Sulfuric acid, also known as oil of vitriol, is a versatile and indispensable chemical with numerous positive applications. As a strong acid, it serves as a crucial industrial and laboratory reagent in various processes. Its colorless, odorless, and viscous nature enhances handling safety. Sulfuric acid's high solubility in water ensures efficient use in various concentrations. With a molecular formula of H2SO4, it exhibits strong acidic properties and finds applications in diverse industries, including metal processing, chemical manufacturing, and fertilizer production, contributing to global industrial development and innovation.

Access Full Report @ https://www.databridgemarketresearch.com/reports/europe-sulfuric-acid-market

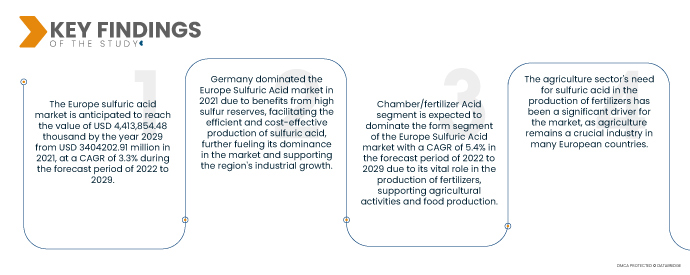

Data Bridge Market Research analyses that the Europe Sulfuric Acid Market is expected to reach the value of USD 4,413,854.48 thousand by the year 2029 from USD 3404202.91 million in 2021, at a CAGR of 3.3% during the forecast period of 2022 to 2029. Sulfuric acid is a fundamental chemical used in a wide range of industrial processes, such as metal processing, petroleum refining, and chemical manufacturing, driving consistent demand in Europe.

Key Findings of the Study

Chemical manufacturing is expected to drive the market's growth rate

In chemical manufacturing, sulfuric acid holds a pivotal role as a fundamental raw material for producing a wide array of essential chemicals. Its applications span across fertilizer production, where it facilitates nutrient-rich fertilizers that support agriculture. Additionally, sulfuric acid plays a key role in the synthesis of synthetic dyes, contributing to the vibrant textile and coloring industries. Furthermore, its use in detergent production aids in delivering effective cleaning products, supporting the growth and development of the chemical industry in Europe.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2014 - 2019)

|

|

Quantitative Units

|

Revenue in USD Thousand, Volumes in Thousand, Pricing in USD

|

|

Segments Covered

|

Raw Material (Base Metal Smelters, Elemental Sulfur, Pyrite Ore, and Others), Form (Concentrated, 66 Degree Baume Sulfuric Acid, Tower/Glover Acid, Chamber/Fertilizer Acid, Battery Acid, and Dilute Sulfuric Acid), Manufacturing Process (Contact Process, Lead Chamber Process, Wet Sulfuric Acid Process, Metabisulfite Process, and Others), Distribution Channel (Offline and Online), Application (Fertilizers, Chemical Manufacturing, Petroleum Refining, Metal Processing, Automotive, Textile, Drug Manufacturing, Pulp & Paper, Industrial And Others)

|

|

Country Covered

|

Germany, U.K., Italy, France, Spain, Russia, Switzerland, Turkey, Belgium, Netherlands and Rest of Europe

|

|

Market Players Covered

|

LANXESS (Germany), Brenntag GmbH (a subsidiary of Brenntag SE)(Germany), Boliden Group (Sweden), Adisseo (France), Veolia (France), Univar Solutions Inc (U.S.), NORAM Engineering & Construction Ltd.( Canada), Nouryon (the Netherlands), International Raw Materials LTD (U.S.), Eti Bakir (Turkey), ACIDEKA SA (Spain), Airedale Chemical Company Limited.(U.K.), BASF SE (Ludwigshafen, Germany), Aguachem Ltd (U.K), Feralco AB (U.K.), Fluorsid (Italy), Aurubis AG (Germany), Nyrstar (The Netherlands), Merck KGaA (Germany), and Shrieve (U.S.)

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis:

The Europe sulfuric acid market is segmented on the basis of raw material, form, manufacturing process, distribution channel, and application.

- On the basis of raw material, the market is segmented into base metal smelters, elemental sulfur, pyrite ore, and others. The elemental sulfur segment is expected to dominate the raw material market due to abundant availability and cost-effectiveness in the production of sulfuric acid through the contact process with a CAGR of 5.1 % in the forecast period of 2022 to 2029

In 2022, the elemental sulfur segment is expected to dominate the raw material of the Europe Sulfuric Acid market

In 2022, the elemental sulfur segment is expected to dominate the raw material market owing to its widespread availability and cost-effectiveness as a primary raw material in the contact process for sulfuric acid production with a CAGR of 5.1 % in the forecast period of 2022 to 2029.

- On the basis of form, the market is segmented into Concentrated, 66 Degree Baume Sulfuric Acid, tower/glover acid, chamber/fertilizer acid, battery acid, and dilute sulfuric acid. The chamber/fertilizer acid segment is expected to dominate the form segment of the Europe Sulfuric Acid market with a CAGR of 5.4% in the forecast period of 2022 to 2029 due to its vital role in the production of fertilizers, supporting agricultural activities and food production.

- On the basis of manufacturing process, the market is segmented into contact process, lead chamber process, wet sulfuric acid process, metabisulfite process, and others. The contact process is expected to dominate the manufacturing process segment of the Europe sulfuric acid market with a CAGR of 5.3% in the forecast period of 2022 to 2029 due to its high efficiency and economic viability. It involves the oxidation of sulfur dioxide to produce sulfur trioxide, which is then hydrated to form sulfuric acid, making it a widely used method in the industry.

