Europe Sulfuric Acid Market Analysis and Size

Sulfuric acid is a colorless, odorless, and viscous liquid soluble in water at all concentrations. It is a strong acid made by oxidizing sulfur dioxide solutions and used in large quantities as an industrial and laboratory reagent. Sulfuric acid or sulfuric acid, also known as oil of vitriol, is a mineral acid composed of sulfur, oxygen, and hydrogen, with molecular formula H2SO4 and melting point is 10 °C, the boiling point is 337°C.

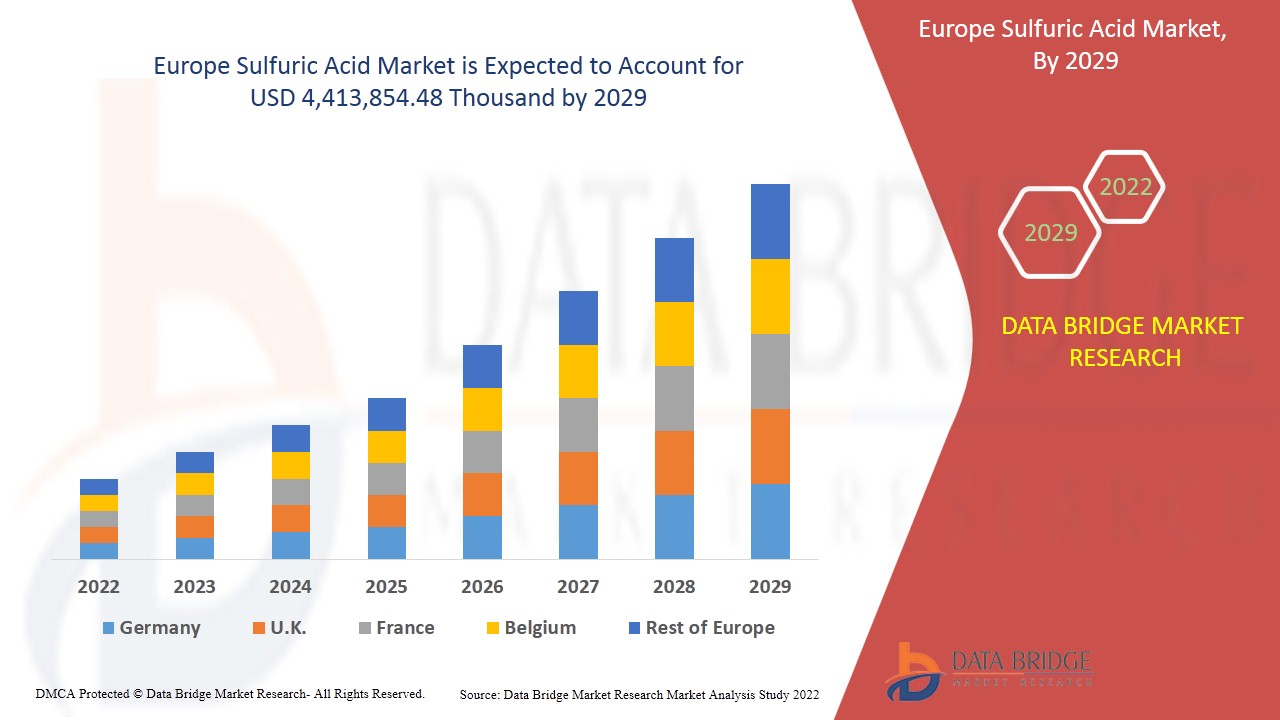

Increasing demand for fertilizers in the agriculture industry and the growing demand for sulfuric acid across various industries are some of the drivers boosting sulfuric acid demand in the market. Data Bridge Market Research analyses that the sulfuric market is expected to reach the value of USD 4,413,854.48 thousand by the year 2029, at a CAGR of 3.3% during the forecast period. " elemental sulfur " accounts for the most prominent raw material segment in the respective due to the abundant availability of sulfur across the globe. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and climate chain scenario.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Thousand, Volumes in Thousand Tonne, Pricing in USD |

|

Segments Covered |

By Raw Material (Base Metal Smelters, Elemental Sulfur, Pyrite Ore and Others), Form (Concentrated, 66 Degree Baume Sulfuric Acid, Tower/Glover Acid, Chamber/Fertilizer Acid, Battery Acid and Dilute Sulfuric Acid), Manufacturing Process (Contact Process, Lead Chamber Process, Wet Sulfuric Acid Process, Metabisulfite Process and Others), Distribution Channel (Offline and Online), Application (Fertilizers, Chemical Manufacturing, Petroleum Refining, Metal Processing, Automotive, Textile, Drug Manufacturing, Pulp & Paper, Industrial And Others) |

