Mexico Analytical Instruments Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

3.56 Billion

USD

4.81 Billion

2024

2032

USD

3.56 Billion

USD

4.81 Billion

2024

2032

| 2025 –2032 | |

| USD 3.56 Billion | |

| USD 4.81 Billion | |

|

|

|

Mexico Analytical Instruments Market Segmentation, By Instruments (Chromatography Instruments, Spectroscopy Instruments, Thermal Analysis, Coating Thickness Gauges, and Others), Sector (Private and Public (Government)), Application (Pharmaceuticals, Food & Beverage, Mining & Minerals, Chemical Manufacturing, Oil & Gas, Electronics & Semiconductor, Textiles, Automotive, Aerospace & Defense, and Others), Distribution Channel (Direct Sales and Indirect Sales) – Industry Trends and Forecast to 2031.

Analytical Instruments Market Analysis

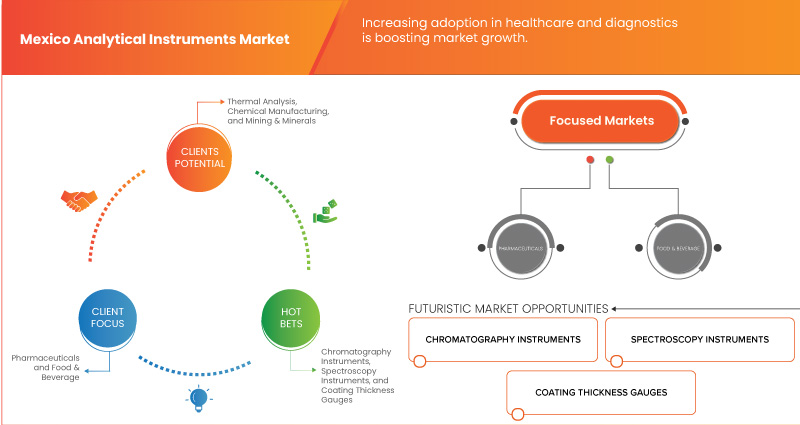

Expansion of the biotechnology and pharmaceutical industries is driving the market growth. Integration of advanced technologies such as Artificial Intelligence (AI) provides opportunities in the market. Moreover, increasing adoption in healthcare and diagnostics is driving market growth. Limited awareness of advanced technologies and limited access in developing regions threaten the Mexico analytical instruments market by reducing consumer demand.

Analytical Instruments Market Size

Mexico analytical instruments market is expected to reach USD 4.64 billion by 2031 from USD 3.49 billion in 2023, growing with a substantial CAGR of 3.82% in the forecast period of 2024 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Analytical Instruments Market Trends

“Rising environmental and food safety concerns”

The increasing focus on environmental protection and food safety in Mexico is significantly driving the demand for advanced analytical instruments. As public awareness of pollution, contamination, and food safety grows, regulatory authorities are tightening controls, requiring precise and reliable testing solutions. This trend is rapidly expanding the Mexico analytical instruments market, as industries must comply with stringent environmental regulations and ensure that food products meet safety standards.

Mexico faces critical environmental challenges, particularly in managing air and water pollution. Cities such as Mexico City experience high levels of air pollution due to industrial activities and vehicular emissions. Moreover, water pollution from agricultural runoff, industrial discharges, and insufficient wastewater treatment poses significant risks. These environmental challenges have led to stricter regulations by organizations such as the Ministry of Environment and Natural Resources (SEMARNAT), which require industries to monitor and control their emissions and discharges. As environmental regulations become more stringent, industries are investing in these instruments to comply with legal requirements, driving market growth.