In 2022, the contact process is expected to dominate the manufacturing process segment of the Europe Sulfuric Acid market

In 2022, the contact process is expected to dominate the manufacturing process segment of the Europe Sulfuric Acid market owing to its high efficiency in converting sulfur dioxide to sulfur trioxide, a crucial step for producing sulfuric acid in large quantities, ensuring industry scalability with a CAGR of 5.3% in the forecast period of 2022 to 2029.

- On the basis of distribution channel, the Europe sulfuric acid market is segmented into offline and online. Offline is expected to dominate the distribution channel segment of the Europe Sulfuric Acid market with a CAGR of 5.1% in the forecast period of 2022 to 2029 due to customer preferences for personalized service and product inspection before purchase. Retail outlets and dealerships offer convenience and direct interactions, enhancing consumer trust and satisfaction.

- On the basis of application, the market is segmented into fertilizers, chemical manufacturing, petroleum refining, metal processing, automotive, textile, drug manufacturing, pulp and paper, industrial, and others. Fertilizers are expected to dominate the application segment of the Europe Sulfuric Acid market with a CAGR of 5.2% in the forecast period of 2022 to 2029 due to sulfuric acid, essential in the agricultural sector for nutrient-rich soil preparation, crop growth, and food production, contributing to the global food supply chain.

Major Players

Data Bridge Market Research recognizes the following companies as the major Europe sulfuric acid market players in Europe sulfuric acid market are BASF SE (Germany), Aguachem Ltd (U.K), Feralco AB (U.K.), Fluorsid (Italy), Aurubis AG (Germany), Nyrstar (The Netherlands)

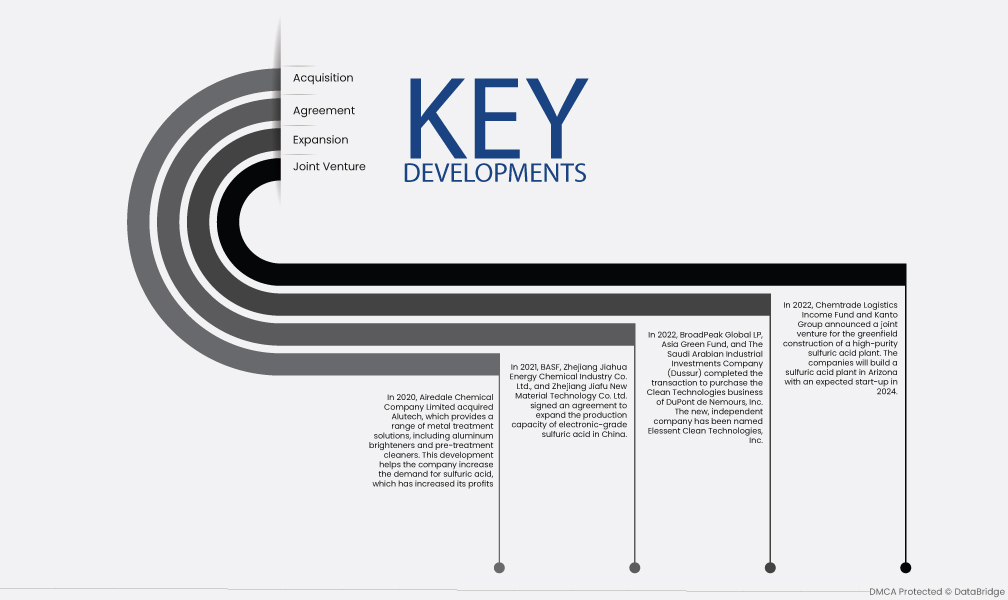

Market Developments

- In 2022, Chemtrade Logistics Income Fund and Kanto Group announced a joint venture for the greenfield construction of a high-purity sulfuric acid plant. The companies will build a sulfuric acid plant in Arizona with an expected start-up in 2024.

- In 2022, BroadPeak Global LP, Asia Green Fund, and The Saudi Arabian Industrial Investments Company (Dussur) completed the transaction to purchase the Clean Technologies business of DuPont de Nemours, Inc. The new, independent company has been named Elessent Clean Technologies, Inc.

- In 2021, BASF, Zhejiang Jiahua Energy Chemical Industry Co. Ltd., and Zhejiang Jiafu New Material Technology Co. Ltd. signed an agreement to expand the production capacity of electronic-grade sulfuric acid in China.

- In 2020, Airedale Chemical Company Limited acquired Alutech, which provides a range of metal treatment solutions, including aluminum brighteners and pre-treatment cleaners. This development helps the company increase the demand for sulfuric acid, which has increased its profits

Regional Analysis

Geographically, the countries covered in the Europe sulfuric acid market report are Germany, U.K., Italy, France, Spain, Russia, Switzerland, Turkey, Belgium, Netherlands, and Rest of Europe

As per Data Bridge Market Research analysis:

Germany is the dominant region in Europe sulfuric acid market during the forecast period 2022-2029

Germany's leading position in the sulfuric acid market can be attributed to its robust industrialization, creating a strong demand for the chemical in various applications. The country's thriving chemical industry relies heavily on sulfuric acid as a vital raw material for producing fertilizers, synthetic dyes, and detergents. Additionally, Germany benefits from high sulfur reserves, facilitating the efficient and cost-effective production of sulfuric acid, further fueling its dominance in the market and supporting the region's industrial growth.

For more detailed information about the Europe sulfuric acid market report, click here – https://www.databridgemarketresearch.com/reports/europe-sulfuric-acid-market