|

Country Covered |

Germany, U.K., Italy, France, Spain, Russia, Switzerland, Turkey, Belgium, Netherlands and Rest of Europe |

|

Market Players Covered |

LANXESS (Cologne, Germany ), Brenntag GmbH (a subsidiary of Brenntag SE)( Essen, Germany), Boliden Group (Stockholm, Sweden), Adisseo (Antony, France), Veolia (Paris, France), Univar Solutions Inc (Illinois, U.S.), NORAM Engineering & Construction Ltd.( Vancouver, Canada), Nouryon (Amsterdam, the Netherlands), International Raw Materials LTD (Pennsylvania, U.S.), Eti Bakir (Kastamonu, Turkey), ACIDEKA SA (Vizcaya, Spain), Airedale Chemical Company Limited.( North Yorkshire, U.K.), BASF SE (Ludwigshafen, Germany), Aguachem Ltd (Wrexham, U.K), Feralco AB (Widnes, U.K.), Fluorsid (Milan, Italy), Aurubis AG (Hamburg, Germany), Nyrstar (Budel, The Netherlands), Merck KGaA (Darmstadt, Germany), and Shrieve (Texas, U.S.) |

Market Definition

Sulfuric acid is a strong acid with hygroscopic characteristics and oxidizing properties. It is used in the fertilizer, chemical, synthetic textile, and pigment industries. Other applications include manufacturing batteries metal pickling, among other industrial manufacturing processes. In market sulfuric acid is available in different concentration grades such as 98%, 96.5%, 76%, 70% and 38%. A large quantity of sulfuric acid produces potassium sulfates and fertilizers. Increasing demand for fertilizers in the agriculture industry and the growing demand for sulfuric acid across various industries are some of the drivers boosting sulfuric acid demand in the market. With the increasing consumption of sulfuric acid globally, major players are expanding their production capacities in different countries to strengthen their presence in the market.

Regulatory Framework

- The DHHS (1994) and EPA have not classified sulfur trioxide or sulfuric acid for carcinogenic effects. IARC considers occupational exposure to strong inorganic mists containing sulfuric acid to be carcinogenic to humans (Group 1) (IARC 1992). ACGIH has classified sulfuric acid as a suspected human carcinogen (Group A2) (ACGIH 1998).

Sulfuric acid is on the list of chemicals in “Toxic Chemicals Subject to Section 3 13 of the Emergency Planning and Community Right-to-Know Act”’ (EPA 1998f).

The occupational permissible exposure limit (PEL) for sulfuric acid is 1 mg/ m3 (OSHA 1998). The NIOSH recommended exposure limit (REL) is also 1 mg/m3 (NIOSH 1997). ACGIH recommends a threshold limit value time-weighted average (TLV-TWA) of 1 mg/m3 and a short-term exposure limit (STEL) of 3 mg/m3 (ACGIH 1998).

COVID-19 had a Minimal Impact on Europe Sulfuric Acid Market

COVID-19 impacted various manufacturing industries in the year 2020-2021 as it led to the closure of workplaces, disruption of supply chains, and restrictions on transportation. However, significant impact was noticed on sulfuric acid in Europe operations and supply chain, with multiple manufacturing facilities still operating. The service providers continued offering sulfuric acid following sanitation and safety measures in the post-COVID scenario.

The Market Dynamics of the Europe Sulfuric Acid Market Include:

- Increasing Demand for Fertilizers in Agricultural Industry

Increasing demand for high-quality fertilizers for crop cultivation boosts the Europe sulfuric acid market.

- Significant Growth in Chemical Industries

Increasing chemical production in the European region with a chemicals strategy for sustainability is a prominent part of the Green Deal to strengthen the growth of the chemicals industry, making it easier to avoid usage of hazardous chemicals and encourage innovation for the development of safe and sustainable alternatives. Thus, a strategy for sustainability in the chemicals industry can help keep the significant growth in the chemical industry and propel the Europe sulfuric acid market in the coming years.

- Growing Demand for Sulfuric Acid Across a Diverse Range of Industries

The demand for sulfuric acid across a diverse range of industries such as pharmaceutical, textile, paper, and pulp, is expected to grow at an increasing rate and is projected to fuel the Europe sulfuric acid market.

- Growing Demand for Batteries in Automotive Industry

With increased demand for the recovery of waste printed circuit boards using sulfuric acid to recover different metals such as gold, silver, iron, and copper is expected to drive the Europe sulfuric acid market.

