O mercado de instrumentos analíticos do México abrange uma variedade de dispositivos e instrumentos utilizados para testar, medir e analisar propriedades químicas, físicas e biológicas em vários setores, incluindo produtos farmacêuticos, saúde, alimentos e bebidas e monitorização ambiental. Os principais segmentos incluem cromatografia, espectroscopia, espectrometria de massa e análise eletroquímica. O mercado é impulsionado pela crescente procura de controlo de qualidade, conformidade regulamentar e avanços tecnológicos nas técnicas analíticas. Fatores como o crescimento das atividades de investigação, o aumento dos investimentos em cuidados de saúde e o foco na sustentabilidade ambiental impulsionam ainda mais o crescimento do mercado. Os principais participantes do mercado incluem fabricantes nacionais e internacionais, contribuindo para um panorama competitivo focado na inovação e na introdução de soluções analíticas avançadas.

Aceda ao relatório completo em https://www.databridgemarketresearch.com/reports/mexico-analytical-instruments-market

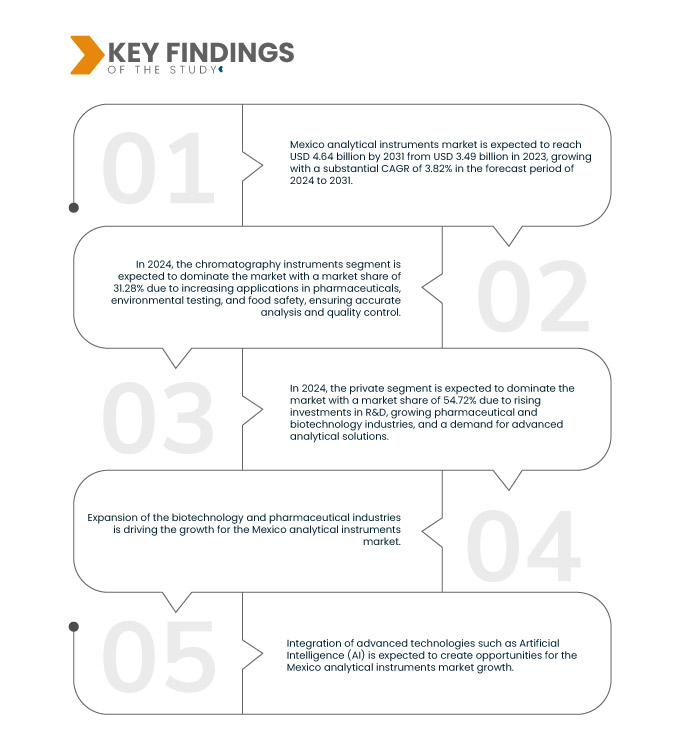

A Data Bridge Market Research analisa que o mercado mexicano de instrumentos analíticos deverá atingir os 4,64 mil milhões de dólares até 2031, face aos 3,49 mil milhões de dólares em 2023, crescendo com um CAGR substancial de 3,82% no período previsto de 2024 a 2031.

Principais conclusões do estudo

Aumento da adoção em saúde e diagnóstico

O setor da saúde no México está a sofrer uma transformação significativa devido à crescente adoção de instrumentos analíticos avançados, impulsionada pela crescente prevalência de doenças crónicas, como a diabetes e as condições cardiovasculares. Este aumento da procura por ferramentas de diagnóstico precisas melhora os resultados dos doentes e otimiza as operações de cuidados de saúde. As iniciativas governamentais para melhorar a infra-estrutura de cuidados de saúde estão a facilitar os investimentos em tecnologias analíticas modernas, aumentando as capacidades de diagnóstico e a qualidade geral dos cuidados. Além disso, o foco na medicina personalizada e a crescente ênfase na investigação e desenvolvimento nos setores farmacêutico e biotecnológico estão a estimular ainda mais a procura de instrumentos analíticos de alta precisão, impulsionando o crescimento do mercado.

