Global Orthopedic Surgical Robots Market

Market Size in USD Billion

CAGR :

%

USD

7.29 Billion

USD

45.76 Billion

2024

2032

USD

7.29 Billion

USD

45.76 Billion

2024

2032

| 2025 –2032 | |

| USD 7.29 Billion | |

| USD 45.76 Billion | |

|

|

|

|

Orthopedic Surgical Robots Market Size

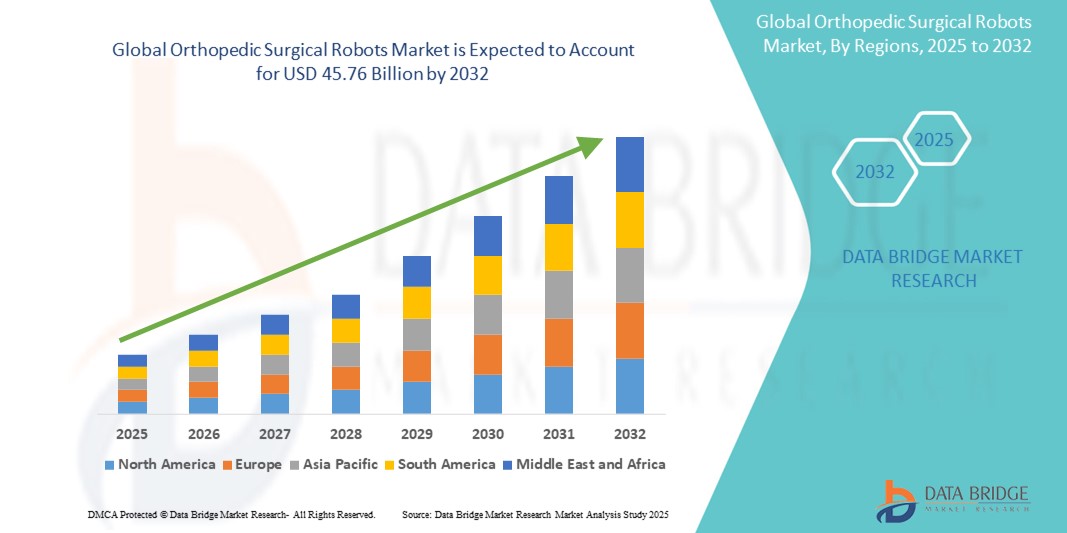

- The global orthopedic surgical robots market size was valued at USD 7.29 billion in 2024 and is expected to reach USD 45.76 billion by 2032, at a CAGR of 25.80% during the forecast period

- The market growth is largely fueled by the increasing demand for minimally invasive procedures, precision-based surgical techniques, and the rising prevalence of orthopedic disorders such as osteoarthritis and degenerative joint diseases

- Furthermore, growing investments in robotic surgery technologies, coupled with the integration of AI and advanced imaging, are enhancing surgical outcomes and reducing recovery times. These advancements are driving the widespread adoption of orthopedic surgical robots, thereby significantly propelling the industry's expansion

Orthopedic Surgical Robots Market Analysis

- Orthopedic surgical robots, which enhance precision and control during orthopedic procedures such as knee and hip replacements, are becoming essential tools in modern surgical suites due to their ability to improve clinical outcomes, reduce complication rates, and support minimally invasive techniques

- The rising demand for orthopedic surgical robots is primarily driven by the growing geriatric population, increasing incidence of musculoskeletal disorders, and the expanding preference for robot-assisted surgeries that ensure higher accuracy and shorter recovery times

- North America dominated the orthopedic surgical robots market with the largest revenue share of 46.3% in 2024, supported by advanced healthcare infrastructure, favorable reimbursement policies, and the presence of leading robotic surgery companies, particularly in the U.S., where hospitals are actively integrating robotic systems to meet rising patient expectations for precision-driven care

- Asia-Pacific is expected to be the fastest growing region in the orthopedic surgical robots market during the forecast period due to a surge in healthcare investments, rising awareness of robotic-assisted surgeries, and improving access to advanced medical technologies in countries such as China, Japan, and India

- Robotic System segment dominated the orthopedic surgical robots market with a market share of 63.9% in 2024, driven by its high upfront costs and increasing installation of robotic platforms across hospitals and surgical centers, particularly for joint replacement procedures

Report Scope and Orthopedic Surgical Robots Market Segmentation

|

Attributes |

Orthopedic Surgical Robots Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Orthopedic Surgical Robots Market Trends

