Ksa Trucking Road Freight Market

Market Size in USD Billion

CAGR :

%

USD

8.61 Billion

USD

13.77 Billion

2024

2031

USD

8.61 Billion

USD

13.77 Billion

2024

2031

| 2025 –2031 | |

| USD 8.61 Billion | |

| USD 13.77 Billion | |

|

|

|

|

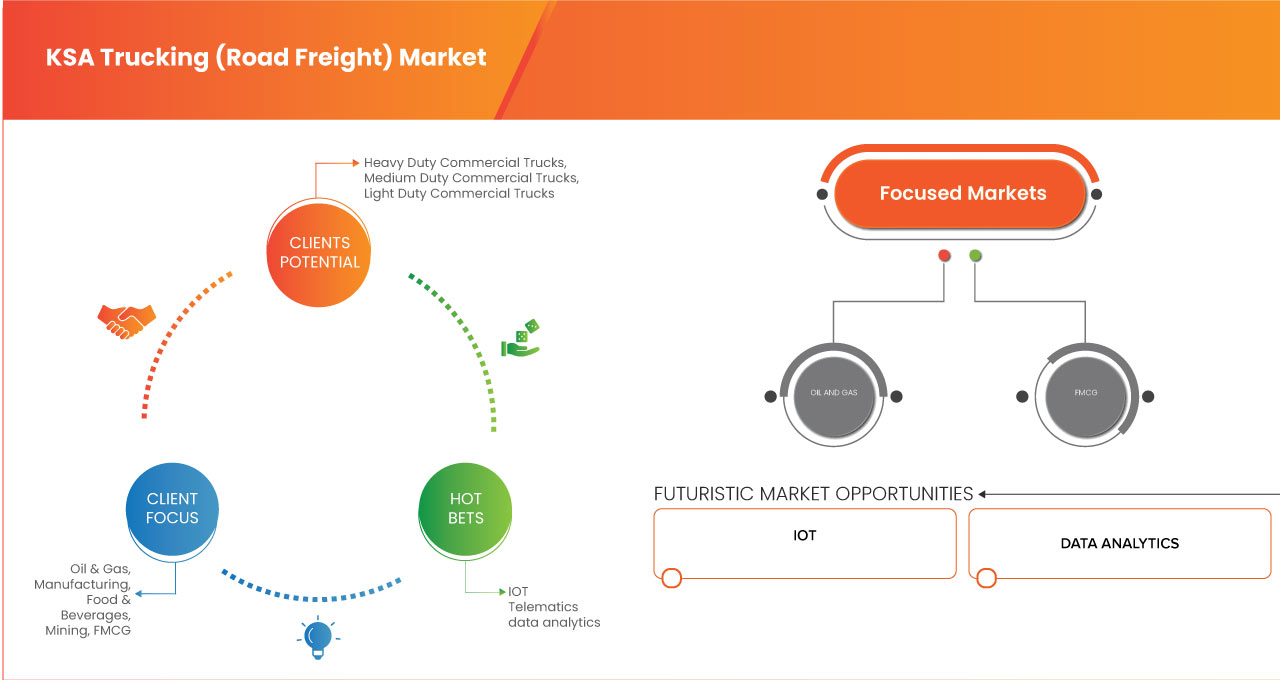

KSA Trucking (Road Freight) Market Analysis

The KSA trucking (road freight) market has seen significant growth driven by advancements in technology and increasing demand for accurate water data across various industries. The market includes a wide range of products such as sonar systems, multi-beam and single-beam echo sounders, underwater drones, GPS systems, and data management software. Key applications span across marine navigation, environmental monitoring, coastal engineering, oil and gas exploration, and defense sectors. The rising need for precise mapping of underwater terrain, coupled with the growth in maritime trade, offshore activities, and environmental protection initiatives, continues to fuel market expansion. In addition, innovations such as automation, AI integration, and improved sensor technology are shaping the future of hydrographic surveys, making them more efficient and cost-effective.

KSA Trucking (Road Freight) Market Size

The KSA trucking (road freight) market is expected to reach USD 13.77 billion by 2032 from USD 8.61 billion in 2024, growing with a CAGR of 6.2% in the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

KSA Trucking (Road Freight) Market Trends

“Expansion of Maritime Trade and Commerce”

The expansion of maritime trade and commerce is a key driver for the KSA trucking (road freight) market market. As international shipping activities grow, the need for accurate and up-to-date marine data becomes crucial for safe navigation and efficient port operations. Hydrographic surveys help in mapping shipping lanes, identifying submerged hazards, and ensuring the safe passage of vessels, thereby supporting the smooth flow of goods across international waters. In addition, the increasing complexity of global trade routes and the need for sustainable port development require advanced survey technologies. This growing demand for precise data ensures the continued growth of the KSA trucking (road freight) market market. With expanding trade volumes, the market is positioned to witness increased investments in advanced surveying technologies. As such, hydrographic surveys play a vital role in sustaining the global maritime economy.

Report Scope and KSA Trucking (Road Freight) Market Segmentation

|

Attributes |

KSA Trucking (Road Freight) Market Key Market Insights |

|

Segments Covered |

|

|

Key Market Players |

Kuehne+Nagel (Switzerland), CEVA Logistics (France), DHL (Germany), DSV (Denmark), Abdul Latif Jameel Transportation Company Limited (KSA), Sinotrans Co., Ltd (China), GAC (U.A.E.), FedEx (U.S.), SEKO Logistics (U.S.), United Parcel Service of America, Inc. (U.S.), Hellmann (Germany), JAS (U.S.), DB SCHENKER (Europe), fourwinds (KSA), Ardian Global Express LLC. (U.A.E.), NTF GROUP (KSA), Defaf Logistics (KSA), WeFreight (U.A.E.), and Freights Solutions Co. (KSA) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

KSA Trucking (Road Freight) Market Definition

The KSA trucking (road freight) market refers to the sector encompassing the transportation of goods via road freight constitutes a dynamic and essential component of the broader logistics industry. This market revolves around the movement of cargo, ranging from raw materials to finished products, using a fleet of trucks across extensive road networks. The trucking industry plays a crucial role in linking various points in supply chains, ensuring the timely and efficient delivery of goods. The marked has varied range of participants such as carriers, shippers, and third-party logistics providers, the road freight sector holds a key position in enabling and supporting trade and commerce. The dynamics of the market are influenced by factors such as technological advancements, regulatory frameworks, fuel prices, and economic trends. These elements shape the strategies employed by businesses within the road freight sector. The road freight market serves as a vital channel for the smooth flow of goods, making a substantial contribution to the global movement of commodities and the operation of contemporary economies.