Report Scope and Analytical Instruments Market Segmentation

|

Attributes |

Analytical Instruments Key Market Insights |

|

Segmentation |

|

|

Key Market Players |

Thermo Fisher Scientific Inc. (U.S.), Agilent Technologies, Inc. (U.S.), Waters Corporation (U.S.), PerkinElmer Inc. (U.S.), Bruker (U.S.), Avantor, Inc. (U.S.), Carl Zeiss AG (Germany), Eppendorf SE (U.S.), Illumina, Inc. (U.S.), and METTLER TOLEDO (Switzerland) among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Analytical Instruments Market Definition

The Mexico analytical instruments market encompasses a range of devices and instruments used for testing, measuring, and analyzing chemical, physical, and biological properties in various industries, including pharmaceuticals, healthcare, food and beverage, and environmental monitoring. Key segments include chromatography, spectroscopy, mass spectrometry, and electrochemical analysis. The market is driven by the increasing demand for quality control, regulatory compliance, and technological advancements in analytical techniques. Factors such as growing research activities, rising investments in healthcare, and a focus on environmental sustainability further propel market growth. Key players in the market include both domestic and international manufacturers, contributing to a competitive landscape focused on innovation and the introduction of advanced analytical solutions.

Analytical Instruments Market Dynamics

Drivers

- Expansion of the Biotechnology and Pharmaceutical Industries

The expansion of the biotechnology and pharmaceutical industries in Mexico is a key driver for the growth of the analytical instruments market. As these industries grow, so does the need for advanced technologies and instruments to support research, development, manufacturing, and quality control processes. Mexico’s increasing investment in biopharmaceuticals industry, driven by both local companies and multinational firms, has created a surge in demand for high-precision analytical tools to meet the stringent requirements of drug development and production.

One of the critical aspects of the biotechnology and pharmaceutical sectors is the need for accuracy and reliability in product development. Analytical instruments such as optical spectrometers, chromatography systems, and spectrophotometers are essential in ensuring the quality and safety of drugs and biological products. As pharmaceutical companies in Mexico invest more in Research and Development (R&D) to develop new drugs and vaccines, they require sophisticated analytical tools to identify chemical compounds, monitor processes, and ensure compliance with global regulatory standards. This demand is especially crucial as Mexico continues to position itself as a competitive player in the global pharmaceutical market, particularly in the production of generic drugs and vaccines.

For Instance,

According to an article published by Tanner Pharma Group, the pharmaceutical industry in Mexico has seen significant growth, driven by low manufacturing costs, proximity to the U.S., and government initiatives. In 2021, over USD 15.48 billion in pharmaceutical sales were recorded, with increasing interest in R&D and biosimilars. Recent regulatory reforms have streamlined drug approval processes, making Mexico more attractive for international pharmaceutical companies.

- Increasing Adoption in Healthcare and Diagnostics

The healthcare sector in Mexico is experiencing a significant transformation driven by the increasing adoption of advanced analytical instruments. This trend is reshaping diagnostics and patient care, thereby catalyzing growth in the analytical instruments market. The demand for precise and efficient diagnostic tools is surging as healthcare providers aim to enhance patient outcomes and streamline operations.

One of the primary factors contributing to this growth is the rising prevalence of chronic diseases, such as diabetes and cardiovascular conditions, which necessitates regular monitoring and accurate diagnosis. Analytical instruments, including spectrophotometers, chromatography systems, and mass spectrometers, are vital in providing accurate analytical data that supports effective disease management. As healthcare institutions invest in these technologies, they enhance their diagnostic capabilities, leading to earlier detection and better management of health conditions.

For Instance,

- In July 2023, according to International Diabetes Federation report, in Mexico nearly 14 million people ages between 20-79 are living with diabetes, making it a pressing public health issue. In response, healthcare facilities are increasingly adopting analytical instruments like glucose meters, HbA1c analyzers, and other analytical systems to provide timely and accurate diagnosis and management of diabetes.

Opportunities

- Integration of Advanced Technologies such as Artificial Intelligence (AI)

The integration of advanced technologies, particularly Artificial Intelligence (AI), presents a significant opportunity for the analytical instrument market in Mexico. As industries increasingly rely on precise data analysis for decision-making, the demand for sophisticated analytical instruments has surged. AI enhances these instruments by improving accuracy, efficiency, and predictive capabilities, enabling businesses to derive actionable insights from complex data sets.

