デジタル決済市場は著しい成長と変革を遂げ、個人や企業の金融取引に革命をもたらしました。この競争の激しい市場には、従来の金融機関、テクノロジー企業、革新的なフィンテックの新興企業など、さまざまなプレーヤーが参入しています。これらの企業は、進化する消費者のニーズに応えるために、さまざまなサービスを提供しています。デジタル決済方法がますます普及するにつれて、市場環境は激しい競争、革新、そして安全で便利な決済ソリューションの継続的な開発によって特徴づけられています。

完全なレポートにアクセスするには、https://www.databridgemarketresearch.com/reports/global-digital-payment-market

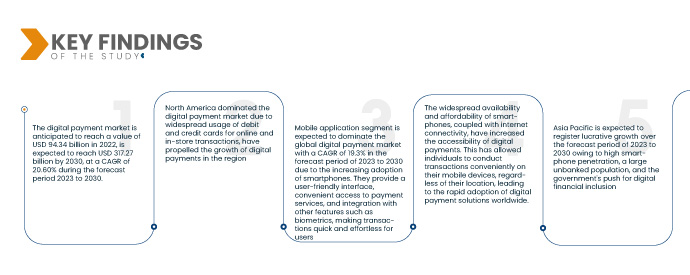

データブリッジマーケットリサーチの分析によると、 デジタル決済市場 2022年には943.4億米ドルに成長すると予想されており、2023年から2030年の予測期間中に20.60%のCAGRで成長し、2030年までに3172.7億米ドルに達すると予想されています。スマートフォンとタブレットの普及は、デジタル決済の成長の基盤となっています。モバイルデバイスは、取引を行うための便利なプラットフォームとして機能し、ユーザーがいつでもどこでも支払いを行えるようにします。

研究の主な結果

キャッシュレス社会への移行が市場の成長率を押し上げると予想される

政府や金融機関は、キャッシュレス社会への移行を積極的に奨励しています。電子取引はデジタルの痕跡を残すため、デジタル決済を推進することで透明性を高めることを目指しています。さらに、現金の使用を減らすことで、違法行為や闇市場と戦うことができます。デジタル決済の導入は、従来の銀行設備を持たない個人が金融サービスにアクセスしやすくなり、経済参加とエンパワーメントを促進するため、金融包摂も促進します。

レポートの範囲と市場セグメンテーション

|

レポートメトリック

|

詳細

|

|

予測期間

|

2023年から2030年

|

|

基準年

|

2022

|

|

歴史的な年

|

2021 (2015~2020年にカスタマイズ可能)

|

|

定量単位

|

売上高(10億米ドル)、販売数量(個数)、価格(米ドル)

|

|

対象セグメント

|

提供内容 (ソリューション、サービス)、導入モデル (オンプレミス、クラウド)、組織規模 (大企業、中小企業 (SME))、支払い方法 (決済カード、POS、統合決済インターフェース (UPI) サービス、モバイル決済、オンライン決済)、使用方法 (モバイル アプリケーション、デスクトップ/Web ブラウザー)、テクノロジー (アプリケーション プログラミング インターフェース (API)、データ分析と ML、デジタル台帳テクノロジー (DLT)、AI と IoT、生体認証)、エンド ユーザー (BFSI、ヘルスケア、IT と通信、メディアとエンターテイメント、小売と電子商取引、運輸、その他)

|

|

対象国

|

北米では米国、カナダ、メキシコ、ヨーロッパではドイツ、フランス、英国、オランダ、スイス、ベルギー、ロシア、イタリア、スペイン、トルコ、その他のヨーロッパ諸国、アジア太平洋地域 (APAC) では中国、日本、インド、韓国、シンガポール、マレーシア、オーストラリア、タイ、インドネシア、フィリピン、その他のアジア太平洋地域 (APAC)、中東およびアフリカ (MEA) の一部としてサウジアラビア、UAE、南アフリカ、エジプト、イスラエル、その他の中東およびアフリカ (MEA)、南米の一部としてブラジル、アルゼンチン、その他の南米。