KSA Trucking (Road Freight) Market Dynamics

Drivers

- Growth in E-Commerce Sector Boosting the Road Freight/Trucking Services

The rising demand for offshore oil and gas exploration is accelerating the need for advanced KSA trucking (road freight) market to support precise underwater mapping and data collection. As companies explore deeper and more complex underwater environments, accurate bathymetric charts and seabed data become critical for identifying resource-rich areas, ensuring safe drilling operations, and minimizing environmental risks. This growing activity in offshore energy production is expected to fuel the adoption of state-of-the-art hydrographic technologies, including multibeam echo sounders, side-scan sonars, and ROV-mounted systems, within the global market.

For Instance:

In February 2024, a hydrographic survey was initiated at a wreckage site off Cove, Tobago, 21 days after a vessel spewing bunker fuel ran aground near the shoreline. The survey aimed to measure water depth and locate navigational hazards to facilitate the removal of the overturned barge while assessing the distribution of fuel and hydrocarbons. Specialists and advanced equipment were deployed for fuel containment and vessel recovery. This incident highlights the critical role of KSA trucking (road freight) market in offshore oil and gas operations, as it enables precise mapping, risk mitigation, and efficient disaster response, further driving demand in the global market

In October 2024, Turkey’s advanced oil research vessel, Oruc Reis, began Somalia’s first comprehensive offshore oil exploration program, covering 15,000 square kilometers across three blocks. Equipped with state-of-the-art hydrographic survey and seismic capabilities, the vessel will conduct geological, geophysical, and oceanographic studies over 5-7 months. This initiative, under a Turkey-Somalia partnership, underscores the growing demand for KSA trucking (road freight) market in offshore oil and gas exploration as countries seek advanced tools to unlock energy resources and drive economic growth in untapped regions

- Rapid Infrastructure Development In KSA

The rise in coastal infrastructure development is contributing to the drive of the KSA trucking (road freight) market market, as accurate and detailed surveying of coastal areas is crucial for the planning and construction of infrastructure such as ports, harbors, and coastal defense systems. As these projects expand globally, the demand for hydrographic survey equipment, including advanced sonar systems, mapping technologies, and environmental monitoring tools, is increasing. These technologies help assess water depths, seabed conditions, and potential environmental impacts, ensuring that coastal infrastructure projects are executed safely, efficiently, and sustainably.

For instance,

- In October 2024, the Indian Navy received the second of four Survey Vessel (Large) ships, Nirdeshak (Yard 3026), built by Garden Reach Shipbuilders & Engineers (GRSE) in Kolkata. Nirdeshak is designed for comprehensive coastal and deep-water hydrographic surveys, which are essential for assessing port and harbor approaches and navigational channels and gathering oceanographic and geophysical data. The ship is equipped with advanced hydrographic technologies, including side scan sonar, DGPS positioning systems, and autonomous underwater vehicles. As coastal infrastructure development continues to rise globally, the demand for such advanced survey vessels, such as Nirdeshak, highlights the growing need for accurate data collection and monitoring for safe, efficient infrastructure planning and development.

- In April 2021, the Nigerian Navy's newest Offshore Survey Vessel, NNS LANA, made a port call at Las Palmas, Spain, on its homeward journey to Nigeria. This vessel, a replacement for the decommissioned NNS LANA, is equipped with state-of-the-art hydrographic, oceanographic, and geophysical survey equipment, including an electric propulsion system for minimal data distortion. Designed for hydrographic surveys and maritime security tasks, NNS LANA is a key asset for Nigeria’s maritime capabilities. The vessel’s advanced capabilities will enhance the nation's ability to conduct detailed surveys, supporting coastal infrastructure development. This growing demand for sophisticated survey vessels contributes to the rising need for KSA trucking (road freight) market globally, particularly in coastal and offshore infrastructure projects.

Opportunities

- Government Initiatives to Support Transportation and Logistics Sector

Technological advancements in survey equipment are significantly transforming the KSA trucking (road freight) market by enabling more accurate, efficient, and cost-effective data collection. Innovations such as Autonomous Underwater Vehicles (AUVs), Remotely Operated Vehicles (ROVs), multibeam sonar systems, and advanced positioning technologies have enhanced survey capabilities, allowing for detailed mapping of complex underwater environments. These developments are driving the adoption of more sophisticated equipment, which is crucial for monitoring and managing coastal infrastructure, marine environments, and navigation routes. As technology continues to evolve, the KSA trucking (road freight) market market is expected to expand, offering more reliable and sustainable solutions for a variety of applications, from maritime safety to environmental monitoring.

For instance,

In November 2020, IIT-Madras, a university in India, developed a solar-powered unmanned autonomous survey craft designed for hydrographic and oceanographic surveys in Indian ports and inland waterways. This innovative vessel, capable of operating both manually and autonomously, provides an indigenous alternative to costly foreign survey vessels. Equipped with echo sounders, GPS, and broadband communication, the craft can measure depth and underwater topography, transmitting real-time data over long distances. It also offers the potential to be fitted with additional sensors such as LiDAR for seamless topography and bathymetry. This technological advancement aligns with the increasing demand for cost-effective, efficient survey equipment in the KSA trucking (road freight) market market, emphasizing the shift toward more autonomous, sustainable solutions that enhance survey accuracy, reduce operational costs, and enable better management of coastal infrastructure

- Increasing Demand for Cold Chain Logistics

As organizations embrace predictive maintenance to improve operational efficiency and reduce downtime, incorporating Hydrographic Survey Equipments into these frameworks presents enormous opportunities. Predictive maintenance uses real-time sensor data to predict equipment breakdowns before they occur, and introducing sensor cleaning methods into these systems can improve sensor performance and durability. This integration not only keeps sensors in top condition, but it also improves the whole value proposition of predictive maintenance programs, especially in businesses that rely on complex machinery and automated systems.For instance,

As per the MDPI article, by using vibration signals from cleaning robots, predictive maintenance frameworks can identify performance degradation and potential safety issues early. This allows for proactive intervention, preventing operational failures in autonomous mobile cleaning systems. The integration of predictive maintenance into sensor cleaning technologies offers a significant opportunity for growth, as it enhances system reliability and reduces downtime. As the demand for autonomous driving increases, sensor cleaning solutions with advanced monitoring capabilities will be essential to maintaining optimal sensor performance. This opens a new avenue for innovation and growth in the sensor cleaning market.

- Strategic Partnerships And Collaborations Among Market Players

The KSA trucking (road freight) market is a pivotal component of the nation's burgeoning logistics and transportation sector. Fueled by a rapidly expanding economy and escalating trade activities, there is a demand for efficient road freight services. The market landscape is diverse, encompassing logistics companies, trucking firms, and technology providers. Opportunities for strategic partnerships abound, notably in technology integration, where collaborations can enhance route optimization, real-time tracking, and overall fleet management, thereby improving efficiency and cutting operational costs. Streamlining customs clearance processes through partnerships with government agencies, customs brokers, and technology providers presents another avenue for enhancing cross-border movements and refining the trucking experience.