Âmbito do Relatório e Segmentação de Mercado

Métrica de Reporte

|

Detalhes

|

Período de previsão

|

2024 a 2031

|

Ano base

|

2023

|

Anos Históricos

|

2022 (personalizável para 2016-2021)

|

Unidades quantitativas

|

Receita em biliões de dólares americanos

|

Segmentos abrangidos

|

Instrumentos ( instrumentos de cromatografia , instrumentos de espectroscopia , análise térmica , medidores de espessura de revestimento e outros), sector (privado e público (governo)), aplicação ( produtos farmacêuticos , alimentos e bebidas, mineração e minerais, fabrico de produtos químicos, petróleo e gás, electrónica e semicondutores, têxteis, automóvel, aeroespacial e defesa e outros), canal de distribuição (venda directa e venda indirecta)

|

Participantes do mercado abrangidos

|

Thermo Fisher Scientific Inc. (EUA), Agilent Technologies, Inc. (EUA), Waters Corporation (EUA), PerkinElmer Inc. (EUA), Bruker (EUA), Avantor, Inc. (EUA), Carl Zeiss AG (Alemanha), Eppendorf SE (EUA), Illumina, Inc. (EUA) e METTLER TOLEDO (Suíça), entre outras

|

Pontos de dados abordados no relatório

|

Para além dos insights sobre os cenários de mercado, tais como o valor de mercado, a taxa de crescimento, a segmentação, a cobertura geográfica e os principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research incluem também análises aprofundadas de especialistas, produção e capacidade das empresas representadas geograficamente, layouts de rede de distribuidores e parceiros, análises detalhadas e atualizadas das tendências de preços e análises de défice da cadeia de abastecimento e da procura.

|

Análise de Segmentos

O mercado de instrumentos analíticos do México está segmentado em quatro segmentos notáveis baseados em instrumentos, setor, aplicação e canal de distribuição.

- Com base nos instrumentos, o mercado de instrumentos analíticos do México está segmentado em instrumentos de cromatografia, instrumentos de espectroscopia, análise térmica, medidores de espessura de revestimento e outros.

Em 2024, prevê-se que o segmento de instrumentos cromatográficos domine o mercado de instrumentos analíticos do México

Em 2024, prevê-se que o segmento dos instrumentos cromatográficos domine o mercado com uma quota de mercado de 31,28% devido ao aumento das aplicações em produtos farmacêuticos, testes ambientais e segurança alimentar, garantindo análises precisas e controlo de qualidade.

- Com base no setor, o mercado de instrumentos analíticos do México está segmentado em privado e público (governamental)

Em 2024, prevê-se que o segmento do setor privado domine o mercado de instrumentos analíticos do México

Em 2024, prevê-se que o segmento privado domine o mercado com uma quota de mercado de 54,72% devido aos crescentes investimentos em I&D, ao crescimento das indústrias farmacêutica e biotecnológica e à procura de soluções analíticas avançadas.

- Com base na aplicação, o mercado de instrumentos analíticos do México está segmentado em produtos farmacêuticos, alimentos e bebidas, mineração e minerais, fabrico de produtos químicos, petróleo e gás, eletrónica e semicondutores, têxteis , automóvel, aeroespacial e defesa, entre outros. Em 2024, prevê-se que o segmento farmacêutico domine o mercado com uma quota de mercado de 28,45%

- Com base no canal de distribuição, o mercado de instrumentos analíticos do México está segmentado em vendas diretas e vendas indiretas. Em 2024, prevê-se que o segmento de vendas diretas domine o mercado com uma quota de mercado de 90,51%

Principais jogadores

A Data Bridge Market Research analisa a Thermo Fisher Scientific Inc. (EUA), a Agilent Technologies, Inc. (EUA), a Waters Corporation (EUA), a PerkinElmer Inc. (EUA), a Bruker, a Avantor, Inc. (EUA) como os principais participantes do mercado.