|

|

対象となる市場プレーヤー

|

PayPal Holdings, Inc (米国)、Fiserv, Inc (米国)、Alipay (中国)、Apple Inc. (米国)、Google, LLC (米国)、Visa (米国)、Mastercard (米国)、American Express (米国)、Amazon Pay (米国)、Aurus Inc. (米国)、Adyen (オランダ)、Kakao Pay Corp (韓国)、Grab (インド)、Paytm (インド)、SAMSUNG (韓国)、UnionPay International (中国)、MercadoLibre SRL (アルゼンチン)、WeChat Pay (中国)、Financial Software and Systems Pvt. Ltd. (米国)、Novatti Group Ltd (オーストラリア) など

|

|

レポートで取り上げられているデータポイント

|

データブリッジ市場調査チームがまとめた市場レポートには、市場価値、成長率、市場セグメント、地理的範囲、市場プレーヤー、市場シナリオなどの市場洞察に加えて、詳細な専門家分析、輸入/輸出分析、価格分析、生産消費分析、ペストル分析が含まれています。

|

セグメント分析:

デジタル決済市場は、提供内容、展開モデル、組織規模、支払い方法、使用方法、テクノロジー、エンドユーザーに基づいてセグメント化されています。

- 提供内容に基づいて、市場はソリューションとサービスに分割されます。ソリューションセグメントは、利便性、セキュリティ、効率性を提供し、顧客のニーズに対応し、進化するトレンドを先取りすることで、2023年から2030年の予測期間に19.2%のCAGRで世界のデジタル決済市場を支配すると予想されており、それによって市場の優位性が確保されます。

- 展開モデルに基づいて、市場はクラウドとオンプレミスに分割されます。オンプレミスセグメントは、組織に支払いインフラストラクチャの完全な制御を提供し、データのプライバシー、コンプライアンス、および特定のビジネス要件を満たすカスタマイズされた構成を保証する機能により、2023年から2030年の予測期間に18.4%のCAGRで世界のデジタル支払い市場を支配すると予想されています。

- 組織規模に基づいて、市場は大企業と中小企業 (SME) に分割されます。大企業セグメントは、豊富なリソース、確立された市場での存在感、規模の経済、研究開発への投資能力により、2023 年から 2030 年の予測期間に 18.5% の CAGR で世界のデジタル決済市場を支配すると予想されており、小規模なプレーヤーよりも優位に立って市場優位性を維持できます。

- 支払い方法に基づいて、市場は決済カード、POS、統合決済インターフェース(UPI)サービス、モバイル決済、オンライン決済に分類されます。決済カードセグメントは、消費者の間で広く受け入れられ、使いやすく、馴染みがあるため、2023年から2030年の予測期間に19.0%のCAGRで世界のデジタル決済市場を支配すると予想されています。利便性、セキュリティ、既存の決済インフラストラクチャとのシームレスな統合を提供し、その優位性に貢献しています。

2023年には、決済カードセグメントが世界のデジタル決済市場における決済モードセグメントを支配すると予想されています。

2023年には、決済カードセグメントが、その幅広い受け入れ、使いやすさ、顧客の間での遍在性により、世界のデジタル決済市場を支配すると予想されています。使いやすさ、セキュリティ、現在の決済インフラとのシームレスな統合を提供することで、その優位性は支えられており、2023年から2030年の予測期間では19.0%のCAGRで成長します。

- 使用方法に基づいて、市場はモバイル アプリケーションとデスクトップ/Web ブラウザーに分割されます。モバイル アプリケーション セグメントは、スマートフォンの採用の増加により、2023 年から 2030 年の予測期間に 19.3% の CAGR で世界のデジタル決済市場を支配すると予想されています。モバイル アプリケーションは、ユーザー フレンドリーなインターフェイス、決済サービスへの便利なアクセス、生体認証などの他の機能との統合を提供し、ユーザーにとって取引を迅速かつ簡単にします。

