電動自転車 (E-Bike) 市場には、環境への優しさ、通勤コストの削減、健康上の利点など、数多くのメリットがあります。主要なセグメントは都市部のコミューター E-Bike カテゴリであり、主に日常の移動に好まれています。これらの E-Bike は、ペダルアシストやコンパクトなデザインなどの機能を備え、ライダーが都市環境を効率的かつ持続的に移動できるように支援します。交通渋滞と二酸化炭素排出量を削減するため、都市部の通勤者にとって理想的な選択肢となり、E-Bike 市場におけるこのセグメントの成長を促進します。

完全なレポートにアクセスするには、 https://www.databridgemarketresearch.com/reports/europe-e-bike-market

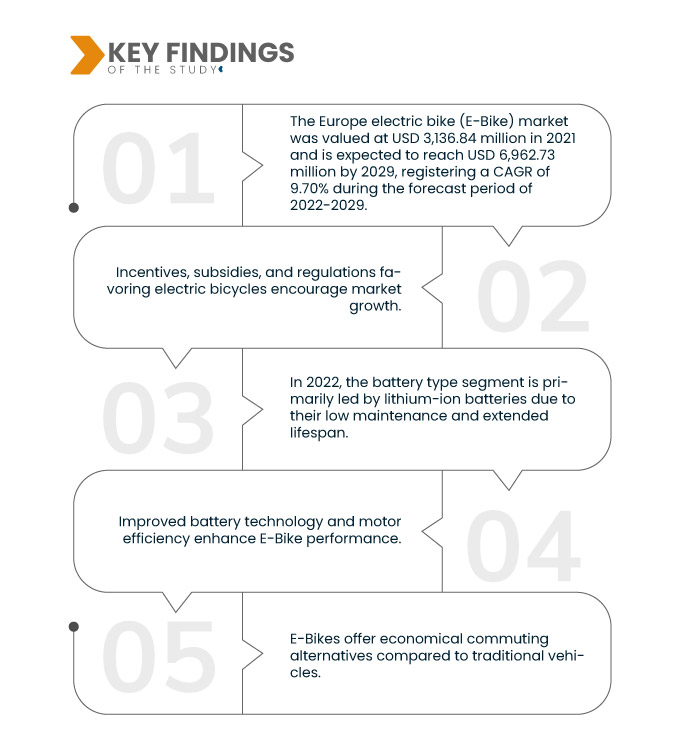

データブリッジ市場調査は次のように分析しています。 欧州電動自転車(E-Bike)市場 2021年には31億3,684万米ドルと評価され、2029年までに69億6,273万米ドルに達すると予想され、2022年から2029年の予測期間中に9.70%のCAGRを記録します。

個人の健康と持続可能性の優先順位がますます高まる中、E-Bike は身体活動を促進し、炭素排出量を削減し、従来の車両に代わる持続可能で環境に優しい代替手段を提供する交通手段を提供することで、この変化に対応しています。

研究の主な結果

健康とフィットネスが市場の成長率を牽引すると予想される

電動自転車 (E-Bike) は、ペダルアシスト技術を提供することで、運動と利便性のバランスをとっています。ライダーはさまざまなレベルのモーターアシストでペダルをこぐことを選択できるため、困難な地形や長距離を楽に走ることができます。これにより、さまざまなフィットネス レベルに対応しながら、身体活動や屋外での運動が促進されます。E-Bike は幅広い層の人々にアピールし、サイクリングをより身近で楽しいものにすることで健康的なライフスタイルを促進し、最終的にはフィットネスと全体的な健康の向上に貢献します。

レポートの範囲と市場セグメンテーション

|

レポート指標

|

詳細

|

|

予測期間

|

2022年から2029年

|

|

基準年

|

2021年

|

|

歴史的な年

|

2020 (2014~2019年にカスタマイズ可能)

|

|

量的単位

|

売上高(百万米ドル)、販売数量(個数)、価格(米ドル)

|

|

対象セグメント

|

バッテリーの種類 (リチウムイオン、リチウムイオンポリマー、ニッケル水素、 鉛酸、密閉型鉛酸およびその他)、ハブ モーターの位置(ミッド ドライブ ハブ モーター、リア ハブ モーターおよびフロント ハブ モーター)、モード(ペダル アシストおよびスロットル)、バッテリー電力(750 W 未満および 750 W 以上)、クラス(クラス I (ペダルアシスト/ペデレック)、クラス II (スロットル) およびクラス III (スピードペデレック))、用途 (シティ/アーバン、クルーズ、マウンテン/トレッキング バイク、レーシング、カーゴ、その他)

