The consumers are increasingly turn to online shopping, there is a surge in the demand for efficient transportation and logistics solutions to ensure timely delivery of goods. This surge in demand has opened up new opportunities for the KSA trucking market, creating a positive environment for growth and development. One of the key factors contributing to the synergy between e-commerce and the road freight sector is the need for last-mile delivery services. E-commerce companies require reliable and flexible transportation options to deliver products directly to consumers' doorsteps. This has led to an increased demand for local trucking services, creating a niche market for companies specializing in road freight in the KSA. The adaptability of trucking services to cater to diverse delivery requirements positions them as a vital link in the e-commerce supply chain. Moreover, the evolving nature of the e-commerce landscape has given rise to innovations in the road freight sector. Companies are investing in technology to optimize routes, enhance real-time tracking capabilities, and improve overall efficiency. These technological advancements not only benefit the trucking companies in terms of operational excellence but also contribute to the overall growth of the e-commerce ecosystem by ensuring faster and more reliable deliveries.

Access Full Report @ https://www.databridgemarketresearch.com/reports/ksa-trucking-road-freight-market

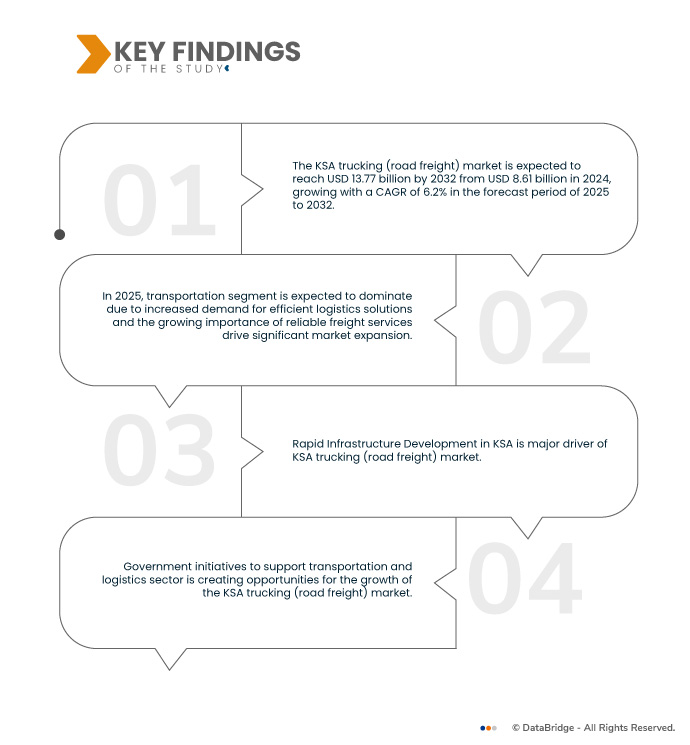

Data Bridge Market Research analyses that the KSA Trucking (Road Freight) Market is expected to reach USD 13.77 billion by 2032 from USD 8.61 billion in 2024, growing with a CAGR of 6.2% in the forecast period of 2025 to 2032.

Key Findings of the Study

Rapid Infrastructure Development in KSA

The KSA government invests heavily in various infrastructure projects such as new highways, ports, and logistics hubs, the demand for efficient and reliable transportation services has surged. The expansion of infrastructure creates an increased need for the transportation of raw materials, equipment, and finished goods, driving the growth of the road freight industry. Moreover, the development of mega-projects, such as NEOM and the Red Sea Project, requires extensive logistics support. These projects entail the movement of large quantities of materials and goods over long distances, and the trucking industry is well-positioned to play a crucial role in facilitating this transportation demand. The trucking sector is likely to benefit from the expansion of logistics and distribution networks, as companies seek reliable and cost-effective solutions to transport goods across the country.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2025 to 2032

|

|

Base Year

|

2024

|

|

Historic Years

|

2023 (Customizable from 2013-2017)