Partnerships addressing last-mile delivery solutions cater to the increasing demand for precise and timely deliveries, optimizing routes, and leveraging shared warehousing facilities. Embracing environmental sustainability, collaboration can focus on adopting eco-friendly practices, alternative fuel solutions, and green technologies in alignment with the nation's sustainability goals. Data sharing for market insights, cross-border collaborations, capacity sharing, and network expansion, along with efforts to navigate regulatory challenges and ensure compliance, further underscore the array of opportunities. Nonetheless, companies must navigate challenges such as regulatory disparities, data security concerns, and cultural nuances to ensure successful collaborations. The KSA trucking (road freight) market holds immense potential for transformative partnerships, paving the way for a more efficient, sustainable, and responsive road freight ecosystem in Saudi Arabia.

For instance,

- In October 2023, according to an article published by Indian Transport & Logistics News, Swiss logistics giant Kuehne+Nagel has entered into an exclusive partnership with Tamer Logistics in Saudi Arabia to bolster its service offerings and meet the growing demand for logistics solutions in the region. The collaboration expands Kuehne+Nagel's capabilities in contract logistics, complementing its existing freight forwarding activities in the country. Tamer Logistics, a part of the Tamer Group, brings a vast local network of modern warehousing facilities and a robust fleet to enhance Kuehne+Nagel's globally recognized contract logistics expertise. Kuehne+Nagel aims to deliver end-to-end supply chain solutions for both global and domestic customers. Gianfranco Sgro, EVP Contract Logistics at Kuehne+Nagel, expressed confidence in Tamer Logistics providing quality services, aligning with the Kingdom's Vision 2030 to establish itself as a central logistical hub in the region. The partnership signifies a crucial milestone in advancing Saudi Arabia's logistics sector, emphasizing efficiency, digital transformation, and sustainability. Ayman Albarqawi, CEO of Tamer Logistics, emphasized their commitment to meeting clients' needs and aligning with international standards for top-quality services

- In October 2023, according to an article published by Locate2u, Neom, the visionary mega-city project in Saudi Arabia, has joined forces with DSV in an exclusive USD10 billion logistics joint venture. This collaboration aims to transform the logistics landscape in Neom, a futuristic urban area planned in the northwestern Tabuk province. The partnership, with Neom holding a 51% majority stake and DSV the remaining 49%, focuses on meeting Neom's complex logistics needs, contributing to rapid development, and bolstering the Saudi economy. The venture, covering ground, sea, and air transportation, is set to generate over 20,000 job opportunities. Beyond traditional logistics, both entities commit to innovation, allocating a portion of revenues to develop sustainable next-gen logistics solutions. The partnership signals a pivotal moment in Neom's journey toward realizing its ambitious vision and showcases its dedication to revolutionizing Saudi Arabia's logistics sector

Restraints/Challenges

- Stringent Government Regulations

Data privacy and security concerns present a significant challenge for the KSA trucking (road freight) market market. As hydrographic surveys increasingly rely on digital systems, unmanned vehicles, and cloud-based data storage, the risk of cyberattacks and data breaches rises. Sensitive information, such as detailed seabed mapping and strategic maritime data, is vulnerable to unauthorized access or manipulation. Ensuring the protection of this data, especially in defense and security applications, requires robust cybersecurity measures and compliance with evolving data protection regulations. The complexity of securing these advanced technologies adds an additional layer of difficulty, particularly as the volume of data collected continues to grow.

For instance: -

In October 2024, according to the blog published by Balbix Inc., data privacy and security concerns have become a major challenge for IoT systems, which can be directly related to the KSA trucking (road freight) market market. As KSA trucking (road freight) market increasingly integrates IoT devices, the same issues of weak security protocols, poor vulnerability testing, and unpatched software arise. Many devices lack robust security measures, leaving them vulnerable to cyberattacks. The vast amount of data generated by these systems, such as detailed seabed mapping, can also pose significant privacy risks if not properly safeguarded. These concerns complicate efforts to ensure secure data management and protection, highlighting the need for stronger security measures in hydrographic survey technologies.

- Fluctuations in Fuel Prices

Limited funding in developing regions presents a significant challenge for the KSA trucking (road freight) market market. Many countries in these regions struggle to allocate sufficient resources for advanced technologies such as hydrographic survey equipment, which are crucial for effective coastal management, infrastructure development, and environmental monitoring. This financial constraint hampers the adoption of modern equipment, limiting the ability to gather accurate data, make informed decisions, and support sustainable development efforts. As a result, these regions may fall behind in achieving reliable survey capabilities, impacting their overall growth and development.

For instance: -

In October 2023, according to the blog published by UNCTAD, the 46 Least Developed Countries (LDCs) faced severe financial challenges due to multiple global crises, growing debt, and dependence on volatile commodities. These financial constraints have significantly reduced their fiscal space, making it difficult to invest in critical infrastructure, including hydrographic survey equipment. Limited funding in these regions has hindered their ability to adopt modern technologies for effective environmental monitoring and infrastructure development. The financial squeeze, exacerbated by the climate emergency and global economic disruptions, presents a major obstacle to the growth of the KSA trucking (road freight) market market in these developing nations.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