|

|

対象国

|

ドイツ、フランス、イギリス、オランダ、スイス、ベルギー、ロシア、イタリア、スペイン、トルコ、その他のヨーロッパ諸国

|

|

対象となる市場プレーヤー

|

Accell Group(オランダ)、Derby Cycle(ドイツ)、JIANGSU XINRI E-VEHICLE CO.,LTD.(中国)、Karbon Kinetics Ltd(英国)、ITALJET SPA(イタリア)、Riese & Müller GmbH(ドイツ)、M1-Sporttechnik(ドイツ)、FIVE Bianchi SpA(イタリア)、Kawasaki Motors Corp., USA(米国)、WUXI YADEA EXPORT-IMPORT CO.,LTD.(中国)、Giant Bicycles(台湾)、Trek Bicycle Corporation(米国)、myStromer AG(スイス)、Specialized Bicycle Components, Inc.(米国)など

|

|

レポートで取り上げるデータポイント

|

市場価値、成長率、市場セグメント、地理的範囲、市場プレーヤー、市場シナリオなどの市場洞察に加えて、データブリッジ市場調査チームによって厳選された市場レポートには、詳細な専門家分析、輸出入分析、価格分析、生産消費分析、乳棒分析。

|

セグメント分析:

ヨーロッパの電動自転車 (E-Bike) 市場は、バッテリーの種類、ハブ モーターの位置、モード、バッテリー電力、クラス、および用途に基づいて分割されています。

- バッテリーの種類に基づいて、ヨーロッパの電動自転車(E-Bike)市場は、リチウムイオン、リチウムイオンポリマー、ニッケル水素、鉛蓄電池、密閉型鉛蓄電池などに分類されます。2022年には、メンテナンスが少なく寿命が長いため、バッテリータイプのセグメントは主にリチウムイオンバッテリーによって牽引されます。

2022年には、2022年から2029年の予測期間中に、バッテリータイプのリチウムイオンセグメントがヨーロッパの電動自転車(E-Bike)市場で支配的になる

バッテリータイプのセグメントは、メンテナンスが少なく寿命が長いため、主にリチウムイオンバッテリーが主導しています。それにもかかわらず、リチウム ポリマー バッテリーは、優れた耐久性を備えたリチウム イオン バッテリーの改良版として、より速いペースで勢いを増しています。

- ハブモーターの位置に基づいて、ヨーロッパの電動自転車(E-Bike)市場は、ミッドドライブハブモーター、リアハブモーター、およびフロントハブモーターに分類されます。2022年には、ミッドドライブハブモーターがハブモーターの位置セグメントで主流の選択肢になります。これは主に、世界のE-Bike購入の大部分を占める電動自転車(E-Bike)とペダルアシストe-bikeに最適な設計によるものです。

2022年、ハブモーターの位置のミッドドライブハブモーターセグメントは、2022年から2029年の予測期間中にヨーロッパの電動自転車(e-バイク)市場で支配的になるでしょう

2022 年には、ミッドドライブ ハブ モーターが、ハブ モーターの設置セグメントでの主要な選択肢となります。これは主に、世界の自転車の重要な部分を構成する電動自転車 (E-Bike) およびペダル補助電動自転車に最適な設計であるためです。電動自転車の購入。

- モードに基づいて、ヨーロッパの電動自転車 (E-Bike) 市場はペダル アシストとスロットルに分類されます。 2022 年には、このモードセグメントで最大の市場シェアはペダルアシストに属します。ペダルアシストは、従来のサイクリングの利点と電動アシストを組み合わせ、より長く、より楽しい乗車を可能にするため、主に消費者に好まれています。

- ヨーロッパの電動自転車 (E-Bike) 市場は、バッテリー電力に基づいて 750 W 未満と 750 W 以上に分類されます。2022 年には、現在 750 W 未満のバッテリー電力がバッテリー電力セグメントをリードしており、急速な成長が期待されています。これらのバッテリーは電動自転車の生産に適しており、製造要件を遵守しながら十分なエネルギー容量を提供するため、電動自転車の生産に最適な選択肢となっています。

- クラスに基づいて、ヨーロッパの電動自転車(Eバイク)市場は、クラスI(ペダルアシスト/ペデレック)、クラスII(スロットル)、クラスIII(スピードペデレック)に分類されます。2022年には、ペダルアシストまたはペデレックEバイクを含むクラスIセグメントが、クラスセグメント内で重要な位置を占めています。ペダルアシストアシスタンスを提供するこれらのEバイクは、フルスロットルEバイクに比べて、よりアクティブで魅力的なライディング体験を求める健康志向の人々に好まれ、その幅広い人気に貢献しています。

- ヨーロッパの電動自転車(E-Bike)市場は、用途に基づいて、シティ/アーバン、クルーズ、マウンテン/トレッキングバイク、レーシング、カーゴ、その他に分類されています。2022年には、通勤者の大多数が、特に都市部での毎日のオフィスや職場への通勤で、短距離の移動にE-Bikeを選択します。その結果、シティ/アーバンカテゴリはこのセグメント内で最も高い成長を遂げており、都市居住者にとってのE-Bikeの実用性と利便性を反映しています。