“Precision Enhancement Through AI and Real-Time Imaging Integration”

- A significant and growing trend in the global orthopedic surgical robots market is the integration of artificial intelligence (AI) and real-time imaging technologies, which are revolutionizing preoperative planning, intraoperative navigation, and postoperative outcomes in orthopedic procedures. These innovations are enabling more precise and individualized surgical interventions, particularly in joint replacement surgeries

- For instance, Stryker’s Mako SmartRobotics system incorporates 3D CT-based planning and real-time intraoperative guidance, allowing surgeons to personalize implant positioning with remarkable accuracy. Similarly, Zimmer Biomet’s ROSA Knee System leverages real-time data and analytics to optimize soft tissue balancing and alignment

- AI-powered orthopedic robots are increasingly capable of learning from surgical data, improving decision support, and offering predictive insights during procedures. This technology enhances the consistency of outcomes while reducing intraoperative errors and recovery times

- The convergence of robotic platforms with advanced imaging tools such as fluoroscopy, CT, and MRI is allowing surgeons to visualize bone morphology and joint dynamics in real time, leading to enhanced precision and reduced surgical invasiveness

- This trend is not only transforming surgical efficiency but is also reshaping patient expectations, as individuals seek minimally invasive, low-complication procedures with faster recovery. As a result, companies such as Medtronic and THINK Surgical are investing heavily in next-generation robotic systems with integrated AI and navigation tools.

- The demand for intelligent and image-guided orthopedic surgical robots is surging across hospitals and ambulatory surgery centers, driven by the dual imperatives of precision and personalization in modern orthopedic care

Orthopedic Surgical Robots Market Dynamics

Driver

“Rising Burden of Orthopedic Conditions and Demand for Minimally Invasive Surgery”

- The global rise in orthopedic disorders such as osteoarthritis, traumatic injuries, and degenerative bone diseases is a major driver of the orthopedic surgical robots market. With an aging population and increasing demand for quality-of-life improvements, the need for advanced and minimally invasive orthopedic surgeries is growing rapidly.

- For instance, over 1.5 million joint replacement procedures were performed globally in 2024, and this number is expected to rise significantly by 2032. Robotic assistance offers better implant precision, reduced blood loss, and quicker postoperative recovery, making it increasingly attractive to both patients and providers.

- Technological advancements in robotic platforms, such as improved haptic feedback, AI-powered analytics, and real-time intraoperative adjustments, are further fueling adoption.

- In addition, healthcare facilities are investing in robotic systems to remain competitive and to offer high-precision, high-outcome surgeries that reduce revision rates and length of hospital stays. This growing demand for efficiency and enhanced patient outcomes is a strong catalyst for market expansion

- Moreover, the increasing awareness among patients and orthopedic surgeons regarding the clinical benefits of robotic-assisted surgery—such as lower complication rates, improved implant longevity, and higher satisfaction—has significantly influenced the preference for these technologies across both developed and emerging markets

Restraint/Challenge

“High Capital Costs and Regulatory Barrier”

- One of the key challenges in the widespread adoption of orthopedic surgical robots is the high upfront cost of robotic systems, which can range from USD 500,000 to over USD 2 million, excluding maintenance, training, and software upgrades. This poses a significant financial burden, particularly for smaller hospitals and ambulatory surgical centers

- In addition, complex regulatory approval processes across different regions slow down the commercialization and clinical integration of new robotic systems. For instance, gaining clearance from the U.S. FDA or European CE authorities involves extensive clinical validation, which delays time-to-market

- There are also concerns related to surgeon training, system reliability, and integration with existing surgical workflows, which can hinder immediate clinical adoption

- Furthermore, reimbursement policies for robot-assisted orthopedic surgeries remain inconsistent, especially in developing economies, deterring investment in robotic infrastructure

- To overcome these barriers, market players are focusing on reducing system costs, enhancing ease of use, and collaborating with healthcare authorities to streamline regulatory pathways. The development of compact and cost-effective robotic platforms tailored for outpatient settings is also expected to mitigate these adoption challenges

Orthopedic Surgical Robots Market Scope

The market is segmented on the basis of product type, end user, and distribution channel.

