Las tuberías son estructuras cilíndricas huecas que se utilizan en diversas industrias para transportar fluidos, gases y, en ocasiones, sólidos. Comúnmente fabricadas con materiales como acero, cobre , PVC y polietileno , son esenciales en sectores como el petróleo y el gas, el suministro de agua, la construcción, el procesamiento químico y la manufactura. Proporcionan un medio seguro y eficiente para transportar sustancias a largas distancias y a través de sistemas complejos. Según la industria y la aplicación, las tuberías pueden variar en tamaño, grosor y composición del material para soportar diferentes presiones, temperaturas y entornos corrosivos, lo que las convierte en componentes vitales de la infraestructura industrial.

Acceda al informe completo en https://www.databridgemarketresearch.com/reports/north-america-pipe-market

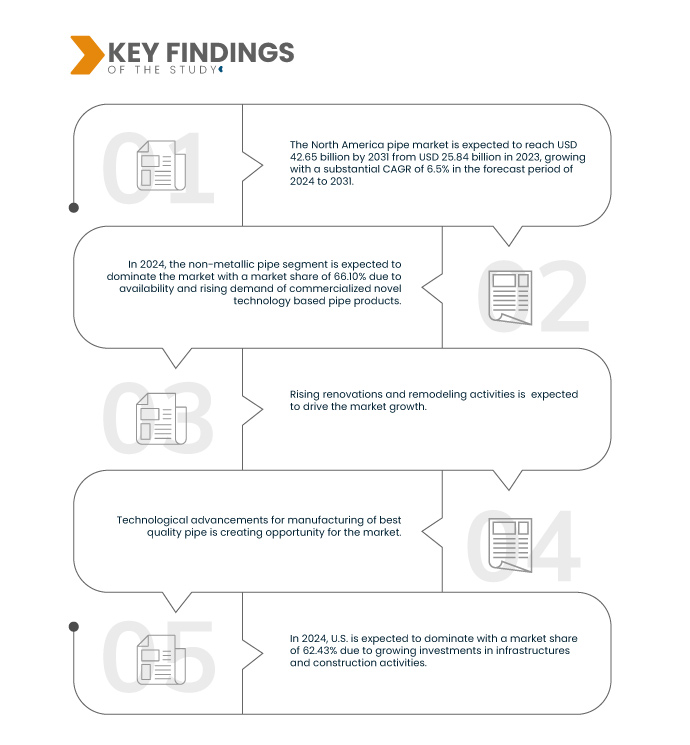

Data Bridge Market Research analiza que se espera que el mercado de tuberías de América del Norte alcance los USD 42,65 mil millones para 2031 desde USD 25,84 mil millones en 2023, creciendo con una CAGR sustancial del 6,5% en el período de pronóstico de 2024 a 2031. Los productos de tuberías comercializados basados en tecnología novedosa impulsarán el crecimiento del mercado.

Principales hallazgos del estudio

Aumento del uso de tuberías para aplicaciones domésticas y comerciales

El mercado norteamericano de tuberías está impulsado por la creciente demanda en aplicaciones domésticas y comerciales. La urbanización y la creciente densidad de población impulsan la necesidad de sistemas de tuberías confiables en entornos residenciales, comerciales e industriales. En el sector doméstico, el aumento de los desarrollos y renovaciones de viviendas impulsa la demanda de soluciones de plomería avanzadas, como tuberías de PVC, PEX y cobre. En el sector comercial, las nuevas construcciones en los sectores de la salud, la hostelería y la industria manufacturera impulsan la necesidad de tuberías duraderas para el suministro de agua, la gestión de residuos, la climatización (HVAC) y los procesos industriales. A medida que crece la construcción y el desarrollo de infraestructuras, se espera que la demanda de sistemas de tuberías eficientes expanda aún más el mercado.

