Increasing chronic diseases is a major growth factor for the home healthcare market in Europe. The burden of chronic diseases such as diabetes, cardiovascular diseases, obesity, cancer, osteoporosis, and dental diseases has increased in Europe. These diseases can be prevented with proper treatment, diet, and nutrition along with proper suggestions from doctors. But in recent times, the treatment can also be taken by sitting at home with the help of home healthcare services in which one does not need to visit hospitals.

The rise in chronic diseases is driven by aging populations, lifestyle changes, and environmental factors, making the demand for home healthcare more pronounced. Home healthcare provides patients with medical care in the comfort of their homes, reducing hospital admissions and prolonged stays. This approach not only enhances patient comfort and satisfaction but also helps manage healthcare costs by alleviating the burden on healthcare facilities.

For instance,

- In March 2024, according to an article “Health Outcomes for Older Patients with Chronic Diseases During the First Pandemic Year” published by National library of Medicine, discussed about the chronic diseases among older adults. In Spain, data from the National Health Survey revealed that people over 75 years of age usually have an average of 3.2 chronic health problems, while people aged 65–74 years (younger population), manage an average of 2.8, disclosed about the multimorbidity (coexistence of two or more chronic diseases in the same individual)

- In November 2023, according to “Self-perceived health statistics” published by Eurostat, showing statistics of chronic morbidity: long-standing illnesses or health problems. In 2022, more than one third of people in the EU report having a long-standing illness or health problem have been identified. Among the EU member states, the lowest shares of people aged 16 years or over with a long-standing illness or health problem were observed in Italy (17.9 %) and Romania (19.8 %)

- In October 2021, according to a report by European federation of Pharmaceutical Industries and Associations, 37% of Europeans aged 65 and over have multiple chronic conditions, but this figure varied almost three-fold between EU member states

- Around 550,000 people of working-age die prematurely every year across the EU due to Non-Communicable Diseases (NCDs), amounting to 3.4 million life-years and Euro 115 billion in economic potential lost annually

- The total health and economic cost of NCDs in the EU is projected to increase by over 70% by 2050

Therefore, for treatment of chronic diseases such as diabetes, cardiovascular diseases, obesity, cancer, osteoporosis, and dental diseases, home healthcare is found to be a better solution as it provides several services for patients which include nursing home care and home care facility. Such facilities provided by organizations to the patient help the market to grow. Hence, increasing cases of chronic diseases where home healthcare can be used for better treatment acts as a major driving factor for the growth of the market.

Access Full Report @ https://www.databridgemarketresearch.com/reports/europe-home-healthcare-market

Data Bridge Market Research analyzes that the Europe Home Healthcare Market is expected to grow at a CAGR of 8.3% in the forecast period of 2024 to 2031 and is expected to reach USD 135,439.00 million by 2031. The devices segment is projected to propel the market growth due to the increasing demand for advanced monitoring.

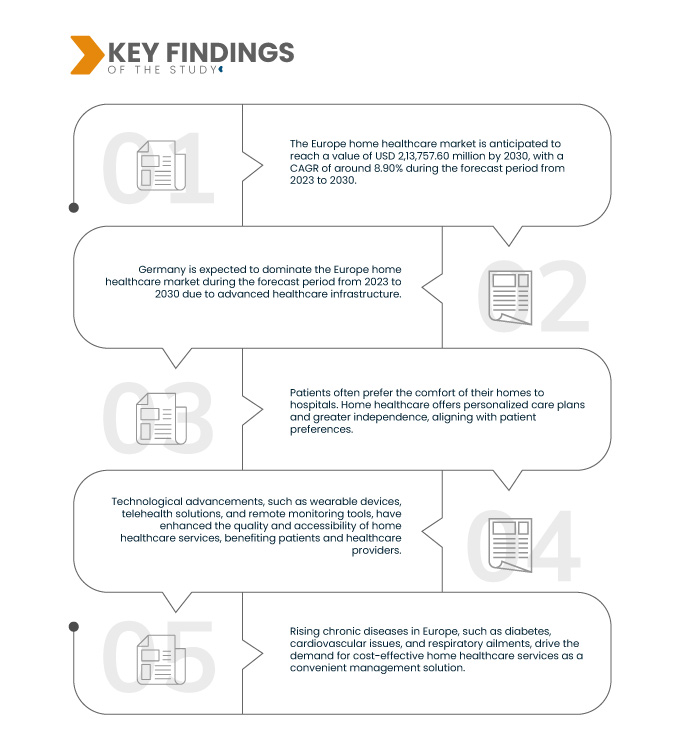

Key Findings of the Study

Increasing Geriatric Population

The increasing elderly population in Europe is a major driver behind the growing demand for home healthcare services. With an aging demographic characterized by longer life expectancies and lower birth rates, there is a rising number of individuals aged 65 and older. This population shift is accompanied by a strong preference among seniors for receiving care in the familiar and comfortable environment of their own homes rather than moving to institutional settings like nursing homes or hospitals. Home healthcare services cater to this preference by providing personalized care tailored to the individual needs of elderly patients, including assistance with daily activities, management of chronic conditions, and medical treatments. Additionally, home healthcare offers economic advantages, often proving to be a more cost-effective alternative to institutional care, which appeals to both patients and the healthcare system. Technological advancements in telemedicine and remote monitoring further support this trend by enabling healthcare providers to deliver high-quality care remotely, enhancing accessibility and convenience for patients.