In Mexico, sectors such as pharmaceuticals, biotechnology, food and beverage, and environmental monitoring are experiencing rapid growth. These industries require advanced analytical tools to ensure product quality, regulatory compliance, and process optimization. By incorporating AI into analytical instruments, companies can automate data analysis, reducing human error and increasing throughput. This automation is crucial for laboratories aiming to keep pace with growing workloads and tight deadlines.

AI-powered analytical instruments can also provide real-time monitoring and predictive analytics, which are vital for industries such as manufacturing and agriculture. For instance, in agriculture, AI can help optimize crop yield by analyzing soil health and environmental conditions, allowing for more effective resource allocation. This capability aligns with Mexico's agricultural goals, enhancing food security and sustainability.

For instance,

According to an article published by Case Western Reserve University, recent advancements in Artificial Intelligence (AI) and Machine Learning (ML) have significantly impacted systems and control engineering, enabling real-time analysis of vast data for enhanced decision-making. Techniques like deep learning, particularly convolutional and recurrent neural networks, excel in areas such as image recognition and natural language processing (NLP). Reinforcement learning has fueled the development of autonomous systems, including self-driving cars. In addition, explainable AI (XAI) aims to make AI decision-making processes transparent and address ethical concerns. These innovations drive efficiency and create new opportunities across various industries, including automation and robotics.

- Collaboration with Academic Institutions

Collaborating with academic institutions presents a significant opportunity for the growth and development of the analytical instrument market in Mexico. As the country invests in research and innovation, academic partnerships can drive technological advancements, enhance product development, and foster a skilled workforce.

Academic institutions are at the forefront of scientific research, often exploring innovative methodologies and technologies. By collaborating with universities and research centers, companies in the analytical instrument sector can gain access to the latest findings and breakthroughs. This collaboration can lead to the development of advanced analytical instruments that meet the evolving needs of various industries, such as pharmaceuticals, food safety, and environmental monitoring.

Collaborating with academia contributes to building a robust innovation ecosystem in Mexico. Such partnerships can stimulate entrepreneurship and encourage the commercialization of research outcomes. This not only benefits the analytical instrument market but also promotes overall economic development and scientific advancement in the country. Many Mexican academic institutions are already involved in international research networks. Companies can leverage these connections to participate in global research initiatives, enhancing their technological capabilities and broadening market reach.

For instance,

In January 2020, according to an article published by The Board of Trustees of the University of Illinois, UIC has partnered with Monterrey Institute of Technology (Tecnológico de Monterrey), a leading Mexican tech university, to enhance academic collaboration in the Midwest. This partnership will facilitate faculty and student exchanges, focusing initially on areas like ophthalmology and applied health sciences. UIC Chancellor Michael Amiridis highlighted the synergy between the two institutions, emphasizing their shared commitment to innovation and community engagement. The initiative aims to strengthen ties, benefiting both UIC and Monterrey Tec’s academic communities while fostering global engagement and research opportunities.

Restrições/Desafios

- Elevado custo dos instrumentos analíticos

O elevado custo dos instrumentos analíticos é uma barreira significativa que está a restringir o crescimento do mercado de instrumentos analíticos no México. Os instrumentos analíticos avançados, como espectrómetros de massa, cromatógrafos e espectrofotómetros, entre outros, que são essenciais para aplicações em setores como a saúde, produtos farmacêuticos, segurança alimentar, monitorização ambiental e muitos outros, têm geralmente preços substanciais. Isto representa um encargo financeiro para muitas organizações, especialmente empresas mais pequenas, instituições governamentais e instalações de investigação académica, limitando a adopção generalizada destas tecnologias.

No México, as pequenas e médias empresas (PME) desempenham um papel vital em setores como a produção alimentar, os produtos farmacêuticos e os testes ambientais. No entanto, muitas destas empresas operam com orçamentos limitados, o que torna desafiante investir em instrumentos analíticos de vanguarda. Por exemplo, um sistema de cromatografia líquida de alta eficiência (HPLC) ou espectrómetro de massa pode custar dezenas ou mesmo centenas de milhares de dólares, tornando-o inacessível para muitas empresas mais pequenas. Isto limita a sua capacidade de cumprir os rigorosos requisitos regulamentares de qualidade e segurança dos produtos, restringindo, em última análise, o crescimento do mercado.