KSA Trucking (Road Freight) Market Scope

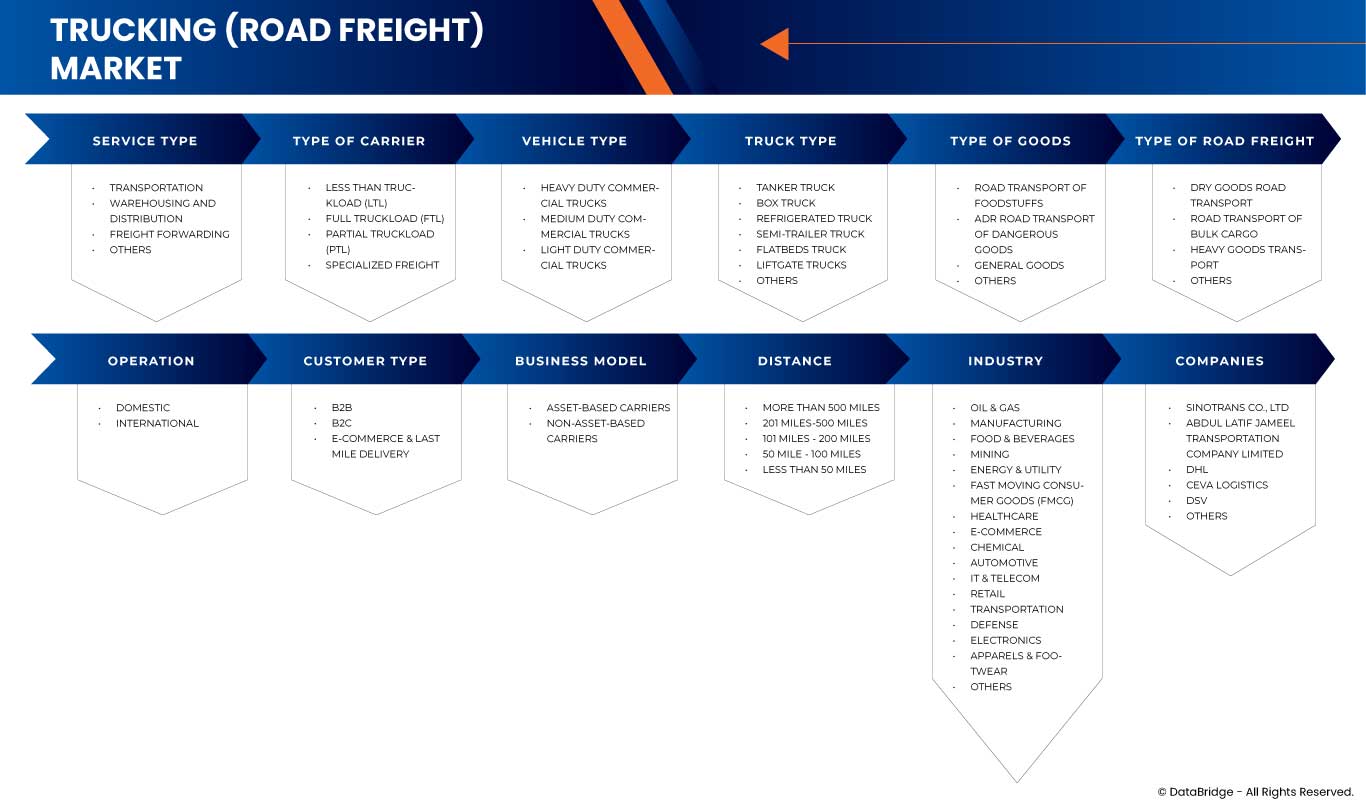

The KSA trucking (road freight) market is segmented into eleven notable segments, based on the basis of service type, type of carrier, vehicle type, truck type, type of goods, type of road freight, operation, customer type, business model, distance, and industry. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Service Type

- Transportation

- Warehousing And Distribution

- Freight Forwarding

- Others

Type Of Carrier

- Less Than Truckload (Ltl)

- Full Truckload (Ftl)

- Partial Truckload (Ptl)

- Specialized Freight

Vehicle Type

- Heavy Duty Commercial Trucks

- Medium Duty Commercial Trucks

- Light Duty Commercial Trucks

Truck Type

- Tanker Truck

- Type

- Liquid Tankers

- Dry Bulk Tankers

- Transport Products

- Fuel

- Type

- Diesel

- Petrol

- Type

- Gases

- Type

- Lpg

- Propane

- Liquefied Butane Gas

- Nitrogen

- Oxygen

- Helium

- Others

- Type

- Chemicals

- Milk

- Juices

- Others

- Fuel

- Pressurization

- Non-Pressurized

- Pressurized

- Refrigeration

- Non-Refrigerated

- Refrigerated

- Insulation

- Non-Insulated

- Insulated

- Type

- Box Truck

- Transport Products

- Food Delivery

- Home Appliances And Furniture

- Last-Mile Deliveries

- Others

- Transport Products

- Refrigerated Truck

- Transport Products

- Food

- Medical Supplies

- Type

- Pharmaceuticals

- Vaccines

- Blood Banks

- Others

- Type

- Perishable Goods

- Type

- Meat

- Fruits

- Vegetables

- Seafood

- Others

- Type

- Beverages

- Type

- Carbonated Beverages

- Juice Based Beverages

- Sports & Energy Beverage

- Tea

- Coffee

- Others

- Type

- Others

- Transport Products

- Semi-Trailer Truck

- Flatbeds Truck

- Transport Products

- Cars

- Construction Material

- Machinery

- Scrap Metal

- Others Recyclables

- Transport Products

- Liftgate Trucks

- Others

Type Of Goods

- Road Transport Of Foodstuffs

- Type

- Refrigerated Transport With Refrigeration

- Refrigerated Transport With Freezing

- Type

- Adr Road Transport Of Dangerous Goods

- General Goods

- Others

Type Of Road Freight

- Dry Goods Road Transport

- Road Transport Of Bulk Cargo

- Heavy Goods Transport

- Others

Operation

- Domestic

- International

Customer Type

- B2B

- B2C

- E-Commerce & Last Mile Delivery

Business Model

- Asset-Based Carriers

- Non-Asset-Based Carriers

Distance

- More Than 500 Miles

- 201 Miles-500 Miles

- 101 Miles – 200 Miles

- 50 Mile – 100 Miles

- Less Than 50 Miles

Industry

- Oil & Gas

- Transportation

- Warehousing And Distribution

- Freight Forwarding

- Others

- Manufacturing

- Transportation

- Warehousing And Distribution

- Freight Forwarding

- Others

- Food & Beverages

- Transportation

- Warehousing And Distribution

- Freight Forwarding

- Others

- Mining

- Transportation

- Warehousing And Distribution

- Freight Forwarding

- Others

- Energy & Utility

- Transportation

- Warehousing And Distribution

- Freight Forwarding

- Others

- Fast Moving Consumer Goods (FMCG)

- Transportation

- Warehousing And Distribution

- Freight Forwarding

- Others

- Healthcare

- Transportation

- Warehousing And Distribution

- Freight Forwarding

- Others

- E-Commerce

- Transportation

- Warehousing And Distribution

- Freight Forwarding

- Others

- Chemical

- Transportation

- Warehousing And Distribution

- Freight Forwarding

- Others

- Automotive

- Transportation

- Warehousing And Distribution

- Freight Forwarding

- Others

- IT & Telecom

- Transportation

- Warehousing And Distribution

- Freight Forwarding

- Others

- Retail

- Transportation

- Warehousing And Distribution

- Freight Forwarding

- Others

- Transportation

- Transportation

- Warehousing And Distribution

- Freight Forwarding

- Others

- Defense

- Transportation

- Warehousing And Distribution

- Freight Forwarding

- Others

- Electronics

- Transportation

- Warehousing And Distribution

- Freight Forwarding

- Others

- Apparels & Footwear

- Transportation

- Warehousing And Distribution

- Freight Forwarding

- Others

- Others

- Transportation

- Warehousing And Distribution

- Freight Forwarding

- Others

KSA Trucking (Road Freight) Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

KSA Trucking (Road Freight) Market Leaders Operating in the Market Are:

- Kuehne+Nagel (Switzerland)

- CEVA Logistics (France)

- DHL (Germany)

- DSV (Denmark)

- Abdul Latif Jameel Transport (KSA)

- Sinotrans Co., Ltd (China)

- GAC (UAE)

- FedEx (USA)

- SEKO Logistics (U.S.)

- United Parcel Service of America (USA)

- Hellmann (Germany)

- JAS (USA)

- DB SCHENKER (Europe)

- fourwinds (UAE)

- Ardian Global Express LLC. (UAE)

- NTF GROUP (KSA)

- Defaf Logistics (KSA)

- WEFEX (U.A.E.)