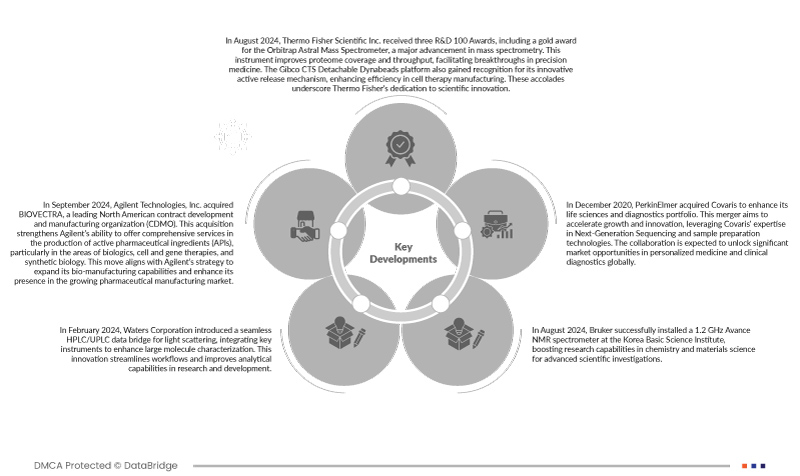

Desenvolvimentos de mercado

- Em agosto de 2024, a Thermo Fisher Scientific Inc. recebeu três prémios R&D 100, incluindo um prémio de ouro para o Espectrómetro de Massa Astral Orbitrap, um grande avanço na espectrometria de massa. Este instrumento melhora a cobertura e o rendimento do proteoma, facilitando os avanços na medicina de precisão. A plataforma Gibco CTS Detachable Dynabeads também ganhou reconhecimento pelo seu inovador mecanismo de libertação ativa, aumentando a eficiência no fabrico de terapia celular. Estes reconhecimentos realçam a dedicação da Thermo Fisher à inovação científica

- Em setembro de 2024, a Agilent Technologies, Inc. adquiriu a BIOVECTRA, uma organização líder de desenvolvimento e fabrico por contrato (CDMO) na América do Norte. Esta aquisição reforça a capacidade da Agilent de oferecer serviços abrangentes na produção de ingredientes farmacêuticos ativos (IFAs), particularmente nas áreas de produtos biológicos, terapias celulares e genéticas e biologia sintética. Esta mudança está alinhada com a estratégia da Agilent de expandir as suas capacidades de biofabricação e aumentar a sua presença no crescente mercado de fabrico farmacêutico.

- Em fevereiro de 2024, a Waters Corporation introduziu uma ponte de dados HPLC/UPLC perfeita para a dispersão de luz, integrando instrumentos importantes para melhorar a caracterização de moléculas de grandes dimensões. Esta inovação agiliza os fluxos de trabalho e melhora as capacidades analíticas em investigação e desenvolvimento

- Em agosto de 2024, a Bruker instalou com sucesso um espectrómetro de RMN Avance de 1,2 GHz no Instituto de Ciências Básicas da Coreia, aumentando as capacidades de investigação em química e ciência dos materiais para investigações científicas avançadas.

- Em dezembro de 2020, a PerkinElmer adquiriu a Covaris para melhorar o seu portefólio de ciências biológicas e de diagnóstico. Esta fusão visa acelerar o crescimento e a inovação, aproveitando a experiência da Covaris em tecnologias de sequenciação de última geração e preparação de amostras. Espera-se que a colaboração abra oportunidades de mercado significativas na medicina personalizada e no diagnóstico clínico em todo o mundo

De acordo com a análise de estudos de mercado da Data Bridge :

Para obter informações mais detalhadas sobre o relatório do mercado de instrumentos analíticos do México, clique aqui – https://www.databridgemarketresearch.com/reports/mexico-analytical-instruments-market