主要企業が分子診断の技術進歩を重視し、他の組織との協力やパートナーシップに熱心に取り組んでいることは、整形外科手術ロボットの市場に大きな影響を与えています。整形外科手術の最も古い記録は 15 世紀に遡ります。現代の整形外科手術と筋骨格の研究により、手術の侵襲性が軽減され、インプラント部品の品質と耐久性が向上しています。人間の骨格系の機能は、整形外科手術ロボットを使用して骨の変形を治療することで回復します。最近では、市場の成長を促進するために、最先端の整形外科手術ロボットの新製品が開発されており、業界の主要企業は製品ラインを拡大しています。整形外科製品は、多数の市場参加者によって生産されています。

完全なレポートにアクセスするには、https://www.databridgemarketresearch.com/reports/global-orthopedic-surgical-robots-market

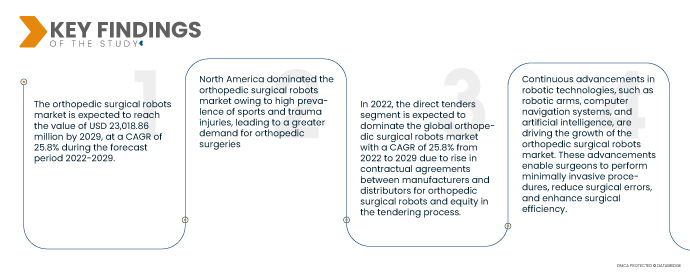

データブリッジマーケットリサーチの分析によると、 整形外科手術ロボット市場 2022年から2029年の予測期間中、ロボット支援手術の市場規模は25.8%で、2029年までに230億1,886万米ドルに達すると予想されています。画像処理システムの改善、触覚フィードバック、拡張現実などのロボット技術の進歩により、整形外科手術用ロボットの機能が強化されています。これらの技術の進歩により、手術計画、ナビゲーション、術中ガイダンスが改善され、ロボット支援手術の効率と信頼性が向上しています。

精密医療と個別化医療の需要増加が市場の成長率を押し上げると予想される

患者と医療提供者が精密で個別化された医療を優先するにつれて、整形外科手術ロボットの需要は高まり続けています。これらの高度な技術により、外科医は優れた精度とカスタマイズ性で手術を計画および実行できるようになり、患者の転帰が改善されます。ロボット支援を統合することで、整形外科手術を個々の患者に合わせて調整できるため、手術の精度が向上し、最終的には整形外科の分野でより成功率が高く効率的な手術が可能になります。

レポートの範囲と市場セグメンテーション

|

レポートメトリック

|

詳細

|

|

予測期間

|

2022年から2029年

|

|

基準年

|

2021

|

|

歴史的な年

|

2020 (2014~2019年にカスタマイズ可能)

|

|

定量単位

|

売上高(百万米ドル)、販売数量(個数)、価格(米ドル)

|

|

対象セグメント

|

製品タイプ (ロボット システム、ロボット アクセサリ、ソフトウェアとサービス)、エンド ユーザー (病院および外来手術センター (ASCS))、流通チャネル (直接入札およびサードパーティの販売代理店)

|

|

対象国

|

北米では米国、カナダ、メキシコ、ヨーロッパではドイツ、フランス、英国、オランダ、スイス、ベルギー、ロシア、イタリア、スペイン、トルコ、その他のヨーロッパ諸国、アジア太平洋地域 (APAC) では中国、日本、インド、韓国、シンガポール、マレーシア、オーストラリア、タイ、インドネシア、フィリピン、その他のアジア太平洋地域 (APAC)、中東およびアフリカ (MEA) の一部としてサウジアラビア、UAE、南アフリカ、エジプト、イスラエル、その他の中東およびアフリカ (MEA)、南米の一部としてブラジル、アルゼンチン、その他の南米。

|

|

対象となる市場プレーヤー

|

Johnson & Johnson Services, Inc. (米国)、Stryker (米国)、Zimmer Biomet (米国)、Smith & Nephew (英国)、Corin Group (英国)、NuVasive, Inc. (米国)、Brainlab AG (ドイツ)、Integrity Implants Inc. d/b/a/Accelus (米国)、Beijing Tinavi Medical Technologies Co., Ltd (中国)、Medtronic (アイルランド)、Globus Medical, Inc. (米国)、Accuray Incorporated (米国)、THINK Surgical, Inc. (米国)、CUREXO, INC. (米国)

|

|

レポートで取り上げられているデータポイント

|

Data Bridge Market Research がまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、専門家による詳細な分析、患者の疫学、パイプライン分析、価格分析、規制の枠組みも含まれています。

|

セグメント分析:

