, tais como o valor de mercado, a taxa de crescimento, a segmentação, a cobertura geográfica e os principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research incluem também a análise de importação e exportação, a visão geral da capacidade de produção, a análise do consumo da produção, a análise da tendência dos preços, o cenário das alterações climáticas, a análise da cadeia de abastecimento, a análise da cadeia de valor, a visão geral da matéria-prima/consumíveis, os critérios de seleção de fornecedores, a análise PESTLE, a análise de Porter e a estrutura regulamentar.

|

Análise de Segmentos

O mercado de betume da Arábia Saudita está segmentado em oito segmentos notáveis com base no produto, grau, forma, categoria, método de processamento, tipo de embalagem, composição e aplicação.

- Com base no produto, o mercado de betume da Arábia Saudita está segmentado em betume penetrado/de grau duro/de grau de pavimentação, betume modificado com polímero, betume diluído, emulsão betuminosa, betume oxidado, betume misturado especial e outros.

Em 2024, prevê-se que o segmento do betume penetrado/de grau duro/de grau de pavimento domine o mercado de betume da Arábia Saudita

Em 2024, prevê-se que o segmento de asfalto penetrado/de grau duro/de pavimentação domine o mercado com uma quota de mercado de 33,08% devido à sua ampla utilização na construção e manutenção de estradas, o que é uma prioridade nas iniciativas de desenvolvimento de infraestruturas do país.

- Com base no grau, o mercado de betume da Arábia Saudita está segmentado em 60/70, 50/70, 70/100, 80/100, 160/220 e outros

Em 2024, prevê-se que o segmento 60/70 domine o mercado de betume da Arábia Saudita

Em 2024, prevê-se que o segmento 60/70 domine o mercado com uma quota de mercado de 29,20% devido à sua ampla utilização na construção de estradas e projetos de infraestruturas. Esta classe é particularmente favorecida pelo seu equilíbrio ideal entre dureza e flexibilidade, tornando-a adequada para as variações extremas de temperatura encontradas na Arábia Saudita.

- Com base na forma, o mercado de betume da Arábia Saudita está segmentado em semi-sólido e líquido. Em 2024, prevê-se que o segmento semi-sólido domine o mercado com uma quota de mercado de 68,28%

- Com base na categoria, o mercado de betume da Arábia Saudita está segmentado em regular e premium. Em 2024, prevê-se que o segmento regular domine o mercado com uma quota de mercado de 90,80%

- Com base no método de processamento, o mercado de betume da Arábia Saudita está segmentado em procedimento de sopro contínuo e procedimento de sopro descontínuo. Em 2024, prevê-se que o segmento dos procedimentos de sopro contínuo domine o mercado com uma quota de mercado de 61,98%

- Com base no tipo de embalagem, o mercado de betume da Arábia Saudita está segmentado em saco de plástico derretível, tambor, caixa de cartão, saco artesanal, barril, caixa de paletes e outros. Em 2024, prevê-se que o segmento dos sacos de plástico derretíveis domine o mercado com uma quota de mercado de 77,75%.

- Com base na composição, o mercado de betume da Arábia Saudita está segmentado em hidrocarbonetos saturados, aromáticos naftênicos, aromáticos polares e asfaltenos. Em 2024, prevê-se que o segmento dos hidrocarbonetos saturados domine o mercado com uma quota de mercado de 72,38%

- Com base na aplicação, o mercado de betume da Arábia Saudita está segmentado em autoestradas, impermeabilização [coberturas], adesivos (isolamento térmico), tintas, vedantes, revestimentos de tubos, mástiques, cerâmicas, produtos elétricos, produção de tinta para jornais e outros. Em 2024, prevê-se que o segmento rodoviário domine o mercado com uma quota de mercado de 79,73%

Principais jogadores

A Data Bridge Market Research analisa a Saudi Arabian Oil Co. (Arábia Saudita), a Shell plc (Reino Unido), a TotalEnergies (EUA), a Exxon Mobil Corporation (França) e a Repsol (Espanha) como as principais empresas do mercado de betume da Arábia Saudita.