- 技術に基づいて、市場はアプリケーションプログラミングインターフェース(API)、データ分析とML、デジタル台帳技術(DLT)、AIとIoT、生体認証に分類されます。アプリケーションプログラミングインターフェース(API)セグメントは、さまざまなアプリケーションへの決済サービスのシームレスな統合を可能にするため、2023年から2030年の予測期間に20.0%のCAGRで世界のデジタル決済市場を支配すると予想されています。安全なデータ交換を促進し、取引を合理化し、相互運用性を促進し、企業が幅広い決済機能を活用できるようにします。

2023年には、アプリケーションプログラミングインターフェース(API)セグメントが世界のデジタル決済市場の技術セグメントを支配すると予想されています。

2023年には、アプリケーションプログラミングインターフェース(API)セグメントが、決済サービスをさまざまなアプリケーションにシームレスに統合することを可能にするため、世界のデジタル決済市場を支配すると予想されています。企業は、2023年から2030年の予測期間に20.0%のCAGRで、合理化された取引、相互運用性のサポート、安全なデータ交換の促進のためにさまざまな決済機能を活用できます。

- エンドユーザーに基づいて、市場は BFSI、ヘルスケア、IT および通信、メディアおよびエンターテイメント、小売および電子商取引、輸送、その他に分類されます。金融取引の量と価値が高いこと、厳格なセキュリティ要件、および高度な支払いシステムとインフラストラクチャの必要性により、BFSI (銀行、金融サービス、保険) セグメントが優勢になることがよくあります。

主要プレーヤー

データブリッジマーケットリサーチは、以下の企業を主要なデジタル決済企業として認識しています。 デジタル決済市場のプレーヤーは、Visa(米国)、PayPal Holdings, Inc.(米国)、Mastercard(米国)、Google(Alphabet Inc.の子会社)(米国)、Global Payments Inc.(米国)である。

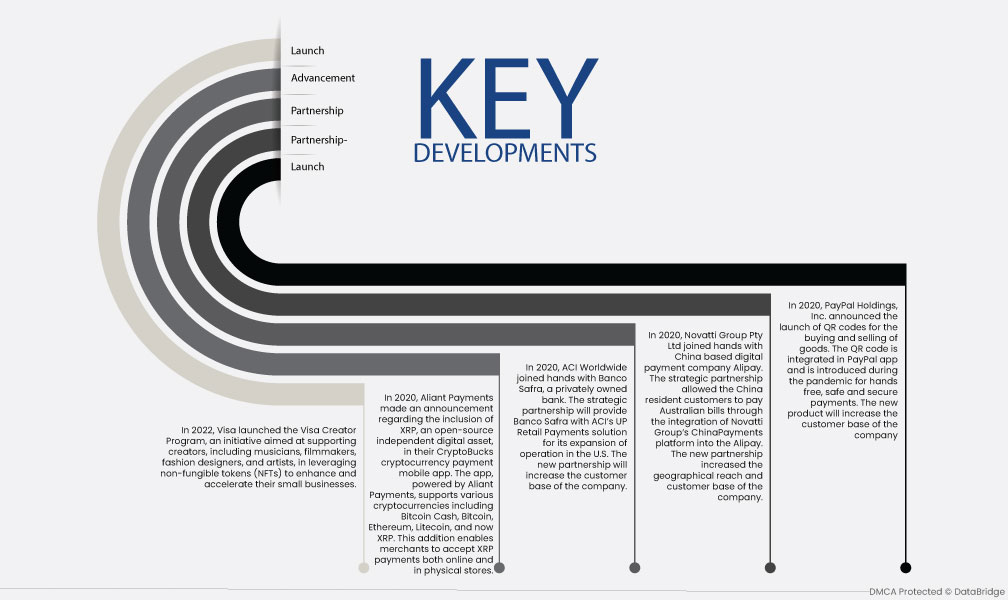

市場開拓

- Visaは2022年に、ミュージシャン、映画製作者、ファッションデザイナー、アーティストなどのクリエイターが非代替性トークン(NFT)を活用して中小企業を強化・加速できるよう支援することを目的としたイニシアチブであるVisa Creator Programを開始しました。