整形外科手術ロボット市場は、製品タイプ、エンドユーザー、流通チャネルに基づいてセグメント化されています。

- 製品タイプに基づいて、世界の整形外科手術ロボット市場は、ロボットシステム、ロボットアクセサリ、ソフトウェアとサービスに分類されます。2022年には、手術手順の精度と自動化を可能にするコアテクノロジーにより、ロボットシステムセグメントが2022年から2029年にかけて25.8%のCAGRで世界の整形外科手術ロボット市場を支配すると予想されています。これらのシステムは、外科医がロボット支援整形外科手術を精度、制御、視覚化の向上とともに実行するために必要な機械的および技術的インフラストラクチャを提供します。

2022年には、ロボットシステムセグメントが世界の整形外科用ロボット市場の製品タイプセグメントを支配すると予想されています。

2022年には、骨疾患の罹患率の増加と、ロボットアーム、手術器具、画像システム、ナビゲーション機能などの高度な機能により、ロボットシステムセグメントが世界の整形外科用ロボット市場を支配すると予想されており、外科医は複雑で正確な手術を行うことができるようになり、2022年から2029年にかけてCAGR 25.8%で成長します。

- エンドユーザーに基づいて、世界の整形外科手術ロボット市場は、病院と外来手術センター(ASCS)に分割されています。2022年には、高度な整形外科手術ロボットの利用可能性、病院に入院する患者数の増加、股関節および膝関節置換手術を受ける患者数の増加、可処分所得の増加により、病院セグメントが世界の整形外科手術ロボット市場を支配し、2022年から2029年にかけて25.8%のCAGRで成長すると予想されています。

- 流通チャネルに基づいて、世界の整形外科用ロボット市場は、直接入札とサードパーティの販売代理店に分割されています。2022年には、整形外科用ロボットのメーカーと販売代理店間の契約の増加と入札プロセスにおける公平性により、直接入札セグメントが2022年から2029年にかけて25.8%のCAGRで世界の整形外科用ロボット市場を支配すると予想されています。

2022年には、直接入札セグメントが世界の整形外科手術ロボット市場の流通チャネルを支配すると予想されています。

2022年には、整形外科用ロボットのような高価値の機器の購入には技術仕様、アフターサポート、価格設定の慎重な評価が伴うことから、直接入札セグメントが世界の整形外科用ロボット市場を支配すると予想されており、2022年から2029年にかけてCAGRは25.8%となる見込みです。

主要プレーヤー

Data Bridge Market Research は、整形外科手術用ロボット市場における主要な整形外科手術用ロボット市場プレーヤーとして、Johnson & Johnson Services, Inc. (米国)、Stryker (米国)、Zimmer Biomet (米国)、Smith & Nephew (英国)、Corin Group (英国)、NuVasive, Inc. (米国)、Brainlab AG (ドイツ)、Integrity Implants Inc. d/b/a/Accelus (米国)、Beijing Tinavi Medical Technologies Co., Ltd (中国)、Medtronic (アイルランド) を認定しています。