Alcance del informe y segmentación del mercado

Métrica del informe

|

Detalles

|

Período de pronóstico

|

2024 a 2031

|

Año base

|

2023

|

Años históricos

|

2022 (personalizable para 2016-2021)

|

Unidades cuantitativas

|

Ingresos en miles de millones de USD, volumen en kilotoneladas y precios en USD/toneladas

|

Segmentos cubiertos

|

Por material (tuberías no metálicas y metálicas ), procesos de fabricación (fabricación de tuberías sin costura, fabricación de tuberías con soldadura por resistencia eléctrica (ERW), fabricación de tuberías con soldadura por arco sumergido (SAW), fabricación de tuberías con soldadura por arco doble sumergido (DSAW) y fabricación de tuberías sin costura y soldadas), categoría (tuberías a presión y tuberías sin presión), tamaño (hasta 1/2'', 1/2-1'', 1-2'', 2-5'', 5-10'', 10-20'' y más de 20''), industria (infraestructura hídrica, infraestructura de petróleo y gas, infraestructura de construcción e infraestructura industrial)

|

Países cubiertos

|

Estados Unidos, Canadá, México

|

Actores del mercado cubiertos

|

JM EAGLE, INC. (EE. UU.), Advanced Drainage Systems (EE. UU.), Chevron Phillips Chemical Company LLC. (EE. UU.), Charlotte Pipe, Foundry (EE. UU.), Aliaxis Holdings SA (Bélgica), Orbia (México), Atkore (EE. UU.), Nucor Tubular Products (EE. UU.), Uponor North America (EE. UU.), Contech Engineered Solutions LLC (EE. UU.), WL Plastics (EE. UU.), Prinsco, Inc. (EE. UU.), Pestan North America (EE. UU.), Furukawa Electric Co. Ltd. (Japón), Lane Enterprises, Inc. (EE. UU.), Westlake Pipe & Fittings (EE. UU.).

|

Puntos de datos cubiertos en el informe

|

Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio.

|

Análisis de segmentos:

El mercado de tuberías de América del Norte está segmentado en cinco segmentos notables según el material, el proceso de fabricación, la categoría, el tamaño y la industria.

- En función del material, el mercado se segmenta en tubos no metálicos y tubos metálicos.

En 2024, se espera que el segmento de tuberías no metálicas domine el mercado de tuberías de América del Norte.

Se espera que en 2024, el segmento de tuberías no metálicas domine el mercado con una participación de mercado del 66,10% debido a sus ventajas en rentabilidad, resistencia a la corrosión y facilidad de instalación.

- Sobre la base del proceso de fabricación, el mercado está segmentado en fabricación de tubos sin costura, fabricación de tubos con soldadura por resistencia eléctrica (ERW), fabricación de tubos con soldadura por arco sumergido (saw), fabricación de tubos con soldadura por arco sumergido doble (DSAW) y proceso de fabricación de tubos sin costura y soldados.

Se espera que en 2024, la fabricación de tubos sin costura domine el mercado de tubos de América del Norte.

Se espera que en 2024, el segmento de fabricación de tubos sin costura domine el mercado con una participación de mercado del 37,36% debido a su resistencia superior, durabilidad y capacidad para soportar condiciones de alta presión y temperatura.

- Según la categoría, el mercado se segmenta en tuberías de presión y tuberías sin presión. Se prevé que en 2024, el segmento de tuberías de presión domine el mercado con una cuota de mercado del 63,97%.

- Según el tamaño, el mercado se segmenta en hasta 1/2'', 1/2-1'', 1-2'', 2-5'', 5-10'', 10-20'' y más de 20''. En 2024, se espera que el segmento de hasta 1/2'' domine el mercado con una cuota de mercado del 22,44%.

- Según la industria, el mercado se segmenta en infraestructura hídrica, infraestructura de petróleo y gas, infraestructura de construcción e infraestructura industrial. En 2024, se prevé que el segmento de infraestructura hídrica domine el mercado con una cuota de mercado del 38,86 %.

Actores principales

Data Bridge Market Research analiza a JM EAGLE, INC. (EE. UU.), Advanced Drainage Systems (EE. UU.), Chevron Phillips Chemical Company LLC. (EE. UU.), Charlotte Pipe and Foundry (EE. UU.) y Aliaxis Holdings SA (Bélgica), entre otros.