- Freights Solutions Co. (KSA)

Latest Developments in KSA Trucking (Road Freight) Market

- In February 2024, Applanix has launched the POS MV series – Surfmaster, Wavemaster, and Oceanmaster – a complete inertial navigation system offering precise attitude, heading, heave, position, and velocity data for marine vessels and sensors. This advancement strengthens Applanix’s reputation as a leader in hydrographic survey equipment, providing highly reliable, accurate solutions that thrive in challenging marine environments, making it the preferred choice for professionals in the field

- In September 2024, Teledyne Marine has named iOne Resources Inc. as its official distributor in the Philippines, expanding its footprint in Southeast Asia. This collaboration allows local customers to access Teledyne Marine's advanced hydrographic survey equipment, including high-resolution multibeam sonar systems, single-beam echo sounders, and robust data acquisition software, along with improved support and services

- In October 2023, ATLAS ELEKTRONIK and Israel Aerospace Industries unveiled the BlueWhale ASW platform for advanced anti-submarine warfare. An advanced autonomous underwater vehicle integrating ELTA’s sophisticated sensor systems and ATLAS ELEKTRONIK’s towed passive sonar array, designed for efficient submarine detection. This collaboration enhances both companies’ capabilities in naval defense, leveraging IAI’s expertise in unmanned systems and ELTA’s advanced sensor technologies, resulting in a state-of-the-art, long-endurance ASW solution suitable for various naval operations

- In January 2022, Esri India has launched GeoInnovation 2022 in collaboration with AGNIi to support start-ups across sectors like agriculture, healthcare, and smart cities by leveraging Location Intelligence technology. The program integrates Esri's GIS solutions into the start-up ecosystem, promoting innovation, particularly in hydrographic surveys. By incorporating geospatial data into industries such as offshore energy and maritime defense, Esri enhances its role in shaping the future of hydrographic survey solutions, fostering growth in this emerging market

- In March 2022, Xylem and UNICEF have deepened their partnership to tackle urgent water and sanitation challenges in the Horn of Africa, focusing on Ethiopia, Somalia, Sudan, and Uganda. This collaboration addresses climate-induced crises like droughts and floods, aiming to enhance sustainable water and sanitation access through innovations like solar-powered boreholes and capacity building for local utilities. The initiative strengthens Xylem’s commitment to water security, showcasing its expertise and social responsibility, while fostering brand credibility and driving sustainable solutions globally

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF KSA TRUCKING (ROAD FREIGHT) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 SERVICE TYPE TIMELINE CURVE

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 ROUTE ANALYSIS FOR COMMODITIES TYPE IN KSA TRUCKING (ROAD FREIGHT) MARKET

4.2 QUICK OUTLOOK FOR COMMODITIES TYPE IN KSA TRUCKING (ROAD FREIGHT) MARKET

4.2.1 BULK

4.2.2 BREAKBULK

4.2.3 PALLETS

4.2.4 LIQUID BULK

4.2.5 CONTAINERS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWTH IN E-COMMERCE SECTOR BOOSTING THE ROAD FREIGHT/TRUCKING SERVICES