- Significant Growth in Healthcare Industry

The increasing advantages of sulfuric acid batteries in motor vehicles and other machines in electric vehicles are increasing the demand for sulfuric acid, creating an opportunity for the Europe sulfuric acid market to tap upon and register higher growth in the future.

- Abundance of Sulfur as a Raw Material

In addition, sulfur nowadays is also produced for industrial use from the petroleum and natural gas industry worldwide. Therefore, an abundance of sulfur reserves around the globe creates an opportunity for the growth of the Europe sulfuric acid market.

Restraints/Challenges faced by the Europe Sulfuric Acid Market

- Health Hazards Associated with Sulfuric Acid

The increasing health hazards associated with the use of sulfuric acid on the skin, eyes, and other organs is likely to hamper the Europe sulfuric acid market demand.

- Decline in Sales Resulting from Oversupply of Sulfuric Acid

The undersupply of sulfuric acid in the Europe sulfuric acid market is the biggest problem being faced by key manufacturers operating in the market, which is directly impacting their sales and profit margins as oversupplied with other producers has led to a decrease in the prices. This is acting as the biggest challenge in the Europe sulfuric acid market growth.

This sulfuric acid market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the sulfuric acid market contact Data Bridge Market Research for an Analyst Brief, Our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In November 2020, Airedale Chemical Company Limited acquired Alutech, which provides a range of metal treatment solutions, including aluminum brighteners and pre-treatment cleaners. This development helps the company increase the demand for sulfuric acid, which has increased its profits

- In May 2017, BASF SE introduced a new sulfuric acid catalyst preferred due to its unique geometrical shape. This update helps the company to increase production capacity, which generates revenue in the future

Europe Sulfuric Acid Market Scope

Europe sulfuric acid market is segmented on the basis of raw material, form, manufacturing process, distribution channel, and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Raw Material

- Base Metal Smelters

- Elemental Sulfur

- Pyrite Ore

- Others

On the basis of raw material, the market is segmented into base metal smelters, elemental sulfur, pyrite ore, and others. In 2022, the elemental sulfur segment is expected to dominate due to the abundant availability of sulfur across the globe

Form

- Concentrated (98%)

- Tower/Glover Acid (77.67%)

- Chamber/Fertilizer Acid (62.8%)

- Battery Acid (33.5%)

- 66 Degree Baume Sulfuric Acid (93%)

- Dilute Sulfuric Acid (10%)

On the basis of form, the market is segmented into concentrated (98%), tower/glover acid (77.67%), chamber/fertilizer acid (62.8%), battery acid (33.5%), 66 degree Baume sulfuric acid (93%) and dilute sulfuric acid (10%).

Manufacturing Process

- Contact Process

- Lead Chamber Process

- Wet Sulfuric Acid Process

- Metabisulfite Process

- Others

Based on manufacturing process, the market is segmented into contact process, lead chamber process, wet sulfuric acid process, metabisulfite process, and others.

Distribution Channel

- Offline

- Online

On the basis of distribution channel, the Europe sulfuric acid market is segmented into offline and online.

Application

- Fertilizer,

- Chemical Manufacturing

- Petroleum Refining

- Metal Processing

- Automotive

- Textile

- Drug Manufacturing

- Pulp & Paper

- Industrial

- Others

On the basis of application, the market is segmented into fertilizers, chemical manufacturing, petroleum refining, metal processing, automotive, textile, drug manufacturing, pulp & paper, industrial, and others. The fertilizers are expected to dominate the application segment as the demand for sulfuric fertilizers increases for crop plantation and soil fertility.

Europe Sulfuric Acid Regional Analysis/Insights

Europe sulfuric acid market is analyzed and market size insights and trends are provided by raw material, form, manufacturing process, distribution channel, and application as referenced above.

The countries covered in the Europe sulfuric acid market report are the Germany, U.K., Italy, France, Spain, Russia, Switzerland, Turkey, Belgium, Netherlands and Rest of Europe.

In Europe, Germany is the leading country in sulfuric acid market owing to growing industrialization, which will help in the growth of the chemical industry in the region. Moreover, the country has high reserves of sulfur, which is used in the production of sulfuric acid.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe Sulfuric Acid Market Share Analysis

Europe sulfuric acid market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to Europe sulfuric acid market.