- By Product Type

On the basis of product type, the orthopedic surgical robots market is segmented into robotic systems, robotic accessories, and software and services. The robotic systems segment dominated the market with the largest revenue share of 63.9% in 2024, primarily due to the high cost of these systems and the increasing number of installations across hospitals and surgical centers. These systems serve as the foundation of robotic-assisted surgeries, offering enhanced precision, reduced complication rates, and better long-term outcomes, particularly in joint replacements.

The software and services segment is projected to witness the fastest CAGR from 2025 to 2032, driven by the growing demand for system upgrades, predictive analytics, data integration, and real-time surgical planning. As hospitals look to enhance the performance and longevity of existing robotic systems, the need for customized software solutions and post-installation services is rising steadily.

- By End User

On the basis of end user, the market is segmented into hospitals and ambulatory surgery centers (ASCs). The hospital segment led the market in 2024, owing to the higher volume of orthopedic procedures performed in these settings, access to advanced infrastructure, and strong financial capacity for investing in capital-intensive robotic systems. In addition, hospitals often serve as training and research hubs, further promoting the adoption of robotic surgical systems.

The ambulatory surgery centers (ASCs) segment is expected to witness notable growth during the forecast period, supported by the shift toward outpatient orthopedic surgeries, reduced hospitalization costs, and the introduction of compact robotic systems designed specifically for ASCs. This trend aligns with the global push for cost-effective and efficient surgical care delivery.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tenders and third-party distributors. The direct tenders segment accounted for the largest market share of 68.5% in 2024, attributed to the preference of healthcare institutions for engaging directly with manufacturers to secure long-term contracts, negotiate pricing, and access reliable support and maintenance services. These partnerships often involve training programs and bundled service agreements that further drive direct procurement.

The third-party distributors segment is expected to grow at fastest rate during forecast period, in emerging markets where local representation, customized financing options, and logistical support are crucial. These channels are becoming increasingly important in expanding market reach, especially for mid-sized healthcare providers

Orthopedic Surgical Robots Market Regional Analysis

- North America dominated the orthopedic surgical robots market with the largest revenue share of 46.3% in 2024, supported by advanced healthcare infrastructure, favorable reimbursement policies, and the presence of leading robotic surgery companies

- The region benefits from a robust healthcare ecosystem, widespread presence of key robotic surgery system manufacturers, and favorable reimbursement frameworks that encourage adoption in both public and private healthcare facilities

- In addition, the growing elderly population and rising demand for minimally invasive procedures are accelerating the utilization of orthopedic surgical robots in joint replacement and spine surgeries, reinforcing North America's position as the leading market

U.S. Orthopedic Surgical Robots Market Insight

The U.S. orthopedic surgical robots market captured the largest revenue share of 78.4% in 2024 within North America, driven by early adoption of robotic-assisted surgical technologies and robust investments in advanced healthcare infrastructure. High patient awareness, rising incidence of orthopedic conditions such as osteoarthritis, and increasing preference for minimally invasive procedures contribute to the market's growth. Furthermore, strong presence of key manufacturers, supportive FDA approvals, and favorable reimbursement policies are accelerating the deployment of surgical robots in U.S. hospitals and surgical centers.

Europe Orthopedic Surgical Robots Market Insight

The Europe orthopedic surgical robots market is projected to grow at a significant CAGR throughout the forecast period, propelled by increasing demand for precision-based orthopedic surgeries and supportive government funding for medical technology advancements. Growing geriatric population, high rates of joint replacement procedures, and technological collaborations between hospitals and medical device firms are key growth drivers. The region's emphasis on improving surgical outcomes and reducing hospital stays fosters adoption across both public and private healthcare institutions.

U.K. Orthopedic Surgical Robots Market Insight

The U.K. orthopedic surgical robots market is anticipated to witness steady growth during the forecast period, supported by rising orthopedic surgery volumes and NHS investments in robotic technology. Increasing awareness about the benefits of robotic-assisted surgeries, such as reduced recovery time and surgical accuracy, is influencing both patient and surgeon preferences. Adoption is further driven by clinical trials, surgeon training programs, and the integration of digital surgery platforms in top-tier hospitals across the country.

Germany Orthopedic Surgical Robots Market Insight

The Germany orthopedic surgical robots market is expected to grow considerably over the forecast period, fueled by the country’s strong medical technology ecosystem and rising demand for advanced orthopedic procedures. High healthcare expenditure, presence of leading surgical robot manufacturers, and an aging population contribute to the expansion. Germany’s focus on high precision, minimally invasive procedures and continuous innovation in robotic systems are central to the market’s growth trajectory.