Por exemplo,

De acordo com um blogue publicado pela Analytical Answer, ao comprar instrumentos analíticos, o custo real vai além do preço inicial — um instrumento de 20.000 mil dólares rapidamente com custos escondidos, como acessórios, formação e pessoal. A manutenção através de contratos de assistência, substituição de peças e atualizações de software acrescenta milhares anualmente. A interpretação de dados, a conformidade regulamentar e a formação de equipas exigem investimento contínuo. Ao longo da vida útil do equipamento, estes valores podem chegar quase aos 100.000 mil dólares. Em contraste, os laboratórios externos oferecem flexibilidade, conhecimento especializado e acesso às melhores técnicas para tarefas específicas sem custos indiretos a longo prazo.

- Consciência limitada das tecnologias avançadas

O conhecimento limitado de tecnologias avançadas representa um desafio significativo para o mercado de instrumentos analíticos de equipamentos do México. Apesar da crescente ênfase do país na investigação científica e na inovação, muitos intervenientes, incluindo empresas, investigadores e organismos reguladores, não estão familiarizados com os métodos e tecnologias analíticas mais recentes. Esta lacuna pode dificultar o crescimento do setor e a adoção de soluções inovadoras.

A falta de sensibilização leva muitas vezes à relutância em adotar tecnologias analíticas avançadas. Muitas organizações podem continuar a utilizar instrumentos e metodologias desatualizados, resultando em ineficiências e resultados abaixo do ideal. Esta estagnação pode atrasar o progresso em vários setores, incluindo produtos farmacêuticos, monitorização ambiental e segurança alimentar, onde as tecnologias de ponta são cruciais para aumentar a precisão e a eficiência. Os investigadores em ambientes académicos e industriais podem não ter acesso a formação ou recursos para se manterem atualizados sobre as tecnologias emergentes. Esta lacuna de conhecimento limita a sua capacidade de aplicar técnicas inovadoras no seu trabalho, afetando a qualidade e a relevância dos resultados da investigação. Consequentemente, o desenvolvimento de novos instrumentos analíticos pode não estar alinhado com as necessidades da indústria, sufocando a inovação.

O desafio da sensibilização limitada sublinha a necessidade de programas de educação e formação melhorados. Promover a sensibilização para as tecnologias avançadas através de workshops, seminários e parcerias com instituições de ensino pode ajudar a colmatar esta lacuna, capacitando os investigadores e os profissionais da indústria para utilizarem as mais recentes técnicas analíticas de forma eficaz.

Este relatório de mercado fornece detalhes de novos desenvolvimentos recentes, regulamentos comerciais, análise de importação e exportação, análise de produção, otimização da cadeia de valor, quota de mercado, impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações do mercado, análise estratégica do crescimento do mercado, tamanho do mercado, crescimento do mercado das categorias, nichos de aplicação e dominância, aprovações de produtos, lançamentos de produtos, expansões geográficas, inovações tecnológicas no mercado. Para mais informações sobre o mercado, contacte a Data Bridge Market Research para obter um briefing de analista.

Impacto e cenário atual do mercado de escassez de matéria-prima e atrasos no envio

A Data Bridge Market Research oferece uma análise de alto nível do mercado e fornece informações tendo em conta o impacto e o ambiente atual do mercado de escassez de matérias-primas e atrasos nas remessas. Isto traduz-se em avaliar possibilidades estratégicas, criar planos de ação eficazes e auxiliar as empresas na tomada de decisões importantes.

Além do relatório padrão, também oferecemos uma análise aprofundada do nível de aquisição, desde atrasos previstos de expedição, mapeamento de distribuidores por região, análise de commodities, análise de produção, tendências de mapeamento de preços, sourcing, análise de desempenho de categoria, soluções avançadas de gestão de risco da cadeia de abastecimento.

