Europe Home Healthcare Market

Market Size in USD Billion

CAGR :

%

USD

77.65 Billion

USD

146.63 Billion

2024

2032

USD

77.65 Billion

USD

146.63 Billion

2024

2032

| 2025 –2032 | |

| USD 77.65 Billion | |

| USD 146.63 Billion | |

|

|

|

Home Healthcare Market Analysis

According to a report “Ageing Europe-statistics on population developments” published by Eurostat in November 2023 provided statistics that the population of older people (defined here as those aged 65 years or more) in the EU-27 will increase significantly, rising from 90.5 million at the start of 2019 to reach 129.8 million by 2050. During this period, the number of people in the Europe aged 75-84 years is projected to expand by 56.1%, while the number aged 65-74 years is projected to increase by 16.6%. This significant growth in the elderly population will drive demand for home healthcare services, as more individuals will require home-based care and support.

Europe Home Healthcare Market Size

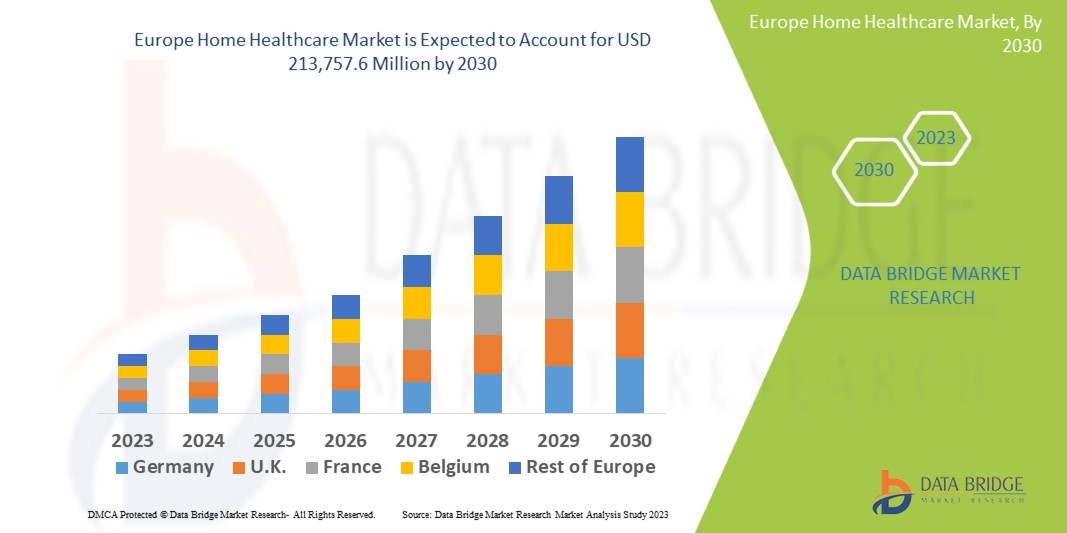

Europe home healthcare market size was valued at USD 77.65 billion in 2024 and is projected to reach USD 146.63 billion by 2032, with a CAGR of 8.27% during the forecast period of 2025 to 2032.

Report Scope and Market Segmentation

|

Attributes |

Home Healthcare Key Market Insights |

|

Segmentation |

|

|

Countries Covered |

Germany, U.K., France, Italy, Netherlands, Spain, Russia, Switzerland, Turkey, Belgium, Poland, Sweden, Denmark, Norway, Finland, and rest of Europe |

|

Key Market Players |

Medline Industries LP, Medtronic, Koninklijke Philips N.V., B. Braun S.E., Fresenius Kabi AG, Abbott, GE Healthcare, Roche Holding AG, Omron Healthcare, Inc, Cardinal Health, BAYADA Home Health Care, 3M, Coloplast GMBH, Boston Scientific Corporation, LINDE PLC, Invacare Corporation, ResMed, Fisher & Paykel Healthcare Limited, CONTEC MEDICAL SYSTEMS CO., LTD, Air Liquide Medical Systems, and A&D Company among others |

Home Healthcare Market Definition

Europe home healthcare market refers to the sector dedicated to providing a range of medical and non-medical services and products in patients' homes rather than in traditional healthcare settings. This market includes home health services such as nursing care, physical therapy, and telehealth consultations; home medical equipment like oxygen concentrators and monitoring devices; non-medical home care services including personal care and companionship; and home diagnostic tools for disease management. Driven by an aging population, rising prevalence of chronic diseases, and advancements in technology, this market reflects a growing preference for home-based care solutions. It is shaped by varying regulatory policies, healthcare infrastructure, and specific regional trends across Europe.