Asia-Pacific Orthopedic Surgical Robots Market Insight

The Asia-Pacific orthopedic surgical robots market is set to grow at the fastest CAGR from 2025 to 2032, driven by increasing healthcare expenditure, rising joint disease prevalence, and expanding access to advanced surgical solutions in countries such as China, India, and Japan. Government-led healthcare modernization programs and rising medical tourism are also contributing to the region’s rapid adoption. Moreover, domestic development of cost-effective robotic systems is making the technology more accessible across various healthcare tiers.

Japan Orthopedic Surgical Robots Market Insight

The Japan orthopedic surgical robots market is experiencing steady growth, during the forecast period, driven by its aging population, high standards in surgical precision, and national focus on healthcare innovation. Japanese hospitals are rapidly integrating robotics to improve surgical outcomes, reduce complications, and minimize hospital stays. Strong government support for digital healthcare and partnerships between technology firms and hospitals are strengthening the robotic surgery landscape in the country.

India Orthopedic Surgical Robots Market Insight

The India orthopedic surgical robots market accounted for the largest share in Asia-Pacific in 2024, owing to rising demand for quality healthcare, increasing orthopedic disease burden, and growing presence of private multispecialty hospitals. India is witnessing a surge in robotic-assisted joint replacement procedures, especially in urban centers. The country’s robust medical tourism sector and improving affordability of surgical robotics systems, supported by local innovation, are key contributors to market expansion.

Orthopedic Surgical Robots Market Share

The orthopedic surgical robots industry is primarily led by well-established companies, including:

- Stryker (U.S.)

- Zimmer Biomet Holdings, Inc. (U.S.)

- Smith + Nephew (U.K.)

- Medtronic (Ireland)

- Globus Medical, Inc. (U.S.)

- Johnson & Johnson Services Inc. (U.S.)

- OMNIlife Science, Inc. (U.S.)

- THINK Surgical, Inc. (U.S.)

- Renishaw plc (U.K.)

- Corin Group (U.K.)

- Medacta International SA (Switzerland)

- Brainlab AG (Germany)

- Curexo, Inc. (South Korea)

- Zimmer MedizinSysteme GmbH (Germany)

- Asensus Surgical, Inc. (U.S.)

- ORTHOTAXY SAS (France)

- MicroPort Orthopedics Inc. (China)

- Intuitive Surgical, Inc. (U.S.)

- Smith Robotics Inc. (Canada)

What are the Recent Developments in Global Orthopedic Surgical Robots Market?

- In April 2024, Stryker Corporation announced the successful first procedures using its Mako Total Knee 2.0 platform in Europe. The upgraded robotic-arm-assisted system incorporates enhanced planning software and real-time intraoperative analytics to deliver improved surgical precision and patient outcomes. This milestone demonstrates Stryker's commitment to expanding its global footprint and advancing robotic solutions that support surgeons in achieving optimal orthopedic carz

- In March 2024, Zimmer Biomet Holdings, Inc. launched ROSA Hip, an extension of its ROSA Robotics portfolio, in select Asia-Pacific markets. The system is designed to support minimally invasive hip replacement procedures through real-time data and intelligent guidance. This launch reflects the company’s focus on providing comprehensive, data-driven robotic solutions to meet rising regional demand for orthopedic innovations.

- In February 2024, Smith+Nephew collaborated with Huma Therapeutics to integrate its CORI Surgical System with digital patient engagement tools. The integration allows orthopedic surgeons to monitor patient progress remotely before and after robotic-assisted procedures, enhancing the continuity of care and post-surgical outcomes. This partnership marks a significant step in combining robotics with digital health technologies

- In January 2024, THINK Surgical, Inc. announced FDA clearance for its next-generation robotic system, TMINI, a wireless, hand-held robot for knee replacement surgery. The system simplifies robotic integration in operating rooms by offering compact design and surgeon-controlled precision. This development reinforces THINK Surgical’s vision of delivering flexible, accessible robotic platforms for orthopedic practices

- In December 2023, Globus Medical, Inc. completed its acquisition of Depuy Synthes’ robotic-assisted surgical business to expand its ExcelsiusGPS platform capabilities. The acquisition aims to accelerate innovation in orthopedic robotics by merging technologies and broadening clinical applications in spine and joint procedures. This strategic move signifies increased competition and consolidation in the evolving surgical robotics market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.