Some of the major players operating in the rodenticides market are LANXESS, Brenntag GmbH (a subsidiary of Brenntag SE), Boliden Group, Adisseo, Veolia, Univar Solutions Inc, NORAM Engineering & Construction Ltd., Nouryon, International Raw Materials LTD, Eti Bakir, ACIDEKA SA, Airedale Chemical Company Limited., BASF SE, Aguachem Ltd, Feralco AB, Fluorsid, Aurubis AG, Nyrstar, Merck KGaA, and Shrieve, among others

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW of EUROPE SULFURIC ACID MARKET

- LIMITATION

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographicAL scope

- years considered for the study

- currency and pricing

- DBMR TRIPOD DATA VALIDATION MODEL

- Raw Material LIFELINE CURVE

- MULTIVARIATE MODELLING

- primary interviews with key opinion leaders

- DBMR MARKET POSITION GRID

- MARKET application COVERAGE GRID

- DBMR MARKET CHALLENGE MATRIX

- vendor share analysis

- IMPORT-EXPORT DATA

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- premium insights

- PRICING ANALYSIS OF SULFURIC ACID

- WHOLESALE PRICE OF SULFURIC ACID IN EUROPE, 2017-2019

- WHOLESALE PRICE OF SULFURIC ACID IN POLAND, 2017-2019

- WHOLESALE PRICE OF SULFURIC ACID IN EUROPE, BY FORM, 2019

- WHOLESALE PRICE OF SULFURIC ACID IN POLAND, BY FORM, 2019

- COST ANALYSIS (EX-PRODUCER PRICE) OF SULFURIC ACID

- EX-PRODUCER PRICE/COST OF SULFURIC ACID IN EUROPE, 2017-2019

- EX-PRODUCER PRICE/COST OF SULFURIC ACID IN POLAND, 2017-2019

- EX-PRODUCER PRICE/COST OF SULFURIC ACID IN EUROPE, BY FORM, 2019

- EX-PRODUCER PRICE/COST OF SULFURIC ACID IN POLAND, BY FORM, 2019

- market overview

- drivers

- INCREASE IN the DEMAND FOR FERTILIZERS IN AGRICULTURAL INDUSTRY

- Significant Growth in Chemical IndustrIES

- Growing Demand of Sulfuric Acid across Diverse Range of Industries

- restraints

- HEALTH HAZARDS ASSOCIATED WITH THE SULFURIC ACID

- Stringent government regulations on usage of sulfuric acid

- oppOrtunities

- Growing demand for batteries in automotive industry

- Abundance of Sulfur as a raw material

- challenge

- Transportation and handling of sulfuric acid

- IMPACT OF COVID-19 ON THE europe SULFURIC ACID MARKET

- ANALYSIS on IMPACT OF COVID-19 ON THE EUROPE SULFURIC ACID MARKET

- AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE EUROPE SULFURIC ACID MARKET

- STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

- IMPACT on price

- IMPACT ON DEMAND

- IMPACT ON SUPPLY CHAIN

- CONCLUSION

- Europe SULFURIC ACID market, BY Raw Material

- overview

- Elemental Sulfur

- Base Metal Smelters

- Pyrite Ore

- Others

- Europe SULFURIC ACID market, BY Form

- overview

- Chamber/Fertilizer Acid

- Concentrated

- Tower/Glover Acid

- Battery Acid

- Dilute Sulfuric Acid

- Europe SULFURIC ACID market, BY Manufacturing Process

- overview

- Contact Process

- Lead Chamber Process

- Wet Sulfuric Acid Process

- Metabisulfite Process

- Others

- Europe SULFURIC ACID market, BY Distribution Channel

- overview

- Offline

- Online

- Europe SULFURIC ACID market, By Application

- overview

- Fertilizers

- Petroleum Refining

- Metal Processing

- Drug Manufacturing

- Chemical Manufacturing

- Agriculture Chemicals

- Hydrochloric Acid

- Nitric Acid

- Dyes And Pigments

- Sulfate Salts

- Synthetic Detergents

- others

- Textile

- Industrial

- Automotive

- Pulp & Paper

- others

- Europe sulfuric acid MARKET BY REGION

- Europe

- Germany

- France

- U.K.

- SPAIN

- ITALY

- BELGIUM

- RUSSIA

- TURKEY

- NETHERLANDS

- SWITZERLAND

- POLAND

- Rest of Europe

- EUROPE SULFURIC ACID SYSTEMS Market: COMPANY landscape

- company share analysis: Europe

- EXPANSIONS

- merger & Acquisition

- SWOT ANALYSIS

- company profiles

- Aurubis AG

- COMPANY SNAPSHot

- revenue analysis

- Product Portfolio

- RECENT UPDATE

- Boliden Group

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATE

- INEOS

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATE

- solvadis deutschland gmbh (A Subsidiary of Sojitz Corporation)

- COMPANY SNAPSHot

- revenue analysis

- Product Portfolio

- RECENT UPDATES

- BASF SE

- COMPANY SNAPSHot

- revenue analysis

- Product Portfolio

- RECENT UPDATE

- Shrieve

- COMPANY SNAPSHot

- Product Portfolio

- RECENT UPDATE

- ACIDEKA SA

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Adisseo

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Aguachem Ltd

- COMPANY SNAPSHot

- Product Portfolio

- RECENT UPDATE

- Airedale Chemical Company Limited

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Brenntag GmbH (a Subsidary of Brenntag SE)

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATE

- DuPont de Nemours, Inc.