Impacto esperado da desaceleração económica nos preços e na disponibilidade dos produtos

Quando a atividade económica abranda, as indústrias começam a sofrer. Os efeitos previstos da crise económica nos preços e na acessibilidade dos produtos são tidos em conta nos relatórios de informação de mercado e nos serviços de informações fornecidos pelo DBMR. Com isto, os nossos clientes conseguem geralmente manter-se um passo à frente dos seus concorrentes, projetar as suas vendas e receitas e estimar as suas despesas com lucros e perdas.

Âmbito do mercado de instrumentos analíticos

O mercado está segmentado em quatro segmentos notáveis baseados em instrumentos, setor, aplicação e canal de distribuição. O crescimento entre estes segmentos irá ajudá-lo a analisar segmentos de baixo crescimento nos setores e fornecerá aos utilizadores uma visão geral e informações valiosas do mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Instrumentos

- Instrumentos de cromatografia

- Cromatografia Líquida

- Cromatografia gasosa

- Instrumentos de Espectroscopia

- Espectrometria de massa

- Espectroscopia de emissão óptica

- Espectroscopia de infravermelhos

- Espectrofotómetros ultravioleta

- Espectroscopia de Fluorescência

- Espectroscopia de absorção atómica

- Espectrómetro infravermelho com transformada de Fourier

- Espectrómetros NIR

- Espectrómetros de fluorescência de raios X

- Fluorescência de raios X dispersiva de energia

- Fluorescência de raios X dispersiva de comprimento de onda

- Espectro de luz visível

- Espectroscopia Óptica

- Outros

- Análise Térmica

- Calorimetria diferencial de varrimento

- Análise Termogravimétrica

- Análise Mecânica Dinâmica

- Análise Termo-Óptica

- Medidores de espessura de revestimento

- Medidores de espessura magnética

- Medidores de correntes parasitas

- Medidores ultrassónicos

- Medidores Mecânicos

- Outros

- Outros

Setor

- Privado

- Público (Governo)

