ヨーロッパのデジタル決済市場は、幅広い電子決済方法とサービスを網羅するダイナミックで急速に進化する分野です。これには、オンライン決済プラットフォーム、モバイルウォレット、 非接触型決済、および従来のカードベースのトランザクション。ヨーロッパ全土でデジタル決済ソリューションの導入が進むにつれ、この市場は近年大幅な成長を遂げています。ヨーロッパの消費者と企業はデジタル決済オプションをますます採用しており、この市場は競争力が高く革新的となっています。デジタル化とフィンテックの発展により決済環境が再構築される中、同社は今後も成長軌道を続けると予想されています。

完全なレポートにアクセス @ https://www.databridgemarketresearch.com/reports/europe-digital-payment-market

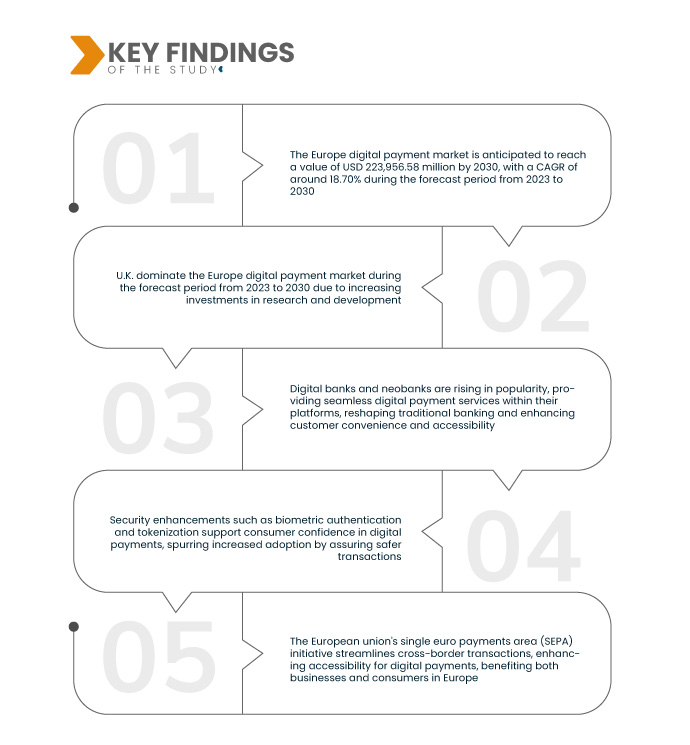

データブリッジ市場調査は次のように分析しています。 ヨーロッパのデジタル決済市場 2023年から2030年の予測期間に18.70%のCAGRで成長すると予想され、2022年の568億2,744万米ドルから2030年までに2兆239億5,658万米ドルに達すると予想されています。ヨーロッパの多くの国がキャッシュレス社会を積極的に提唱し、その普及を促しています。日常の取引におけるデジタル決済の割合。これらの取り組みは、地域全体で安全かつ効率的な電子決済方法を推進しながら、利便性の向上、コストの削減、金融包摂の促進を目的としています。

研究の主な結果

Eコマースの拡大 市場の成長率を牽引すると予想される

電子商取引分野の拡大は、ヨーロッパにおけるデジタル決済ソリューションの台頭にとって重要な触媒となっています。オンライン ショッピングと電子商取引プラットフォームの普及により、デジタル支払い方法に対する大きな需要が高まりました。この傾向により、消費者がオンラインで購入する方法が簡素化され、便利で安全な支払い体験が提供されます。その結果、デジタル決済システムは、大陸全体の電子商取引の成長とアクセスしやすさを促進する上で極めて重要な役割を果たしています。