- COMPANY SNAPSHot

- revenue analysis

- Product Portfolio

- RECENT UPDATE

- Eti Bakır

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Feralco AB

- COMPANY SNAPSHot

- Product Portfolio

- RECENT UPDATE

- Fluorsid

- COMPANY SNAPSHot

- Product Portfolio

- RECENT UPDATE

- KBR Inc.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATE

- LANXESS

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATE

- Nyrstar

- COMPANY SNAPSHot

- revenue analysis

- Product Portfolio

- RECENT UPDATE

- Tessenderlo Group

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT UPDATE

- questionnaire

- related reports

List of Table

TABLE 1 IMPORT DATA of SulFuric acid; oleum; HS Code - 2807 (USD Thousand)

TABLE 2 EXPORT data of SulFuric acid; oleum; HS Code - 2807 (USD Thousand)

TABLE 3 Demand for Fertilizer Nutrient Use in the World, 2015-2020 (Thousand Tones)

TABLE 4 New MoDEL AnnOUNCEMENT OF ELECTRICAL CARS

TABLE 5 Europe Sulfuric acid Market, By raw material, 2019-2028 (thousand Tonne)

TABLE 6 Europe SULFURIC ACID market, BY raw material, 2019-2028 (USD thousand)

TABLE 7 europe Elemental sulfur in SULFURIC ACID market, BY country, 2019-2028 (USD thousand)

TABLE 8 Europe Elemental sulfur in SULFURIC ACID market, BY Country, 2019-2028 (thousand Tonne)

TABLE 9 Europe Base Metal Smelters in SULFURIC ACID market, BY Country, 2019-2028 (USD thousand)

TABLE 10 Europe Base Metal Smelters in SULFURIC ACID market, BY Country, 2019-2028 (thousand Tonne)

TABLE 11 Europe Pyrite Ore in SULFURIC ACID market, BY Country, 2019-2028 (USD thousand)

TABLE 12 Europe Pyrite Ore in SULFURIC ACID market, BY Country, 2019-2028 (thousand Tonne)

TABLE 13 Europe others in SULFURIC ACID market, BY Country, 2019-2028 (USD thousand)

TABLE 14 Europe others in SULFURIC ACID market, BY Country, 2019-2028 (thousand Tonne)

TABLE 15 Europe SULFURIC ACID market, BY Form, 2019-2028 (USD thousand)

TABLE 16 Europe Chamber/Fertilizer Acid in SULFURIC ACID market, BY Country, 2019-2028 (USD thousand)

TABLE 17 Europe Concentrated in SULFURIC ACID market, BY Country, 2019-2028 (USD thousand)

TABLE 18 Europe Tower/Glover Acid in SULFURIC ACID market, BY Country, 2019-2028 (USD thousand)

TABLE 19 Europe Battery Acid in SULFURIC ACID market, BY Country, 2019-2028 (USD thousand)

TABLE 20 Europe Dilute Sulfuric Acid in SULFURIC ACID market, BY Country, 2019-2028 (USD thousand)

TABLE 21 Europe SULFURIC ACID market, BY manufacturing process, 2019-2028 (USD thousand)

TABLE 22 Europe Contact Process in SULFURIC ACID market, BY Country, 2019-2028 (USD thousand)

TABLE 23 Europe Lead Chamber Process in SULFURIC ACID market, BY Country, 2019-2028 (USD thousand)

TABLE 24 Europe Wet Sulfuric Acid Process in SULFURIC ACID market, BY Country, 2019-2028 (USD thousand)

TABLE 25 Europe Metabisulfite Process in SULFURIC ACID market, BY Country, 2019-2028 (USD thousand)

TABLE 26 Europe Others in SULFURIC ACID market, BY Country, 2019-2028 (USD thousand)

TABLE 27 Europe SULFURIC ACID market, BY Distribution Channel, 2019-2028 (USD thousand)

TABLE 28 Europe offline in SULFURIC ACID market, BY Country, 2019-2028 (USD thousand)

TABLE 29 Europe Online in SULFURIC ACID market, BY Country, 2019-2028 (USD thousand)