|

|

Quantitative Units

|

Revenue in USD Billion

|

|

Segments Covered

|

By Service Type (Transportation, Warehousing & Distribution, and Freight Forwarding), Type of Carrier (Less than Truckload (LTL), Full Truckload (FTL), Partial Truckload (PTL), and Specialized Freight), Vehicle Type (Heavy Duty Commercial Trucks, Medium Duty Commercial Trucks, and Light Duty Commercial Trucks), Truck Type (Tanker Truck, Box Truck, Refrigerated Truck, Semi-Trailer Truck, Flatbeds Truck, and Liftgate Trucks), Type of Goods (Road Transport of Foodstuffs, ADR Road Transport of Dangerous Goods, and General Goods), Type of Road Freight (Dry Goods Road Transport, Road Transport of Bulk Cargo, and Heavy Goods Transport), Operation (Domestic and International), Customer Type (B2B, B2C, and E-Commerce and Last Mile Delivery), Business Model (Asset-Based Carriers and Non-Asset-Based Carriers) Distance (More Than 500 Miles, 201 Miles-500 Miles, 101 Miles – 200 Miles, 50 Mile – 100 Miles, and Less Than 50 Miles), Industry (Oil & Gas, Manufacturing, Food & Beverages, Mining, Energy & Utility, Fast Moving Consumer Goods (FMCG), Healthcare, E-Commerce, Chemical, Automotive, IT & Telecom, Retail, Transportation, Defense, Electronics, Apparels, and Footwear)

|

|

Market Players Covered

|

Kuehne+Nagel (Switzerland), CEVA Logistics (France), DHL (Germany), DSV (Denmark), Abdul Latif Jameel Transportation Company Limited (KSA), Sinotrans Co., Ltd (China), GAC (U.A.E.), FedEx (U.S.), SEKO Logistics (U.S.), United Parcel Service of America, Inc. (U.S.), Hellmann (Germany), JAS (U.S.), DB SCHENKER (Europe), fourwinds (KSA), Ardian Global Express LLC. (U.A.E.), NTF GROUP (KSA), Defaf Logistics (KSA), WeFreight (U.A.E.), and Freights Solutions Co. (KSA)

|

|

Data Points Covered in the Report

|

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

|

Segment Analysis

The KSA trucking (road freight) market is segmented into eleven notable segments, based on the basis of service type, type of carrier, vehicle type, truck type, type of goods, type of road freight, operation, customer type, business model, distance, and industry.

- On the basis of service type, the market is segmented into transportation, warehousing and distribution, freight forwarding, and others

In 2025, transportation segment is expected to dominate the market with 54.83% market share

In 2025, transportation segment is expected to dominate the market with 54.83% market share due to increased demand for efficient logistics solutions and the growing importance of reliable freight services drive significant market expansion.

- On the basis of type of carrier, the market is segmented into less than truckload (LTL), full truckload (FTL), partial truckload (PTL), and specialized freight

In 2025, less than truckload (LTL) segment is expected to dominate the market with 44.96% market share

In 2025, less than truckload (LTL) segment is expected to dominate the market with 44.96% market share due to its cost-efficiency for businesses with smaller freight volumes, enabling them to share space in a truck and reduce shipping costs. Additionally, LTL offers greater flexibility and accessibility, making it a preferred option for both local and regional shipments.

- On the basis of vehicle type, the market is segmented into heavy duty commercial trucks, medium duty commercial trucks, and light duty commercial trucks. In 2025, heavy duty commercial trucks segment is expected to dominate the market with 40.13% market share

- On the basis of truck type, the market is segmented into tanker truck, box truck, refrigerated truck, semi-trailer truck, flatbeds truck, liftgate trucks, and others. In 2025, tanker truck segment is expected to dominate the market with 25.60% market share

- On the basis of type of goods, the market is segmented into road transport of foodstuffs, ADR road transport of dangerous goods, general goods, and others. In 2025, road transport of foodstuffs segment is expected to dominate the market with 39.12% market share

- On the basis of type of road freight, the market is segmented into dry goods road transport, road transport of bulk cargo, heavy goods transport, and others. In 2025, dry goods road transport segment is expected to dominate the market with 42.03% market share

- On the basis of operation, the market is segmented into domestic and international. In 2025, domestic segment is expected to dominate the market with 81.64% market share

- On the basis of customer type, the market is segmented into B2B, B2C, and E-Commerce & last mile delivery. In 2025, B2B segment is expected to dominate the market with 62.40% market share

- On the basis of business model, The market is segmented into asset-based carriers and non-asset-based carriers. In 2025, asset-based carriers segment is expected to dominate the market with 61.51% market share

- On the basis of distance, the market is segmented into more than 500 miles, 201 miles-500 miles, 101 miles – 200 miles, 50 mile – 100 miles, and less than 50 miles. In 2025, more than 500 miles segment is expected to dominate the market with 29.88% market share

- On the basis of industry, the market is segmented into oil & gas, manufacturing, food & beverages, mining, energy & utility, fast moving consumer goods (fmcg), healthcare, e-commerce, chemical, automotive, it & telecom, retail, transportation, defense, electronics, apparels & footwear, and others. In 2025, oil and gas segment is expected to dominate the market with 15.54% market share