レポートの範囲と市場セグメンテーション

|

レポート指標

|

詳細

|

|

予測期間

|

2023年から2030年まで

|

|

基準年

|

2022

|

|

歴史的な年

|

2021 (2015 ~ 2020 にカスタマイズ可能)

|

|

量的単位

|

収益(百万米ドル)、数量(単位)、価格(米ドル)

|

|

対象となるセグメント

|

提供内容 (ソリューション、サービス)、導入モデル (オンプレミス、クラウド)、組織規模 (大企業、中小企業 (SME))、支払い方法 (支払いカード、販売時点管理、統一支払インターフェイス (UPI) サービス) 、モバイル決済、オンライン決済)、使用モード (モバイル アプリケーション、デスクトップ/Web ブラウザー)、テクノロジー (アプリケーション プログラミング インターフェイス (API)、データ分析と機械学習、デジタル台帳テクノロジー (DLT)、 人工知能 モノのインターネット、生体認証)、ユースケース(個人(P/C)、販売者/企業、政府)、エンドユーザー(商用、消費者)

|

|

対象国

|

ドイツ、フランス、イギリス、オランダ、スイス、ベルギー、ロシア、イタリア、スペイン、トルコ、その他のヨーロッパ。

|

|

対象となる市場関係者

|

ACI Worldwide (米国)、PayPal, Inc. (米国)、Novatti Group Limited (オーストラリア)、Global Payments Inc. (米国)、Visa (米国)、Stripe, Inc. (アイルランド)、Google, LLC (米国)、Finastra 。 (英国)、SAMSUNG(韓国)、Amazon Web Services, Inc.(米国)、Financial Software & Systems Pvt. Ltd. (米国)、Aurus Inc. (米国)、Adyen (オランダ)、Apple Inc. (米国)、Fiserv, Inc. (米国)、WEX Inc. (米国)、wirecard (米国)、Mastercard。 (米国)他にも多数あります。

|

|

レポートで取り上げるデータポイント

|

市場価値、成長率、市場セグメント、地理的範囲、市場プレーヤー、市場シナリオなどの市場洞察に加えて、データブリッジ市場調査チームによって厳選された市場レポートには、詳細な専門家分析、輸出入分析、価格分析、生産消費分析、乳棒分析。

|

セグメント分析:

ヨーロッパのデジタル決済市場は、サービス、導入モデル、組織規模、支払い方法、使用方法、テクノロジー、ユースケース、エンドユーザーに基づいて分割されています。

- ヨーロッパのデジタル決済市場は、提供内容に基づいてソリューションとサービスに分類されます。

- 展開モデルに基づいて、ヨーロッパのデジタル決済市場はオンプレミスとクラウドに分類されます。

- ヨーロッパのデジタル決済市場は、組織規模に基づいて大企業、中小企業(SME)に分類されます。

- ヨーロッパのデジタル決済市場は、決済方法に基づいて、決済カード、販売時点管理、統一決済インターフェース (UPI) サービス、モバイル決済、オンライン決済に分類されます。

- ヨーロッパのデジタル決済市場は、使用方法に基づいて、モバイル アプリケーション、デスクトップ/Web ブラウザーに分類されます。

- ヨーロッパのデジタル決済市場は、テクノロジーに基づいて、アプリケーション プログラミング インターフェイス (API)、データ分析と機械学習、デジタル台帳テクノロジー (DLT)、人工知能とモノのインターネット、生体認証に分類されます。

- ユースケースに基づいて、ヨーロッパのデジタル決済市場は個人 (P/C)、商業者/企業、政府に分類されます。

- エンドユーザーに基づいて、ヨーロッパのデジタル決済市場は商業用と消費者用に分類されます。

主なプレーヤー

Data Bridge Market Researchは、ヨーロッパのデジタル決済市場における主要なプレーヤーとして次の企業を認識しています:ACI Worldwide (米国)、PayPal, Inc. (米国)、Novatti Group Limited (オーストラリア)、Global Payments Inc. (米国) 、Visa (米国)、Stripe, Inc. (アイルランド)、Google, LLC (米国)、Finastra。 (イギリス)、サムスン(韓国)。