Aplicação

- Produtos farmacêuticos

- Instrumentos de cromatografia

- Cromatografia Líquida

- Cromatografia gasosa

- Instrumentos de Espectroscopia

- Espectrometria de massa

- Espectrofotómetros ultravioleta

- Espectroscopia de infravermelhos

- Espectroscopia de Fluorescência

- Espectroscopia Óptica

- Espectroscopia de emissão óptica

- Espectroscopia de absorção atómica

- Espectro de luz visível

- Espectrómetros NIR

- Espectrómetro infravermelho com transformada de Fourier

- Espectrómetros de fluorescência de raios X

- Outros

- Análise Térmica

- Medidores de espessura de revestimento

- Outros

- Instrumentos de cromatografia

- Alimentos e Bebidas

- Instrumentos de cromatografia

- Cromatografia Líquida

- Cromatografia gasosa

- Instrumentos de Espectroscopia

- Espectroscopia Óptica

- Espectrofotómetros ultravioleta

- Espectrometria de massa

- Espectroscopia de infravermelhos

- Espectrómetro infravermelho com transformada de Fourier

- Espectrómetros NIR

- Espectroscopia de emissão óptica

- Espectroscopia de Fluorescência

- Espectro de luz visível

- Espectroscopia de absorção atómica

- Espectrómetros de fluorescência de raios X

- Outros

- Análise Térmica

- Medidores de espessura de revestimento

- Outros

- Instrumentos de cromatografia

- Mineração e Minerais

- Instrumentos de Espectroscopia

- Espectroscopia de emissão óptica

- Espectroscopia Óptica

- Espectrometria de massa

- Espectrómetros de fluorescência de raios X

- Espectroscopia de infravermelhos

- Espectroscopia de absorção atómica

- Espectroscopia de Fluorescência

- Espectrómetro infravermelho com transformada de Fourier

- Espectrómetros NIR

- Espectro de luz visível

- Espectrofotómetros ultravioleta

- Outros

- Instrumentos de cromatografia

- Cromatografia Líquida

- Cromatografia gasosa

- Análise Térmica

- Medidores de espessura de revestimento

- Outros

- Instrumentos de Espectroscopia

- Fabricação Química

- Instrumentos de Espectroscopia

- Espectrometria de massa

- Espectroscopia Óptica

- Espectrofotómetros ultravioleta

- Espectroscopia de infravermelhos

- Espectroscopia de emissão óptica

- Espectroscopia de Fluorescência

- Espectroscopia de absorção atómica

- Espectrómetro infravermelho com transformada de Fourier

- Espectrómetros NIR

- Espectrómetros de fluorescência de raios X

- Espectro de luz visível

- Outros

- Instrumentos de cromatografia

- Cromatografia Líquida

- Cromatografia gasosa

- Análise Térmica

- Medidores de espessura de revestimento

- Outros

- Instrumentos de Espectroscopia

- Petróleo e Gás

- Instrumentos de Espectroscopia

- Espectrometria de massa

- Espectroscopia de infravermelhos

- Espectroscopia de emissão óptica

- Espectrofotómetros ultravioleta

- Espectroscopia de Fluorescência

- Espectrómetro infravermelho com transformada de Fourier

- Espectrómetros NIR

- Espectroscopia de absorção atómica

- Espectrómetros de fluorescência de raios X

- Espectro de luz visível

- Espectroscopia Óptica

- Outros

- Instrumentos de cromatografia

- Cromatografia Líquida

- Cromatografia gasosa

- Análise Térmica

- Medidores de espessura de revestimento

- Outros

- Instrumentos de Espectroscopia

- Electrónica e Semicondutores

- Instrumentos de Espectroscopia

- Espectrometria de massa

- Espectroscopia Óptica

- Espectrofotómetros ultravioleta

- Espectroscopia de infravermelhos

- Espectroscopia de emissão óptica

- Espectroscopia de Fluorescência

- Espectroscopia de absorção atómica

- Espectrómetro infravermelho com transformada de Fourier

- Espectrómetros NIR

- Espectro de luz visível

- Espectrómetros de fluorescência de raios X

- Outros

- Instrumentos de cromatografia

- Cromatografia Líquida

- Cromatografia gasosa

- Análise Térmica

- Medidores de espessura de revestimento

- Outros

- Instrumentos de Espectroscopia

- Têxteis

- Instrumentos de Espectroscopia

- Espectroscopia de infravermelhos

- Espectrofotómetros ultravioleta

- Espectroscopia Óptica

- Espectroscopia de emissão óptica

- Espectrometria de massa

- Espectroscopia de Fluorescência

- Espectrómetro infravermelho com transformada de Fourier

- Espectrómetros NIR

- Espectroscopia de absorção atómica

- Espectro de luz visível

- Espectrómetros de fluorescência de raios X

- Outros

- Instrumentos de cromatografia

- Cromatografia Líquida

- Cromatografia gasosa

- Análise Térmica

- Medidores de espessura de revestimento

- Outros

- Instrumentos de Espectroscopia

- Automotivo

- Instrumentos de cromatografia

- Cromatografia Líquida

- Cromatografia gasosa

- Instrumentos de Espectroscopia

- Espectrometria de massa

- Espectrómetro infravermelho com transformada de Fourier

- Espectroscopia de emissão óptica

- Espectrómetros de fluorescência de raios X

- Espectroscopia de infravermelhos

- Espectrómetros NIR

- Espectroscopia de absorção atómica

- Espectro de luz visível

- Espectroscopia de Fluorescência

- Espectrofotómetros ultravioleta

- Espectroscopia Óptica