Desenvolvimentos de mercado

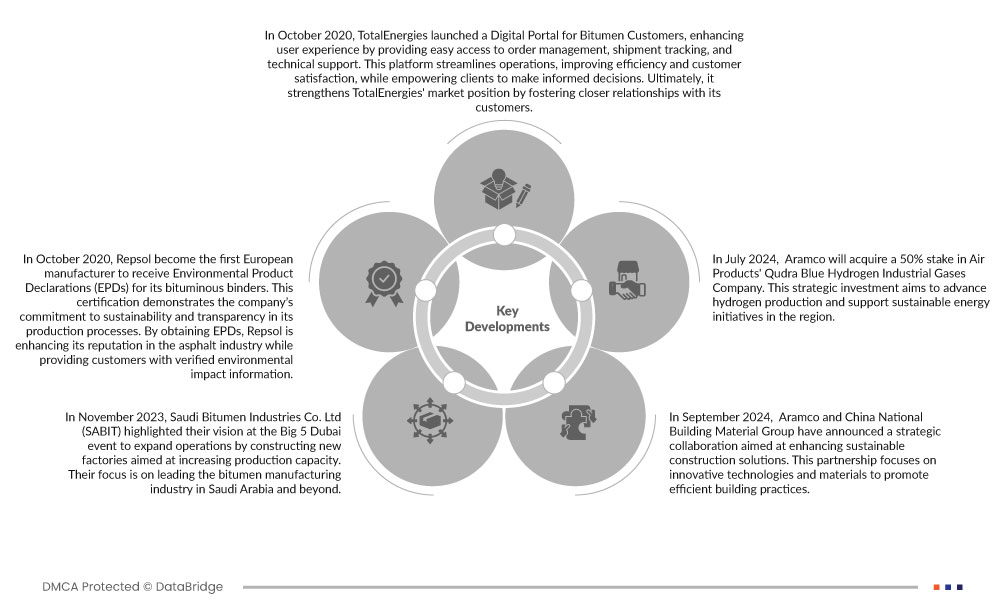

- Em setembro de 2024, a Aramco e o China National Building Material Group anunciaram uma colaboração estratégica com o objetivo de melhorar as soluções de construção sustentável. Esta parceria centra-se em tecnologias e materiais inovadores para promover práticas de construção eficientes

- Em julho de 2024, a Aramco irá adquirir uma participação de 50% na Qudra Blue Hydrogen Industrial Gases Company à Air Products. Este investimento estratégico visa promover a produção de hidrogénio e apoiar iniciativas de energia sustentável na região

- Em outubro de 2020, a TotalEnergies lançou um Portal Digital para Clientes de Betume, melhorando a experiência do utilizador ao proporcionar um acesso fácil à gestão de encomendas, ao seguimento de remessas e ao suporte técnico. Esta plataforma simplifica as operações, melhorando a eficiência e a satisfação do cliente, ao mesmo tempo que os capacita para tomar decisões informadas. Em última análise, reforça a posição de mercado da TotalEnergies ao promover relações mais próximas com os seus clientes

- Em outubro de 2020, a Repsol tornou-se o primeiro fabricante europeu a receber Declarações Ambientais de Produto (DAPs) para os seus ligantes betuminosos. Esta certificação demonstra o compromisso da empresa com a sustentabilidade e a transparência nos seus processos produtivos. Ao obter EPDs, a Repsol está a reforçar a sua reputação na indústria do asfalto, ao mesmo tempo que fornece aos clientes informações verificadas sobre o impacto ambiental

- Em novembro de 2023, a SaudiBitumen destacou a sua visão no evento Big 5 Dubai de expandir as operações através da construção de novas fábricas com o objetivo de aumentar a capacidade de produção. O seu foco é liderar a indústria de fabrico de betume na Arábia Saudita e além

De acordo com a análise de pesquisa de mercado da Data Bridge:

Para obter informações mais detalhadas sobre o relatório do mercado de betume da Arábia Saudita, clique aqui – https://www.databridgemarketresearch.com/reports/saudi-arabia-bitumen-market