5.1.2 RAPID INFRASTRUCTURE DEVELOPMENT IN KSA

5.1.3 RISING INVESTMENT IN SMART FREIGHT MANAGEMENT

5.1.4 INCREASING CROSS-BORDER TRADES IN KSA

5.2 RESTRAINTS

5.2.1 STRINGENT GOVERNMENT REGULATIONS

5.2.2 FLUCTUATIONS IN FUEL PRICES

5.3 OPPORTUNITIES

5.3.1 GOVERNMENT INITIATIVES TO SUPPORT TRANSPORTATION AND LOGISTICS SECTOR

5.3.2 INCREASING DEMAND FOR COLD CHAIN LOGISTICS

5.3.3 STRATEGIC PARTNERSHIPS AND COLLABORATIONS AMONG MARKET PLAYERS

5.4 CHALLENGES

5.4.1 AVAILABILITY OF ALTERNATIVE MODES OF TRANSPORTATION

5.4.2 SECURITY CONCERNS RELATED TO CARGO THEFT

6 KSA TRUCKING (ROAD FREIGHT) MARKET, SERVICE TYPE

6.1 OVERVIEW

6.2 TRANSPORTATION

6.3 WAREHOUSING AND DISTRIBUTION

6.4 FREIGHT FORWARDING

6.5 OTHERS

7 KSA TRUCKING (ROAD FREIGHT) MARKET, TYPE OF CARRIER

7.1 OVERVIEW

7.2 LESS THAN TRUCKLOAD (LTL)

7.3 FULL TRUCKLOAD (FTL)

7.4 PARTIAL TRUCKLOAD (PTL)

7.5 SPECIALIZED FREIGHT

8 KSA TRUCKING (ROAD FREIGHT) MARKET, TYPE OF GOODS

8.1 OVERVIEW

8.2 ROAD TRANSPORT OF FOODSTUFFS

8.2.1 REFRIGERATED TRANSPORT WITH REFRIGERATION

8.2.2 REFRIGERATED TRANSPORT WITH FREEZING

8.3 ADR ROAD TRANSPORT OF DANGEROUS GOODS

8.4 GENERAL GOODS

8.5 OTHERS

9 KSA TRUCKING (ROAD FREIGHT) MARKET, BY BUSINESS MODEL

9.1 OVERVIEW

9.2 ASSET-BASED CARRIERS

9.3 NON-ASSET-BASED CARRIERS

10 KSA TRUCKING (ROAD FREIGHT) MARKET, BY DISTANCE

10.1 OVERVIEW

10.2 MORE THAN 500 MILES

10.3 201 MILES-500 MILES

10.4 101 MILES – 200 MILES

10.5 50 MILE – 100 MILES

10.6 LESS THAN 50 MILES

11 KSA TRUCKING (ROAD FREIGHT) MARKET, BY INDUSTRY

11.1 OVERVIEW

11.2 OIL & GAS

11.2.1 BY SERVICE TYPE

11.2.1.1 TRANSPORTATION

11.2.1.2 WAREHOUSING AND DISTRIBUTION

11.2.1.3 FREIGHT FORWARDING

11.2.1.4 OTHERS

11.3 MANUFACTURING

11.3.1 BY SERVICE TYPE

11.3.1.1 TRANSPORTATION

11.3.1.2 WAREHOUSING AND DISTRIBUTION

11.3.1.3 FREIGHT FORWARDING

11.3.1.4 OTHERS

11.4 FOOD & BEVERAGES

11.4.1 BY SERVICE TYPE

11.4.1.1 TRANSPORTATION

11.4.1.2 WAREHOUSING AND DISTRIBUTION

11.4.1.3 FREIGHT FORWARDING

11.4.1.4 OTHERS

11.5 MINING

11.5.1 BY SERVICE TYPE

11.5.1.1 TRANSPORTATION

11.5.1.2 WAREHOUSING AND DISTRIBUTION

11.5.1.3 FREIGHT FORWARDING

11.5.1.4 OTHERS

11.6 ENERGY & UTILITY

11.6.1 BY SERVICE TYPE

11.6.1.1 TRANSPORTATION

11.6.1.2 WAREHOUSING AND DISTRIBUTION

11.6.1.3 FREIGHT FORWARDING

11.6.1.4 OTHERS

11.7 FAST MOVING CONSUMER GOODS (FMCG)

11.7.1 BY SERVICE TYPE

11.7.1.1 TRANSPORTATION

11.7.1.2 WAREHOUSING AND DISTRIBUTION

11.7.1.3 FREIGHT FORWARDING

11.7.1.4 OTHERS

11.8 HEALTHCARE

11.8.1 BY SERVICE TYPE

11.8.1.1 TRANSPORTATION

11.8.1.2 WAREHOUSING AND DISTRIBUTION

11.8.1.3 FREIGHT FORWARDING

11.8.1.4 OTHERS

11.9 E-COMMERCE

11.9.1 BY SERVICE TYPE

11.9.1.1 TRANSPORTATION

11.9.1.2 WAREHOUSING AND DISTRIBUTION

11.9.1.3 FREIGHT FORWARDING

11.9.1.4 OTHERS

11.1 CHEMICAL

11.10.1 BY SERVICE TYPE

11.10.1.1 TRANSPORTATION

11.10.1.2 WAREHOUSING AND DISTRIBUTION

11.10.1.3 FREIGHT FORWARDING

11.10.1.4 OTHERS

11.11 AUTOMOTIVE

11.11.1 BY SERVICE TYPE

11.11.1.1 TRANSPORTATION

11.11.1.2 WAREHOUSING AND DISTRIBUTION

11.11.1.3 FREIGHT FORWARDING

11.11.1.4 OTHERS

11.12 IT & TELECOM

11.12.1 BY SERVICE TYPE

11.12.1.1 TRANSPORTATION

11.12.1.2 WAREHOUSING AND DISTRIBUTION

11.12.1.3 FREIGHT FORWARDING

11.12.1.4 OTHERS

11.13 RETAIL

11.13.1 BY SERVICE TYPE

11.13.1.1 TRANSPORTATION

11.13.1.2 WAREHOUSING AND DISTRIBUTION

11.13.1.3 FREIGHT FORWARDING

11.13.1.4 OTHERS

11.14 TRANSPORTATION

11.14.1 BY SERVICE TYPE

11.14.1.1 TRANSPORTATION

11.14.1.2 WAREHOUSING AND DISTRIBUTION

11.14.1.3 FREIGHT FORWARDING

11.14.1.4 OTHERS

11.15 DEFENSE

11.15.1 BY SERVICE TYPE

11.15.1.1 TRANSPORTATION

11.15.1.2 WAREHOUSING AND DISTRIBUTION

11.15.1.3 FREIGHT FORWARDING

11.15.1.4 OTHERS

11.16 ELECTRONICS

11.16.1 BY SERVICE TYPE

11.16.1.1 TRANSPORTATION

11.16.1.2 WAREHOUSING AND DISTRIBUTION

11.16.1.3 FREIGHT FORWARDING

11.16.1.4 OTHERS

11.17 APPARELS & FOOTWEAR

11.17.1 BY SERVICE TYPE

11.17.1.1 TRANSPORTATION

11.17.1.2 WAREHOUSING AND DISTRIBUTION

11.17.1.3 FREIGHT FORWARDING

11.17.1.4 OTHERS

11.18 OTHERS

11.18.1 BY SERVICE TYPE

11.18.1.1 TRANSPORTATION

11.18.1.2 WAREHOUSING AND DISTRIBUTION

11.18.1.3 FREIGHT FORWARDING

11.18.1.4 OTHERS

12 KSA TRUCKING (ROAD FREIGHT) MARKET, VEHICLE TYPE

12.1 OVERVIEW

12.2 HEAVY DUTY COMMERCIAL TRUCKS

12.3 MEDIUM DUTY COMMERCIAL TRUCKS

12.4 LIGHT DUTY COMMERCIAL TRUCKS

13 KSA TRUCKING (ROAD FREIGHT) MARKET, BY TYPE OF ROAD FREIGHT

13.1 OVERVIEW

13.2 DRY GOODS ROAD TRANSPORT

13.3 ROAD TRANSPORT OF BULK CARGO

13.4 HEAVY GOODS TRANSPORT

13.5 OTHERS

14 KSA TRUCKING (ROAD FREIGHT) MARKET, BY OPERATION

14.1 OVERVIEW

14.2 DOMESTIC

14.3 NON-ASSET-BASED CARRIERS

15 KSA TRUCKING (ROAD FREIGHT) MARKET, BY CUSTOMER TYPE

15.1 OVERVIEW

15.2 B2B

15.3 B2C

15.4 E-COMMERCE & LAST MILE DELIVERY