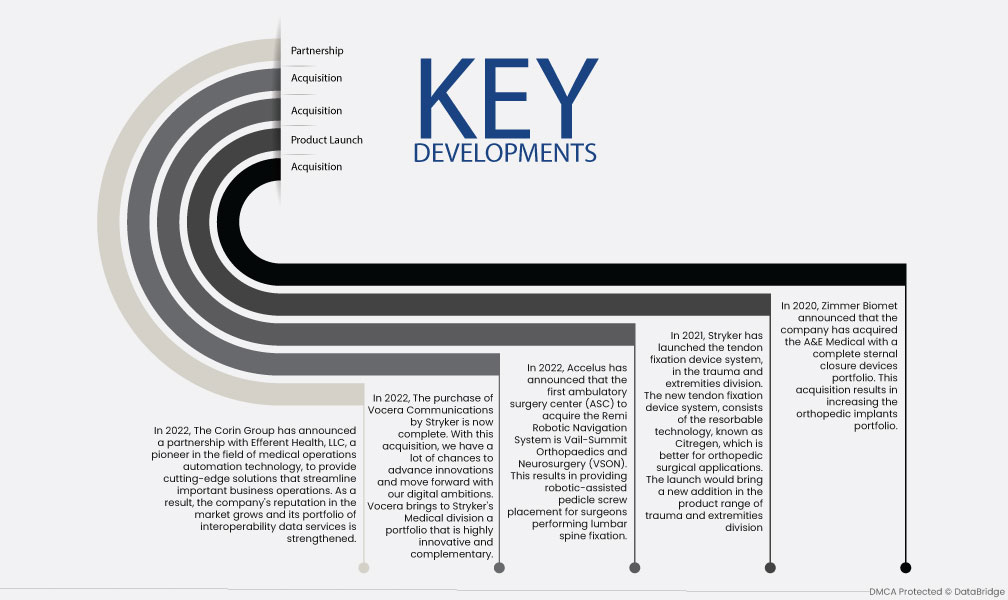

市場開拓

- 2022年、Corinグループは、医療業務自動化テクノロジー分野の先駆者であるEfferent Health, LLCとの提携を発表し、重要な業務を効率化する最先端のソリューションを提供します。その結果、市場での同社の評判が高まり、相互運用性データサービスのポートフォリオが強化されます。

- 2022年、ストライカーによるVocera Communicationsの買収が完了しました。この買収により、当社はイノベーションを推進し、デジタル化への野望を前進させる多くのチャンスを得ました。Voceraは、ストライカーの医療部門に非常に革新的で補完的なポートフォリオをもたらします。

- 2022 年、Accelus は、Remi Robotic Navigation System を導入する最初の外来手術センター (ASC) が Vail-Summit Orthopaedics and Neurosurgery (VSON) であると発表しました。これにより、腰椎固定術を行う外科医にロボット支援による椎弓根スクリューの配置が提供されることになります。

- 2021年、ストライカーは外傷および四肢部門で腱固定装置システムを発売しました。新しい腱固定装置システムは、シトレゲンと呼ばれる吸収性技術で構成されており、整形外科手術の用途に適しています。この発売により、外傷および四肢部門の製品ラインナップに新たな製品が加わります。

- 2020年、Zimmer Biometは、胸骨閉鎖装置の完全なポートフォリオを備えたA&E Medicalを買収したことを発表しました。この買収により、整形外科用インプラントのポートフォリオが拡大します。

地域分析

地理的に見ると、整形外科手術ロボット市場レポートでカバーされている国は、北米では米国、カナダ、メキシコ、ヨーロッパではドイツ、フランス、英国、オランダ、スイス、ベルギー、ロシア、イタリア、スペイン、トルコ、その他のヨーロッパ諸国、アジア太平洋地域 (APAC) では中国、日本、インド、韓国、シンガポール、マレーシア、オーストラリア、タイ、インドネシア、フィリピン、その他のアジア太平洋地域 (APAC)、中東およびアフリカ (MEA) の一部としてサウジアラビア、UAE、南アフリカ、エジプト、イスラエル、その他の中東およびアフリカ (MEA)、南米の一部としてブラジル、アルゼンチン、その他の南米です。

Data Bridge Market Research の分析によると:

2022年から2029年の予測期間中、北米は整形外科手術ロボット市場の主要な地域となる。

北米が世界の整形外科手術ロボット市場で優位に立っている理由はいくつかあります。この地域ではスポーツや外傷による傷害の発生率が高く、整形外科手術の需要が高まっています。さらに、この地域では慢性骨疾患の治療に多額の投資が行われており、整形外科手術ロボットと関連機器の市場成長をさらに促進しています。これらの要因は、北米での整形外科手術における先進技術の採用と利用に貢献しています。

整形外科手術ロボット市場に関する詳細情報 レポートはこちらをクリックしてください –https://www.databridgemarketresearch.com/reports/global-orthopedic-surgical-robots-market