TABLE 30 Europe SULFURIC ACID market, BY Application, 2019-2028 (USD thousand)

TABLE 31 Europe Fertilizers in SULFURIC ACID market, BY Country, 2019-2028 (USD thousand)

TABLE 32 Europe Petroleum Refining in SULFURIC ACID market, BY Country, 2019-2028 (USD thousand)

TABLE 33 Europe Metal processing in SULFURIC ACID market, BY Country, 2019-2028 (USD thousand)

TABLE 34 Europe Drug Manufacturing in SULFURIC ACID market, BY Country, 2019-2028 (USD thousand)

TABLE 35 Europe Chemical Manufacturing in SULFURIC ACID market, BY Country, 2019-2028 (USD thousand)

TABLE 36 Europe chemical manufacturing in Sulfuric acid Market, By Application, 2019-2028 (USD thousand)

TABLE 37 Europe Textile in SULFURIC ACID market, BY Country, 2019-2028 (USD thousand)

TABLE 38 Europe Industrial in SULFURIC ACID market, BY Country, 2019-2028 (USD thousand)

TABLE 39 Europe Automotive in SULFURIC ACID market, BY Country, 2019-2028 (USD thousand)

TABLE 40 Europe Pulp & Paper in SULFURIC ACID market, BY Country, 2019-2028 (USD thousand)

TABLE 41 Europe others in SULFURIC ACID market, BY Country, 2019-2028 (USD thousand)

TABLE 42 Europe Sulfuric acid Market, By Country, 2019-2028 (Thousand Tonne)

TABLE 43 Europe Sulfuric acid Market, By COUNTRY, 2019-2028 (USD Thousand)

TABLE 44 Germany Sulfuric acid Market, By Raw Material, 2019-2028 (Thousand Tonne)

TABLE 45 Germany Sulfuric acid Market, By Raw Material, 2019-2028 (USD Thousand)

TABLE 46 Germany Sulfuric acid Market, By Form, 2019-2028 (USD Thousand)

TABLE 47 GERMANY Sulfuric acid Market, By Manufacturing Process, 2019-2028 (USD Thousand)

TABLE 48 GERMANY Sulfuric acid Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 49 GERMANY Sulfuric acid Market, By Application, 2019-2028 (USD Thousand)

TABLE 50 GERMANY Chemical Manufacturing in Sulfuric acid Market, By Application, 2019-2028 (USD Thousand)

TABLE 51 France Sulfuric acid Market, By Raw Material, 2019-2028 (Thousand Tonne)

TABLE 52 France Sulfuric acid Market, By Raw Material, 2019-2028 (USD Thousand)

TABLE 53 France Sulfuric acid Market, By Form, 2019-2028 (USD Thousand)

TABLE 54 FRANCE Sulfuric acid Market, By Manufacturing Process, 2019-2028 (USD Thousand)

TABLE 55 FRANCE Sulfuric acid Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 56 FRANCE Sulfuric acid Market, By Application, 2019-2028 (USD Thousand)

TABLE 57 FRANCE Chemical Manufacturing in Sulfuric acid Market, By Application, 2019-2028 (USD Thousand)

TABLE 58 U.K. Sulfuric acid Market, By Raw Material, 2019-2028 (Thousand Tonne)

TABLE 59 U.K. Sulfuric acid Market, By Raw Material, 2019-2028 (USD Thousand)

TABLE 60 U.K. Sulfuric acid Market, By Form, 2019-2028 (USD Thousand)

TABLE 61 U.K. Sulfuric acid Market, By Manufacturing Process, 2019-2028 (USD Thousand)

TABLE 62 U.K. Sulfuric acid Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 63 U.K. Sulfuric acid Market, By Application, 2019-2028 (USD Thousand)

TABLE 64 U.K. Chemical Manufacturing in Sulfuric acid Market, By Application, 2019-2028 (USD Thousand)

TABLE 65 SPAIN Sulfuric acid Market, By Raw Material, 2019-2028 (Thousand Tonne)

TABLE 66 SPAIN Sulfuric acid Market, By Raw Material, 2019-2028 (USD Thousand)

TABLE 67 SPAIN Sulfuric acid Market, By Form, 2019-2028 (USD Thousand)

TABLE 68 SPAIN Sulfuric acid Market, By Manufacturing Process, 2019-2028 (USD Thousand)

TABLE 69 SPAIN Sulfuric acid Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 70 SPAIN Sulfuric acid Market, By Application, 2019-2028 (USD Thousand)

TABLE 71 SPAIN Chemical Manufacturing in Sulfuric acid Market, By Application, 2019-2028 (USD Thousand)