主なプレーヤー

データブリッジ市場調査は、ヨーロッパの電動自転車(E-Bike)市場における主要なプレーヤーとして次の企業を認識しています:Accell Group(オランダ)、Derby Cycle(ドイツ)、JIANGSU XINRI E-VEHICLE CO .,LTD. (中国)、Karbon Kinetics Ltd(英国)、ITALJET SPA(イタリア)、Riese & Müller GmbH(ドイツ)、M1-Sporttechnik(ドイツ)、FIVE Bianchi SpA(イタリア)、Kawasaki Motors Corp.、USA(米国)。

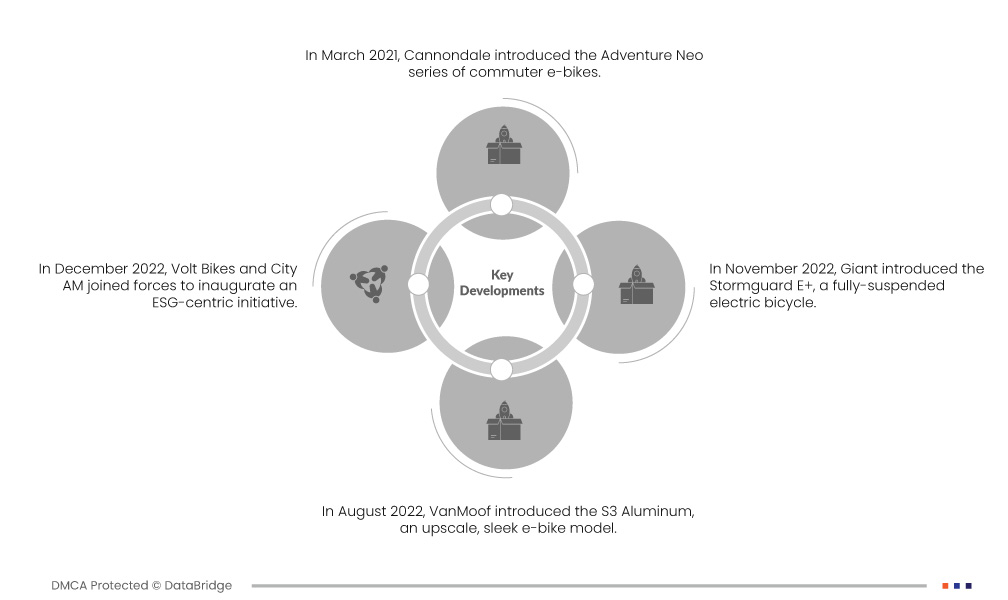

市場の発展

- 2021 年 3 月、キャノンデールは通勤用 e-bike のアドベンチャー ネオ シリーズを発表しました。このラインナップは 4 つの異なるモデルで構成され、それぞれがステップスルー デザイン、アルミ フレーム、バッテリー付きのボッシュ ドライブ システムを備えています。これらの e-bike は、ライダーにとってアクセシビリティ、耐久性、効率的な電動アシスト通勤オプションを提供するように設計されており、ユーザーフレンドリーで高性能な電動自転車への取り組みを体現しています。

- 2022 年 12 月、Volt Bikes と City AM は協力して ESG 中心のイニシアチブを開始しました。City AM 内に最近設立された部門である Impact AM とのこのコラボレーションは、環境、社会、ガバナンス (ESG) の問題への取り組みに重点を置いています。両社は協力して、持続可能で責任ある慣行を促進し、ESG 問題への取り組みと、ビジネスおよび社会環境におけるその重要性を強調することを目指しています。

- 2022 年 11 月、ジャイアントは完全にサスペンションされた電動自転車であるストームガード E+ を発表しました。これらの電動自転車は2023年に欧州市場に投入される予定で、価格はE+1モデルが7,999ユーロ、E+2モデルが6,499ユーロとなる。この発売は、ヨーロッパの消費者に高度な電動自転車テクノロジーを提供し、フルサスペンション電動自転車体験を求める消費者に高性能のオプションを提供するというジャイアントの取り組みを表しています。

- 2022 年 8 月、VanMoof は高級で洗練された e-bike モデルである S3 アルミニウムを発表しました。S3 アルミニウムは、生の溶接とブラシ仕上げの金属フレームのみを使用したミニマリストなデザインが際立っています。このリリースは、プレミアムな e-bike オプションを提供するという VanMoof の取り組みを表しています。無駄を省いたミニマリストな美学を備えた S3 アルミニウムは、e-bike でスタイルとパフォーマンスの両方を求めるライダーにエレガントで現代的な選択肢を提供します。

詳細については、 ヨーロッパの電動自転車 (E-Bike) 市場レポート、ここをクリック –https://www.databridgemarketresearch.com/reports/europe-e-bike-market