- 2020年、Aliant Paymentsは、オープンソースの独立デジタル資産であるXRPを、同社のCryptoBucks暗号通貨決済モバイルアプリに組み込むことを発表しました。Aliant Paymentsを搭載したこのアプリは、ビットコインキャッシュ、ビットコイン、イーサリアム、ライトコイン、そして新たにXRPを含むさまざまな暗号通貨をサポートしています。この追加により、商店はオンラインでも実店舗でもXRP決済を受け入れることができるようになります。

- 2020年、ACIワールドワイドは民間銀行のバンコ・サフラと提携しました。この戦略的提携により、バンコ・サフラは米国での事業拡大のためにACIのUPリテール決済ソリューションを利用できるようになります。この新しい提携により、同社の顧客基盤が拡大します。

- 2020年、Novatti Group Pty Ltdは中国を拠点とするデジタル決済会社Alipayと提携しました。この戦略的提携により、Novatti GroupのChinaPaymentsプラットフォームをAlipayに統合することで、中国在住の顧客はオーストラリアの請求書を支払うことができるようになりました。この新しい提携により、同社の地理的範囲と顧客基盤が拡大しました。

- 2020年、PayPal Holdings, Inc.は、商品の売買にQRコードを導入すると発表しました。QRコードはPayPalアプリに統合されており、パンデミック中にハンズフリーで安全かつ確実な支払いのために導入されました。この新製品により、同社の顧客基盤は拡大するでしょう。

地域分析

地理的に見ると、デジタル決済市場レポートでカバーされている国は、北米では米国、カナダ、メキシコ、ヨーロッパではドイツ、フランス、英国、オランダ、スイス、ベルギー、ロシア、イタリア、スペイン、トルコ、その他のヨーロッパ、アジア太平洋地域 (APAC) では中国、日本、インド、韓国、シンガポール、マレーシア、オーストラリア、タイ、インドネシア、フィリピン、その他のアジア太平洋地域 (APAC)、中東およびアフリカ (MEA) の一部としてサウジアラビア、UAE、南アフリカ、エジプト、イスラエル、その他の中東およびアフリカ (MEA)、南米の一部としてブラジル、アルゼンチン、その他の南米です。

Data Bridge Market Research の分析によると:

北米は、 デジタル決済市場 予測期間2023~2030年

北米は、特に米国でデジタル決済市場を支配しています。Apple PayやGoogle Payなどのモバイルウォレット、およびオンラインや店舗での取引におけるデビットカードやクレジットカードの広範な使用が、この地域でのデジタル決済の成長を牽引してきました。確立された決済処理業者、金融機関、および高度な金融インフラストラクチャの存在により、デジタル決済市場における北米の地位はさらに強固なものになっています。

アジア太平洋地域はデジタル決済市場において最も急速に成長する地域であると推定されている 予測期間2023-2030年

アジア太平洋地域ではデジタル決済が著しく成長しており、2023年から2030年の予測期間中も、主に中国、インド、東南アジア諸国などの国々の牽引により成長すると予想されています。AlipayやWeChat Payなどのモバイル決済プラットフォームの台頭により、この地域の決済環境は一変しました。スマートフォンの普及率の高さ、銀行口座を持たない人口の多さ、政府によるデジタル金融包摂の推進が、デジタル決済におけるアジア太平洋地域の優位性に貢献しています。

デジタル決済に関する詳しい情報については 市場 レポートはこちらをクリックしてください – https://www.databridgemarketresearch.com/reports/global-digital-payment-market