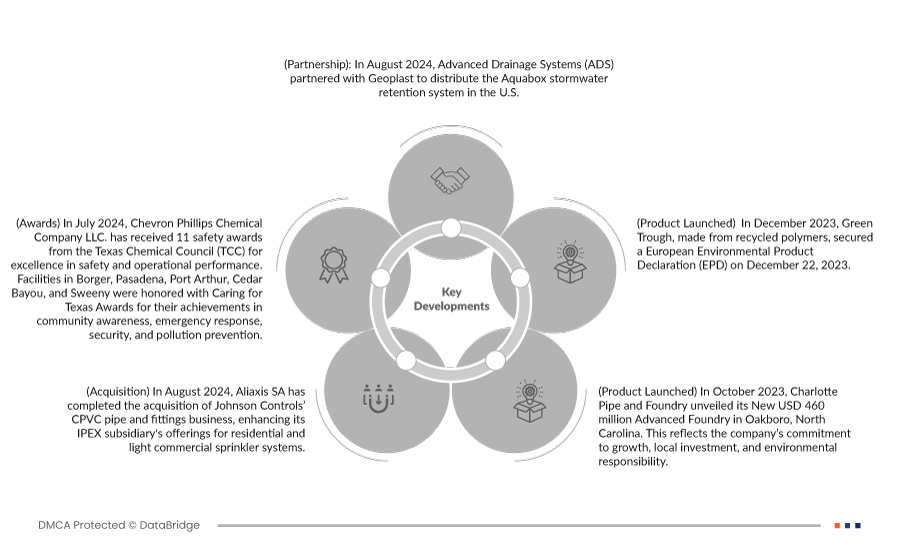

Desarrollo del mercado

- En agosto de 2024, Advanced Drainage Systems (ADS) se asoció con Geoplast para distribuir el sistema de retención de aguas pluviales Aquabox en EE. UU. Esta colaboración amplía la cartera de gestión de aguas pluviales de ADS, ofreciendo soluciones innovadoras de alta capacidad para el control de inundaciones urbanas y la gestión sostenible del agua, mejorando su liderazgo en el mercado.

- En julio de 2024, Chevron Phillips Chemical Company LLC recibió 11 premios de seguridad del Consejo Químico de Texas (TCC) por su excelencia en seguridad y desempeño operativo. Las instalaciones de Borger, Pasadena, Port Arthur, Cedar Bayou y Sweeny fueron galardonadas con los Premios Caring for Texas por sus logros en concientización comunitaria, respuesta a emergencias, seguridad y prevención de la contaminación. Las instalaciones de Conroe y Orange fueron reconocidas con el Premio Cero Incidentes y el Premio Dr. Sam Mannan por no registrar lesiones registrables por OSHA ni incidentes de Nivel 1/2.

- En agosto de 2024, Aliaxis SA completó la adquisición del negocio de tuberías y accesorios de CPVC de Johnson Controls, lo que amplía la oferta de su filial IPEX para sistemas de rociadores residenciales y comerciales ligeros. Esta adquisición fortalece las soluciones de extinción de incendios de Aliaxis en Norteamérica, amplía su capacidad de fabricación y demuestra su compromiso con el crecimiento y la mejora del servicio al cliente.

- En octubre de 2023, Charlotte Pipe and Foundry inauguró su nueva fundición avanzada de USD 460 millones en Oakboro, Carolina del Norte. Esto refleja el compromiso de la empresa con el crecimiento, la inversión local y la responsabilidad ambiental.

- En diciembre de 2023, Green Trough, fabricado con polímeros reciclados, obtuvo una Declaración Ambiental de Producto Europea (DAP) el 22 de diciembre de 2023. Este logro marcó la primera adquisición de DAP para un fabricante japonés de comederos en Europa, apoyando los objetivos ambientales y los cambios modales bajo el Pacto Verde Europeo.

Análisis regional

Sobre la base de la geografía, el mercado está segmentado en EE. UU., Canadá y México.

Según el análisis de investigación de mercado de Data Bridge :

Se espera que Estados Unidos sea el país dominante y de más rápido crecimiento en el mercado de tuberías de América del Norte.

Estados Unidos dominará el mercado norteamericano de tuberías gracias a su sólido desarrollo en construcción e infraestructura, impulsado por las inversiones gubernamentales en proyectos de modernización y urbanización. Además, cuenta con un sector manufacturero consolidado y una fuerte demanda de tuberías en industrias como la del petróleo y el gas, el suministro de agua y la energía. Además, el enfoque del país en la modernización de infraestructuras obsoletas y el aumento de la construcción residencial y comercial impulsan aún más la demanda de tuberías. El mercado estadounidense se beneficia de tecnologías avanzadas, una amplia gama de materiales disponibles y rigurosas normas regulatorias, lo que lo convierte en un líder en la región.

Para obtener información más detallada sobre el mercado de tuberías de América del Norte, haga clic aquí: https://www.databridgemarketresearch.com/reports/north-america-pipe-market