TABLE 72 ITALY Sulfuric acid Market, By Raw Material, 2019-2028 (Thousand Tonne)

TABLE 73 ITALY Sulfuric acid Market, By Raw Material, 2019-2028 (USD Thousand)

TABLE 74 ITALY Sulfuric acid Market, By Form, 2019-2028 (USD Thousand)

TABLE 75 ITALY Sulfuric acid Market, By Manufacturing Process, 2019-2028 (USD Thousand)

TABLE 76 ITALY Sulfuric acid Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 77 ITALY Sulfuric acid Market, By Application, 2019-2028 (USD Thousand)

TABLE 78 ITALY Chemical Manufacturing in Sulfuric acid Market, By Application, 2019-2028 (USD Thousand)

TABLE 79 BELGIUM Sulfuric acid Market, By Raw Material, 2019-2028 (Thousand Tonne)

TABLE 80 BELGIUM Sulfuric acid Market, By Raw Material, 2019-2028 (USD Thousand)

TABLE 81 BELGIUM Sulfuric acid Market, By Form, 2019-2028 (USD Thousand)

TABLE 82 BELGIUM Sulfuric acid Market, By Manufacturing Process, 2019-2028 (USD Thousand)

TABLE 83 BELGIUM Sulfuric acid Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 84 BELGIUM Sulfuric acid Market, By Application, 2019-2028 (USD Thousand)

TABLE 85 BELGIUM Chemical Manufacturing in Sulfuric acid Market, By Application, 2019-2028 (USD Thousand)

TABLE 86 RUSSIA Sulfuric acid Market, By Raw Material, 2019-2028 (Thousand Tonne)

TABLE 87 RUSSIA Sulfuric acid Market, By Raw Material, 2019-2028 (USD Thousand)

TABLE 88 RUSSIA Sulfuric acid Market, By Form, 2019-2028 (USD Thousand)

TABLE 89 RUSSIA Sulfuric acid Market, By Manufacturing Process, 2019-2028 (USD Thousand)

TABLE 90 RUSSIA Sulfuric acid Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 91 RUSSIA Sulfuric acid Market, By Application, 2019-2028 (USD Thousand)

TABLE 92 RUSSIA Chemical Manufacturing in Sulfuric acid Market, By Application, 2019-2028 (USD Thousand)

TABLE 93 TURKEY Sulfuric acid Market, By Raw Material, 2019-2028 (Thousand Tonne)

TABLE 94 TURKEY Sulfuric acid Market, By Raw Material, 2019-2028 (USD Thousand)

TABLE 95 TURKEY Sulfuric acid Market, By Form, 2019-2028 (USD Thousand)

TABLE 96 TURKEY Sulfuric acid Market, By Manufacturing Process, 2019-2028 (USD Thousand)

TABLE 97 TURKEY Sulfuric acid Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 98 TURKEY Sulfuric acid Market, By Application, 2019-2028 (USD Thousand)

TABLE 99 TURKEY Chemical Manufacturing in Sulfuric acid Market, By Application, 2019-2028 (USD Thousand)

TABLE 100 NETHERLANDS Sulfuric acid Market, By Raw Material, 2019-2028 (Thousand Tonne)

TABLE 101 NETHERLANDS Sulfuric acid Market, By Raw Material, 2019-2028 (USD Thousand)

TABLE 102 NETHERLANDS Sulfuric acid Market, By Form, 2019-2028 (USD Thousand)

TABLE 103 NETHERLANDS Sulfuric acid Market, By Manufacturing Process, 2019-2028 (USD Thousand)

TABLE 104 NETHERLANDS Sulfuric acid Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 105 NETHERLANDS Sulfuric acid Market, By Application, 2019-2028 (USD Thousand)

TABLE 106 NETHERLANDS Chemical Manufacturing in Sulfuric acid Market, By Application, 2019-2028 (USD Thousand)

TABLE 107 SWITZERLAND Sulfuric acid Market, By Raw Material, 2019-2028 (Thousand Tonne)

TABLE 108 SWITZERLAND Sulfuric acid Market, By Raw Material, 2019-2028 (USD Thousand)

TABLE 109 SWITZERLAND Sulfuric acid Market, By Form, 2019-2028 (USD Thousand)

TABLE 110 SWITZERLAND Sulfuric acid Market, By Manufacturing Process, 2019-2028 (USD Thousand)

TABLE 111 SWITZERLAND Sulfuric acid Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 112 SWITZERLAND Sulfuric acid Market, By Application, 2019-2028 (USD Thousand)

TABLE 113 SWITZERLAND Chemical Manufacturing in Sulfuric acid Market, By Application, 2019-2028 (USD Thousand)