This significant demographic shift will drive the Europe home healthcare market, as the rising need for personalized and accessible care solutions for the growing elderly population will increase demand for innovative home healthcare services and technologies.

As the elderly population continues to grow, the need for robust, efficient, and adaptable home healthcare solutions becomes increasingly critical to meet the evolving demands of this demographic and ensure their well-being and quality of life.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Year

|

2022 (Customizable to 2016–2021)

|

|

Quantitative Units

|

Revenue in USD Million

|

|

Segments Covered

|

Type (Devices, Services, and Softwares), Disease (Heart Diseases, Hypertension, Bone and Joint Diseases, Diabetes, Respiratory Diseases, Obesity, Dementia/Alzheimer's Diseases, Infectious Diseases (HIV/AIDS), Parkinson's Diseases, Smoking, Asthma, Depression, and Others), Application (Diagnostics, Therapeutics, and Monitoring), Care Type (Post-Acute, Acute Care, Pre-Operative Care, Respite Care, Urgent Care, General, and Others), Distribution Channel (B2B Channel, and B2C Channel)

|

|

Market Players Covered

|

Medline Industries LP (U.S.), Medtronic (U.S.), Koninklijke Philips N.V (Europe), B. Braun S.E. (Germany), Fresenius Kabi AG (Germany), Abbott (U.S.), GE Healthcare (U.S.), Roche Holding AG (Europe), Omron Healthcare, Inc (Japan), Cardinal Health (U.S.), BAYADA Home Health Care (U.S.), 3M (U.S.), Coloplast GMBH (Germany), Boston Scientific Corporation (U.S.), LINDE PLC (Europe), Invacare Corporation (U.S.), ResMed (U.S.), Fisher & Paykel Healthcare Limited (New Zealand), CONTEC MEDICAL SYSTEMS CO., LTD (China), Air Liquide Medical Systems (Europe), and A&D Company (Japan) among others

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework

|

Segment Analysis

Europe Home Healthcare market is categorized into five notable segments based on basis of type, disease, application, care type and distribution channel

- On the basis of type, the market is segmented into devices, services, and software

In 2024, the devices segment of the type segment is expected to dominate the Europe Home Healthcare market

In 2024, the devices segment is expected to dominate the market with a market share of 56.71% due to the increasing demand for advanced monitoring and diagnostic tools that enable real-time patient management and personalized care.

- On the basis of disease, the market is segmented into heart diseases, hypertension, bone and joint diseases, diabetes, respiratory diseases, obesity, dementia/Alzheimer’s diseases, infectious diseases (HIV/AIDS), parkinson’s diseases, smoking, asthma, depression, and others

In 2024, the heart diseases segment of the services segment is expected to dominate the Europe Home Healthcare market

In 2024, the heart diseases segment is expected to dominate the market with a market share of 25.48% due to increasing cases of chronic diseases.

- On the basis of application, the market is segmented into diagnostics, therapeutics, and monitoring. In 2024, the monitoring segment is expected to dominate the market with a market share of 39.17%

- On the basis of care type, the market is segmented into post-acute, acute care pre-operative care, respite care, urgent care, general, and others. In 2024, the acute care segment is expected to dominate the market with a market share of 27.58%

- On the basis of distribution channel, the market is segmented into B2B channels, B2C channels. In 2024, the B2B channels segment is expected to dominate the market with a market share of 60.74%

Major Players

Data Bridge Market Research recognizes the following companies as the major home healthcare players in the market that includes Medline Industries LP (U.S.), Medtronic (U.S.), Koninklijke Philips N.V.(Europe), B. Braun S.E. (Germany), and Fresenius Kabi AG (Germany), among others.