Home Healthcare Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail below:

Driver

- Increasing Geriatric Population

The increasing elderly population in Europe is a major driver behind the growing demand for home healthcare services. With an aging demographic characterized by longer life expectancies and lower birth rates, there is a rising number of individuals aged 65 and older. This population shift is accompanied by a strong preference among seniors for receiving care in the familiar and comfortable environment of their own homes rather than moving to institutional settings like nursing homes or hospitals. Home healthcare services cater to this preference by providing personalized care tailored to the individual needs of elderly patients, including assistance with daily activities, management of chronic conditions, and medical treatments. Additionally, home healthcare offers economic advantages, often proving to be a more cost-effective alternative to institutional care, which appeals to both patients and the healthcare system. Technological advancements in telemedicine and remote monitoring further support this trend by enabling healthcare providers to deliver high-quality care remotely, enhancing accessibility and convenience for patients.

Restraint

- High Cost Of Home Healthcare Services

The high cost of home care services in Europe can be attributed to several factors. Firstly, the need for specialized medical equipment and technology, such as remote monitoring devices and telemedicine systems, drives up expenses. Additionally, home care requires a high level of personalized attention from skilled healthcare professionals, leading to increased labor costs. The training and retention of qualified caregivers also contribute to the overall expense. Furthermore, logistical difficulties, such as travel time and transportation for home visits, add to the costs. Regulatory compliance and the need to maintain high standards of care and safety further elevate the financial burden.

Opportunity

- Increasing Collaboration Between Market Players

Multiple collaborations between healthcare providers and different MedTech companies provide an excellent opportunity for the effective deployment of healthcare services at home. By fostering partnerships among healthcare providers, technology companies, insurers, and policymakers, stakeholders are expected to create a more integrated and efficient care system. Collaborative efforts will enhance service delivery, improve patient outcomes, and streamline operations.

For instance, partnerships between home healthcare providers and technology firms lead to the development and implementation of advanced telemedicine solutions and remote monitoring tools. These technologies enable real-time health data collection and facilitate remote consultations, making it easier to manage chronic conditions and respond promptly to patient needs.

Challenge

- Work Force Shortage In Home Healthcare Services

The workforce shortage in home healthcare services is a significant challenge in the European market, impacting the quality and accessibility of care. As the demand for home-based care grows due to an aging population and increased preference for in-home treatments, there is a concurrent strain on the availability of qualified professionals. Many European countries face a shortage of skilled nurses, caregivers, and other healthcare workers, exacerbated by factors such as low wages, demanding job conditions, and limited career advancement opportunities. This shortage not only increases the workload on existing staff but can also lead to longer wait times for patients and potentially reduced quality of care.

Europe Home Healthcare Market Scope

Europe home healthcare market is segmented into five notable segments based on basis of type, disease, application, care type and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the differences in your target markets.

Type

- Devices

- Services

- Software

Disease

- Heart diseases

- Hypertension

- Bone and Joint Diseases

- Diabetes

- Respiratory Diseases

- Obesity

- Dementia/Alzheimer’s Diseases

- Cancer

- Infectious Diseases (HIV/AIDS)

- Parkinson’s Diseases

- Smoking

- Depression

- Others

Application

- Diagnostics

- Therapeutics

- Monitoring

Care Type

- Acute Care

- Post-Acute

- Pre-Operative Care

- Respite Care

- Urgent Care

- General

- Others

Distribution Channel

- B2B Channel

- B2C Channel

Europe Home Healthcare Market Regional Analysis

Europe Home Healthcare market is segmented into five notable segments based on basis of type, disease, application, care type and distribution channel

The countries covered in this market report are Germany, U.K., France, Italy, Netherlands, Spain, Russia, Switzerland, Belgium, Turkey, rest of Europe.