- Outros

- Análise Térmica

- Medidores de espessura de revestimento

- Outros

- Instrumentos de cromatografia

- Automóvel, Por Tipo de Veículo

- Convencional

- Veículos elétricos

- Híbrido

- Aeroespacial e Defesa

- Instrumentos de Espectroscopia

- Espectrometria de massa

- Espectroscopia de emissão óptica

- Espectroscopia de absorção atómica

- Espectrómetro infravermelho com transformada de Fourier

- Espectrómetros NIR

- Espectrómetros de fluorescência de raios X

- Espectroscopia de infravermelhos

- Espectroscopia de Fluorescência

- Espectrofotómetros ultravioleta

- Espectro de luz visível

- Espectroscopia Óptica

- Outros

- Instrumentos de cromatografia

- Cromatografia Líquida

- Cromatografia gasosa

- Análise Térmica

- Medidores de espessura de revestimento

- Outros

- Instrumentos de Espectroscopia

- Outros

- Instrumentos de Espectroscopia

- Espectroscopia de emissão óptica

- Espectroscopia de infravermelhos

- Espectroscopia de Fluorescência

- Espectrofotómetros ultravioleta

- Espectro de luz visível

- Espectrometria de massa

- Espectroscopia de absorção atómica

- Espectrómetro infravermelho com transformada de Fourier

- Espectrómetros NIR

- Espectrómetros de fluorescência de raios X

- Espectroscopia Óptica

- Outros

- Instrumentos de cromatografia

- Cromatografia Líquida

- Cromatografia gasosa

- Análise Térmica

- Medidores de espessura de revestimento

- Outros

- Instrumentos de Espectroscopia

Canal de Distribuição

- Vendas Diretas

- Vendas indiretas

- Grossista/Distribuidores

- Outros

Análise regional do mercado de instrumentos analíticos

O mercado é analisado e os insights e tendências sobre o tamanho do mercado são fornecidos por instrumentos, setor, aplicação e canal de distribuição, conforme referenciado acima.

A secção do relatório sobre os países também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado nacional que impactam as tendências atuais e futuras do mercado. Pontos de dados como a análise da cadeia de valor a montante e a jusante, tendências técnicas e análise das cinco forças de Porter, estudos de caso são alguns dos indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade de marcas globais e os seus desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, ao impacto de tarifas domésticas e rotas comerciais são considerados ao fornecer uma análise de previsão dos dados do país.

Quota de mercado de instrumentos analíticos

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Analytical Instruments Market Leaders Operating in the Market Are:

- Thermo Fisher Scientific Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Waters Corporation (U.S.)

- PerkinElmer Inc. (U.S.)

- Bruker (U.S.)

- Avantor, Inc. (U.S.)

- Carl Zeiss AG (Germany)

- Eppendorf SE (U.S.)

- Illumina, Inc. (U.S.)

- METTLER TOLEDO (Switzerland)

Latest Developments in Analytical Instruments Market

- In August 2024, Thermo Fisher Scientific Inc. received three R&D 100 Awards, including a gold award for the Orbitrap Astral Mass Spectrometer, a major advancement in mass spectrometry. This instrument improves proteome coverage and throughput, facilitating breakthroughs in precision medicine. The Gibco CTS Detachable Dynabeads platform also gained recognition for its innovative active release mechanism, enhancing efficiency in cell therapy manufacturing. These accolades underscore Thermo Fisher's dedication to scientific innovation

- In August 2024, Thermo Fisher Scientific Inc. completed its acquisition of Olink Holding AB for approximately $3.1 billion, integrating Olink into its Life Sciences Solutions segment. This acquisition enhances Thermo Fisher's capabilities in proteomics, vital for advancing precision medicine. The tender offer accepted all validly tendered shares at $26.00 each, resulting in Thermo Fisher owning about 98.2% of Olink's outstanding shares. The subsequent offering period will expire at 5:00 p.m. New York time on July 16, 2024

- In July 2024, Thermo Fisher Scientific Inc. opened its first electron microscopy demo center, or NanoPort, in Taiwan to support semiconductor innovation and materials R&D. Located in a key semiconductor manufacturing hub, the facility will provide access to advanced analytical instruments and expert guidance, helping customers accelerate research and reduce time-to-market. This new center joins five other NanoPorts globally, reinforcing Thermo Fisher's commitment to advancing science and technology.

- In June 2024, Thermo Fisher Scientific Inc. introduced the Stellar mass spectrometer, enhancing clinical research and precision medicine. With fast throughput and high sensitivity, it enables efficient verification of proteins and metabolites, achieving ten times the quantitative sensitivity of traditional methods. This innovation accelerates study completion and improves productivity, supporting the development of personalized therapies

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.