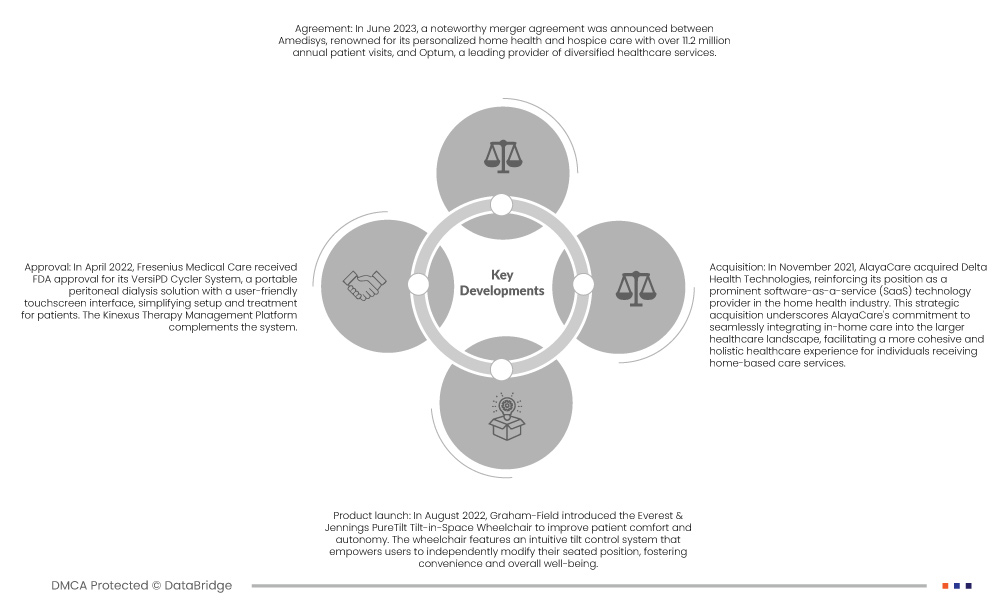

Market Development

- In July 2024, Bon Secours Mercy Health and Philips partnership provided access to the latest Philips monitoring innovations, including a scalable patient monitoring platform that integrates patient data and provides vital insights. It standardized patient monitoring for BSMH’s 49 hospitals, reducing costs through a predictable payment model and enabling further reinvestment in innovation

- In July, Air Liquide Medical Systems launched Monnal TEO. It is a ventilator designed and manufactured in France, intended for intensive care and critical care services. The company continued its history in the field of mechanical ventilation, further pioneering its spirit by offering its brand new ICU ventilator entirely designed and manufactured in France with acute respiratory failure

- In May 2024, A&D company entered into agreement with Aevice Health Pte Ltd, a Singapore-based company specializing in remote respiratory monitoring. Aevice's innovative platform and wearable stethoscope, are designed to enhance asthma and COPD care by improving access, empowering patients, and reducing healthcare costs. This investment aimed to leverage A&D's expertise in medical technology and sales networks with Aevice’s digital health solutions to develop new, high-value products and services. A&D, known for its electronic measuring instruments and medical equipment, seeks to address societal health challenges through this strategic partnership

- In April 2024, Philips’ subsidiaries Philips Holding USA and Philips Respironics finally agreed on the consent decree with DOJ and FDA that primarily focuses on Philips Respironics’ business operations in the US, including its manufacturing facilities in Murrysville and New Kensington, its service center in Mount Pleasant and its Respironics headquarters in Pittsburgh in Pennsylvania

- In April, 2024 Abbott's announced that the U.S. Food and Drug Administration (FDA) approved the Esprit BTK Everolimus Eluting Resorbable Scaffold System (Esprit BTK System), a breakthrough innovation for people with chronic limb-threatening ischemia (CLTI) below-the-knee (BTK). The Esprit BTK System is designed to keep arteries open and deliver a drug (Everolimus) to support vessel healing prior to completely dissolving

- In October 2023, Philips Respironics’ number one priority is patient safety and quality. Philips Respironics was in discussion with the U.S. Food and Drug Administration (FDA) regarding the reports it filed with FDA related to possible thermal issues in the humidifier of the DreamStation 2 sleep therapy device while in use

- In May 2023, A&D company has been honored with the International Society of Weighing and Measurement (ISWM) Product of the Year award for its Borealis BA microbalance. This accolade highlighted the microbalance's exceptional design and innovation in weighing and measurement. The Borealis BA, known for its precision with a readability of 0.001 milligrams and a maximum capacity of 6 grams, is ideal for laboratory applications in pharmaceuticals, chemical analysis, and environmental testing. Paul Wesolowski, Vice President of A&D Weighing, expressed pride in the team's achievement, underscoring their commitment to advancing weighing solutions. The ISWM award is based on criteria including innovation, design, and functionality

- In May 2023, Air Liquide Medical Systems launched ALNEST N1 Silent nasal mask which was designed for patients undergoing non-invasive ventilation at home, particularly those using CPAP for sleep apnea. The mask is notable for its Quiet Flow leak system, which ensures a low noise level by gently diffusing exhaled air, providing a serene experience for both patients and their partners

For more detailed information about the Europe home healthcare market report, click here – https://www.databridgemarketresearch.com/reports/europe-home-healthcare-market