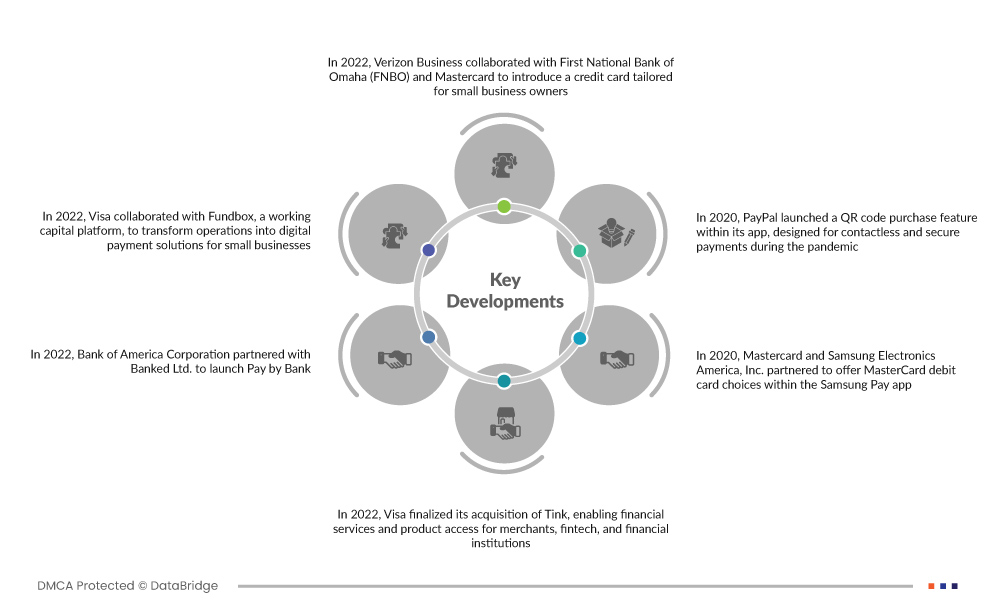

市場の発展

- 2022年、Verizon BusinessはFirst National Bank of Omaha(FNBO)およびMastercardと提携し、中小企業のオーナー向けにカスタマイズされたクレジットカードを導入しました。オンラインアカウント保有者が利用できるVerizon Business Mastercardは、購入ごとに特典を提供します。

- 2022年、Visaは運転資本プラットフォームであるFundboxと協力し、中小企業向けのデジタル決済ソリューションに業務を変革しました。最初のステップでは、Pathward NA が発行した Fundbox Flex Visa デビット カードを導入しました。

- 2022 年、バンク オブ アメリカ コーポレーションは Banked Ltd. と提携して、電子商取引の顧客が銀行口座から直接支払いできるオンライン決済ソリューションである Pay by Bank を立ち上げました。この動きは、同社が継続的に行っているテクノロジー投資イニシアチブの一環です。

- 2022 年、Visa は Tink の買収を完了し、加盟店、フィンテック、金融機関が金融サービスと製品にアクセスできるようになりました。 Tink は 3,400 以上の銀行および数百万のヨーロッパの銀行顧客と提携しています

- 2020年、PayPalはアプリ内でQRコード購入機能を開始し、パンデミック下での非接触型で安全な支払いのために設計されました。このイノベーションは、企業の知名度と市場での存在感を高めることになるでしょう

- 2020 年、Mastercard と Samsung Electronics America, Inc. は提携して、Samsung Pay アプリ内で MasterCard デビット カードの選択肢を提供し、顧客リーチを拡大し、アプリを通じて便利なデビット カード支払いを可能にしました。

地域分析

地理的に、ヨーロッパのデジタル決済市場レポートでカバーされている国は、ドイツ、フランス、イギリス、オランダ、スイス、ベルギー、ロシア、イタリア、スペイン、トルコ、ヨーロッパのその他の地域です。

データブリッジ市場調査分析によると:

英国は主な地域です ヨーロッパのデジタル決済市場 2023年から2030年の予測期間中

英国は、研究開発への多額の投資によりデジタル決済市場を独占し、先進技術を育成しています。この地域のデジタル インフラストラクチャ、オンライン プラットフォーム、インターネット アクセシビリティの成長により、市場の拡大が促進されます。これらの要因が相乗的にイノベーションと利便性を推進し、英国をデジタル決済の分野で傑出したプレーヤーにしています。

詳細については、 ヨーロッパのデジタル決済市場レポート、ここをクリック –https://www.databridgemarketresearch.com/reports/europe-digital-payment-market