Major Players

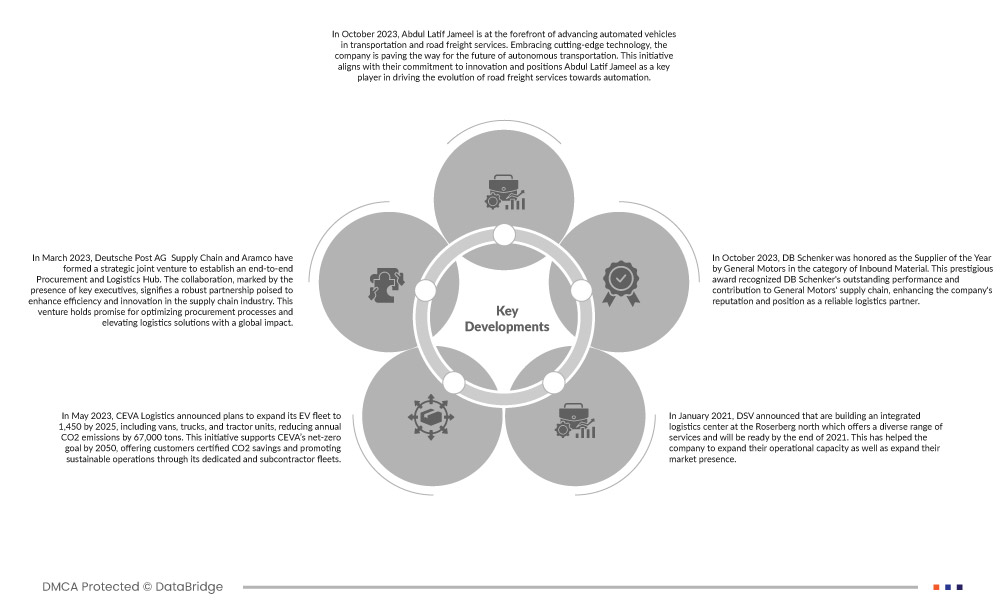

Data Bridge Market Research analyzes Sinotrans Co., Ltd (China), Abdul Latif Jameel Transportation Company Limited (KSA), DHL (Germany), CEVA Logistics (France), and DSV (Denmark) as major market players.

Market Development

- In February 2024, Applanix has launched the POS MV series – Surfmaster, Wavemaster, and Oceanmaster – a complete inertial navigation system offering precise attitude, heading, heave, position, and velocity data for marine vessels and sensors. This advancement strengthens Applanix’s reputation as a leader in hydrographic survey equipment, providing highly reliable, accurate solutions that thrive in challenging marine environments, making it the preferred choice for professionals in the field

- In September 2024, Teledyne Marine has named iOne Resources Inc. as its official distributor in the Philippines, expanding its footprint in Southeast Asia. This collaboration allows local customers to access Teledyne Marine's advanced hydrographic survey equipment, including high-resolution multibeam sonar systems, single-beam echo sounders, and robust data acquisition software, along with improved support and services

- In October 2023, ATLAS ELEKTRONIK and Israel Aerospace Industries unveiled the BlueWhale ASW platform for advanced anti-submarine warfare. An advanced autonomous underwater vehicle integrating ELTA’s sophisticated sensor systems and ATLAS ELEKTRONIK’s towed passive sonar array, designed for efficient submarine detection. This collaboration enhances both companies’ capabilities in naval defense, leveraging IAI’s expertise in unmanned systems and ELTA’s advanced sensor technologies, resulting in a state-of-the-art, long-endurance ASW solution suitable for various naval operations

- In January 2022, Esri India has launched GeoInnovation 2022 in collaboration with AGNIi to support start-ups across sectors like agriculture, healthcare, and smart cities by leveraging Location Intelligence technology. The program integrates Esri's GIS solutions into the start-up ecosystem, promoting innovation, particularly in hydrographic surveys. By incorporating geospatial data into industries such as offshore energy and maritime defense, Esri enhances its role in shaping the future of hydrographic survey solutions, fostering growth in this emerging market

- In March 2022, Xylem and UNICEF have deepened their partnership to tackle urgent water and sanitation challenges in the Horn of Africa, focusing on Ethiopia, Somalia, Sudan, and Uganda. This collaboration addresses climate-induced crises like droughts and floods, aiming to enhance sustainable water and sanitation access through innovations like solar-powered boreholes and capacity building for local utilities. The initiative strengthens Xylem’s commitment to water security, showcasing its expertise and social responsibility, while fostering brand credibility and driving sustainable solutions globally

As per Data Bridge Market Research analysis:

For more detailed information about KSA trucking (road freight) market click here – https://www.databridgemarketresearch.com/reports/ksa-trucking-road-freight-market