16 KSA TRUCKING (ROAD FREIGHT) MARKET, BY TRUCK TYPE

16.1 OVERVIEW

16.2 TANKER TRUCK

16.2.1 TANKER TRUCK, BY TYPE

16.2.1.1 LIQUID TANKERS

16.2.1.2 DRY BULK TANKERS

16.2.2 TANKER TRUCK, BY TRANSPORT PRODUCT

16.2.2.1 FUEL

16.2.2.1.1 FUEL, BY TYPE

16.2.2.1.1.1 DIESEL

16.2.2.1.1.2 PETROL

16.2.2.2 GASES

16.2.2.2.1 GASES, BY TYPE

16.2.2.2.1.1 LPG

16.2.2.2.1.2 PROPANE

16.2.2.2.1.3 LIQUEFIED BUTANE GAS

16.2.2.2.1.4 NITROGEN

16.2.2.2.1.5 OXYGEN

16.2.2.2.1.6 HELIUM

16.2.2.3 CHEMICALS

16.2.2.4 MILK

16.2.2.5 JUICES

16.2.2.6 OTHERS

16.2.3 TANKER TRUCK, BY PRESSURIZATION

16.2.3.1 NON-PRESSURIZED

16.2.3.2 PRESSURIZED

16.2.4 TANKER TRUCK, BY REFRIGERATION

16.2.4.1 NON-REFRIGERATED

16.2.4.2 REFRIGERATED

16.2.5 TANKER TRUCK, BY INSULATION

16.2.5.1 NON-INSULATED

16.2.5.2 INSULATED

16.3 BOX TRUCK

16.3.1 BOX TRUCK, BY TRANSPORT PRODUCTS

16.3.1.1 FOOD DELIVERY

16.3.1.2 HOME APPLIANCES AND FURNITURE

16.3.1.3 LAST-MILE DELIVERIES

16.3.1.4 OTHERS

16.4 REFRIGERATED TRUCK

16.4.1 REFRIGERATED TRUCK, BY TRANSPORT PRODUCTS

16.4.1.1 FOOD

16.4.1.2 MEDICAL SUPPLIES

16.4.1.2.1 MEDICAL SUPPLIES, BY TYPE

16.4.1.2.1.1 PHARMACEUTICALS

16.4.1.2.1.2 VACCINES

16.4.1.2.1.3 BLOOD BANKS

16.4.1.2.1.4 OTHERS

16.4.1.3 PERISHABLE GOODS

16.4.1.3.1 PERISHABLE GOODS, BY TYPE

16.4.1.3.1.1 MEAT

16.4.1.3.1.2 FRUITS

16.4.1.3.1.3 VEGETABLES

16.4.1.3.1.4 SEAFOOD

16.4.1.3.1.5 OTHERS

16.4.1.4 BEVERAGES

16.4.1.4.1 BEVERAGES, BY TYPE

16.4.1.4.1.1 CARBONATED BEVERAGES

16.4.1.4.1.2 JUICE BASED BEVERAGES

16.4.1.4.1.3 SPORTS & ENERGY BEVERAGES

16.4.1.4.1.4 TEA

16.4.1.4.1.5 COFFEE

16.4.1.4.1.6 OTHERS

16.4.1.5 OTHERS

16.5 SEMI-TRAILER TRUCK

16.6 FLATBEDS TRUCK

16.6.1 FLATBEDS TRUCK, BY TRANSPORT PRODUCTS

16.6.1.1 CARS

16.6.1.2 CONSTRUCTION MATERIAL

16.6.1.3 MACHINERY

16.6.1.4 SCRAP METAL

16.6.1.5 OTHERS RECYCLABLES

16.7 LIFTGATE TRUCK

16.8 OTHERS

17 KSA TRUCKING (ROAD FREIGHT) MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: KSA

18 SWOT ANALYSIS

19 COMPANY PROFILES

19.1 SINOTRANS LIMITED

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 SERVICE PORTFOLIO

19.1.4 RECENT DEVELOPMENTS

19.2 ABDUL LATIF JAMEEL

19.2.1 COMPANY SNAPSHOT

19.2.2 SERVICE PORTFOLIO

19.2.3 RECENT DEVELOPMENTS

19.3 DEUTSCHE POST AG

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 SOLUTION PORTFOLIO

19.3.4 RECENT DEVELOPMENT

19.4 CEVA LOGISTICS

19.4.1 COMPANY SNAPSHOT

19.4.2 SERVICES PORTFOLIO

19.4.3 RECENT DEVELOPMENTS

19.5 DSV

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 SOLUTION PORTFOLIO

19.5.4 RECENT DEVELOPMENTS

19.6 ARDIAN GLOBAL EXPRESS LLC.

19.6.1 COMPANY SNAPSHOT

19.6.2 SERVICE PORTFOLIO

19.6.3 RECENT DEVELOPMENTS

19.7 DB SCHENKER

19.7.1 COMPANY SNAPSHOT

19.7.2 SERVICES PORTFOLIO

19.7.3 RECENT DEVELOPMENTS

19.8 DEFAF LOGISTICS

19.8.1 COMPANY SNAPSHOT

19.8.2 SERVICE PORTFOLIO

19.8.3 RECENT DEVELOPMENT

19.9 FEDEX

19.9.1 COMPANY SNAPSHOT

19.9.2 REVENUE ANALYSIS

19.9.3 SERVICES PORTFOLIO

19.9.4 RECENT DEVELOPMENTS

19.1 FOURWINDS-KSA.COM

19.10.1 COMPANY SNAPSHOT

19.10.2 SERVICE PORTFOLIO

19.10.3 RECENT DEVELOPMENT

19.11 FREIGHTS SOLUTIONS CO.

19.11.1 COMPANY SNAPSHOT

19.11.2 SERVICE PORTFOLIO

19.11.3 RECENT DEVELOPMENT

19.12 GAC

19.12.1 COMPANY SNAPSHOT

19.12.2 SERVICE PORTFOLIO

19.12.3 RECENT DEVELOPMENTS

19.13 HELLMANN WORLDWIDE LOGISTICS SE & CO. KG

19.13.1 COMPANY SNAPSHOT

19.13.2 SERVICE PORTFOLIO

19.13.3 RECENT DEVELOPMENT

19.14 JAS WORLDWIDE, INC.

19.14.1 COMPANY SNAPSHOT

19.14.2 SERVICE PORTFOLIO

19.14.3 RECENT DEVELOPMENTS

19.15 KUEHNE+NAGEL

19.15.1 COMPANY SNAPSHOT

19.15.2 REVENUE ANALYSIS

19.15.3 SERVICE PORTFOLIO

19.15.4 RECENT DEVELOPMENTS

19.16 NTF GROUP

19.16.1 COMPANY SNAPSHOT

19.16.2 SERVICE PORTFOLIO

19.16.3 RECENT DEVELOPMENT

19.17 SEKO LOGISTICS

19.17.1 COMPANY SNAPSHOT

19.17.2 SERVICE PORTFOLIO

19.17.3 RECENT DEVELOPMENTS

19.18 UNITED PARCEL SERVICE OF AMERICA, INC.

19.18.1 COMPANY SNAPSHOT

19.18.2 REVENUE ANALYSIS

19.18.3 SERVICE PORTFOLIO

19.18.4 RECENT DEVELOPMENTS

19.19 WEFREIGHT

19.19.1 COMPANY SNAPSHOT

19.19.2 SERVICES PORTFOLIO

19.19.3 RECENT DEVELOPMENTS

20 QUESTIONNAIRE

21 RELATED REPORTS

List of Table

TABLE 1 KSA TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 2 KSA TRUCKING (ROAD FREIGHT) MARKET, BY TYPE OF CARRIER, 2018-2032 (USD MILLION)

TABLE 3 KSA TRUCKING (ROAD FREIGHT) MARKET, BY TYPE OF GOODS, 2018-2032 (USD MILLION)

TABLE 4 KSA ROAD TRANSPORT OF FOODSTUFFS IN TRUCKING (ROAD FREIGHT) MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 5 KSA TRUCKING (ROAD FREIGHT) MARKET, BY BUSINESS MODEL, 2018-2032 (USD MILLION)

TABLE 6 KSA TRUCKING (ROAD FREIGHT) MARKET, BY DISTANCE, 2018-2032 (USD MILLION)

TABLE 7 KSA TRUCKING (ROAD FREIGHT) MARKET, BY INDUSTRY, 2018-2032 (USD MILLION)