TABLE 114 POLAND Sulfuric acid Market, By Raw Material, 2019-2028 (Thousand Tonne)

TABLE 115 POLAND Sulfuric acid Market, By Raw Material, 2019-2028 (USD Thousand)

TABLE 116 POLAND Sulfuric acid Market, By Form, 2019-2028 (USD Thousand)

TABLE 117 POLAND Sulfuric acid Market, By Manufacturing Process, 2019-2028 (USD Thousand)

TABLE 118 POLAND Sulfuric acid Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 119 POLAND Sulfuric acid Market, By Application, 2019-2028 (USD Thousand)

TABLE 120 POLAND Chemical Manufacturing in Sulfuric acid Market, By Application, 2019-2028 (USD Thousand)

TABLE 121 Rest of Europe Sulfuric acid Market, By Raw Material, 2019-2028 (Thousand Tonne)

TABLE 122 Rest of Europe Sulfuric acid Market, By Raw Material, 2019-2028 (USD Thousand)

List of Figure

FIGURE 1 EUROPE SULFURIC ACID MARKET: segmentation

FIGURE 2 EUROPE SULFURIC ACID MARKET: data triangulation

FIGURE 3 EUROPE SULFURIC ACID MARKET: DROC ANALYSIS

FIGURE 4 EUROPE SULFURIC ACID MARKET: regional VS COUNTRY MARKET analysis

FIGURE 5 EUROPE SULFURIC ACID MARKET: company research analysis

FIGURE 6 EUROPE SULFURIC ACID MARKET: THE raw material LIFELINE CURVE

FIGURE 7 EUROPE SULFURIC ACID MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE SULFURIC ACID MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE SULFURIC ACID MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE SULFURIC ACID MARKET: MARKET application COVERAGE GRID

FIGURE 11 EUROPE SULFURIC ACID MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 Europe sulfuric acid Market: vendor share analysis

FIGURE 13 EUROPE SULFURIC ACID MARKET: SEGMENTATION

FIGURE 14 Increasing demand of fertilizers in agriculture industry IS DRIVING Europe sulfuric acid market in the forecast period of 2021 to 2028

FIGURE 15 Elemental Sulfur SEGMENT is expected to account for the largest share of Europe sulfuric acid MARKET in 2021 & 2028

FIGURE 16 WHOLESALE PRICE OF SULFURIC ACID IN EUROPE, 2017-2019

FIGURE 17 WHOLESALE PRICE OF SULFURIC ACID IN POLAND, 2017-2019

FIGURE 18 WHOLESALE PRICE OF SULFURIC ACID IN EUROPE, BY FORM, 2019

FIGURE 19 WHOLESALE PRICE OF SULFURIC ACID IN POLAND, BY FORM, 2019

FIGURE 20 EX-PRODUCER PRICE/COST OF SULFURIC ACID IN EUROPE, 2017-2019

FIGURE 21 EX-PRODUCER PRICE/COST OF SULFURIC ACID IN POLAND, 2017-2019

FIGURE 22 EX-PRODUCER PRICE/COST OF SULFURIC ACID IN EUROPE, BY FORM, 2019

FIGURE 23 EX-PRODUCER PRICE/COST OF SULFURIC ACID IN POLAND, BY FORM, 2019

FIGURE 24 DRIVERS, RESTRAINTs, OPPORTUNITies, AND CHALLENGE OF Europe sulfuric acid market

FIGURE 25 Fertilizer Consumption OF European Countries (2019) (Kilograms Per Hectare of Land)

FIGURE 26 production and reserves in European countries (Million tons) (2020)

FIGURE 27 Europe SULFURIC ACID market: BY raw material, 2020

FIGURE 28 Europe SULFURIC ACID market: BY Form, 2020

FIGURE 29 Europe SULFURIC ACID market: BY manufacturing process, 2020

FIGURE 30 Europe SULFURIC ACID market: BY Distribution Channel, 2020

FIGURE 31 Europe SULFURIC ACID market: BY Application, 2020

FIGURE 32 Europe sulfuric acid MARKET: SNAPSHOT (2020)

FIGURE 33 Europe sulfuric acid MARKET: by COUNTRY (2020)

FIGURE 34 Europe sulfuric acid MARKET: by COUNTRY (2021 & 2028)

FIGURE 35 Europe sulfuric acid MARKET: by COUNTRY (2020 & 2028)

FIGURE 36 Europe sulfuric acid MARKET: by Raw material (2021-2028)

FIGURE 37 Europe sulfuric acid systems MARKET: COMPANY SHARE 2020(%)

Europe Sulfuric Acid Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Sulfuric Acid Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Sulfuric Acid Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.