Germany dominates the Europe home healthcare market due to its advanced healthcare infrastructure, high adoption of innovative medical technologies, and strong government support for home-based care. This leadership is bolstered by an aging population and a well-established system of healthcare providers and insurance.

The country section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Home Healthcare Market Share

Europe Home Healthcare market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product approvals, product width and breadth, application dominance, and product type lifeline curve. The above data points provided are only related to the company’s focus on the market.

Home Healthcare Market Leaders Operating in the Market Are:

- Medline Industries LP

- Medtronic

- Koninklijke Philips N.V.

- B. Braun S.E.

- Fresenius Kabi AG

Latest Developments in Home Healthcare Market

- In July 2024, Bon Secours Mercy Health and Philips partnership provided access to the latest Philips monitoring innovations, including a scalable patient monitoring platform that integrated patient data and provided vital insights. It standardized patient monitoring for BSMH’s 49 hospitals, reducing costs through a predictable payment model and enabling further reinvestment in innovation

- In July, Air Liquide Medical Systems launched Monnal TEO. It is a ventilator designed and manufactured in France, intended for intensive care and critical care services. The company continued its history in the field of mechanical ventilation, continuing its pioneering spirit, by offering its brand new ICU ventilator entirely designed and manufactured in France with acute respiratory failure

- In May 2024, A&D company entered into agreement with Aevice Health Pte Ltd, a Singapore-based company specializing in remote respiratory monitoring. Aevice's innovative platform and wearable stethoscope, were designed to enhance asthma and COPD care by improving access, empowering patients, and reducing healthcare costs. This investment aimed to leverage A&D's expertise in medical technology and sales networks with Aevice’s digital health solutions to develop new, high-value products and services. A&D, known for its electronic measuring instruments and medical equipment, seeked to address societal health challenges through this strategic partnership

- In April 2024, Philips’ subsidiaries Philips Holding USA and Philips Respironics finally agreed on the consent decree with DOJ and FDA that primarily focused on Philips Respironics’ business operations in the US, including its manufacturing facilities in Murrysville and New Kensington, its service center in Mount Pleasant and its Respironics headquarters in Pittsburgh in Pennsylvania

- In April, 2024 Abbott's announced that the U.S. Food and Drug Administration (FDA) has approved the Esprit BTK Everolimus Eluting Resorbable Scaffold System (Esprit BTK System), a breakthrough innovation for people with chronic limb-threatening ischemia (CLTI) below-the-knee (BTK). The Esprit BTK System was designed to keep arteries open and deliver a drug (Everolimus) to support vessel healing prior to completely dissolving

- In October 2023, Philips Respironics’ number one priority is patient safety and quality. Philips Respironics was in discussion with the U.S. Food and Drug Administration (FDA) regarding the reports it filed with FDA related to possible thermal issues in the humidifier of the DreamStation 2 sleep therapy device while in use

- In May 2023, A&D company has been honored with the International Society of Weighing and Measurement (ISWM) Product of the Year award for its Borealis BA microbalance. This accolade highlighted the microbalance's exceptional design and innovation in weighing and measurement. The Borealis BA, known for its precision with a readability of 0.001 milligrams and a maximum capacity of 6 grams, is ideal for laboratory applications in pharmaceuticals, chemical analysis, and environmental testing. Paul Wesolowski, Vice President of A&D Weighing, expressed pride in the team's achievement, underscoring their commitment to advancing weighing solutions. The ISWM award is based on criteria including innovation, design, and functionality

- In May 2023, Air Liquide Medical Systems launched ALNEST N1 Silent nasal mask which was designed for patients undergoing non-invasive ventilation at home, particularly those using CPAP for sleep apnea. The mask is notable for its Quiet Flow leak system, which ensures a low noise level by gently diffusing exhaled air, providing a serene experience for both; patients and their partners

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.