TABLE 8 KSA OIL & GAS IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 9 KSA OIL & GAS IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 10 KSA MANUFACTURING IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 11 KSA MANUFACTURING IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 12 KSA FOOD & BEVERAGES IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 13 KSA FOOD & BEVERAGES IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 14 KSA MINING IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 15 KSA MINING IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 16 KSA ENERGY & UTILITY IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 17 KSA ENERGY & UTILITY IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 18 KSA FAST MOVING CONSUMER GOODS (FMCG) IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 19 KSA FAST MOVING CONSUMER GOODS (FMCG) IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 20 KSA HEALTHCARE IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 21 KSA HEALTHCARE IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 22 KSA E-COMMERCE IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 23 KSA E-COMMERCE IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 24 KSA CHEMICAL IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 25 KSA CHEMICAL IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 26 KSA AUTOMOTIVE IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 27 KSA AUTOMOTIVE IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 28 KSA IT & TELECOM IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 29 KSA IT & TELECOM IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 30 KSA RETAIL IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 31 KSA RETAIL IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 32 KSA TRANSPORTATION IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 33 KSA TRANSPORTATION IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 34 KSA DEFENSE IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 35 KSA DEFENSE IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 36 KSA ELECTRONICS IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 37 KSA ELECTRONICS IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 38 KSA APPARELS & FOOTWEAR IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 39 KSA APPARELS & FOOTWEAR IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 40 KSA OTHERS IN TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE, 2018-2032 (USD MILLION)

TABLE 41 KSA OTHERS IN TRUCKING (ROAD FREIGHT) MARKET, BY COMMODITIES TYPE, 2018-2032 (MILLION TONS)

TABLE 42 KSA TRUCKING (ROAD FREIGHT) MARKET, BY VEHICLE TYPE, 2018-2032 (USD MILLION)

TABLE 43 KSA TRUCKING (ROAD FREIGHT) MARKET, BY TYPE OF ROAD FREIGHT, 2018-2032 (USD MILLION)

TABLE 44 KSA TRUCKING (ROAD FREIGHT) MARKET, BY OPERATION, 2018-2032 (USD MILLION)

TABLE 45 KSA TRUCKING (ROAD FREIGHT) MARKET, BY CUSTOMER TYPE, 2018-2032 (USD MILLION)

TABLE 46 KSA TRUCKING (ROAD FREIGHT) MARKET, BY TRUCK TYPE, 2018-2032 (USD MILLION)

TABLE 47 KSA TANKER TRUCK IN TRUCKING (ROAD FREIGHT) MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 48 KSA TANKER TRUCK IN TRUCKING (ROAD FREIGHT) MARKET, BY TRANSPORT PRODUCT, 2018-2032 (USD MILLION)

TABLE 49 KSA FUEL IN TRUCKING (ROAD FREIGHT) MARKET, BY TYPE 2018-2032 (USD MILLION)

TABLE 50 KSA GASES IN TRUCKING (ROAD FREIGHT) MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 51 KSA TANKER TRUCK IN TRUCKING (ROAD FREIGHT) MARKET, BY PRESSURIZATION, 2018-2032 (USD MILLION)

TABLE 52 KSA TANKER TRUCK IN TRUCKING (ROAD FREIGHT) MARKET, BY REFRIGERATION, 2018-2032 (USD MILLION)

TABLE 53 KSA TANKER TRUCK IN TRUCKING (ROAD FREIGHT) MARKET, BY INSULATION, 2018-2032 (USD MILLION)

TABLE 54 KSA BOX TRUCK IN TRUCKING (ROAD FREIGHT) MARKET, BY TRANSPORT PRODUCTS, 2018-2032 (USD MILLION)

TABLE 55 KSA REFRIGERATED TRUCK IN TRUCKING (ROAD FREIGHT) MARKET, BY TRANSPORT PRODUCTS, 2018-2032 (USD MILLION)

TABLE 56 KSA MEDICAL SUPPLIES IN TRUCKING (ROAD FREIGHT) MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 57 KSA PERISHABLE GOODS IN TRUCKING (ROAD FREIGHT) MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 58 KSA BEVERAGES IN TRUCKING (ROAD FREIGHT) MARKET, BY TYPE, 2018-2032 (USD MILLION)

TABLE 59 KSA FLATBEDS TRUCK IN TRUCKING (ROAD FREIGHT) MARKET, BY TRANSPORT PRODUCTS, 2018-2032 (USD MILLION)

List of Figure

FIGURE 1 KSA TRUCKING (ROAD FREIGHT) MARKET: SEGMENTATION

FIGURE 2 KSA TRUCKING (ROAD FREIGHT) MARKET: DATA TRIANGULATION

FIGURE 3 KSA TRUCKING (ROAD FREIGHT) MARKET: DROC ANALYSIS

FIGURE 4 KSA TRUCKING (ROAD FREIGHT) MARKET: COUNTRY-WISE ANALYSIS

FIGURE 5 KSA TRUCKING (ROAD FREIGHT) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 KSA TRUCKING (ROAD FREIGHT) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 KSA TRUCKING (ROAD FREIGHT) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 KSA TRUCKING (ROAD FREIGHT) MARKET: SEGMENTATION

FIGURE 9 FOUR SEGMENTS COMPRISE THE KSA TRUCKING (ROAD FREIGHT) MARKET, BY SERVICE TYPE (2024)

FIGURE 10 EXECUTIVE SUMMARY

FIGURE 11 STRATEGIC DECISIONS

FIGURE 12 GROWTH IN E-COMMERCE SECTOR BOOSTING THE ROAD FREIGHT/TRUCKING SERVICES IS EXPECTED TO DRIVE THE KSA TRUCKING (ROAD FREIGHT) MARKET GROWTH IN THE FORECAST PERIOD 2025-2032

FIGURE 13 TRANSPORTATION IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE KSA TRUCKING (ROAD FREIGHT) MARKET IN 2025 & 2032

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE KSA TRUCKING (ROAD FREIGHT) MARKET

FIGURE 15 KSA TRUCKING (ROAD FREIGHT) MARKET: BY SERVICE TYPE, 2024

FIGURE 16 KSA TRUCKING (ROAD FREIGHT) MARKET: BY TYPE OF CARRIER, 2024

FIGURE 17 KSA TRUCKING (ROAD FREIGHT) MARKET: BY TYPE OF GOODS, 2024

FIGURE 18 KSA TRUCKING (ROAD FREIGHT) MARKET: BY BUSINESS MODEL, 2024

FIGURE 19 KSA TRUCKING (ROAD FREIGHT) MARKET: BY DISTANCE, 2024

FIGURE 20 KSA TRUCKING (ROAD FREIGHT) MARKET: BY INDUSTRY, 2024

FIGURE 21 KSA TRUCKING (ROAD FREIGHT) MARKET: BY VEHICLE TYPE, 2024

FIGURE 22 KSA TRUCKING (ROAD FREIGHT) MARKET: BY TYPE OF ROAD FREIGHT, 2024

FIGURE 23 KSA TRUCKING (ROAD FREIGHT) MARKET: BY OPERATION, 2024

FIGURE 24 KSA TRUCKING (ROAD FREIGHT) MARKET: BY CUSTOMER TYPE, 2024

FIGURE 25 KSA TRUCKING (ROAD FREIGHT) MARKET: BY TRUCK TYPE, 2024

FIGURE 26 KSA TRUCKING (ROAD FREIGHT) MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.